Railway Traction Motor Market in North America Size 2024-2028

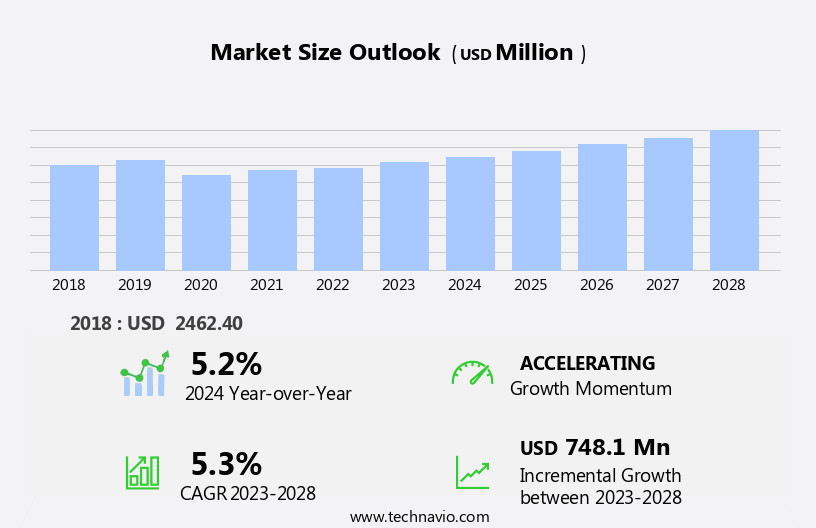

The railway traction motor market in North America size is forecast to increase by USD 748.1 million at a CAGR of 5.3% between 2023 and 2028.

- The North American Railway Traction Motor Market is experiencing significant growth, driven by the procurement of new locomotives. According to industry reports, the rail logistic sector is investing heavily in modernizing its fleet to enhance efficiency and reduce operational costs. This trend is expected to continue, providing a robust demand outlook for railway traction motors. Another key driver for the market is the increasing adoption of permanent magnet synchronous motors (PMSMs) in railway applications. PMSMs offer several advantages over traditional motors, including higher efficiency, longer lifespan, and lower maintenance requirements. As a result, railways are increasingly opting for PMSMs in their new locomotives, creating a lucrative opportunity for market participants.

- However, the market faces challenges as well. One of the most significant obstacles is the high cost of development. The research and development (R&D) expenses associated with designing and manufacturing advanced traction motors are substantial. Companies must invest heavily in R&D to create efficient, reliable, and cost-effective solutions that meet the evolving demands of the rail industry. Additionally, regulatory requirements and stringent safety standards further increase the development costs. Despite these challenges, the market presents substantial growth opportunities for companies. By focusing on innovation, efficiency, and cost reduction, market participants can capitalize on the demand for modern, efficient traction motors and maintain a competitive edge in the industry.

What will be the Size of the Railway Traction Motor Market in North America during the forecast period?

- The market is characterized by its continuous evolution, driven by the dynamic interplay of various sectors and technologies. Freight rail and passenger rail applications, for instance, are at the forefront of this transformation, with ongoing investments in induction motors, light rail, and railway modernization. Emissions reduction is a key focus, leading to the increasing adoption of brushless motors, permanent magnet motors, and electric drive systems. Signaling systems and rail infrastructure upgrades are essential components of this modernization, enabling smart rail and autonomous train operations. Moreover, the railway industry is embracing sustainable transportation solutions, such as fuel cells and hybrid locomotives, to reduce fuel consumption and promote energy efficiency.

- Motor control systems, power generation, and data analytics are crucial enablers of these advancements, optimizing power output and enabling predictive maintenance. Regenerative braking and urban mobility applications are also gaining traction, with subway systems and transit systems integrating these technologies to enhance passenger comfort and reduce maintenance costs. The railway traction motor market is a complex ecosystem, with various players contributing to the ongoing unfolding of market activities. Traction motors, whether AC or DC, synchronous or asynchronous, play a pivotal role in this ecosystem, powering the movement of freight and passenger trains. The market's dynamics are shaped by factors such as infrastructure upgrades, traction control, remote monitoring, and the integration of advanced technologies like permanent magnet motors and power electronics. The railway industry's ongoing modernization and the pursuit of energy efficiency and emissions reduction continue to drive the market forward, creating new opportunities and challenges.

