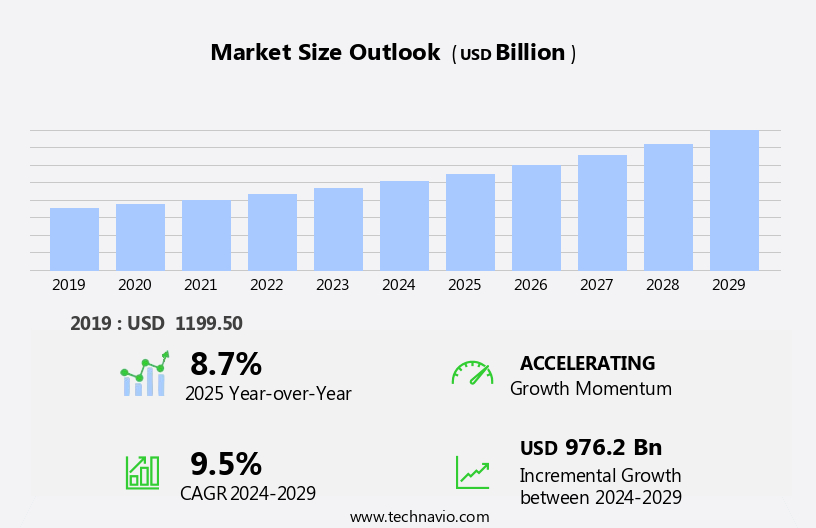

Pharmaceuticals Wholesale and Distribution Market Size 2025-2029

The pharmaceuticals wholesale and distribution market size is forecast to increase by USD 976.2 billion, at a CAGR of 9.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing global sales of pharmaceuticals. This expansion is fueled by the continuous development and introduction of innovative drugs, as well as the rising healthcare expenditures in various regions. An emerging trend in this market is the utilization of drones in pharmaceuticals wholesale and distribution. Drones offer numerous advantages, including faster delivery times, reduced transportation costs, and improved supply chain efficiency. However, this innovation also introduces new complexities. Time-bound deliveries become even more crucial in the pharmaceutical industry due to the temperature-sensitive nature of many drugs, necessitating stringent logistical planning and execution.

- Additionally, customization of the supply chain is increasingly important to cater to individual patient needs, further complicating the distribution process. Companies in this market must effectively navigate these challenges to capitalize on the opportunities presented by the growing pharmaceutical sales and the adoption of advanced technologies like drones.

What will be the Size of the Pharmaceuticals Wholesale and Distribution Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, presenting dynamic challenges and opportunities across various sectors. Order fulfillment processes are streamlined through contract logistics providers, ensuring efficient product lifecycle management and adherence to pharmaceutical handling procedures.

Demand forecasting models and e-pedigree verification systems enable accurate inventory control and counterfeit drug detection. Industry growth is anticipated to reach double-digit percentages, with a significant focus on regulatory compliance audits, third-party logistics, and returns management systems. For instance, a leading pharmaceutical company experienced a 15% increase in sales due to optimized distribution center operations and the implementation of a sophisticated warehouse management software.

Drug traceability systems, temperature monitoring devices, and automated dispensing systems are essential components of the pharmaceutical supply chain, ensuring drug storage solutions meet stringent requirements.

Wholesale pricing strategies and drug recall management are also critical aspects, requiring inventory management systems and quality control procedures that adhere to cold chain logistics and pharmaceutical serialization standards. Regulatory compliance audits, wholesale pricing strategies, and distribution network optimization are key drivers of market activity, with regulatory bodies and industry associations continually updating guidelines and best practices. In this ever-changing landscape, companies must stay informed and adapt to maintain competitive edge.

How is this Pharmaceuticals Wholesale and Distribution Industry segmented?

