Recycle For Plastic Bottle Market Size 2024-2028

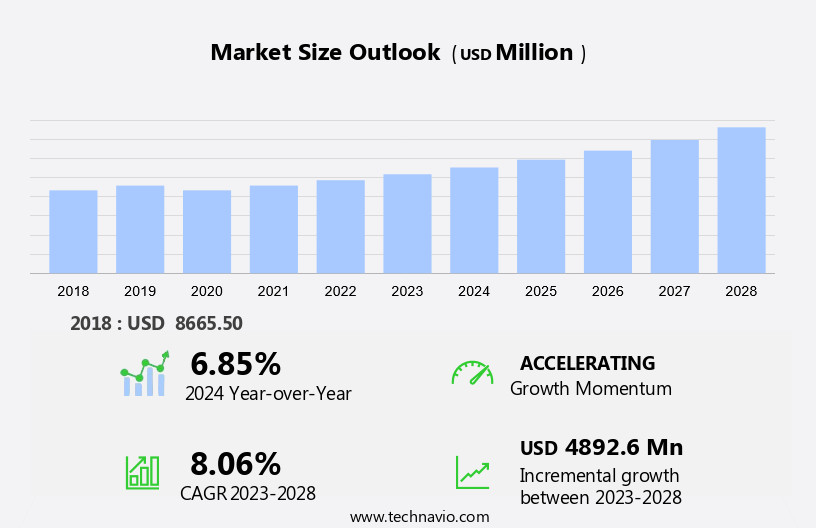

The recycle for plastic bottle market size is forecast to increase by USD 4.89 billion at a CAGR of 8.06% between 2023 and 2028.

- The recycled plastic bottle market is witnessing significant growth due to several key factors. The increasing use of plastic bottles and their recycled forms in various applications is a major driving force. Additionally, manufacturing companies are focusing on recycling plastic to reduce their carbon footprint and meet sustainability goals. Sustainable packaging initiatives further propel the growth of the plastic bottle recycling market. Polypropylene (PP) bottles represent a substantial portion of the plastic bottle recycling market, with their lightweight and versatile properties making them suitable for various applications. However, the low recycling rate remains a significant challenge for market growth. Despite this, advancements in technology and increasing consumer awareness are expected to boost the market In the coming years. The use of recycled plastic bottles In the production of new bottles, fibers, and other products is also on the rise, further fueling market demand. Overall, the recycled plastic bottle market is poised for steady growth, offering numerous opportunities for stakeholders.

What will be the Size of the Market During the Forecast Period?

- The recycle market for plastic bottles encompasses various types of plastic materials, including PET bottle recycling, plastic films, synthetic fibers, rigid plastics and foams, and a range of polymers such as polyethylene terephthalate (PET), polypropylene (PP), polyvinyl chloride (PVC), polystyrene (PS), polyamide (PA), and polycarbonate. The collection, sorting, and processing of these plastics aim to reduce environmental degradation and plastic waste, contributing to a circular economy. Beverages, personal care, pharmaceutical, and food packaging industries are significant contributors to plastic bottle production and subsequent recycling. Mechanical and chemical recycling methods are employed to convert used plastic bottles into raw materials for new products.

- Closed-loop systems are increasingly popular, enabling the reuse of recycled plastic bottles In the same application. The recycling process for PP bottles involves mechanical methods to separate and process the material, ensuring its reuse in new bottles or other products. Recycling facilities play a crucial role in this process, transforming plastic waste into valuable resources in a sustainable manner.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Grade Type

- PET

- HDPE

- PP

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- UK

- North America

- US

- Middle East and Africa

- South America

- APAC

By Grade Type Insights

- The PET segment is estimated to witness significant growth during the forecast period. PET is a form of polyester that is formed by combining two monomers, namely modified ethylene glycol and purified terephthalic acid. It is a commonly used packaging material that comes under the thermoplastic category and has a crystal-clear look. PET is a popular packaging material for food and non-food products, including liquids. Manufacturers and suppliers of food and beverages use PET bottles to package products because of their strength, thermo-stability, and transparency. PET bottles are labeled with the #1 code on or near the bottom and are commonly used to package soft drinks, water, juice, salad dressings, oil, cosmetics, and household cleaners.

