Outsourcing In BFSI Sector Market Size 2025-2029

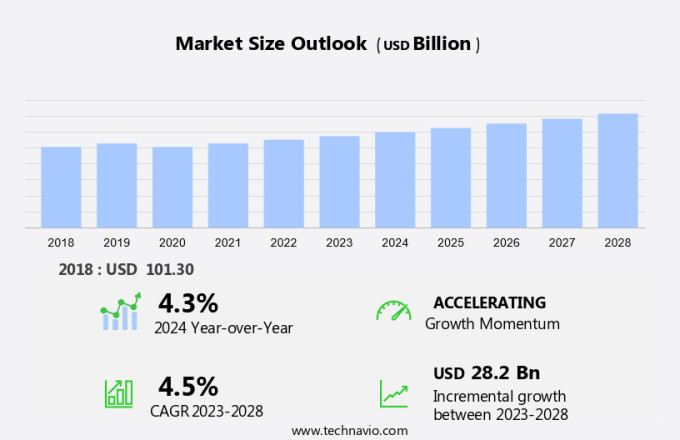

The outsourcing in BFSI sector market size is forecast to increase by USD 32.2 billion at a CAGR of 4.9% between 2024 and 2029.

- In the Outsourcing in BFSI sector, three key market drivers are shaping the strategic landscape. First, the increasing need for regulatory compliance is pushing financial institutions to outsource non-core functions to specialized service providers. This trend is driven by the complex and ever-evolving regulatory environment, which requires significant resources and expertise to navigate. Second, the rising emphasis on process automation is another significant driver. Customer support, data analytics, and transaction processing are among the key functions outsourced to achieve economies of scale and specialized expertise. Outsourcing allows financial institutions to leverage advanced technologies and specialized skills to automate repetitive and time-consuming tasks.

- Growing concerns regarding data breaches and cybersecurity threats pose a significant risk to financial institutions that outsource sensitive data and processes. These concerns have intensified with the increasing adoption of cloud-based services and the growing use of digital channels for banking and financial services. Companies must invest in robust security measures and establish strong service level agreements with their outsourcing partners to mitigate these risks. Compliance issues and cybersecurity threats are addressed through IT outsourcing, ensuring regulatory compliance and operational efficiency.

What will be the Size of the Outsourcing In BFSI Sector Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- In the BFSI sector, outsourcing back-office operations to specialized experts has become a strategic move for financial services firms seeking a competitive advantage. Customer relationship management and transaction processing are common functions outsourced to gain operational efficiency and reduce costs. Digital transformation, advanced analytics, and Gen AI are driving trends in the outsourcing market, enabling threat detection, error reduction, and improved customer experience. Compliance risks are mitigated through regulatory compliance expertise, ensuring businesses remain agile and adapt to evolving regulatory requirements.

- Core competencies are focused on, allowing firms to streamline processes and enhance their financial services offerings. The outsourcing of customer service and advanced analytics functions can lead to significant cost savings and operational improvements. This not only improves operational efficiency but also reduces errors and enhances customer experience. However, the outsourcing market in BFSI is not without challenges.

How is this Outsourcing In BFSI Sector Industry segmented?

The outsourcing in BFSI sector industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- ITO

- BPO

- Delivery Mode

- Offshore outsourcing

- Onshore outsourcing

- Nearshore outsourcing

- End-user

- Large enterprises

- SMEs

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

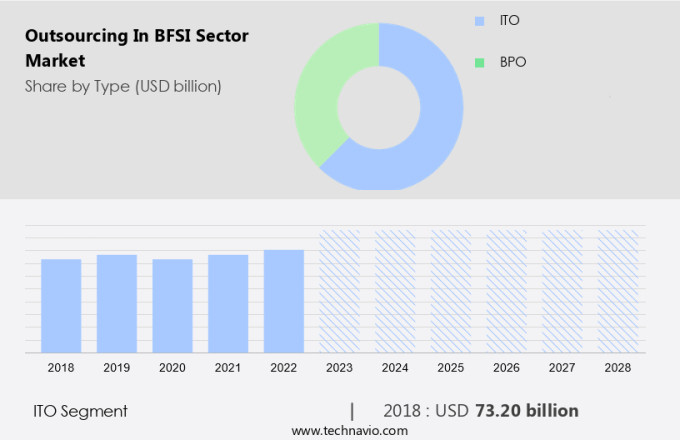

By Type Insights

The ITO segment is estimated to witness significant growth during the forecast period. In the digital age, the BFSI sector's reliance on Information Technology Outsourcing (ITO) continues to grow, driven by the increasing complexity of digital transactions and the need for advanced analytics capabilities. The rise in digital adoption in the sector necessitates efficient management of operational processes and scalability, leading financial institutions to outsource non-core functions. The digital transformation of customer relationship management necessitates advanced analytics to gain insights from vast volumes of behavioral data. Siloed departments are streamlined, and employee experience is enhanced through outsourcing.