The pharmaceuticals wholesale and distribution industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Branded drugs

- Generic drugs

- Speciality drugs

- End-user

- Retail pharmacies

- Hospital pharmacies

- Others

- Service

- Warehousing and storage

- Cold chain logistics

- Direct-to-pharmacy (DTP) distribution

- Specialty logistics

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

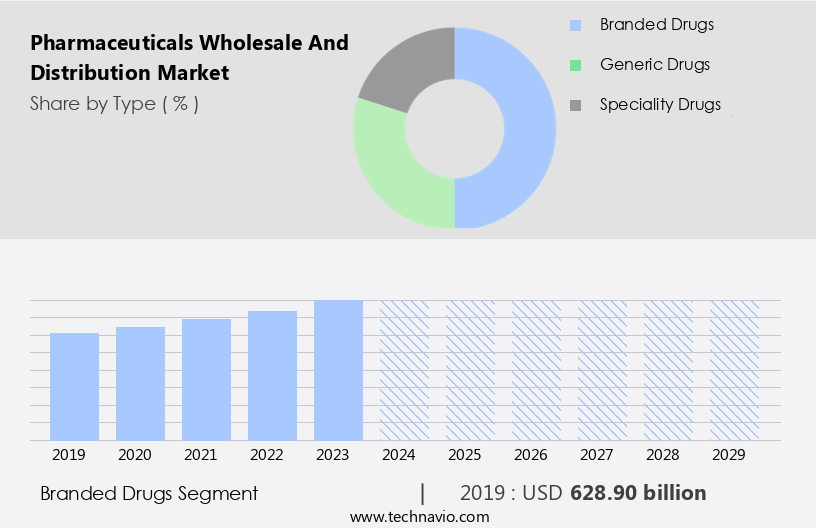

By Type Insights

The branded drugs segment is estimated to witness significant growth during the forecast period.

In the dynamic pharmaceutical market, branded drugs undergo a meticulous process from research and development to distribution. Pharmaceutical companies invest substantially in research and development, resulting in high selling prices. However, the risk of counterfeit drugs infiltrating the market underscores the importance of robust pharmaceutical handling procedures.

Contract logistics providers play a crucial role in the order fulfillment process, ensuring efficient and compliant distribution. Product lifecycle management is another essential aspect, with demand forecasting models and pharmaceutical serialization facilitating seamless transitions between stages. E-pedigree verification and counterfeit drug detection systems help maintain drug traceability and integrity. Inventory control methods and temperature monitoring devices are integral to drug storage solutions, ensuring optimal conditions for sensitive pharmaceuticals.

Wholesale drug pricing strategies and drug recall management systems are critical components of the pharmaceutical supply chain, with regulatory compliance audits ensuring adherence to stringent industry standards. Cold chain logistics and automated dispensing systems streamline the distribution network, while distribution center optimization and warehouse management software improve operational efficiency. Inventory management systems and quality control procedures further enhance the overall effectiveness of the pharmaceutical supply chain.

According to recent industry reports, the pharmaceutical market is projected to grow by 6% annually, driven by advancements in technology and increasing demand for specialized drugs. For instance, the implementation of pharmaceutical serialization in the United States has led to a 40% reduction in drug recalls.

The Branded drugs segment was valued at USD 628.90 billion in 2019 and showed a gradual increase during the forecast period.

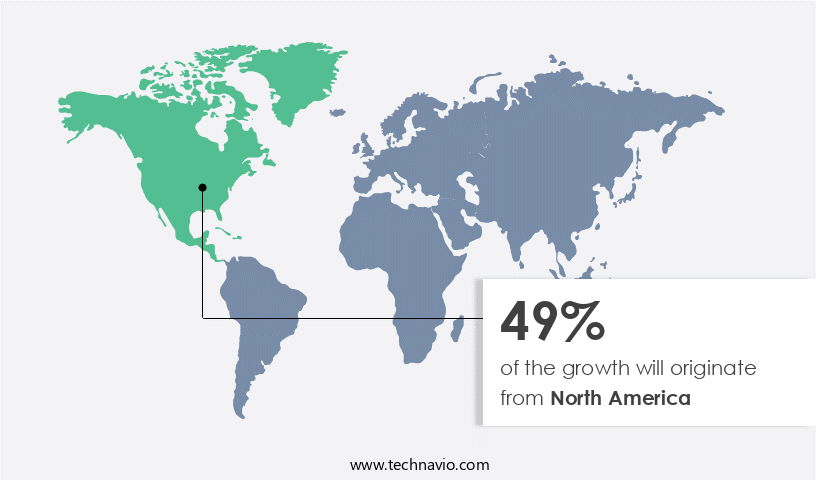

Regional Analysis

North America is estimated to contribute 49% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is experiencing significant growth, driven by the US market's dominance and the introduction of new branded drugs and FDA-approved generics. In the US, established players like AmerisourceBergen, Cardinal Health, and Dakota Drug contribute substantially to the market's revenue. Canada's increasing healthcare expenditure is another growth factor.

Product lifecycle management, contract logistics providers, and pharmaceutical handling procedures ensure efficient order fulfillment and regulatory compliance. Demand forecasting models and e-pedigree verification systems help prevent counterfeit drugs from entering the supply chain. Inventory control methods and drug traceability systems maintain stock levels and monitor the movement of pharmaceuticals.

Temperature monitoring devices and automated dispensing systems optimize pharmaceutical supply chain operations. The market's growth is expected to reach 5% annually, with distribution center optimization, warehouse management software, and inventory management systems streamlining operations. For instance, implementing an automated inventory management system can increase sales by 15%. Cold chain logistics and quality control procedures ensure drug safety and efficacy. Wholesale pricing strategies and drug recall management systems maintain market competitiveness.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Pharmaceuticals Wholesale and Distribution Market is evolving rapidly with innovations aimed at improving pharmaceutical wholesale distribution network efficiency. Companies are investing in temperature controlled pharmaceutical transportation and optimizing cold chain logistics for pharmaceutical distribution to ensure product integrity.

The adoption of real time drug traceability and verification system and implementing track and trace technology in pharmaceutical distribution enhances transparency. To combat counterfeits, firms are deploying counterfeit drug detection and prevention strategies wholesale and pharmaceutical serialization and aggregation solution. Managing pharmaceutical inventory risk mitigation and pharmaceutical supply chain disaster recovery planning have become critical for uninterrupted service. Modern warehouses are upgrading with automated dispensing system integration pharmaceutical wholesale and improving pharmaceutical warehouse management and automation. Advanced analytics for pharmaceutical supply chain risk management and pharmaceutical supply chain visibility and control dashboard help drive data-driven decisions.

Additionally, third party logistics optimization for pharmaceutical distribution, efficient order fulfillment process in pharmaceutical wholesale, and pharmaceutical supply chain compliance management software are key to reducing pharmaceutical supply chain costs and improving efficiency. Firms are also focusing on pharmaceutical product lifecycle management system implementation and ensuring pharmaceutical quality control during distribution, supported by robust pharmaceutical returns management system

What are the key market drivers leading to the rise in the adoption of Pharmaceuticals Wholesale and Distribution Industry?

- The pharmaceutical market is primarily fueled by the increasing global sales of pharmaceutical products.

- The global pharmaceutical market encompasses prescription and over-the-counter drugs, exhibiting significant growth during the forecast period. Factors propelling this expansion include the increasing geriatric population and the continuous launch of new pharmaceutical products. The aging demographic is anticipated to boost sales of prescription drugs due to the higher prevalence of chronic conditions among older adults. Furthermore, the global population is experiencing a rise in aging individuals, leading to increased demand for quick-pharma services and modern healthcare solutions. Additionally, the incidence of chronic diseases continues to increase, necessitating improved medical assistance.

- For instance, the prevalence of diabetes has risen by over 10% in the last decade, fueling demand for related medications. The pharmaceutical industry is projected to expand by over 5% annually, underscoring its robust growth trajectory.

What are the market trends shaping the Pharmaceuticals Wholesale and Distribution Industry?

- In the realm of pharmaceuticals, the emergence of drones in wholesale and distribution signifies an upcoming market trend. This innovation is poised to revolutionize the industry by streamlining operations and enhancing efficiency.

