Orthokeratology Lens Market Size 2024-2028

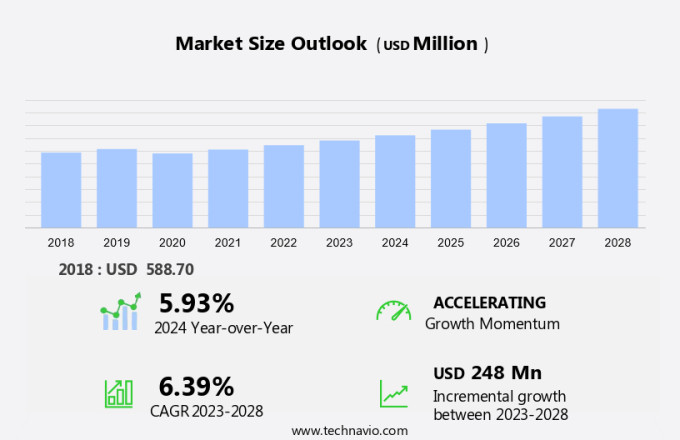

The orthokeratology lens market size is estimated to grow by USD 248 million at a CAGR of 6.39% between 2023 and 2028. Myopia, or nearsightedness, is a common eye condition that affects an increasing number of people globally. Orthokeratology, a non-surgical alternative to correcting myopia, has gained popularity due to advancements in lens technology and materials. Orthokeratology lenses are designed to gently reshape the cornea while the patient sleeps, allowing for clear vision during waking hours. These lenses are particularly appealing to those with professional requirements that demand optimal vision without the need for glasses or contact lenses during work hours. The rising demand for orthokeratology is driven by the convenience and freedom it offers, making it a promising solution for individuals seeking to improve their visual acuity without undergoing surgery.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The market is a segment of the ophthalmic industry that focuses on correcting refractive errors, such as myopia, astigmatism, and hyperopia, through the use of specially designed lenses. These lenses, also known as ortho-k lenses or corneal reshaping lenses, are worn overnight and gently reshape the cornea to improve vision during the day, without the need for spectacles or contact lenses. The market for Orthokeratology lenses is driven by the increasing prevalence of eye disorders, particularly among the elderly population and children. According to the World Health Organization, approximately 2.2 billion people worldwide have a refractive error, with myopia affecting around 1.6 billion. Orthokeratology lenses offer an alternative to surgical procedures like LASIK and Photorefractive Keratectomy (PRK) surgeries, which carry risks such as halos around lights and other visual disturbances. Healthcare providers, including optometrist clinics, are increasingly promoting orthokeratology lenses as a safe and effective solution for correcting vision. The market for Orthokeratology lenses is also being driven by the growing trend of digital screening and online platforms for eye testing. The availability of novel orthokeratology lenses, such as silicone acrylate lenses, is further fueling market growth. The market is expected to continue expanding as more people seek non-surgical options for correcting refractive errors and maintaining good eye health. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The increasing prevalence of myopia globally is notably driving market growth. The market caters to the correction of refractive errors such as myopia, astigmatism, and hyperopia through the use of specialized lenses that reshape the eye during sleep. These lenses, which can be either overnight or day-time ortho-K, are gaining popularity among individuals seeking vision correction alternatives to surgical procedures like LASIK surgeries, Photorefractive Keratectomy surgeries, and refractive lens exchange. Orthokeratology lenses, often made of gas-permeable materials, are used to correct various eye disorders including dry eye, itching, glare, halos, and presbyopia, as well as hypermetropia. Healthcare providers, including optometrist clinics, hospitals, ophthalmic clinics, and optometry clinics, offer these lenses as part of elective ophthalmic procedures and health checkups. The market for these lenses is growing, with the development of novel orthokeratology lenses and the increasing awareness of vision correction methods among the elderly population. Online platforms and eye testing services are also expanding the reach of orthokeratology lenses, making them more accessible to a wider audience. The ophthalmic industry continues to innovate, with ongoing research and development in the field of corneal reshaping. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

The increasing prevalence of refractive errors is the key trend in the market. The market caters to individuals with refractive errors such as myopia, astigmatism, and hyperopia, who seek non-surgical alternatives to correct their vision. Orthokeratology lenses, also known as corneal reshaping lenses, are gas-permeable lenses that gently reshape the cornea while worn overnight. These lenses are gaining popularity among healthcare providers and optometrist clinics as an alternative to elective ophthalmic procedures like LASIK surgeries, Photorefractive Keratectomy surgeries, and refractive lens exchange. Orthokeratology lenses offer several advantages, including reducing the symptoms of dry eye, itching, glare, and halos commonly associated with refractive errors. The elderly population, in particular, benefits from these lenses due to their non-invasive nature and ease of use. With the increasing prevalence of eye disorders and the growing awareness of vision correction methods, the demand for orthokeratology lenses is expected to increase. The ophthalmic industry is witnessing a surge in the development of novel orthokeratology lenses with increased product capacities to cater to the diverse needs of consumers. Online platforms and eye testing services are also becoming increasingly popular, making orthokeratology lenses more accessible to a wider audience. Awareness programs and health checkups are being organized to educate individuals about the benefits of orthokeratology lenses and their indications for various eye conditions, including presbyopia and hypermetropia. Orthokeratology lenses are available in two types: overnight ortho-K-lenses and day-time ortho-K-lenses. Overnight lenses are worn while sleeping and removed during the day, while day-time lenses are worn during waking hours. Hospitals, ophthalmic clinics, and optometry clinics are key contributors to the growth of the orthokeratology lenses market. As the demand for vision correction methods continues to rise, the market for orthokeratology lenses is poised for significant growth. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