How is this Railway Traction Motor in North America Industry segmented?

The railway traction motor in North America industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- DC motors

- AC motors

- Synchronous motors

- Application

- Electric trains

- Hybrid trains

- Power Rating

- Low Power

- Medium Power

- High Power

- Application Type

- Diesel Locomotives

- Electric Locomotives

- Hybrid Locomotives

- Electric Multiple Units

- Geography

- North America

- US

- Canada

- Mexico

- North America

By Type Insights

The dc motors segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant advancements, with various entities driving its growth. Commuter rail and passenger rail sectors prioritize passenger comfort, leading to the adoption of synchronous motors and motor control systems. High-speed rail and smart rail projects emphasize power output and energy efficiency, fostering the use of permanent magnet motors and power electronics. Sustainable transportation is a key focus, with emissions reduction initiatives promoting the use of electric drive systems, including AC motors and regenerative braking. Freight rail is also evolving, with fuel consumption a major concern. Fuel cells and hybrid locomotives are gaining traction as solutions.

Predictive maintenance and remote monitoring are essential for both passenger and freight rail, reducing maintenance costs and improving track maintenance. Light rail and transit systems are adopting induction motors and asynchronous motors for their versatility and cost-effectiveness. In the realm of signaling systems and railway infrastructure upgrades, autonomous trains and urban mobility are emerging trends. Regenerative braking and traction control systems are crucial for optimizing energy usage and enhancing overall performance. Data analytics plays a pivotal role in optimizing railway operations and improving operational efficiency. Major players in the market are focusing on developing advanced motor technologies, including brushless motors and DC motors, to cater to diverse railway applications.

Electric locomotives continue to dominate the market due to their high power output and efficiency. The market is expected to continue its growth trajectory, driven by these trends and the ongoing railway modernization efforts.

The DC motors segment was valued at USD 999.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

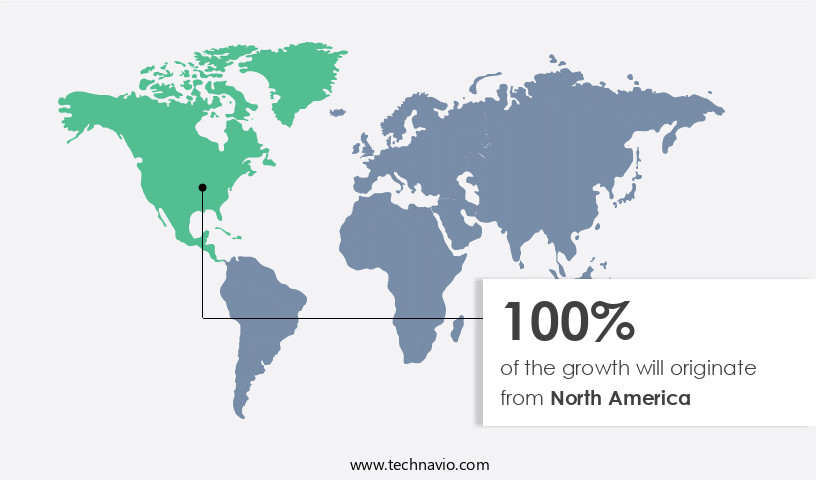

North America is estimated to contribute 100% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, with the US being a key contributor. The market's expansion is fueled by substantial government investments and strategic procurement initiatives. In October 2024, the US government allocated over USD2.4 billion to fund 122 rail improvement projects across 41 states and Washington, DC. These projects aim to enhance rail safety, reliability, and resilience, demonstrating the government's commitment to modernizing and expanding the national rail infrastructure. Moreover, major industry developments further boost the market. For instance, Amtrak's order of 50 ALC-42 locomotives from Siemens Mobility in June 2022 is a significant step towards sustainability and modernization in the rail sector.