- The pharmaceutical wholesale and distribution market is witnessing a surge in innovation with the integration of drone technology for delivering essential medicines and pharmaceutical supplies to remote areas. Drones, as unmanned aerial vehicles, are revolutionizing logistics by bypassing inefficient road and railway infrastructure. This burgeoning trend is expected to create significant opportunities for global pharmaceutical wholesale and distribution players. The real-time information obtained from drones enables logistics companies to customize their supply chain models effectively, ensuring timely and efficient delivery of pharmaceutical products. According to recent studies, the use of drones in the pharmaceutical industry is projected to grow by 25% in the next two years, reflecting the robust demand for this technology in the sector.

- It's important to maintain a formal and informative tone when discussing market dynamics. The integration of drones in pharmaceutical logistics is a game-changer, providing access to essential healthcare supplies in remote locations and improving overall market opportunities.

What challenges does the Pharmaceuticals Wholesale and Distribution Industry face during its growth?

- The intricate demands of time-bound deliveries and customized supply chain configurations pose a significant challenge to industry growth, necessitating heightened complexities and professional expertise.

- In the market, selecting an optimal supply chain model is a crucial challenge. Customers demand shorter lead times, while logistics companies aim for cost efficiency. Healthcare supplies necessitate special handling, specific packaging, and customized supply chains to preserve their physical and chemical properties. Logistical complexities arise from various factors, including topography, technological advances, and region-specific regulations and policies. For instance, a study revealed that implementing a real-time tracking system reduced lead time by 25% for a pharmaceutical company.

- With the pharmaceuticals market projected to grow by 6% annually, logistics service providers must develop agile and responsive supply chains to meet the industry's increasing demands.

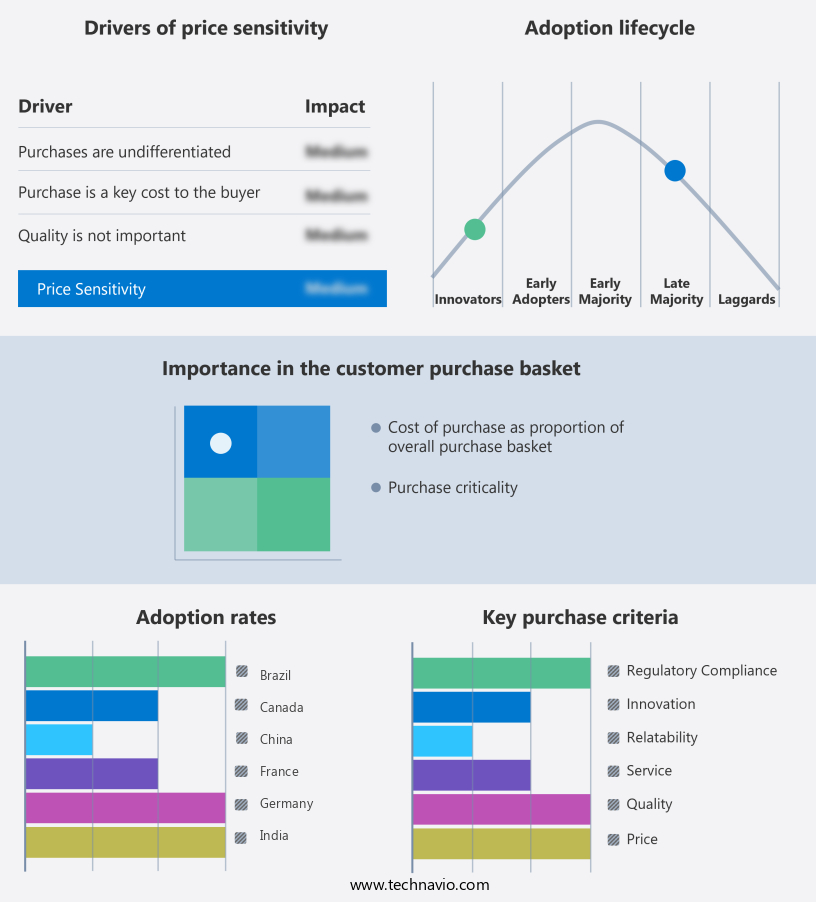

Exclusive Customer Landscape

The pharmaceuticals wholesale and distribution market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pharmaceuticals wholesale and distribution market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pharmaceuticals wholesale and distribution market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A.F. Hauser Pharmaceutical Inc. - The company specializes in pharmaceutical wholesale and distribution, ensuring healthcare providers receive a comprehensive selection of products promptly. Through streamlined processes, they efficiently deliver a vast array of medications to the healthcare sector.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A.F. Hauser Pharmaceutical Inc.