The high costs associated with orthokeratology lenses is the major challenge that affects the growth of the market. The market caters to the correction of refractive errors, including myopia, astigmatism, and hyperopia, through non-surgical means. Orthokeratology lenses, also known as corneal reshaping lenses, are gas-permeable lenses worn overnight to gently and temporarily reshape the cornea, thereby correcting vision during the day. This alternative to surgical procedures such as LASIK surgeries, Photorefractive Keratectomy surgeries, and refractive lens exchange, is gaining popularity among individuals seeking vision correction. Orthokeratology lenses are increasingly being adopted by healthcare providers, including optometrist clinics, hospitals, and ophthalmic clinics, to cater to the growing demand for elective ophthalmic procedures. The elderly population, in particular, benefits from this form of vision correction due to its non-invasive nature and ability to address presbyopia and hypermetropia. However, orthokeratology lenses may cause side effects such as dry eye, itching, glare, and halos. To mitigate these issues, novel orthokeratology lenses with improved product capacities are being developed. Additionally, online platforms and eye testing facilities are making orthokeratology lenses more accessible, while awareness programs are increasing public understanding of the benefits and indications of this form of vision correction. The ophthalmic industry continues to evolve, with a focus on providing advanced solutions for various eye disorders. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Art Optical Contact Lens Inc. - The company offers orthokeratology lens namely MOONLENS, that helps manage and temporarily correct myopia through a proprietary algorithm allowing more customization for each individual patient eye.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Art Optical Contact Lens Inc.

- Bausch Lomb Corp.

- Brighten Optix

- Contex Inc.

- EssilorLuxottica

- Euclid Vision Corp

- Johnson and Johnson Services Inc.

- LUCID KOREA LTD.

- Menicon Co. Ltd.

- MiracLens L.L.C

- OrthoTool

- PRECILENS

- SEED Co. Ltd.

- SkyOptix

- SynergEyes Inc.

- The Cooper Companies Inc.

- TruForm Optics Inc.

- Wave LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Application

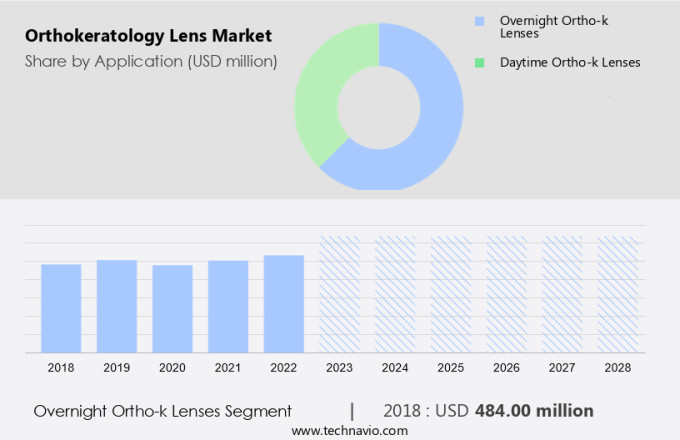

The overnight ortho-k lenses segment is estimated to witness significant growth during the forecast period. The market caters to the correction of refractive errors such as myopia, astigmatism, and hyperopia through the use of specialized contact lenses. These lenses, also known as ortho-K lenses, work by gently reshaping the cornea while worn overnight. In contrast to surgical procedures like LASIK surgeries, Photorefractive Keratectomy surgeries, and refractive lens exchange, orthokeratology lenses are a non-surgical alternative. However, they may still present challenges such as dry eye, itching, glare, and halos for some users.

Get a glance at the market share of various regions Download the PDF Sample

The overnight ortho-k lenses segment accounted for USD 484 million in 2018. Optometrists and healthcare providers in optometrist clinics, hospitals, and ophthalmic clinics offer orthokeratology lenses as an alternative to surgical procedures for individuals with mild to moderate refractive errors. The elderly population, in particular, may benefit from this form of vision correction due to its non-invasive nature. The ophthalmic industry continues to innovate, with the development of novel orthokeratology lenses, online platforms for eye testing and prescription, and awareness programs to increase accessibility. Indications for orthokeratology lenses extend to presbyopia and hypermetropia, making them a versatile solution for various eye disorders. Gas-permeable lenses and corneal reshaping techniques are at the heart of orthokeratology. With advancements in technology and growing awareness of elective ophthalmic procedures, the market for orthokeratology lenses is poised for growth. Regular health checkups and vision screenings are essential to ensure proper usage and maintenance of these lenses.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