This order includes advanced technologies such as synchronous motors, motor control systems, and energy efficiency features, which are essential for the rail industry's evolution. The market also focuses on reducing emissions and improving passenger comfort. High-speed rail, commuter rail, light rail, and subway systems are adopting sustainable transportation solutions, including electric drive systems, regenerative braking, and hybrid locomotives. Rail infrastructure upgrades, such as predictive maintenance, remote monitoring, and railway traction control, are also crucial to ensure the longevity and efficiency of rolling stock. Furthermore, the integration of smart rail technologies, including power electronics, data analytics, and signaling systems, is transforming the railway sector.

These technologies enable real-time monitoring, optimizing energy consumption, and improving overall operational efficiency. Permanent magnet motors, brushless motors, and asynchronous motors are some of the motor types that are gaining popularity due to their high power output and energy efficiency. In conclusion, the market is witnessing significant growth, driven by government investments, industry developments, and the adoption of advanced technologies. The focus on sustainability, passenger comfort, and operational efficiency is shaping the market's future trends.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Railway traction motor market grows with traction motors for freight trains and electric traction motors for rail. Railway traction motor trends 2024 highlight high-efficiency traction motors and traction motors for high-speed rail. Traction motors for urban transit and AC traction motors for locomotives drive demand, per railway traction motor forecast. Traction motors with regenerative braking leverage traction motors for electrified rail, while traction motors for commuter trains ensure reliability. Traction motors for industrial rail and traction motors for passenger trains enhance performance. Traction motors for sustainable rail, advanced traction motor technologies, and traction motor supply chain optimize growth. Traction motors for regulatory compliance, traction motors for rail modernization, traction motors for global rail, traction motors for operational efficiency, and traction motors for B2B markets fuel expansion throughout forecast year.

What are the key market drivers leading to the rise in the adoption of Railway Traction Motor in North America Industry?

- The procurement of new locomotives serves as the primary catalyst for market growth. The market is driven by the procurement of new locomotives to promote modernization, efficiency, and sustainability in rail transport. In the US, Amtrak's decision to order 50 ALC-42 locomotives from Siemens Mobility is a strategic move towards introducing advanced and eco-friendly locomotives into service by 2029. These new locomotives are expected to deliver higher energy efficiency and lower emissions, aligning with Amtrak's commitment to environmentally friendly rail operations. VIA Rail Canada is also undertaking an ambitious plan to replace its aging long-haul locomotives and cars.

- The adoption of electric drive systems, including asynchronous motors and dc motors, and the integration of remote monitoring, data analytics, and electric locomotives, are key trends shaping the market. Electric drive systems offer improved energy efficiency and reduced maintenance requirements for track maintenance. Companies are focusing on developing innovative traction motor solutions to cater to the evolving needs of the rail industry.

What are the market trends shaping the Railway Traction Motor in North America Industry?

- Permanent magnet synchronous motors (PMSMs) are gaining increasing popularity in the market due to their energy efficiency and high power density. The adoption of PMSMs is a notable trend in various industries, including automotive, renewable energy, and industrial automation.

- The North American railway traction motor market is experiencing a transformation, driven by the adoption of advanced technologies such as permanent magnet synchronous motors (PMSMs). These motors offer improved performance and energy efficiency, making them an increasingly popular choice for modern rail systems. In August 2023, Siemens AG introduced PMSMs in its latest locomotives, marking a significant advancement in railway technology. These motors are engineered to minimize energy consumption while delivering superior performance, making them an appealing solution for passenger rail applications. Furthermore, in June 2023, a metro train's traction equipment featuring a silicon carbide traction converter and a PMSM was successfully demonstrated in passenger service on Chengdu Line 7 in China.

- This innovation underscores the growing trend towards energy-efficient and high-performing motor solutions in the railway sector. Additionally, predictive maintenance systems are gaining traction in the market, enabling railway operators to optimize motor performance, reduce downtime, and lower fuel consumption. Ac motors and motor control systems continue to play a crucial role in the railway traction motor market, ensuring passenger comfort and safety in various applications, including commuter rail and high-speed rail systems.

