Pharmaceutical Contract Research And Manufacturing Market Size 2024-2028

The pharmaceutical contract research and manufacturing market size is forecast to increase by USD 141.3 bn at a CAGR of 10.87% between 2023 and 2028.

What will be the Size of the Pharmaceutical Contract Research And Manufacturing Market during the Forecast Period?

How is this Pharmaceutical Contract Research And Manufacturing Industry segmented and which is the largest segment?

The pharmaceutical contract research and manufacturing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Service

- CMO

- CRO

- End-user

- Big pharmaceuticals

- Small and medium-sized pharmaceuticals

- Generic pharmaceuticals

- Geography

- North America

- US

- Asia

- China

- India

- Europe

- Germany

- UK

- Rest of World (ROW)

- North America

By Service Insights

The cmo segment is estimated to witness significant growth during the forecast period. The Contract Research and Manufacturing Organizations (CMO) segment dominates the global pharmaceutical market, driven by the increasing demand for specialized manufacturing processes for short-lived drugs and healthcare products. Advancements in medical sciences and the growing preference for specialty medicines, coupled with technological innovations like nanotechnology and stem cell research, are fueling the production of complex drugs. Pharmaceutical giants such as Pfizer, Johnson & Johnson, and GlaxoSmithKline are outsourcing their manufacturing activities to CMOs to optimize resource utilization. Additionally, the emergence of biologics, biosimilars, and targeted medication therapies is increasing the demand for cost-effective manufacturing services. CMOs offer a range of specialized services, including drug discovery, biologics manufacturing, clinical trial support, and regulatory compliance, among others.

The pharmaceutical ecosystem comprises big pharma companies, academic institutes, CROs, and various service providers, all contributing to the drug development process. The integration of digitalization, personalized medicines, and advanced manufacturing technologies is further transforming the pharmaceutical landscape.

Get a glance at the market report of various segments Request Free Sample

The CMO segment was valued at USD 91.90 bn in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

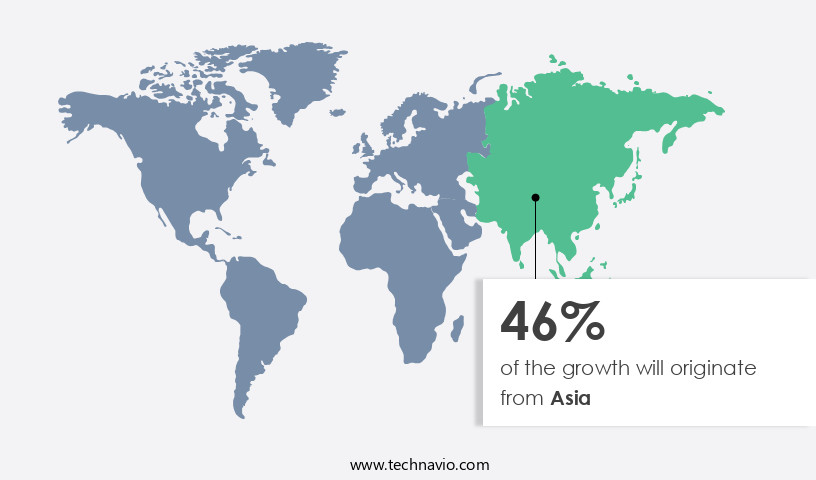

Asia is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Pharmaceutical Contract Research and Manufacturing (CRAM) market in North America experienced notable expansion in 2023 and is projected to continue growing during the forecast period. This growth can be attributed to the robust CRO (Contract Research Organizations) sector In the region, as well as the increasing adoption of CMOs (Contract Manufacturing Organizations) In the US and Mexico. North America holds a leading position In the global CRO segment due to the presence of numerous large-scale CROs based In the US, such as IQVIA, a global leader in providing research and development solutions to major pharmaceutical companies worldwide. The region's growth is further driven by advancements in areas like Drug Development, Route Scouting Services, Regulatory Compliance, Clinical Trials, and Outsourcing.

Additionally, the increasing focus on cost-effective manufacturing for Biologics, Biosimilars, Drug Discovery, and Drug Development Services, as well as the integration of Digitalization, Personalized Medicines, and Advanced Manufacturing Technologies, contribute to the market's growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of market?

Availability of cost-efficient resources in emerging markets is the key driver of the market.The market has experienced notable growth due to several factors. Developing countries like China, India, Brazil, and Mexico have made significant strides in healthcare infrastructure and advanced drug development processes. This progress has led large and mid-sized pharmaceutical companies from developed nations to outsource their research and manufacturing operations for various drugs and therapies to companies In these countries. The primary reason for this trend is the availability of labor at lower costs compared to developed countries. Furthermore, the presence of US FDA-approved manufacturing facilities In these countries, such as India's over 100, strengthens the appeal of outsourcing.