Get a glance at the market report of share of various segments Request Free Sample

The PET segment was valued at USD 5.24 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 57% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The global plastic bottle recycling market is significantly driven by the increasing consumption of beverages and bottled water, particularly in Asia Pacific (APAC), which accounted for the largest market share in 2023. With population growth and economic expansion in APAC, there is an increase in demand for plastic bottles for packaging various products, including beverages, dairy, and water. In Southeast Asia, there is a high consumption of takeaway food, leading to increased plastic bottle waste. The recycling of plastic bottles, including PET, HDPE, and PP, is essential for reducing environmental degradation and pollution, conserving energy, and minimizing greenhouse gas emissions.

Recycling technologies such as mechanical and chemical processes convert plastic bottles into feedstock for various applications, including building and construction, textiles, and energy production. Corporate sustainability programs and closed-loop systems are key initiatives promoting recycling, while collection, sorting, and processing infrastructure are crucial for the economic viability of the recycling industry. Key applications for recycled plastic include beverages, personal care, pharmaceutical, food packaging, and various industrial uses. The circular economy approach to plastic bottle recycling reduces the need for virgin plastic production and its associated negative environmental effects.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Recycle For Plastic Bottle Industry?

Growing use of plastic bottles and their recycled forms is the key driver of the market.

- The global market for plastic bottle recycling is experiencing significant growth due to the increasing demand for plastic bottles in various consumer industries. This trend is driven by the rising consumption of beverages, personal care products, pharmaceuticals, and food packaging. As a result, an increasing number of plastic bottles are being produced, leading to a corresponding increase in plastic waste. Recycling plastic bottles offers numerous benefits, including energy conservation, reduced pollution, and the reduction of greenhouse gases. Recycled plastic can be used to produce a range of products, including building and construction materials, textiles, and packaging. The use of recycled plastic in closed-loop systems is a key aspect of circular economy initiatives, which aim to minimize the negative environmental effects of plastic waste and virgin plastic production.

- The recycling process involves several stages, including collection, sorting, processing, and reuse. Mechanical recycling is the most common method, which involves melting down the plastic and reforming it into new products. Chemical recycling is another method, which involves breaking down the plastic into its base components and then rebuilding it into new products. Contamination and plastic composition are major challenges In the recycling process. Effective collection procedures and recycling infrastructure are essential to ensure the economic viability of plastic bottle recycling. Programs and incentives, such as curbside recycling, drop-off centers, and deposit refund systems, can help increase collection rates and promote environmental consciousness among consumers.

What are the market trends shaping the Recycle For Plastic Bottle Industry?

Growing focus on recycling plastic by manufacturing companies is the upcoming market trend.

- Plastic waste generation is a significant economic and environmental concern, with the World Economic Forum estimating a loss of USD 80-USD 120 billion annually. To address this issue and contribute to the UN Sustainable Development Goal on Sustainable Consumption and Production, companies are shifting towards a more circular economy approach. This approach prioritizes the reduction of packaging usage and the design of reusable, recyclable, or compostable packaging. PET bottles, HDPE bottles, and PP bottles are among the most commonly recycled plastic types. Mechanical recycling and chemical recycling are two primary methods used to process these bottles into new products. Mechanical recycling involves the physical processing of waste plastic into pellets or flakes, while chemical recycling breaks down plastic into its base chemicals to create new polymers.

- Recycled plastic feedstock is used in various industries, including building and construction, textiles, and energy conservation. These industries benefit from reduced pollution, greenhouse gas emissions, and the conservation of biodiversity and aquatic lives. Recycling also helps reduce CO2 emissions, making it an essential component of corporate sustainability programs. Closed-loop systems are essential for the economic viability of recycling. These systems ensure that recycled plastic is collected, sorted, processed, and reused, creating a continuous cycle. Collection procedures, sorting, and processing are crucial steps in maintaining the quality and purity of recycled plastic. Contamination can significantly impact the recycling process and the final product's quality.

What challenges does the Recycle For Plastic Bottle Industry face during its growth?

Low recycling rate is a key challenge affecting the industry growth.

- The plastic bottle recycling market encompasses the production and processing of various types of plastic bottles, including PET, HDPE, PP, PVC, Polystyrene, Polyamide, Polycarbonate, and Acrylonitrile-butadiene Styrene. These bottles are used extensively in industries such as building & construction, textiles, beverages, personal care, pharmaceutical, and food packaging. Recycling these bottles is essential for environmental conservation, reduced pollution, and energy conservation. It helps minimize greenhouse gas emissions, protect biodiversity, and aquatic lives, and decrease CO2 emissions. However, the lack of infrastructure for plastic bottle recycling is a significant challenge. Collection, sorting, processing, and reuse procedures are insufficient in many regions, leading to the disposal of plastic bottles In the environment.