What challenges does the Railway Traction Motor in North America Industry face during its growth?

- The escalating development costs represent a significant obstacle to the expansion and growth of the industry. The market faces significant challenges due to the high costs associated with research and development, manufacturing, materials, and compliance. Advanced traction motor designs require substantial investments in engineering, prototyping, testing, and refining to meet stringent performance and regulatory standards. The manufacturing process involves utilizing advanced machinery and technology to produce small, high-durability, and reliable motors using high-quality materials. Induction motors, brushless motors, permanent magnet motors, and signaling systems are key components of railway traction systems undergoing modernization for freight rail and light rail applications.

- Emissions reduction is a critical factor driving the market, with an emphasis on smart rail solutions and power output optimization. Railway infrastructure upgrades and the adoption of new technologies, such as smart rail and permanent magnet motors, are expected to offer growth opportunities.

Exclusive Customer Landscape

The railway traction motor market in North America forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the railway traction motor market in North America report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, railway traction motor market in North America forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- General Electric Company

- Siemens AG

- Alstom SA

- Bombardier Transportation

- Wabtec Corporation

- Hitachi Rail Ltd.

- Toshiba Corporation

- Mitsubishi Electric Corporation

- ABB Ltd.

- Medha Servo Drives Pvt. Ltd.

- CRRC Corporation Limited

- Hyundai Rotem Company

- Kawasaki Heavy Industries Ltd.

- Skoda Transportation a.s.

- VEM Group

- Traktionssysteme Austria GmbH

- Nidec Corporation

- Stadler Rail AG

- CAF â Construcciones y Auxiliar de Ferrocarriles

- Woojin Industrial Systems Co., Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Railway Traction Motor Market In North America

- In February 2023, Bombardier Transportation announced the launch of its innovative traction motor, the Mitrac DE35, in Chicago, Illinois. This asynchronous motor, which is part of Bombardier's Mov'eo family, offers improved energy efficiency and reduced maintenance costs for railway operators (Bombardier Transportation, 2023).

- In July 2024, Caterpillar Inc. And Wabtec Corporation entered into a strategic partnership to develop and manufacture heavy-duty electric and hybrid traction motors for the North American rail market. This collaboration aims to expand Caterpillar's presence in the rail industry and leverage Wabtec's expertise in traction motor technology (Caterpillar Inc., 2024).

- In October 2024, General Electric (GE) Transportation secured a significant contract from Amtrak to supply traction motors for its new Northeast Regional train fleet. This deal is valued at over USD100 million and marks a continued partnership between GE and Amtrak (GE Transportation, 2024).

- In January 2025, the United States Federal Railroad Administration (FRA) announced new regulations requiring the adoption of energy-efficient traction motors for new and existing passenger and freight trains. This initiative aims to reduce greenhouse gas emissions and improve overall energy efficiency in the North American railway sector (FRA, 2025).

Research Analyst Overview

The North American rail sector outlook remains robust, driven by railway safety standards, rail investment, and a focus on sustainability. Traction motor control and rail innovation are key areas of investment, with traction motor technology and energy storage systems playing crucial roles in rail modernization projects. The rail industry is embracing renewable energy sources, such as solar and wind, for railway electrification, contributing to the future of green transportation. Operational efficiency and rail network optimization are top priorities, with smart rail technology and digital transformation shaping the industry.

Traction motor and driver technology advancements, including electric train propulsion, are enhancing train performance and passenger experience. Rail infrastructure development is ongoing, with a focus on locomotive design and rail industry trends. Despite challenges, the rail industry continues to evolve, leveraging sustainable practices and technological advancements to meet the demands of modern transportation.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Railway Traction Motor Market in North America insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2024-2028 |

USD 748.1 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

5.2 |

|

Key countries |

US, Canada, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Railway Traction Motor Market in North America Research and Growth Report?

- CAGR of the Railway Traction Motor in North America industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the railway traction motor market in North America growth of industry companies

We can help! Our analysts can customize this railway traction motor market in North America research report to meet your requirements.