Nucleic Acid Amplification Market Size 2024-2028

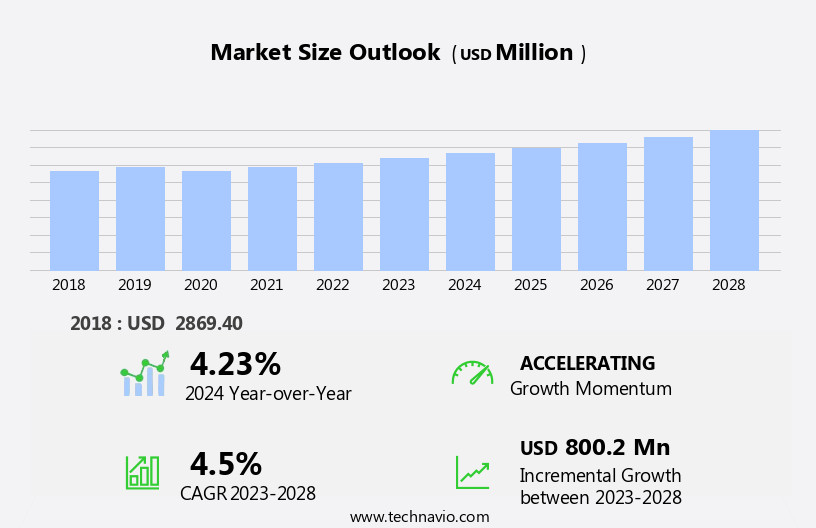

The nucleic acid amplification market size is forecast to increase by USD 800.2 million, at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing research and development activities at academic institutes and medical technologies and organizations. These institutions are investing heavily in the development of new biotechnological techniques, leading to advancements in diagnostics and therapeutics. However, the market faces a notable challenge: the lack of a skilled workforce to handle the complexities of nucleic acid amplification technologies. As these techniques become more sophisticated, there is a pressing need for trained professionals to ensure accurate and reliable results.

- Companies seeking to capitalize on market opportunities must invest in workforce training and development programs. Additionally, collaborations with academic institutions and industry partners can provide access to the latest research and expertise. Navigating this dynamic market requires a strategic approach, with a focus on innovation, workforce development, and partnerships.

What will be the Size of the Nucleic Acid Amplification Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technologies and applications across various sectors. Microfluidic devices, isothermal amplification, and molecular diagnostics are key components of this dynamic market. Isothermal amplification methods, such as loop-mediated isothermal amplification (LAMP) and transcription-mediated amplification, offer advantages in speed and simplicity for pathogen detection and genetic testing. Infectious disease diagnosis and microbial sequencing are major applications, with LAMP showing promise in point-of-care settings. Quantitative PCR (qPCR) and digital PCR (dPCR) are essential tools for mutation detection and precise quantification of nucleic acids. Software platforms and qPCR arrays facilitate data analysis and biomarker discovery in fields like oncology and personalized medicine.

Nucleic acid extraction, including DNA and RNA isolation, is a critical step in these applications. Next-generation sequencing (NGS), including whole genome sequencing and RNA sequencing, revolutionizes genome analysis and drug discovery. Single-cell sequencing and capillary electrophoresis are emerging technologies that further expand the capabilities of the market. Forensic analysis, gene expression profiling, and cancer diagnostics are additional applications that benefit from these advancements. The market's continuous unfolding is shaped by ongoing research and innovation, with technologies like targeted sequencing, exome sequencing, and miRNA analysis expanding the scope of molecular biology and diagnostics. The integration of in vitro diagnostics, precision medicine, and real-time PCR further strengthens the market's role in advancing healthcare and scientific research.

How is this Nucleic Acid Amplification Industry segmented?

The nucleic acid amplification industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technique

- Target amplification

- Probe amplification

- Signal amplification

- Application

- Infectious Disease Diagnostics

- Oncology Testing

- Genetic Testing

- Blood Screening

- Pathogen Detection

- End-User

- Hospitals

- Clinical Laboratories

- Academic and Research Institutions

- Point-of-Care Settings

- Blood Banks

- Type

- Polymerase Chain Reaction (PCR)

- Loop-Mediated Isothermal Amplification (LAMP)

- Transcription-Mediated Amplification (TMA)

- Nucleic Acid Sequence-Based Amplification (NASBA)

