Piston Market Size 2024-2028

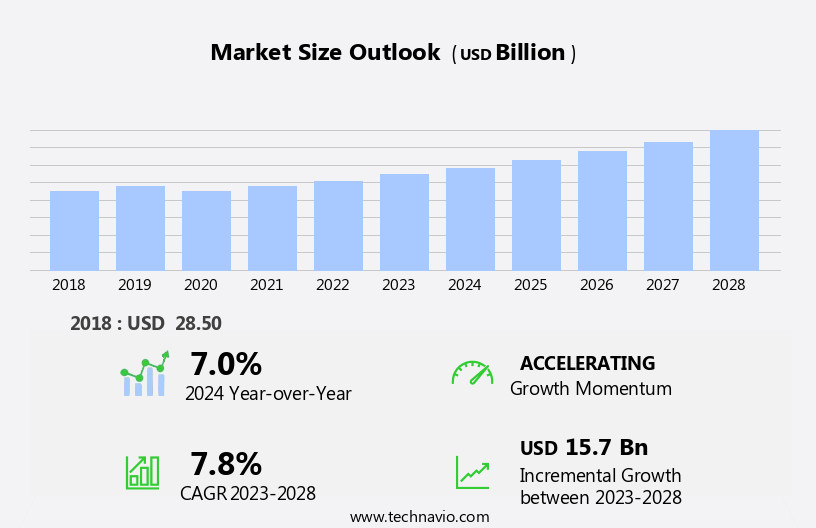

The piston market size is forecast to increase by USD 15.7 billion, at a CAGR of 7.8% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing production of vehicles and the adoption of additive manufacturing technologies. The automotive industry's shift towards producing more sustainable and fuel-efficient vehicles is a key factor fueling market expansion. This trend is further amplified by the growing demand for engine downsizing, which necessitates the development and implementation of advanced piston designs. However, the market faces several challenges. One significant obstacle is the stringent regulatory requirements for piston materials and manufacturing processes, which necessitate substantial investments in research and development.

- Additionally, the high cost of raw materials, particularly aluminum and steel, poses a challenge for market participants. Despite these hurdles, companies that successfully navigate these challenges and innovate in response to evolving market demands will be well-positioned to capitalize on the significant growth opportunities in the market.

What will be the Size of the Piston Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Oil pumps, a crucial component in internal combustion engines, are being replaced with electric variants in electric vehicles (EVs), while hydrogen fuel cells are gaining traction as an alternative fuel source. Timing chains and belts are being supplanted by more durable and efficient alternatives in hybrid powertrains. Aluminum and steel alloys remain key materials in piston manufacturing, with ongoing research and development leading to lighter and stronger alloys. Engine mounts and suspension systems are being redesigned for improved vehicle dynamics, while exhaust systems are being optimized for fuel efficiency and emissions standards.

Performance tuning and electrical systems require high-quality pistons, leading to increased demand for precision manufacturing processes. Lightweight materials, such as carbon fiber, are being explored for their potential in reducing vehicle weight and improving fuel efficiency. Cylinder heads and engine blocks are being redesigned for improved durability and efficiency, while alternative fuels like biodiesel and ethanol are driving demand for fuel injectors and ignition systems. Engine oil and piston rings continue to be refined for better performance and longer life. Autonomous driving technology is revolutionizing the automotive industry, leading to new applications for pistons in electric and hybrid powertrains.

Manufacturing processes are being optimized for increased production efficiency and reduced costs. The market is a dynamic and evolving landscape, with ongoing research and development driving innovation and growth across various sectors.

How is this Piston Industry segmented?