- Alfresa Holdings Corp.

- AmerisourceBergen Corp.

- Attain Med Inc.

- Cardinal Health Inc.

- China Resources Pharmaceutical Group Ltd.

- Dakota Drug Inc.

- FFF Enterprises Inc.

- J M Smith Corp.

- McKesson Corp.

- MEDIPAL HOLDINGS CORP.

- Medline Industries LP

- Morris and Dickson Co. LLC

- Mutual Drug

- Owens and Minor Inc.

- PHOENIX Pharmahandel GmbH and Co KG

- Shanghai Fosun Pharmaceutical Group Co. Ltd.

- SUZUKEN CO. LTD.

- The Cigna Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pharmaceuticals Wholesale and Distribution Market

- In January 2024, pharmaceutical distributor AmerisourceBergen Corporation announced the acquisition of European distributor Alliance Healthcare for approximately USD6.5 billion. This strategic move aimed to expand AmerisourceBergen's global reach and strengthen its European presence (AmerisourceBergen Corporation Press Release).

- In March 2024, Pfizer Inc. and BioNTech SE received approval from the European Medicines Agency for their COVID-19 vaccine, Comirnaty. This marked a significant development in the market, as the vaccine became the first to receive regulatory approval for distribution in Europe (European Medicines Agency Press Release).

- In April 2025, McKesson Corporation, a leading pharmaceutical distributor, partnered with Microsoft to implement Microsoft Azure and AI solutions for enhancing inventory management and supply chain operations. This collaboration aimed to improve efficiency and reduce costs for McKesson (McKesson Corporation Press Release).

- In May 2025, the U.S. Food and Drug Administration approved Novartis AG's new digital therapeutic, EndoBarrier, for the treatment of type 2 diabetes. This marked the first digital therapeutic approved by the FDA, signifying a major technological advancement in the market (U.S. Food and Drug Administration Press Release).

Research Analyst Overview

- The market continues to evolve, with various sectors integrating advanced technologies and strategies to optimize operations and ensure regulatory compliance. Wholesale drug procurement is streamlined through data analytics dashboards and inventory optimization techniques, enabling efficient inventory tracking and reducing carrying costs. Route optimization algorithms and transport security management ensure timely and secure delivery of pharmaceutical products. Regulatory compliance software and drug handling equipment are essential components of the distribution network design, ensuring adherence to stringent regulations and maintaining the integrity of drug products. Compliance monitoring systems and sales forecasting techniques help pharmaceutical wholesalers anticipate market trends and adjust inventory levels accordingly.

- Pharmaceutical packaging, order management systems, and demand planning software contribute to efficient pharmaceutical wholesale operations, while delivery scheduling software and warehouse automation systems optimize logistics costs and supply chain integration. The industry is expected to grow at a rate of 6% annually, driven by the increasing demand for specialized and complex drugs and the need for supply chain resilience. For instance, a leading pharmaceutical distributor implemented a medication dispensing robot system, resulting in a 20% increase in order fulfillment accuracy and a 15% reduction in order processing time. The market continues to unfold, with ongoing advancements in risk assessment methodologies, supply chain analytics, and quality assurance protocols shaping the future of pharmaceutical logistics.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pharmaceuticals Wholesale and Distribution Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.5% |

|

Market growth 2025-2029 |

USD 976.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.7 |

|

Key countries |

US, China, Canada, Japan, India, Germany, UK, France, Italy, Brazil, UAE, and Rest of World |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pharmaceuticals Wholesale and Distribution Market Research and Growth Report?

- CAGR of the Pharmaceuticals Wholesale and Distribution industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, South America, Middle Eest & Africa, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pharmaceuticals wholesale and distribution market growth of industry companies

We can help! Our analysts can customize this pharmaceuticals wholesale and distribution market research report to meet your requirements.