- Digital PCR

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Technique Insights

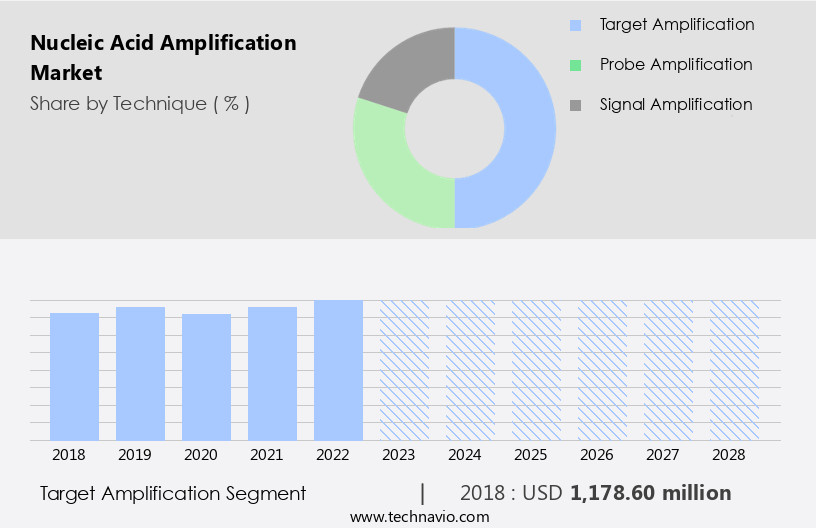

The target amplification segment is estimated to witness significant growth during the forecast period.

Nucleic acid amplification techniques, including microfluidic devices and isothermal amplification, play a pivotal role in various applications such as infectious disease diagnosis, microbial sequencing, and genetic testing. Isothermal amplification methods, like loop-mediated isothermal amplification (LAMP) and transcription-mediated amplification (TMA), offer advantages such as rapid results and simplicity, making them suitable for point-of-care diagnostics and field applications. Molecular diagnostics, including quantitative PCR (qPCR) and digital PCR (dPCR), are widely used for pathogen detection and mutation analysis in clinical settings. These techniques enable precise and sensitive identification of genetic material, contributing to the advancement of personalized medicine and drug discovery.

Software platforms and qPCR arrays facilitate data analysis, while nucleic acid extraction methods, such as DNA and RNA isolation, ensure the purity of samples for downstream applications. Next-generation sequencing technologies, including capillary electrophoresis and single-cell sequencing, have revolutionized genome sequencing, RNA sequencing, and whole genome sequencing, leading to breakthroughs in cancer diagnostics, targeted sequencing, and biomarker discovery. Molecular biology techniques, including gene expression profiling, reverse transcription PCR, and real-time PCR, are essential for understanding the intricacies of biological processes and developing innovative therapeutic strategies. These methods are also used in forensic analysis and precision medicine, further expanding their applications and impact on various industries.

The Target amplification segment was valued at USD 1178.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

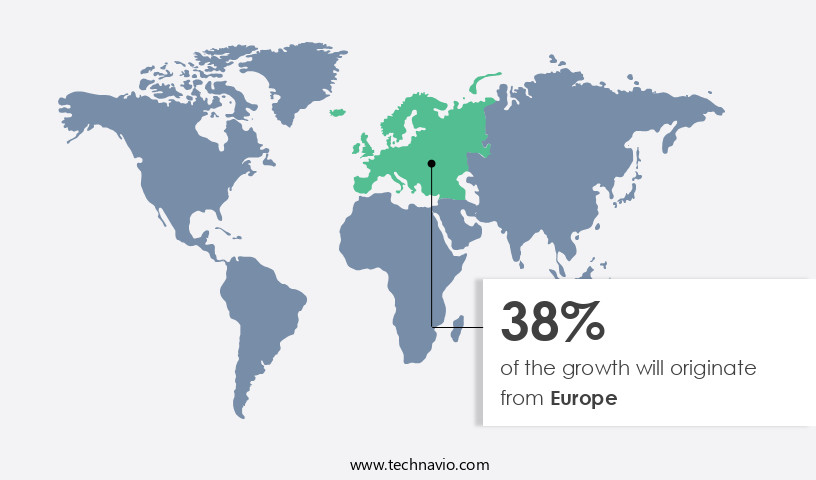

Europe is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

North America (U.S., Canada): North America, particularly the United States, plays a leading role in the molecular diagnostics market, supported by a robust healthcare infrastructure and significant investments in target amplification technologies for infectious disease and oncology testing. Companies such as Thermo Fisher Scientific are at the forefront of innovation. In Canada, the emphasis on point-of-care diagnostics enhances the use of probe amplification, especially for improving access in rural and underserved areas. Regulatory support from the FDA further accelerates technology adoption. The presence of top-tier research institutions continues to drive demand for advanced amplification systems.

Europe (Germany, UK): Europe remains a central hub for precision medicine and infectious disease research, with Germany applying target amplification techniques in genetic sequencing for oncology, while the UK emphasizes signal amplification in viral diagnostic applications. Strict EU regulations around diagnostic accuracy and data integrity are boosting the demand for reliable amplification platforms. Collaborative research networks, particularly in Germany, support advancements in isothermal amplification, and the region's broader commitment to sustainable healthcare practices encourages the development of eco-friendly diagnostics.