The piston industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Transport

- Others

- Material

- Aluminum

- Steel

- Aluminum

- Steel

- Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Component

- Piston Ring

- Piston Head

- Piston Pin

- Piston Ring

- Piston Head

- Piston Pin

- Geography

- North America

- US

- Europe

- Germany

- Russia

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Application Insights

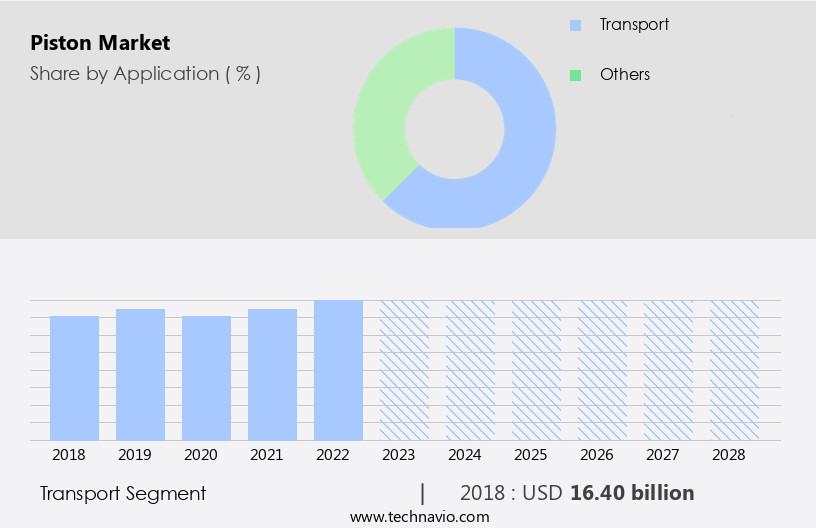

The transport segment is estimated to witness significant growth during the forecast period.

Internal and external combustion engines rely on pistons to convert expanding gas energy into mechanical force, enabling vehicles to operate. Pistons facilitate the transfer of this force to the crankshaft via piston rods or connecting rods. They create a sliding gas and oil-tight seal in cylinders, transport the gas load to connecting rods' tiny ends, and serve as bearings for gudgeon pins. Piston design balances strength, weight, and thermal expansion control. Automotive pistons have long been a critical component in the global transportation industry. Recently, there has been significant interest in advanced materials such as aluminum alloys and steel alloys for piston manufacturing.

Hydrogen fuel cells and electric vehicles (EVs) are emerging alternatives to traditional combustion engines, necessitating the development of new piston designs for hybrid powertrains. Performance tuning and vehicle dynamics are essential considerations in piston design. Engine mounts, suspension systems, steering systems, and exhaust systems all influence piston performance. Quality control is crucial in the manufacturing process to ensure piston rings, timing chains, timing belts, and other components function optimally. Innovations in manufacturing processes, alternative fuels, and emissions standards have driven advancements in piston technology. Fuel injectors, ignition systems, engine oil, and control units are all interconnected components that impact piston performance.

Lightweight materials like carbon fiber and composite materials are increasingly used to reduce weight and improve fuel efficiency. Autonomous driving technology and the integration of electrical systems into vehicles present new challenges and opportunities for piston manufacturers. Aftermarket parts and torque converters also play a role in the market. Overall, the market is dynamic and evolving, driven by technological advancements and changing consumer preferences.

The Transport segment was valued at USD 16.40 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

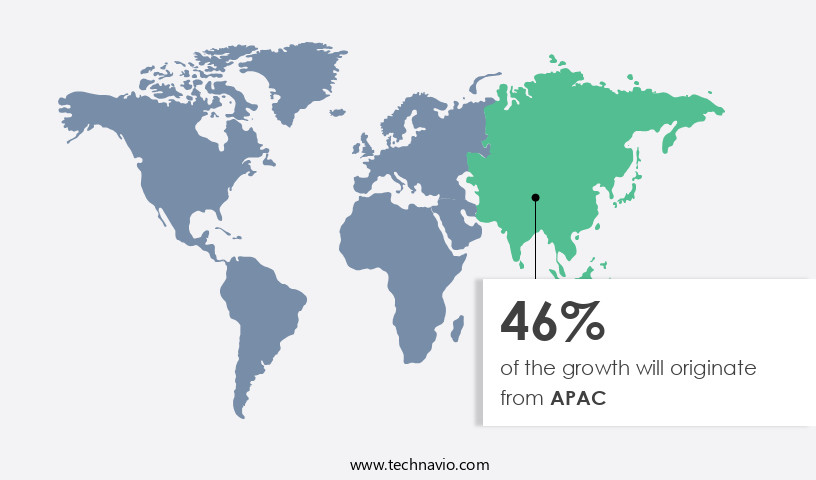

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The automotive industry in Asia Pacific (APAC), specifically in China, India, and South Korea, is experiencing significant growth, making it a key player in global vehicle production. Notable automotive production countries in APAC include India, China, South Korea, and Japan. This expanding sector will drive the pistons market in APAC, as the demand for fuel-efficient and lightweight automobiles increases. With stricter emissions standards and a focus on improving fuel economy, pistons are essential components in internal combustion engine (ICE) cars. In response to increased ICE vehicle sales and the need for environmentally friendly components, manufacturers are developing advanced pistons and lubricants.

Additionally, the adoption of technologies such as hydrogen fuel cells, hybrid powertrains, and alternative fuels is expected to further boost market growth. The integration of advanced materials like aluminum alloys, steel alloys, carbon fiber, and composite materials in manufacturing processes enhances the durability and performance of pistons. Furthermore, the aftermarket for pistons and related components continues to grow, providing opportunities for manufacturers to expand their offerings. Overall, the pistons market in APAC is poised for growth, driven by increasing vehicle production, technological advancements, and regulatory requirements.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Piston Industry?

- The significant increase in vehicle production serves as the primary growth catalyst for the automotive market.

- The market experiences continuous growth due to the increasing production of vehicles, driven by the expanding population and urbanization in both developed and emerging economies. This trend is fueled by the rising demand for personal transportation options, leading to increased sales of passenger cars, trucks, and commercial vehicles. Consequently, the production of pistons, essential components in internal combustion engines, is escalating. Furthermore, the transition towards electric vehicles has prompted traditional automakers to improve their engine technologies, stimulating innovation and manufacturing expansion in the market. As manufacturers ramp up production to meet this escalating demand, The market is expected to maintain a steady growth trajectory throughout the forecast period.

- Key components of internal combustion engines, such as fuel injectors, ignition systems, engine oil, connecting rods, fuel efficiency, emissions standards, control units, spark plugs, and pistons, are integral to the market's growth. The advancements in these components, driven by technological innovations, are crucial in enhancing vehicle dynamics and engine performance, making the market a vital player in the automotive industry.

What are the market trends shaping the Piston Industry?

- The adoption of additive manufacturing is gaining significant traction in the market, representing an emerging trend. This advanced manufacturing technique is increasingly being adopted by industries for its numerous benefits, including reduced production time, lower material waste, and the ability to create complex geometries.

- Additive manufacturing, also known as 3D printing, is revolutionizing the industrial machinery sector by enabling the production of complex components such as oil pumps, hydrogen fuel cell components, engine mounts, timing chains, timing belts, water pumps, and more. This technology allows for the creation of intricate designs that are difficult to achieve through traditional manufacturing methods. With additive manufacturing, companies can verify designs before investing in expensive tooling, significantly reducing the risks and costs associated with new product development. Furthermore, the process streamlines production by eliminating the complexities of traditional manufacturing practices, resulting in cost savings.

- In the context of industrial machinery components, additive manufacturing offers benefits such as reduced weight through the use of aluminum alloys and steel alloys, improved durability, and enhanced performance. Overall, additive manufacturing is transforming the industrial machinery industry by providing a more efficient, cost-effective, and innovative approach to manufacturing.

What challenges does the Piston Industry face during its growth?

- The increasing demand for engine downsizing poses a significant challenge to the industry's growth trajectory. This trend, driven by factors such as fuel efficiency and emissions regulations, necessitates continuous innovation and adaptation within the automotive sector.

- The global automotive industry is experiencing a significant shift towards developing high-performance, fuel-efficient engines. This trend is driven by increasing government regulations and consumer demand for eco-friendly vehicles. As a result, engine downsizing has become a popular approach for automakers to enhance engine efficiency. In developed countries, such as the US, regulatory bodies like the Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) are pushing for reduced greenhouse gas emissions and improved fuel efficiency in vehicles and engines. To meet these requirements, OEMs are adopting engine downsizing techniques, which help reduce torque and fuel consumption.

- For instance, Honda Motors' 1-liter three-cylinder engine in Europe incorporates friction reduction technologies to offer better fuel economy. Additionally, advancements in exhaust systems, cylinder heads, engine blocks, suspension systems, steering systems, electrical systems, and carbon fiber components are contributing to the development of more efficient engines. Furthermore, the advent of autonomous driving technology is expected to further drive the demand for fuel-efficient engines in the future.

Exclusive Customer Landscape

The piston market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the piston market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, piston market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AISIN CORP. - The company specializes in manufacturing and supplying pistons, including Aisin Engine Pistons, for diverse automotive applications. These pistons are renowned for their durability and performance, enhancing engine efficiency and reliability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AISIN CORP.

- Amalgamations Group

- Amsted Industries Inc.

- Arias Pistons

- Capricorn Automotive Ltd.

- Continental AG

- Cosworth Group Holdings Ltd.

- Hitachi Ltd.

- Honda Motor Co. Ltd.

- MAHLE GmbH

- Menon Pistons Ltd.

- MING SHUN INDUSTRIAL CO. LTD.

- Rheinmetall AG

- Ross Racing Pistons

- Shandong Binzhou Bohai Piston Co. Ltd.

- Shriram Pistons and Rings Ltd.

- Tenneco Inc.

- Wossner GmbH

- ZENITH TROOP INDUSTRIAL Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Piston Market

- In January 2024, Caterpillar Inc., a leading manufacturer of piston engines, announced the launch of its new line of high-efficiency piston engines, the Caterpillar Sustainable Engine Program (CSEP), aimed at reducing carbon emissions by up to 25% compared to conventional engines. (Caterpillar Inc. Press release)

- In March 2024, Rolls-Royce and MTU Aero Engines, two major piston engine manufacturers, entered into a strategic partnership to jointly develop and manufacture advanced piston engines for the general aviation market. (Rolls-Royce plc and MTU Aero Engines AG press releases)

- In July 2024, Pratt & Whitney, a leading piston engine manufacturer, completed the acquisition of Electric Motors Corporation (EMC), a pioneer in electric propulsion systems for piston aircraft. This acquisition was aimed at expanding Pratt & Whitney's product portfolio and strengthening its position in the emerging electric aviation market. (Pratt & Whitney press release)

- In May 2025, the European Union Aviation Safety Agency (EASA) granted certification to Rolls-Royce for its new Advanced Twin-spool Compressor (ATC) piston engine, marking a significant milestone in the development of more fuel-efficient and environmentally friendly piston engines. (Rolls-Royce plc press release)

Research Analyst Overview

- The market is characterized by continuous advancements in manufacturing technology, driving production efficiency and cost optimization. Price elasticity remains a significant factor, as aftermarket services and repair costs influence consumer preferences. Vehicle safety and performance, along with reliability, are key considerations for consumers, shaping demand forecasting and brand loyalty. Supply chain management plays a crucial role in ensuring parts availability and distribution networks, while technological innovation, material science, and design innovation fuel product development. Automotive engineering and engine design continue to evolve, impacting sales volume and product lifecycle management.

- Fuel economy standards and environmental regulations also shape market dynamics, as consumers prioritize eco-friendly options. Consumer demographics and retail channels further influence market trends, with a focus on cost optimization and demand for high-performing, reliable pistons.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Piston Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

135 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.8% |

|

Market growth 2024-2028 |

USD 15.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.0 |

|

Key countries |

China, US, Germany, India, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Piston Market Research and Growth Report?

- CAGR of the Piston industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the piston market growth of industry companies

We can help! Our analysts can customize this piston market research report to meet your requirements.