Advancements in technology, particularly Artificial Intelligence (AI), have revolutionized drug discovery and development processes. AI-driven route scouting services and drug development services enable faster identification of Drug Candidates and Active Pharmaceutical Ingredients (APIs), reducing the overall time and cost of drug development. Bioprocess outsourcing, manufacturing services for Biologics and Biosimilars, and drug formulation are other significant areas of outsourcing. Quality control, advanced manufacturing technologies like Continuous manufacturing, and specialized services such as Drug delivery systems and Clinical trial support are essential components of these processes. The pharmaceutical ecosystem, consisting of Big Pharmaceutical Companies, Academic Institutes, Contract Research Organizations (CROs), and other stakeholders, benefits from cost-effective manufacturing and regulatory compliance.

The market also caters to the production of Small Molecule Drugs, Targeted Medication Therapies, Vaccines, Antibiotics, and Serialization to mitigate Counterfeiting concerns. Digitalization and Personalized medicines are emerging trends In the pharmaceutical industry, necessitating the adoption of advanced manufacturing technologies and production workflows that adhere to stringent Quality standards. Meeting Patient needs remains the primary focus, driving the growth of the market.

What are the market trends shaping the Pharmaceutical Contract Research And Manufacturing market?

Increasing number of US FDA approved manufacturing facilities is the upcoming market trend.The Pharmaceutical Contract Research and Manufacturing (CRAM) market is experiencing significant growth due to the increasing number of US FDA-approved manufacturing facilities in emerging economies, particularly in China and India. India, with over 400 such facilities, is a leading destination for outsourcing pharmaceutical manufacturing services. This country boasts approximately 230 approved Active Pharmaceutical Ingredient (API) facilities and 150 finished dosage form (FDF) facilities, the highest In the world. India also houses around 147 laboratories for formulations. The approval of manufacturing facilities in other emerging economies like China, Mexico, and Brazil is also on the rise. This trend is driven by the need for cost-effective manufacturing, regulatory compliance, and access to specialized services.

The pharmaceutical ecosystem, including Big Pharma companies, academic institutes, and Contract Research Organizations (CROs), is increasingly relying on these countries for drug development services, biologics manufacturing, biosimilars, and drug formulation. Advanced manufacturing technologies, such as serialization, counterfeiting prevention, digitalization, and continuous manufacturing, are also gaining popularity. The market caters to various drug development processes, production workflows, and quality standards to meet patient needs and regulatory requirements. The focus is on small molecule drugs, drug candidates, and clinical trial support, as well as clinical and commercial operations for both generic drugs and originator APIs, including low potent APIs, oral solids, liquids, emulsions, and drug delivery systems.

What challenges does the market face during its growth?

Stereotypical nature of CMOs is a key challenge affecting the industry growth.The global Pharmaceutical Contract Research and Manufacturing (CRAM) market faces a significant challenge due to the limited advanced technology offerings from Contract Manufacturing Organizations (CMOs) in emerging economies, particularly Asia, which hold the largest market share. Although healthcare infrastructure In these regions has improved, CMOs in Asia primarily use older manufacturing technologies due to the complexities and high costs associated with producing biological drugs and vaccines using advanced technologies. These complexities require specialized services, such as route scouting, regulatory compliance, and clinical trial support, which are not readily available in Asia. As a result, CMOs in Asia primarily focus on manufacturing small molecule-based drugs, such as generic drugs, antibiotics, and active pharmaceutical ingredients (APIs), which can be produced in large quantities using older technologies.

However, they lack the capability to manufacture biologics, biosimilars, and drug delivery systems on a large scale. This gap In the pharmaceutical ecosystem is driving Big Pharmaceutical Companies and Academic Institutes to outsource their drug development services to CROs and specialized manufacturing services providers based in developed regions. The pharmaceutical CRAM market is witnessing digitalization, with the adoption of artificial intelligence (AI) and advanced manufacturing technologies, such as continuous manufacturing, in drug discovery and production workflows. This trend is expected to increase the demand for cost-effective manufacturing services for small molecule drugs, drug candidates, and clinical trial support. Additionally, the growing focus on personalized medicines and targeted medication therapies is driving the need for specialized services and manufacturing processes that meet quality standards and patient needs.

Exclusive Customer Landscape

The pharmaceutical contract research and manufacturing market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pharmaceutical contract research and manufacturing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pharmaceutical contract research and manufacturing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Almac Group Ltd. - Pharmaceutical contract research and manufacturing services encompass various offerings, including API (Active Pharmaceutical Ingredient) Services and Chemical Development, as well as Pharmaceutical Drug Product Development. These solutions assist pharmaceutical companies in bringing their drugs to market by providing expertise in research, development, and manufacturing processes. API Services involve the synthesis, development, and production of the active ingredients used in pharmaceuticals. Chemical Development focuses on optimizing chemical processes and developing formulations for drug products. Pharmaceutical Drug Product Development encompasses formulation development, analytical services, and manufacturing of finished dosage forms. These services enable pharmaceutical companies to outsource critical aspects of their drug development process, reducing time-to-market and costs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Almac Group Ltd.

- Boehringer Ingelheim International GmbH

- Cadila Pharmaceuticals Ltd.

- Catalent Inc.

- Charles River Laboratories International Inc.

- Cmic Holdings Co. Ltd

- Dr Reddys Laboratories Ltd.

- ICON plc

- IQVIA Holdings Inc.

- Laboratory Corp. of America Holdings

- Lonza Group Ltd.

- Lupin Ltd.

- Novotech Health Holdings

- OPTIMAPHARM d.o.o.

- Parexel International Corp.

- PCI Pharma Services

- Recipharm AB

- Samsung Electronics Co. Ltd.

- Syneos Health Inc.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of services that support the development and production of various pharmaceutical products. This market plays a crucial role In the pharmaceutical ecosystem, enabling the transformation of drug candidates into marketed medicines. Drug development is a complex and intricate process, requiring extensive research and rigorous testing. Contract research organizations (CROs) offer specialized services to assist in various stages of drug development, from route scouting and discovery to clinical trials. These organizations employ advanced manufacturing technologies, such as continuous manufacturing and digitalization, to enhance efficiency and productivity. Bioprocess outsourcing is another significant aspect of the market.

Biologics, including vaccines, antibodies, and other complex therapeutics, require unique manufacturing processes. Outsourcing these processes to specialized contract manufacturing organizations (CMOs) allows for cost-effective manufacturing and access to expertise and capabilities that may not be available in-house. Regulatory compliance is a critical consideration In the pharmaceutical industry. Contract research and manufacturing organizations must adhere to stringent regulations to ensure the safety, efficacy, and quality of their products. This includes compliance with Good Manufacturing Practices (GMP) and Good Laboratory Practices (GLP) guidelines. The pharmaceutical industry is undergoing a digital transformation, with the adoption of advanced technologies such as artificial intelligence (AI) and machine learning.

These technologies are being used to streamline processes, improve efficiency, and enhance the accuracy of data analysis. For instance, AI algorithms can be employed to optimize drug formulation and identify potential drug candidates. The market caters to various stakeholders, including big pharmaceutical companies, academic institutes, and small and medium-sized enterprises (SMEs). The market is highly competitive, with numerous players offering a range of services. This competition drives innovation and continuous improvement, ensuring that the industry remains at the forefront of scientific and technological advancements. The market for pharmaceutical contract research and manufacturing services is dynamic, with ongoing trends shaping the industry.

These trends include the increasing focus on personalized medicines, the growing importance of quality control, and the emergence of advanced manufacturing technologies. Cost-effective manufacturing is a significant driver of growth In the market. CMOs are increasingly offering services for the production of active pharmaceutical ingredients (APIs) and intermediates, enabling clients to reduce costs and improve their overall manufacturing efficiency. The market for pharmaceutical contract research and manufacturing services is vast and diverse, encompassing a range of products and services. These include small molecule drugs, biologics, biosimilars, drug formulation, and manufacturing services. The market also caters to various stages of the drug development process, from discovery to commercial operations.

Quality standards are a top priority In the pharmaceutical industry. Contract research and manufacturing organizations must ensure that their products meet the highest standards of quality, safety, and efficacy. This requires a robust quality control system, including rigorous testing and validation procedures. The pharmaceutical industry is also grappling with the challenges of serialization and counterfeiting. Contract research and manufacturing organizations must implement robust anti-counterfeiting measures to protect their clients' intellectual property and ensure the safety and efficacy of their products. In conclusion, the market plays a vital role In the development and production of pharmaceutical products. This market is dynamic and diverse, with ongoing trends shaping the industry.

Contract research and manufacturing organizations offer a range of services, from drug discovery to commercial operations, and employ advanced technologies to enhance efficiency and productivity. The market is highly competitive, with numerous players offering specialized services to cater to the unique needs of various stakeholders. Quality standards, cost-effectiveness, and regulatory compliance are top priorities In the industry, and the market is undergoing a digital transformation, with the adoption of advanced technologies such as AI and machine learning.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

|

Market growth 2024-2028 |

USD 141.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.51 |

|

Key countries |

US, China, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pharmaceutical Contract Research And Manufacturing Market Research and Growth Report?

- CAGR of the Pharmaceutical Contract Research And Manufacturing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Asia, Europe, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pharmaceutical contract research and manufacturing market growth of industry companies

We can help! Our analysts can customize this pharmaceutical contract research and manufacturing market research report to meet your requirements.