Sustainable practices and risk management are integrated into outsourcing strategies, ensuring a competitive advantage. Back-office operations, such as account reconciliation and document processing, are outsourced to improve efficiency and reduce costs. Business Process Outsourcing (BPO) plays a crucial role in product development, with Gen AI and cloud-based solutions enabling operational excellence and threat detection. Disparate systems are integrated through best practices, and service level agreements ensure seamless service delivery. Cheaper labor markets offer cost savings, while employee skill enhancement and risk management are prioritized.

The BFSI sector's outsourcing landscape is shaped by the need for operational efficiency, regulatory compliance, and digital transformation. The evolving market trends necessitate a focus on advanced analytics, cybersecurity, and employee skill enhancement, ensuring a competitive edge in the digital age.

The ITO segment was valued at USD 76.70 billion in 2019 and showed a gradual increase during the forecast period.

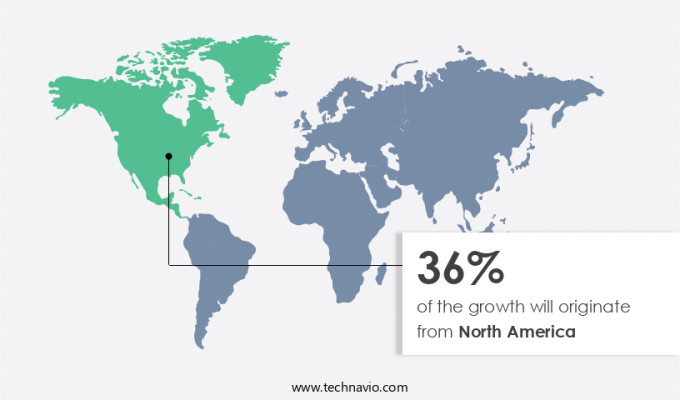

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the BFSI sector, the outsourcing market in North America continues to thrive, with the US being a significant contributor. The region's financial organizations face ongoing regulatory and economic challenges, leading them to outsource various functions to specialized experts. The US market offers extensive support to meet these requirements, making it a preferred destination for business process outsourcing (BPO). Advanced technologies, such as digital transformation, artificial intelligence, and advanced analytics, are increasingly adopted in the region. These technologies enable financial services companies to streamline processes, reduce costs, and improve operational efficiency. However, the presence of siloed departments and disparate systems poses challenges, necessitating the need for best practices and risk management.

Compliance issues and cybersecurity threats are critical concerns for financial institutions. Outsourcing partners offer specialized skills and expertise to address these risks, ensuring regulatory compliance and data security. The use of cloud-based solutions and document processing further enhances operational excellence and improves efficiency. Cost savings and employee skill enhancement are other significant benefits of outsourcing in the BFSI sector. Service level agreements and performance monitoring ensure operational efficiency and a competitive advantage. The market is expected to continue evolving, with a focus on core competencies, threat detection, and back-office operations.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Outsourcing In BFSI Sector market drivers leading to the rise in the adoption of Industry?

- The escalating importance of regulatory compliance is the primary factor fueling market growth. Adherence to regulatory requirements is a non-negotiable necessity in today's business landscape, and failure to do so can result in severe consequences. As regulatory frameworks continue to evolve and become more complex, companies must prioritize compliance to mitigate risks, protect their reputation, and ensure long-term success. The BFSI sector is experiencing significant regulatory changes, leading to increased demand for compliance and transparency. In 2024, financial institutions globally faced heightened regulatory scrutiny due to emerging risks and technological advancements. Basel III reforms, enhanced liquidity stress testing, and new prudential standards were implemented across jurisdictions.

- The BFSI sector's regulatory landscape is driving the growth of the outsourcing market. Financial institutions are outsourcing to specialized partners to streamline processes, reduce costs, and address compliance issues and cybersecurity threats, ultimately enhancing operational efficiency and improving the customer experience. The European Central Bank introduced cyber resilience stress tests, while the US and UK regulators highlighted liquidity risk management and internal governance. These regulatory requirements have led to the outsourcing of specialized skills, such as transaction processing, account reconciliation, and error reduction, to ensure operational efficiency and reduce costs. Outsourcing also enables financial services firms to focus on their core competencies while addressing compliance issues and cybersecurity threats.

What are the Outsourcing In BFSI Sector market trends shaping the Industry?

- The increasing prioritization of process automation is a notable market trend. This prioritization signifies a significant shift towards streamlining operations and enhancing efficiency through technology. The Business Process Outsourcing (BPO) market in the BFSI sector has witnessed significant growth due to the adoption of advanced technologies such as artificial intelligence (AI), cloud computing, and process automation. According to recent research, AI software can streamline process functions, ensuring accuracy and efficiency, while cloud storage eliminates the need for extensive physical infrastructure, reducing energy consumption. It is projected that by 2025, 83% of enterprise workloads will be stored on the cloud.

- Service level agreements (SLAs) play a vital role in ensuring quality and consistency in outsourced services. BPO companies in the BFSI sector prioritize sustainable practices, ensuring regulatory compliance and data security. By leveraging the power of emerging technologies, they can deliver cost savings and improved efficiency, making them indispensable partners for businesses worldwide. Effective communication channels and regulatory compliance are crucial in the BFSI sector. Outsourcing partners must adhere to best practices for risk management and employee skill enhancement.

How does Outsourcing In BFSI Sector market face challenges during its growth?

- The escalating issue of data breaches poses a significant challenge to the industry's growth, necessitating heightened efforts to enhance cybersecurity measures and restore consumer trust. In the BFSI sector, outsourcing has become a popular strategy for businesses seeking operational excellence and cost savings through cheaper labor markets. However, with the increasing use of cloud-based solutions and the digitalization of back-office operations, data security has emerged as a significant concern. Data breaches, which involve the unauthorized transfer of confidential, financial, or personal information, can result in severe penalties and reputational damage.

- Document processing, threat detection, and compliance risks are critical areas where outsourcing companies must excel to maintain a competitive advantage. Performance monitoring and continuous improvement are essential to ensure the security and privacy of customer data. By focusing on core competencies and outsourcing non-core functions, firms can enhance efficiency and mitigate risks while maintaining data security and operational excellence. The sophistication of cyber threats continues to evolve, necessitating robust security measures and adherence to regulations such as the General Data Protection Regulation (GDPR).

Exclusive Customer Landscape

The outsourcing in BFSI sector market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the outsourcing in BFSI sector market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, outsourcing in bfsi sector market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - The company specializes in outsourcing services for the Banking, Financial Services, and Insurance (BFSI) sector, offering solutions such as Mortgage Business Process Outsourcing and Finance and Accounting Business Process Outsourcing.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Beyondsoft Consulting Inc.

- CGI Inc.

- Cognizant Technology Solutions Corp.

- Dell Technologies Inc.

- eClerx Services Ltd.

- EPAM Systems Inc.

- ExlService Holdings Inc.

- Genpact Ltd.

- HCL Technologies Ltd.

- Infosys Ltd.

- International Business Machines Corp.

- Larsen and Toubro Ltd.

- Mahindra and Mahindra Ltd.

- Unisys Corp.

- Valores Corporativos Softtek S.A. de C.V.

- Virtusa Corp.

- Wipro Ltd.

- WNS Holdings Ltd.

- Xerox Holdings Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Outsourcing In BFSI Sector Market

- In January 2024, Infosys BPO, a leading business process management (BPM) services provider, announced the launch of its advanced Automated Risk and Compliance (ARC) solution for the banking, financial services, and insurance (BFSI) sector (Infosys Press Release, 2024). This solution uses artificial intelligence and machine learning to help financial institutions automate regulatory compliance and risk management processes.

- In March 2024, TCS, another major BFSI outsourcing player, formed a strategic partnership with a leading fintech company to offer cloud-based digital banking solutions (TCS Press Release, 2024). The collaboration aims to provide TCS's extensive BFSI client base with advanced digital banking capabilities, enabling them to offer superior customer experiences and improved operational efficiency.

- In May 2025, Wipro Limited, a global information technology, consulting, and outsourcing company, completed the acquisition of a mid-sized BFSI outsourcing firm, significantly expanding its presence in the European market (Wipro Press Release, 2025). The acquisition brought in over 1,500 employees and added several key clients in the banking and insurance sectors, increasing Wipro's market share in the region.

Research Analyst Overview

In the Business Process Outsourcing (BPO) sector, particularly in the Financial Services Industry (BFSi), market dynamics continue to evolve, driven by the digital age and the need for operational efficiency, cost savings, and regulatory compliance. Economies of scale and access to specialized expertise have led financial institutions to outsource various functions, including customer support, data analytics, and transaction processing. BFSi companies are leveraging advanced analytics to gain insights from disparate systems, improving customer experience and reducing errors. The digital transformation of customer relationship management has led to the integration of communication channels, enabling seamless interactions between customers and service providers.

Business process outsourcing has extended to product development, with Gen AI and automation being employed to streamline processes and enhance employee experience. Risk management and compliance issues remain a priority, with service level agreements ensuring operational excellence and cybersecurity threats being mitigated through rigorous monitoring and evaluation. The BPO market is characterized by the integration of best practices, sustainable business models, and employee skill enhancement. Back-office operations, such as document processing and account reconciliation, are being outsourced to cheaper labor markets, enabling financial institutions to focus on their core competencies and gain a competitive advantage.

Cloud-based solutions are becoming increasingly popular, enabling real-time data access and improving operational efficiency. The ongoing unfolding of market activities highlights the need for continuous improvement and adaptation to the evolving regulatory landscape and customer expectations.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Outsourcing In BFSI Sector Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.9% |

|

Market growth 2025-2029 |

USD 32.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, Canada, China, Germany, UK, France, India, Brazil, Japan, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Outsourcing In BFSI Sector Market Research and Growth Report?

- CAGR of the Outsourcing In BFSI Sector industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the outsourcing in BFSI sector market growth of industry companies

We can help! Our analysts can customize this outsourcing in BFSI sector market research report to meet your requirements.