- This contributes to the growing issue of plastic waste. According to estimates, around 8.3 billion metric tons of plastics have been produced since the 1950s, out of which only around 9% were recycled. Mechanical and chemical recycling technologies are used to convert plastic waste into recycled plastic feedstock for the production of new bottles. Programs and incentives, such as closed-loop systems and deposit refund systems, can encourage the collection and recycling of plastic bottles. Corporate sustainability programs also play a crucial role in promoting environmental consciousness and reducing the negative environmental effects of virgin plastic production. Circular economy principles and circular packaging solutions can help create a more sustainable future for the plastic bottle industry.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Complete Recycling LLC

- ECO2 PLASTICS Inc.

- Ecoplast Solutions

- EREMA Engineering Recycling Maschinen und Anlagen Ges.m.b.H.

- EVERGREEN A GREENBRIDGE Co.

- Ioniqa Technologies B.V.

- Loop Industries Inc.

- MoistureShield

- NATIONAL RECOVERY TECHNOLOGIES LLC

- NaturaPCR

- perPETual Technologies GmbH

- Phoenix Technologies International LLC

- PlastiKetic Co.

- PTP GROUP Ltd.

- Recycle Clear

- UltrePET LLC

- United Resource Recovery Corp.

- Worn Again Technologies

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The plastic bottle market encompasses a diverse range of applications, with pet bottles being a significant segment. Pet bottles are primarily used for packaging beverages, personal care products, pharmaceuticals, and food items. These bottles are manufactured using various types of plastics, including polyethylene terephthalate (PET), polypropylene (PP), polyvinyl chloride (PVC), polystyrene (PS), polyamide (PA), polycarbonate, acrylonitrile-butadiene styrene, and others. The recycling of plastic bottles is a critical aspect of the market, with both mechanical and chemical recycling methods being employed. Mechanical recycling involves the reprocessing of used plastic bottles into new bottles or other products, while chemical recycling converts the plastic feedstock into its base chemical components, which can then be used to produce virgin plastic.

In addition, the recycling of plastic bottles offers numerous benefits, including reduced environmental degradation, pollution, and greenhouse gas emissions. The circular economy model, which prioritizes the reuse and recycling of resources, is gaining popularity as a sustainable alternative to virgin plastic production. Plastic bottle recycling also contributes to the reduction of CO2 emissions. According to market research, the recycling of one ton of PET bottles saves approximately 2,750 gallons of gasoline and reduces CO2 emissions by 10,000 pounds. The collection, sorting, and processing of plastic bottles are crucial components of the recycling process. Effective collection procedures ensure that a high percentage of bottles are captured for recycling.

Moreover, sorting is necessary to separate different types of plastic bottles, which are processed differently. Processing involves the conversion of sorted plastic bottles into recycled products. The recycling infrastructure plays a vital role In the economic viability of plastic bottle recycling. Recycling facilities are essential for the efficient processing of collected plastic bottles. Programs and incentives, such as deposit refund systems and curbside recycling, encourage consumers to recycle their plastic bottles. The use of recycled plastic feedstock in closed-loop systems is another trend In the plastic bottle market. Closed-loop systems involve the production of new bottles using recycled plastic feedstock, reducing the need for virgin plastic.

In addition, environmental consciousness and corporate sustainability programs are driving the demand for recycled plastic products. The use of recycled plastic in building and construction, textiles, and energy conservation applications is increasing. Contamination is a challenge In the plastic bottle recycling industry. Contamination can occur during the collection, sorting, or processing stages. Effective contamination management is essential to ensure the quality of recycled plastic products. The benefits of plastic bottle recycling, including environmental sustainability and economic viability, make it an essential component of the circular economy. Effective collection, sorting, and processing of plastic bottles, as well as the development of innovative recycling technologies, are key to maximizing the value of plastic bottle recycling.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.06% |

|

Market growth 2024-2028 |

USD 4.89 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.85 |

|

Key countries |

China, US, India, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Recycle For Plastic Bottle industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the recycle for plastic bottle market growth of industry companies

We can help! Our analysts can customize this recycle for plastic bottle market research report to meet your requirements.