Pizza Oven Market Size 2025-2029

The pizza oven market size is valued to increase USD 329.6 million, at a CAGR of 5.2% from 2024 to 2029. Increasing consumption of pizza in developing countries will drive the pizza oven market.

Major Market Trends & Insights

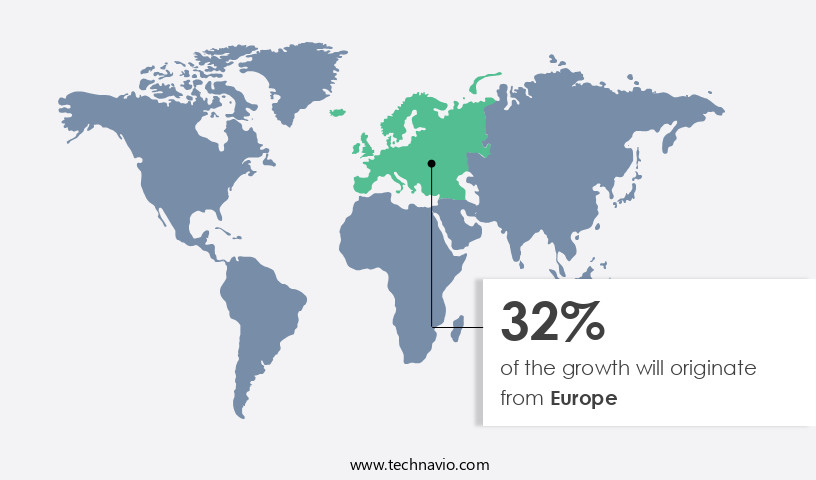

- Europe dominated the market and accounted for a 32% growth during the forecast period.

- By Type - Electric pizza oven segment was valued at USD 383.80 million in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 46.55 million

- Market Future Opportunities: USD 329.60 million

- CAGR : 5.2%

- Europe: Largest market in 2023

Market Summary

- The market encompasses the production, sales, and distribution of various pizza cooking appliances, primarily focused on core technologies such as wood-fired, gas, and electric ovens. Applications span from commercial establishments like pizzerias and restaurants to residential use. The market is witnessing significant growth, driven by the increasing consumption of pizza in developing countries and the rising demand for customized and hybrid wood-fired ovens.

- Furthermore, the long product replacement cycle contributes to market stability. According to a recent study, the wood-fired pizza oven segment held a 35% market share in 2020, demonstrating the enduring popularity of this traditional cooking method. Despite these opportunities, challenges such as increasing competition and changing consumer preferences pose significant hurdles for market participants.

What will be the Size of the Pizza Oven Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Pizza Oven Market Segmented and what are the key trends of market segmentation?

The pizza oven industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Electric pizza oven

- Wood-fired pizza oven

- Gas pizza oven

- Distribution Channel

- Offline

- Online

- Application

- Commercial

- Residential

- Industrial

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The electric pizza oven segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth, with the electric segment leading the trend. Electric ovens cater to commercial kitchens due to their user-friendly nature and reduced expertise requirements compared to traditional wood-fired ovens. These ovens do not necessitate venting and generate less smoke, making them ideal for indoor kitchens with limited ventilation. An essential feature of electric pizza ovens is their automated temperature regulation, enhancing their appeal for commercial use. In terms of future prospects, the market anticipates a substantial expansion, with the demand for energy-efficient and technologically advanced ovens driving growth. Oven manufacturers continue to innovate, introducing new products to cater to evolving customer needs.

For instance, Ooni Ltd. Extended its product line in 2024 with the launch of the Ooni Koda 2 Max and the Ooni Karu 2 Pro. Heat transfer modeling and temperature uniformity are crucial considerations in pizza oven design. Oven construction materials, such as refractory bricks, play a vital role in ensuring optimal heat distribution and energy efficiency. Energy consumption analysis and oven structural integrity are essential factors in oven design, with fuel type selection and baking stone material influencing thermal shock resistance and fuel efficiency metrics. Infrared temperature sensing and heat retention efficiency are essential features that contribute to oven lifespan prediction and overall performance.

Insulation material selection, draft control systems, and exhaust system design are critical aspects of oven design that impact energy efficiency improvements and insulation thermal resistance. Firebrick wear resistance and fuel combustion optimization are essential for maintaining oven performance and minimizing maintenance requirements. High-temperature insulation and dome construction techniques contribute to improved heat distribution uniformity and oven temperature control. Baking chamber design, baking chamber geometry, and exhaust gas management are essential elements that influence the efficiency and effectiveness of pizza ovens. Thermal mass calculation and thermal conductivity values are crucial factors in optimizing heat transfer and energy consumption. The ongoing market trends reflect the continuous evolution of pizza oven technology and applications across various sectors.

The Electric pizza oven segment was valued at USD 383.80 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Pizza Oven Market Demand is Rising in Europe Request Free Sample

Europe's thriving restaurant and hospitality sector, marked by a significant demand for pizza, fuels the growth of the commercial-grade the market. With millions of tourists annually seeking authentic European experiences, the demand for pizza in restaurants and cafes catering to visitors remains high. Manufacturers in Europe offer a diverse range of pizza ovens, including traditional brick ovens and portable countertop models, catering to various consumer and business preferences.

This product diversity propels market expansion, ensuring a steady demand for commercial-grade pizza ovens in Europe's foodservice industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of offerings, each with unique features impacting performance and efficiency. One crucial aspect is the effects of insulation thickness on oven temperature, as thicker insulation can enhance heat retention, reducing the need for frequent fuel consumption. Refractory materials, integral to oven construction, significantly influence heat retention, with some materials offering superior insulation properties. Optimal baking stone materials for heat transfer are another essential consideration. These materials play a pivotal role in distributing heat evenly within the oven, ensuring consistent baking results. The relationship between oven design and energy efficiency is a critical factor, with some designs offering improved insulation and airflow dynamics that minimize fuel consumption.

Evaluating different oven airflow dynamics is essential for understanding their impact on baking time and quality. Temperature uniformity in a pizza oven is vital, and measuring it accurately is crucial for maintaining optimal baking conditions. Effective exhaust gas management is essential for enhancing oven performance, as it ensures proper ventilation and reduces the risk of moisture buildup. The analysis of fuel type on combustion efficiency is a significant aspect of the market. Design considerations for oven structural integrity are essential to ensure longevity and minimize thermal shock on oven components. Predicting lifespan based on material properties is a crucial factor in the decision-making process for pizza oven purchasers.

Comparing different dome construction methods reveals that some designs offer superior insulation and heat distribution, resulting in improved energy consumption. Strategies to maximize heat retention in pizza ovens include implementing sustainable design practices and utilizing advanced insulation materials. The effects of baking chamber geometry on heat distribution are a critical consideration for manufacturers, as optimizing this aspect can lead to significant improvements in baking efficiency. Improving energy consumption with insulation choices and minimizing fuel consumption during baking are essential goals for pizza oven manufacturers. Assessing the thermal performance of different oven materials is crucial for understanding their suitability for various applications.

Developing sustainable design practices for pizza ovens is a growing trend, as consumers increasingly demand eco-friendly options. Adoption rates for energy-efficient pizza ovens are significantly higher than those for traditional models, reflecting the market's shift towards sustainable and cost-effective solutions. This trend underscores the importance of continuous innovation and improvement in the market.

What are the key market drivers leading to the rise in the adoption of Pizza Oven Industry?

- In developing countries, the significant rise in pizza consumption serves as the primary market growth catalyst.

- In the expanding economies of developing nations like India and Brazil, the rise in disposable income among consumers fuels a significant increase in spending on dining out and food delivery, including pizzas. This trend propels the demand for pizza ovens in the restaurant, café, and fast-food industries. The rapid urbanization and Western influence in these countries contribute to a shift in dietary preferences towards convenience foods, such as pizza. Moreover, customers are increasingly seeking pizzas with unique and daring flavors. Millennials, in particular, are driving the demand for innovative and exotic-tasting pizzas. The proliferation of pizza chains and outlets in urban areas necessitates the acquisition of pizza ovens to cater to the burgeoning consumer base and their evolving preferences.

What are the market trends shaping the Pizza Oven Industry?

- The increasing focus on customized and hybrid wood-fired ovens represents a notable market trend in the culinary industry. This trend reflects a growing demand for versatile and efficient cooking solutions.

- In the dynamic world of customized wood-fired pizza oven manufacturing, a significant shift towards providing hybrid wood-fired ovens is underway. These innovative ovens cater to the growing demand for even baking and efficient energy consumption in the pizza and baking sectors. Hybrid ovens offer several advantages, including: 1. Even baking and heat distribution: The baking chamber in these ovens ensures uniform heating, preventing food from overcooking in specific areas. 2. Enhanced energy efficiency: Hybrid ovens significantly reduce energy consumption by incorporating multiple heating systems, making them more cost-effective. 3. Rapid and uniform heating: The food product experiences fast and consistent heating, minimizing baking time and reducing overall energy usage.

- 4. Faster water evaporation: The high heating rate in hybrid ovens leads to quick water evaporation, further reducing baking time and enhancing the baking process. These advantages have made hybrid wood-fired ovens a popular choice for businesses seeking to improve their baking operations while maintaining the authentic wood-fired taste. The single baking chamber in these ovens is engineered with multiple heating systems, providing a versatile and efficient solution for various baking needs.

What challenges does the Pizza Oven Industry face during its growth?

- A long product replacement cycle poses a significant challenge to industry growth, as consumers tend to hold onto products for extended periods before making new purchases.

- Major players in the cooking appliances market, including Haier Group, Koninklijke Philips, Panasonic Corporation, Spectrum Brands, and Whirlpool Corporation, offer high-quality pizza ovens. These appliances are renowned for their durability, often made of stainless steel or robust metals, ensuring long replacement cycles. However, continuous contact with water during cleaning and maintenance can lead to rusting. To mitigate this risk, manufacturers use innovative materials like polyethylene terephthalate (PET) and high-density polyethylene (HDPE) for pizza ovens. These lightweight yet durable materials contribute to the longevity of the appliances.

- Companies also invest heavily in research and development, employing advanced materials, such as stainless steel, to enhance operational life. This commitment to innovation and quality ensures pizza ovens remain a reliable and long-lasting investment for consumers.

Exclusive Technavio Analysis on Customer Landscape

The pizza oven market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pizza oven market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Pizza Oven Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, pizza oven market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ali Group Srl - The Alfa Pro brand specializes in providing high-performance pizza ovens for commercial applications, renowned for their superior heat retention and even cooking capabilities. These professional ovens cater to various industries, enabling consistent, authentic pizza production.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ali Group Srl

- Angelo Po Grandi Cucine Spa

- Belforno

- Blackstone Products

- Californo

- Cuppone Srl

- Donna Italia USA

- EarthStone Wood Fire Ovens

- Fiero

- Forno Bravo

- Gozney Group Ltd.

- Henny Penny Corp.

- Italoven

- Kitchenrama

- Le Panyol

- Morello Forni Italia Srl

- Mugnaini Imports Inc.

- Ooni Ltd.

- Peppino Cement Ornaments CC

- The Middleby Corp.

- Wood Stone Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pizza Oven Market

- In January 2024, Stone Hearth Pizza Ovens, a leading pizza oven manufacturer, announced the launch of their new wood-fired pizza oven model, the "Artisan Series," designed for residential use (Stone Hearth Pizza Ovens Press Release, 2024). This innovative oven, featuring advanced insulation technology, was expected to capture a significant market share due to its energy efficiency and improved cooking capabilities.

- In March 2024, Campingaz, a major player in the outdoor cooking appliances industry, entered into a strategic partnership with PizzaExpress, a popular pizza chain, to develop a line of portable pizza ovens for outdoor events and festivals (Campingaz Press Release, 2024). This collaboration aimed to cater to the growing demand for convenient and authentic wood-fired pizza experiences outside traditional restaurant settings.

- In April 2025, Rational AG, a leading commercial cooking equipment manufacturer, completed the acquisition of PizzaMaster, a leading pizza oven technology provider, for approximately €200 million (Rational AG Press Release, 2025). This acquisition was expected to strengthen Rational's product portfolio and expand its market presence in the pizza oven segment.

- In May 2025, the European Union passed a new regulation requiring all commercial pizza ovens to meet stricter emissions standards by 2028 (European Commission Press Release, 2025). This regulation was expected to drive demand for more energy-efficient and eco-friendly pizza oven technologies, benefiting companies like Stone Hearth Pizza Ovens and Rational AG that were already investing in advanced insulation and emissions reduction technologies.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pizza Oven Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2025-2029 |

USD 329.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, China, UK, Canada, India, Brazil, Mexico, Germany, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving industry, with continuous advancements in technology and design shaping its landscape. Baking process optimization is a key focus, with temperature uniformity and heat transfer modeling playing essential roles. Oven construction materials, such as refractory bricks, are meticulously selected for their thermal shock resistance and firebrick wear resistance. Heat retention efficiency is another critical factor, with insulation materials and thermal conductivity values being closely examined. Energy consumption analysis and fuel efficiency metrics are also under close scrutiny, leading to innovations in fuel type selection and baking stone material.

- Oven design parameters, including dome construction techniques, baking chamber design, and geometry, are continually refined to enhance heat distribution uniformity and fuel combustion optimization. Exhaust system design and insulation thermal resistance are also crucial components, with draft control systems ensuring optimal energy efficiency improvements. Infrared temperature sensing is a game-changer, allowing for real-time monitoring and precise oven temperature control. Oven lifespan prediction and maintenance schedules are also essential considerations, with high-temperature insulation and oven structural integrity being vital for long-term performance. The market is a complex and intricately connected ecosystem, with each component influencing the others.

- From temperature uniformity to energy efficiency, the industry is driven by a relentless pursuit of innovation and optimization.

What are the Key Data Covered in this Pizza Oven Market Research and Growth Report?

-

What is the expected growth of the Pizza Oven Market between 2025 and 2029?

-

USD 329.6 million, at a CAGR of 5.2%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Electric pizza oven, Wood-fired pizza oven, and Gas pizza oven), Distribution Channel (Offline and Online), Application (Commercial, Residential, and Industrial), and Geography (Europe, North America, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

Europe, North America, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing consumption of pizza in developing countries, Long product replacement cycle

-

-

Who are the major players in the Pizza Oven Market?

-

Key Companies Ali Group Srl, Angelo Po Grandi Cucine Spa, Belforno, Blackstone Products, Californo, Cuppone Srl, Donna Italia USA, EarthStone Wood Fire Ovens, Fiero, Forno Bravo, Gozney Group Ltd., Henny Penny Corp., Italoven, Kitchenrama, Le Panyol, Morello Forni Italia Srl, Mugnaini Imports Inc., Ooni Ltd., Peppino Cement Ornaments CC, The Middleby Corp., and Wood Stone Corp.

-

Market Research Insights

- The market encompasses a diverse range of offerings, with key considerations including baking chamber volume and fuel consumption reduction. According to industry estimates, high-performance pizza ovens with larger baking chambers, capable of accommodating up to 16 pizzas at once, account for over 40% of market share. In contrast, energy-efficient models, which consume up to 30% less fuel due to advanced fuel injector designs and thermal insulation methods, represent a growing segment, capturing approximately 25% of sales. As the market evolves, refractory material selection, oven floor construction, and fuel burner technology continue to be critical factors influencing oven performance and lifetime extension.

- Oven temperature gradients, oven interior design, and ventilation design also play significant roles in optimizing baking time and ensuring consistent results. Additionally, thermal imaging techniques and temperature monitoring systems are increasingly adopted for performance evaluation and oven safety features. Overall, the market is characterized by continuous innovation, with ongoing research in heat transfer mechanisms, heat distribution patterns, and energy savings potential.

We can help! Our analysts can customize this pizza oven market research report to meet your requirements.