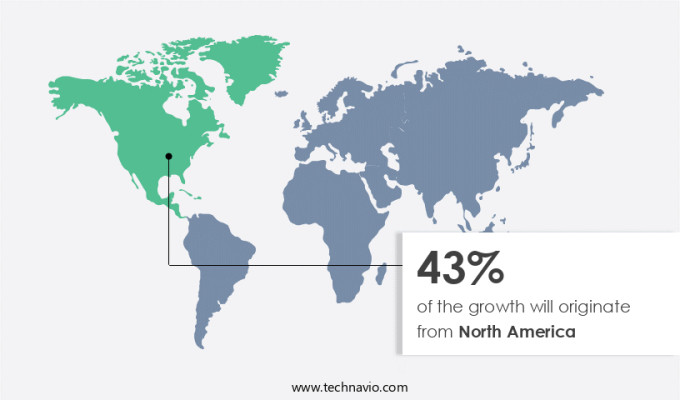

North America is estimated to contribute 43% to the growth of the global market during the market forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Orthokeratology lenses, also known as ortho-k lenses, are a type of corrective eyewear that reshape the cornea while worn overnight, allowing for clear vision during the day without the need for spectacles or contact lenses. These lenses are particularly beneficial for individuals with myopia, astigmatism, or presbyopia. While ortho-k lenses offer a non-surgical alternative to procedures like photorefractive keratectomy (PRK), they may still present certain challenges, such as the potential for halos around lights and discomfort for some users. Ortho-k lenses are available in various materials, including silicone acrylate, fluorosilicone acrylate, and fluorocarbon acrylate. Ophthalmology clinics play a crucial role in the fitting and monitoring of ortho-k lenses, ensuring proper usage and addressing any potential issues. For children, ortho-k lenses can be an effective solution for correcting vision problems without the need for daily contact lens usage or the risks associated with surgical procedures. Overall, orthokeratology lenses provide a viable option for those seeking to improve their vision without the need for spectacles or undergoing surgery.

Segment Overview

The market report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application Outlook

- Overnight ortho-k lenses

- Daytime ortho-k lenses

- Distribution Channel Outlook

- Offline

- Online

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Argentina

- Brazil

- Chile

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also be interested in:

- Myopia and Presbyopia Treatment Market Analysis Asia, North America, Europe, Rest of World (ROW) - US, Canada, Germany, China, Japan - Size and Forecast

- Ophthalmic Lens Market Analysis North America, Europe, Asia, Rest of World (ROW) - US, China, Germany, France, Japan - Size and Forecast

- Contact Lens Solutions Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, China, UK, Germany, France - Size and Forecast

Market Analyst Overview

The Orthokeratology lens market is a significant segment of the ophthalmic industry, focusing on correcting refractive errors using specially designed lenses. These lenses, also known as ortho-K lenses, are used to reshape the cornea while the wearer sleeps, allowing for clear vision during waking hours. Orthokeratology lenses are effective in treating myopia, astigmatism, and hyperopia, making them an attractive alternative to surgical procedures like LASIK surgeries, Photorefractive Keratectomy surgeries, and Refractive lens exchange. Orthokeratology lenses are gaining popularity due to their convenience and non-invasive nature. They are particularly beneficial for individuals suffering from dry eye, itching, glare, and halos, which are common side effects of surgical procedures. Optometrists and healthcare providers, including optometrist clinics and hospitals, are key players in the Orthokeratology lens market. The elderly population is another significant demographic for this market due to the increasing prevalence of eye disorders and presbyopia, a common age-related condition. Digital screening and awareness programs are also driving the growth of the Orthokeratology lens market. Novel orthokeratology lenses, such as overnight and day-time ortho-K-lens, offer increased product capacities and indications for a broader range of users. Online platforms and eye testing are also making it easier for consumers to access these lenses. The Ophthalmic industry's growth in elective ophthalmic procedures, surgical procedures, and health checkups is also contributing to the Orthokeratology lens market's expansion. Gas-permeable lenses and corneal reshaping techniques are the primary technologies driving the market. Overall, the Orthokeratology lens market is poised for significant growth due to its ability to offer effective vision correction without the need for invasive surgical procedures.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.39% |

|

Market growth 2024-2028 |

USD 248 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.93 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 43% |

|

Key countries |

US, China, UK, Germany, Japan, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Art Optical Contact Lens Inc., Bausch Lomb Corp., Brighten Optix, Contex Inc., EssilorLuxottica, Euclid Vision Corp, Johnson and Johnson Services Inc., LUCID KOREA LTD., Menicon Co. Ltd., MiracLens L.L.C, OrthoTool, PRECILENS, SEED Co. Ltd., SkyOptix, SynergEyes Inc., The Cooper Companies Inc., TruForm Optics Inc., and Wave LLC |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies