Oral Hygiene Market Size 2024-2028

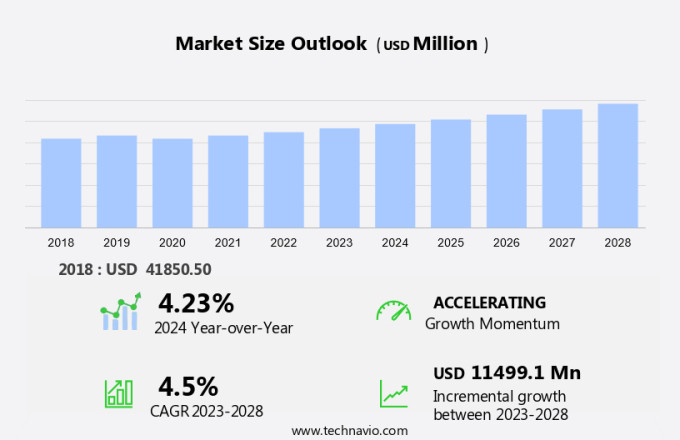

The oral hygiene market size is forecast to increase by USD 11.49 billion at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth, driven by various trends and factors. One of the primary growth factors is the increasing demand for teeth whitening products and mouthwash, as consumers seek to maintain a bright and healthy smile. Another trend is the rise in preference for natural and organic oral hygiene products, reflecting a broader trend towards healthier lifestyles and eco-consciousness. Additionally, homemade remedies and alternative oral health solutions are gaining popularity, particularly among budget-conscious consumers and those seeking more natural options. These trends are expected to continue shaping the market in the coming years.

Furthermore, the toothbrush segment includes manual and electric toothbrushes. Consumer needs and public awareness are key factors influencing market trends. The geriatric population and cosmetic dentistry are also driving consumer spending power in the market.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Primary oral hygiene products

- Secondary oral hygiene products

- Geography

- Europe

- Germany

- UK

- North America

- US

- APAC

- China

- Japan

- South America

- Middle East and Africa

- Europe

By Distribution Channel Insights

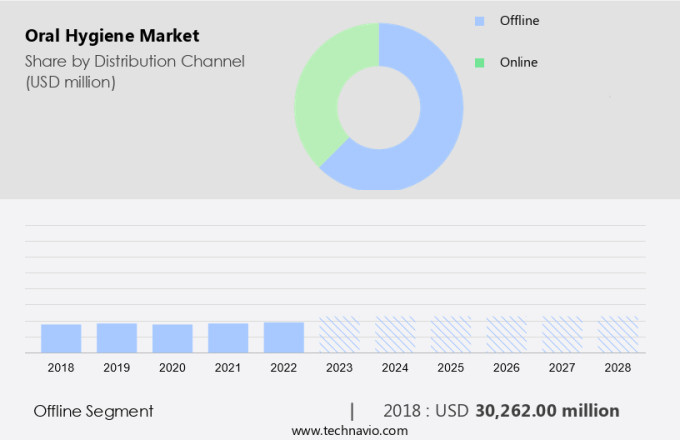

The offline segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to the rising prevalence of dental diseases, particularly among the aging population and those with unhealthy food habits. Product innovation is a key trend in the industry, with companies introducing new mouthwashes and toothpastes. However, poverty and limited access to dental care remain challenges, with brands targeting affordable options. The toothpaste and mouthwash segments continue to dominate, with manual and electric toothbrushes gaining popularity.

Furthermore, consumer needs and public awareness are driving the market, with a focus on sustainable and eco-friendly products, such as those with nano-hydroxyapatite. The geriatric population and those with oral diseases are major consumer groups for cosmetic dentistry, while consumer spending power and industry applications continue to shape market dynamics.

Get a glance at the market share of various segments Request Free Sample

The offline segment was valued at USD 30.26 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

Europe is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market caters to adults, kids, and infants with a wide range of natural and innovative products. Natural offerings are gaining popularity due to increasing health consciousness. Digital marketing strategies are being employed extensively by both global giants and emerging local players to expand their customer base. Strategic initiatives, collaborations, and partnerships with dental professionals, regulatory compliances, and dental associations are key growth drivers. Emerging markets in Asia-Pacific and Africa present significant opportunities. Social media and digital platforms are used for educational initiatives, creating awareness about oral health issues such as dental caries, periodontal diseases, oral cancers, gum recession, dry mouth, aesthetic appearance, teeth whitening, veneers, and orthodontics. Furthermore, water flossers and toothpaste formulations undergo development through clinical studies. Dental associations and public health campaigns play a crucial role in promoting oral hygiene practices.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The demand for teeth whitening products and mouthwash is the key driver of the market. The market has experienced significant growth due to the increasing awareness of dental diseases and the ageing population. Unhealthy food habits and poverty are major factors contributing to an increase in oral health issues. In response, companies have introduced innovative oral hygiene products to cater to consumer needs. Colgate-Palmolive Company and Procter and Gamble (P&G) are major players in the market, offering toothpaste and mouthwash under their respective brands. Listerine mouthwash, a popular mouthwash brand, has gained popularity due to its antimicrobial properties. Product innovation continues to be a key trend in the market, with new entrants such as BURST Oral Care, Oclean X Ultra, and PerioBiotic Silver introducing eco-friendly and sustainable products.

Furthermore, the Toothbrush segment, including both manual and electric toothbrushes, is a significant contributor to the market. Laifen Tech, Ojook, and Burst are some of the brands offering advanced toothbrush technology. Subchapter D-Drugs under the Human Use category include toothpaste and mouthwash, which are subject to regulatory approval. Consumer spending power, health awareness, and public awareness of oral diseases, including the geriatric population and cosmetic dentistry, are driving the demand for oral hygiene products. Nano-hydroxyapatite and other advanced technologies are being used to develop eco-friendly and effective oral hygiene products.

Market Trends

An increase in demand for natural and organic oral hygiene products is the upcoming trend in the market. The market is witnessing significant growth due to the increasing awareness of personal health and dental hygiene. With an ageing population and unhealthy food habits leading to a rise in dental diseases, the demand for oral hygiene products is on the rise. Product innovation is a key trend in the market, with companies introducing natural and organic toothpaste and mouthwash options. Colgate-Palmolive, Listerine, and BURST Oral Care are some major players in the market. However, poverty and limited consumer spending power in certain regions pose a challenge. Regulatory scrutiny, particularly regarding the use of certain ingredients such as triclosan and fluoride under Subchapter D-Drugs, adds complexity to the market.

Furthermore, the toothbrush segment, including manual toothbrushes from Laifen Tech and electric toothbrushes from Oclean X Ultra, is also seeing innovation with the introduction of eco-friendly and sustainable products. Consumer needs and public awareness of oral diseases, including tooth decay, cavities, and oral cancer, are driving demand for oral hygiene products. Cosmetic dentistry and industry applications are also contributing to market growth.

Market Challenge

Homemade remedies and alternative products adoption is a key challenge affecting the market growth. The market faces challenges due to the prevalence of homemade remedies and traditional oral care practices, particularly in rural areas of developing countries. This trend is significant as the rural population represents a substantial customer base for oral hygiene product companies. However, the adoption of these alternative methods limits the sales volume of commercial oral care products in such regions, impacting the market growth. To counter this, market players are focusing on increasing public awareness of modern oral care habits. This approach could potentially expand their customer base and boost revenue. Key players in the market include Colgate-Palmolive, Procter & Gamble, and BURST Oral Care, among others.

Furthermore, product innovation remains a crucial strategy for these companies to stay competitive. For instance, Colgate-Palmolive introduced PerioBiotic Silver, a toothpaste that contains silver ions to fight gum diseases. Listerine mouthwash, a product of Johnson & Johnson, offers antiseptic properties to prevent oral diseases. Moreover, the aging population and unhealthy food habits contribute to the increasing prevalence of dental diseases. This trend creates opportunities for oral hygiene product manufacturers. Product segments include toothpaste, mouthwash, toothbrushes, and other oral care devices. Manual and electric toothbrushes are popular choices, with companies offering advanced features. The market is subject to regulatory scrutiny, particularly in the Human Use segment under Subchapter D-Drugs.

Furthermore, industry applications include supermarkets/hypermarkets and the online retail segment. Consumer spending power and health awareness influence the market's growth. Sustainable and eco-friendly products are gaining popularity, with companies like Ojook and Burst offering nano-hydroxyapatite toothbrushes. Cosmetic dentistry also contributes to the market's growth, with consumers seeking to maintain a visually appealing smile.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amway Corp. - The company offers oral hygiene products such as Glister toothpaste, multi-action tooth brush, and essential kit.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Amway Corp.

- Church and Dwight Co. Inc.

- Colgate Palmolive Co.

- Dentaid

- Dr. Fresh LLC

- GC Corp.

- GlaxoSmithKline Plc

- GoSmile LLC

- Henkel AG and Co. KGaA

- Himalaya Global Holdings Ltd.

- Johnson and Johnson Services Inc.

- Kao Specialties Americas LLC

- Koninklijke Philips N.V.

- Lion Corp.

- Prestige Consumer Healthcare Inc.

- Sanofi SA

- Sunstar Suisse SA

- The Procter and Gamble Co.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the rising prevalence of dental diseases, an aging population, and unhealthy food habits. Mergers, such as Procter & Gamble's acquisition of Ojook, are shaping the market. The toothbrush segment is divided into manual and electric toothbrushes. Supermarkets/hypermarkets and the online retail segment are major distribution channels. Consumer spending power, health awareness, toothbrushes, mouthwashes, and consumer needs are driving the market. Public awareness campaigns and cosmetic dentistry are also contributing to the growth. The geriatric population and oral diseases are significant industry applications. Sustainable products and eco-friendly packaging are becoming essential as consumers prioritize the environment.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market Growth 2024-2028 |

USD 11.49 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 41% |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., Amway Corp., Church and Dwight Co. Inc., Colgate Palmolive Co., Dentaid, Dr. Fresh LLC, GC Corp., GlaxoSmithKline Plc, GoSmile LLC, Henkel AG and Co. KGaA, Himalaya Global Holdings Ltd., Johnson and Johnson Services Inc., Kao Specialties Americas LLC, Koninklijke Philips N.V., Lion Corp., Prestige Consumer Healthcare Inc., Sanofi SA, Sunstar Suisse SA, The Procter and Gamble Co., and Unilever PLC |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch