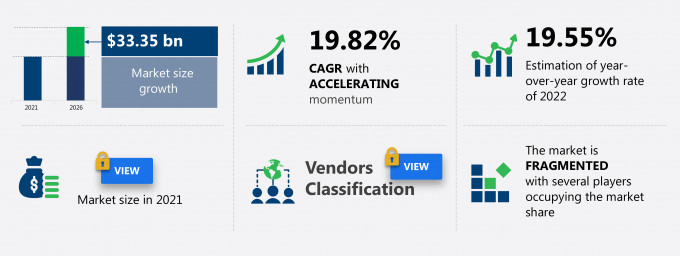

The online higher education market share in the US is expected to increase by USD 33.35 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 19.82%.

This online higher education market in the US research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers online higher education market in the US segmentation by subjects (commerce and management, STEM, Arts, and others) and courses (non-degree courses and degree courses). The online higher education market in the US report also offers information on several market vendors, including American Public Education Inc., Adtalem Global Education Inc., Apollo Education Group Inc., Graham Holdings Co., Grand Canyon Education Inc., ITT Educational Services Inc., LINCOLN EDUCATIONAL SERVICES Corp., Perdoceo Education Corp., Strategic Education Inc., and Zovio Inc. among others.

What will the Online Higher Education Market Size in the US be During the Forecast Period?

Download the Free Report Sample to Unlock the Online Higher Education Market Size in the US for the Forecast Period and Other Important Statistics

Online Higher Education Market in the US: Key Drivers, Trends, and Challenges

The collaborations between enterprises and educational institutions is notably driving the online higher education market growth in the US, although factors such as designing e-learning courses may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the online higher education industry in the US. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Online Higher Education Market Driver in the US

The collaborations between enterprises and educational institutions is one of the key drivers supporting the online higher education market growth in the US. Although such collaborations can take numerous forms, the most common are training, partnerships, or R&D partnerships. For instance, IBM-Charlotte was designed by the University of North Carolina-Charlotte (UNC-Charlotte) and IBM with the aim of enhancing the university’s technical vitality, expanding its local personnel resource bank, and ultimately offering IBM's technical communicators a way of earning degrees in their field of work. For UNC-Charlotte, the relationship with IBM gave its developing Technical Communication program community support and visibility and simultaneously provided faculty with research opportunities and practical experience at the workplace. Such collaborations are driving the growth of the online higher education market in the US during the forecast period.

Key Online Higher Education Market Trend in the US

Increased use of wearable gadgets is another factor supporting the online higher education market growth in the US. Technologies such as augmented reality (AR) are also changing the learning experience of participants. 3D simulations and scenarios that are developed using wearable technology devices give users a chance to learn in different learning environments. Moreover, the theoretical explanation of various concepts and step-by-step training on operations in an organization, followed by familiarizing students with on-the-floor working environments, are time-consuming. Therefore, wearable technology devices can help universities or educational institutions to engage with students directly on the floor. This reduces the duration and makes students more comfortable with online learning. Thus, the affordable prices of wearable gadgets will foster their greater adoption, in turn fostering the growth of the online higher education market in the US

Key Online Higher Education Market Challenge in the US

Designing e-learning courses is one of the factors hindering the online higher education market growth in the US. A significant amount of time, money, and resources are needed for developing the content for online courses. On average, moderately interactive online content takes about 90-240 hours to develop and costs developers approximately $10,000 per produced hour for moderate-level content. Similarly, the cost keeps rising as the complexity of the content increases. The major factors impacting the cost incurred on creating online education content are the resources needed, the state of the source content, the elements embedded in the online content, and the interactivity and instructional complexities involved. Therefore, this is a challenging factor for the growth of the online higher education market in the US.

This online higher education market in the US analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the online higher education market in the US as a part of the global education services market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the online higher education market in the US during the forecast period.

Who are the Major Online Higher Education Market Vendors in the US?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- American Public Education Inc.

- Adtalem Global Education Inc.

- Apollo Education Group Inc.

- Graham Holdings Co.

- Grand Canyon Education Inc.

- ITT Educational Services Inc.

- LINCOLN EDUCATIONAL SERVICES Corp.

- Perdoceo Education Corp.

- Strategic Education Inc.

- Zovio Inc.

This statistical study of the online higher education market in the US encompasses successful business strategies deployed by the key vendors. The online higher education market in the US is fragmented and the vendors are deploying growth strategies such as extensive product development and enhancing their courses by adding programs related to business, science, arts, as well as mobile learning and microlearning modules to compete in the market.

Product Insights and News

- American Public Education Inc. is a public company that is headquartered in the US. It is a global company that generated a revenue of $321.79 million and had around 2940 employees. Its revenue from the online higher education market in the US contributes to its overall revenues, along with its other offerings, but is not a key revenue stream for the company.

- American Public Education Inc. - The company offers solutions for online higher education that focuses on training and degrees that help provide pathways to employment and career advancement.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The online higher education market in the US forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Online Higher Education Market in the US Value Chain Analysis

Our report provides extensive information on the value chain analysis for the online higher education market in the US, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the education services market includes the following core components:

- Inputs

- Support activities

- Innovations

The report has further elucidated on other innovative approaches being followed by service providers to ensure a sustainable market presence.

What are the Revenue-generating Subjects Segments in the Online Higher Education Market in the US?

To gain further insights on the market contribution of various segments Request for a FREE sample

The online higher education market share growth in the US by the commerce management segment will be significant during the forecast period. Commerce and management studies has a significant role in the US economy. Through online learning US organizations has witnessed an increase in income of about 42%. Commerce and business management online courses are designed to help students achieve business language proficiency which is combined by adding business analytics and financial accounting courses. Moreover, the number of students participating in these online courses doubled from 2019. Therefore, the increasing number of participants is driving the segment growth.

This report provides an accurate prediction of the contribution of all the segments to the growth of the online higher education market size in the US and actionable market insights on post COVID-19 impact on each segment.

|

Online Higher Education Market Scope in the US |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.82% |

|

Market growth 2022-2026 |

$ 33.35 billion |

|

Market structure |

Fragmented |

|

Key consumer countries |

US and Rest of North America |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

American Public Education Inc., Adtalem Global Education Inc., Apollo Education Group Inc., Graham Holdings Co., Grand Canyon Education Inc., ITT Educational Services Inc., LINCOLN EDUCATIONAL SERVICES Corp., Perdoceo Education Corp., Strategic Education Inc., and Zovio Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Online Higher Education Market in the US Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive online higher education market growth in the US during the next five years

- Precise estimation of the online higher education market size in the US and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the online higher education market industry in the US

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of online higher education market vendors in the US

We can help! Our analysts can customize this report to meet your requirements. Get in touch