Asia (China): Asia's molecular diagnostics market is expanding rapidly, with China as a key driver. Rising healthcare investment, increasing infectious disease burden, and strong government initiatives are fueling demand. Target amplification is widely used for COVID-19 and hepatitis testing, supported by domestic leaders like BGI Genomics. Growth in genomics research further stimulates the adoption of sophisticated amplification methods. Rapid urbanization and the need for scalable healthcare solutions are boosting the use of probe amplification in point-of-care settings.

Rest of the World (Latin America, Middle East, Africa): In the Rest of the World, including Brazil, South Africa, and the Middle East, the focus is on accessible and cost-effective diagnostic solutions. Brazil applies probe amplification to detect dengue and Zika in remote areas, while South Africa utilizes target amplification to address widespread HIV infections. In the Middle East, cities like Dubai are incorporating signal amplification into clinical research through emerging biotech hubs. As these regions strengthen their healthcare infrastructure, the adoption of amplification technologies continues to grow despite budgetary constraints.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Nucleic Acid Amplification Market is expanding rapidly, driven by demand for PCR test kits, isothermal amplification kits, real-time PCR assays, and digital PCR kits. These technologies support critical applications like infectious disease diagnostics and oncology testing. Advanced methods such as polymerase chain reaction (PCR), loop-mediated isothermal amplification (LAMP), and CRISPR-based amplification for pathogen detection enhance diagnostic accuracy. Multiplex NAAT assays and portable NAAT devices cater to diverse needs, from clinical labs to field diagnostics. High-demand searches like best PCR test kits for infectious diseases 2025, top isothermal amplification kits for point-of-care, and how to choose real-time PCR machines reflect market trends. High-sensitivity NAAT for oncology testing, top digital PCR systems for genetic testing, best portable NAAT devices for field diagnostics, how to select automated NAAT workstations, and top NAAT reagents for viral load monitoring drive innovation and accessibility.

What are the key market drivers leading to the rise in the adoption of Nucleic Acid Amplification Industry?

- Academic institutes and medical organizations significantly contribute to market growth through their escalating research and development (R&D) activities.

- Nucleic acid amplification techniques play a pivotal role in molecular biology research, particularly in academic institutions and medical organizations. These techniques are employed for applications in microbiology, biochemistry, immunology, genetics, and cell biology. Bioinformatics and genome sequencing are key areas of focus in R&D activities at these institutions, which also offer DNA sequencing services to industry. The surge in genome sequencing and genetics research has fueled the demand for nucleic acid amplification methods. The global health crisis caused by COVID-19 in 2020 led to an unprecedented increase in research studies at academic institutions and medical organizations worldwide. These studies focused on identifying potential treatments and diagnostics for the disease.

- Techniques such as targeted sequencing, microRNA analysis, reverse transcription PCR, real-time PCR, single-cell sequencing, and lateral flow assays have been instrumental in these research efforts. Data analysis is a critical component of these techniques, enabling researchers to gain valuable insights into gene expression profiling and disease mechanisms.

What are the market trends shaping the Nucleic Acid Amplification Industry?

- The investment trend in the biotechnology sector is shifting towards the development of new techniques. This includes the exploration and implementation of advanced biotechnological methods to drive market growth.

- Nucleic acid amplification has become a crucial technology in the field of molecular diagnostics, particularly for infectious disease diagnosis. Hospitals, diagnostic centers, academic institutes, and research organizations are increasingly utilizing this technique for disease detection and pathogen identification. companies provide various Polymerase Chain Reaction (PCR) kits for hospitals, clinics, laboratories, and research institutions to diagnose diseases, monitor viral loads, and identify genetic mutations. Isothermal amplification methods, such as Loop-mediated Isothermal Amplification (LAMP), are gaining popularity due to their simplicity and efficiency. Additionally, microfluidic devices are being employed to automate and miniaturize nucleic acid amplification processes. The integration of nucleic acid amplification with microbial sequencing and Single Nucleotide Polymorphism (SNP) analysis is revolutionizing the field of molecular diagnostics.

- Molecular biology enzymes, kits, and reagents are in high demand for the detection of pathogenic events at the genomic level. The advancements in genomics and nucleic acid amplification have significantly expanded the scope of molecular diagnostics.

What challenges does the Nucleic Acid Amplification Industry face during its growth?

- The insufficient supply of skilled labor poses a significant challenge to the expansion and growth of the industry.

- Nucleic acid amplification is a critical technology in the field of pathogen detection and genetic testing, including mutation detection and forensic analysis. In vitro diagnostics utilizing nucleic acid amplification techniques, such as qPCR arrays and nucleic acid extraction, play a significant role in the diagnosis and treatment of various diseases. These tests require skilled professionals, including pathologists and clinicians, who possess a deep understanding of molecular mechanisms and can safely and competently perform tests using standard operating procedures (SOPs). The demand for precision medicine, genome sequencing, and RNA sequencing is driving the growth of the market. Software platforms are increasingly being used to streamline the process of data analysis and interpretation.

- However, the limited availability of adequate training and courses on nucleic acid amplification tests is a significant challenge, hindering the growth of the workforce required to meet the increasing demand for these tests. In conclusion, the market is a dynamic and evolving field, driven by advancements in technology and the growing need for accurate and timely diagnosis and treatment of diseases. Skilled professionals are essential to the success of this industry, and addressing the training gap is crucial to ensuring the continued growth and success of nucleic acid amplification technologies.

Exclusive Customer Landscape

The nucleic acid amplification market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the nucleic acid amplification market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, nucleic acid amplification market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company provides a nucleic acid amplification solution through the Abbott RealTime SARS CoV 2 Amplification reagent kit. This platform utilizes advanced molecular biology techniques to detect and amplify specific viral RNA sequences related to SARS-CoV-2, the causative agent of COVID-19. By offering this solution, the company contributes to the global research and diagnostic efforts aimed at combating the ongoing pandemic. The Abbott RealTime SARS CoV 2 Amplification reagent kit is a valuable tool for laboratories and research institutions, enabling them to perform accurate and timely detection of SARS-CoV-2, thereby contributing to effective disease management and public health initiatives.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Becton Dickinson and Co.

- bioMerieux SA

- Ustar Biotechnologies Hangzhou Ltd.

- Danaher Corp.

- Eiken Chemical Co. Ltd.

- F. Hoffmann La Roche Ltd.

- Grifols SA

- Hologic Inc.

- Illumina Inc.

- LGC Science Group Holdings Ltd.

- Meridian Bioscience Inc.

- New England Biolabs Inc.

- Novartis AG

- OptiGene Ltd.

- Promega Corp.

- Quidelortho Corp.

- Siemens AG

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Nucleic Acid Amplification Market

- In January 2024, Thermo Fisher Scientific, a leading biotech company, launched the QuantStudio 3D Digital PCR System, which significantly enhances the accuracy and sensitivity of nucleic acid quantification (Thermo Fisher Scientific Press Release).

- In March 2024, Roche Diagnostics and Illumina, two major players in the diagnostics industry, announced a strategic collaboration to integrate Roche's molecular diagnostics with Illumina's sequencing and genotyping platforms (Roche and Illumina Press Release).

- In April 2025, Qiagen, a Dutch biotech firm, completed the acquisition of NeuMoDx Molecular, a US-based molecular diagnostics company, expanding its portfolio in automation and sample-to-answer solutions (Qiagen Press Release).

- In May 2025, the US Food and Drug Administration (FDA) granted Emergency Use Authorization (EUA) to Hologic for its Panther Fusion SARS-CoV-2 Assay, a real-time PCR test for COVID-19 diagnosis, further expanding the company's diagnostic offerings (FDA EUA Announcement).

Research Analyst Overview

- The market encompasses a range of technologies and tools essential for the analysis of genetic material. Key components include data management systems, sequencing reagents, library preparation kits, and various amplification techniques such as Polymerase Chain Reaction (PCR) and Next-Generation Sequencing (NGS) platforms. These technologies facilitate the identification of therapeutic targets, gene editing, and genome engineering, among others. Precision medicine strategies have fueled market growth, with RNA sequencing and gene expression analysis gaining prominence. Diagnostic accuracy and clinical validation are critical for regulatory compliance in drug development. Sample management and preparation are crucial steps in assay validation and biomarker discovery.

- Quality control is paramount in ensuring reliable results, with clinical trial design and regulatory compliance playing significant roles. NGS platforms enable the detection of biomarkers and the limit of detection analysis, contributing to the advancement of personalized medicine. The integration of RNA microarrays and DNA microarrays further expands the scope of genetic research. Market trends include the increasing importance of data management, the development of advanced library preparation methods, and the continuous improvement of PCR and NGS technologies to enhance diagnostic accuracy and therapeutic potential. Regulatory compliance and data interpretation remain key challenges in the rapidly evolving the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Nucleic Acid Amplification Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

133 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 800.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Germany, China, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Nucleic Acid Amplification Market Research and Growth Report?

- CAGR of the Nucleic Acid Amplification industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the nucleic acid amplification market growth of industry companies

We can help! Our analysts can customize this nucleic acid amplification market research report to meet your requirements.