Polyamide Market Size 2024-2028

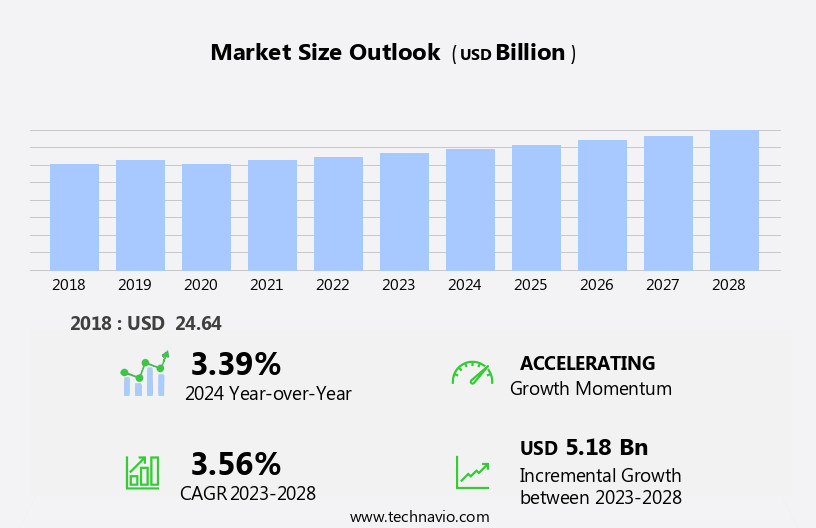

The polyamide market size is forecast to increase by USD 5.18 billion at a CAGR of 3.56% between 2023 and 2028.

What will be the Size of the Polyamide Market During the Forecast Period?

How is this Polyamide Industry segmented and which is the largest segment?

The polyamide industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- PA6

- PA66

- Bio-based PA

- Specialty PA

- End-user

- Automotive sector

- Electrical and electronics sector

- Packaging sector

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

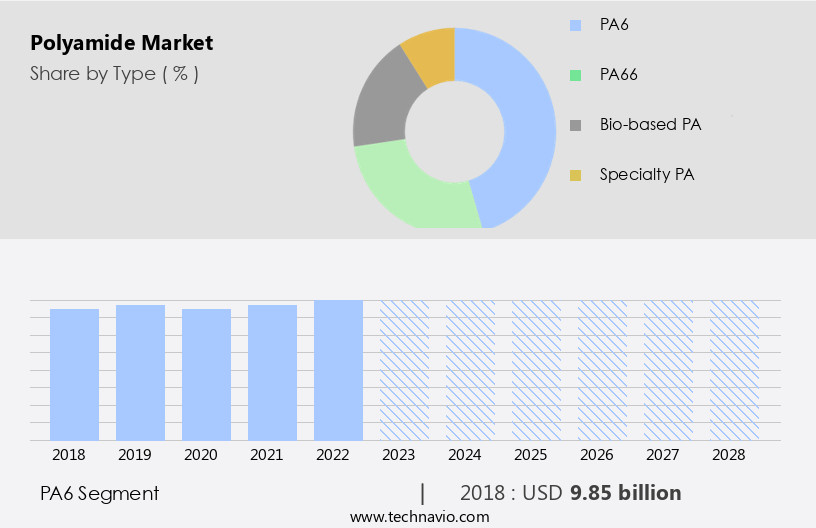

By Type Insights

- The pa6 segment is estimated to witness significant growth during the forecast period.

The market is driven by the production of PA 6, primarily from caprolactam (CPL). CPL is produced through a hydrolytic polymerization process, which ensures large-scale production and control parameters. Market participants have developed proprietary methods to cater to specific end-uses, granting them a competitive edge. APAC is witnessing an increase in CPL production, fueled by the growing demand for polyamides, particularly PA 6. This trend is observed across various industries, including engineering, textiles, consumer goods, electrical appliances, and aerospace. The demand for lightweight, high-performance materials with excellent chemical resistance and mechanical qualities is driving market growth. Key applications include vehicle production, electrical insulation, and aerospace components.

Bio-based polyamides are also gaining traction due to environmental awareness and industry life cycle considerations. The market is expected to reach significant revenue in USD, with steady growth in emerging nations.

Get a glance at the Polyamide Industry report of share of various segments Request Free Sample

The PA6 segment was valued at USD 9.85 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

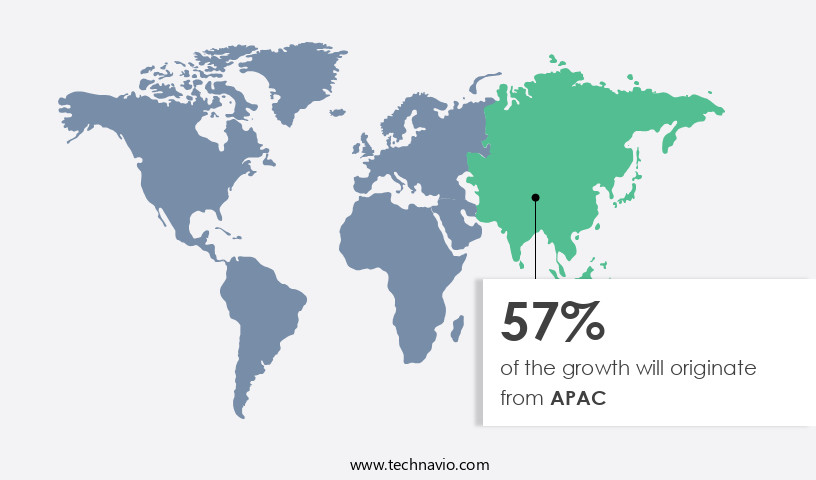

- APAC is estimated to contribute 57% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The APAC region holds a significant position In the market, accounting for the third-largest share in 2023. China is a major producer and consumer of polyamides (PAs) in this region, with increasing production capacity and above-average consumption forecasted during the upcoming years. Among various PA applications, fibers are projected to exhibit moderate growth. The automotive industry's expanding demand in APAC, coupled with China and India's emergence as global hubs for electrical and electronics manufacturing, will drive PA consumption In the region. These trends are expected to continue during the forecast period. Polyamides are widely used in engineering plastics, textiles, consumer goods, electrical appliances, and various industries due to their high-temperature resistance, chemical resistance, and excellent mechanical qualities.

The growing demand for lightweight automobiles, electric vehicles, and increasing environmental awareness are also contributing factors to the market's growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Polyamide Industry?

Superior properties and versatile nature of PAs is the key driver of the market.

What are the market trends shaping the Polyamide Industry?

Wide usage of PAs in additive manufacturing industry is the upcoming market trend.

What challenges does the Polyamide Industry face during its growth?

Volatility in raw material prices and its impact is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The polyamide market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the polyamide market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, polyamide market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AdvanSix Inc. - Polyamide, a high-performance material offered by the company, exhibits exceptional toughness, abrasion resistance, and impact resistance. Renewable sourcing options are available for this versatile polymer, contributing to its eco-friendly appeal. By combining durability with sustainability, this material caters to various industries, including automotive, construction, and textiles, among others.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AdvanSix Inc.

- Arkema SA

- Ascend Performance Materials

- BASF SE

- Domo Chemicals GmbH

- DuPont de Nemours Inc.

- Evonik Industries AG

- Formosa Chemicals and Fibre Corp.

- Goodfellow Cambridge Ltd.

- Huntsman Corp

- Invista

- Koninklijke DSM NV

- Lanxess AG

- Lealea Group

- Radici Partecipazioni Spa

- Shenma Industrial Co. Ltd.

- Solvay SA

- Toray Industries Inc.

- Toyobo Co. Ltd.

- Ube Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Polyamides, also known as nylons, are a type of macromolecule used extensively in various industries due to their unique properties. These thermoplastic materials exhibit excellent mechanical qualities, including high tensile strength, wear resistance, and gas permeability. They also offer chemical resistance, making them suitable for use in corrosive environments and high-temperature applications. Polyamides find extensive use in engineering applications, particularly In the manufacturing of consumer goods, electrical appliances, and industrial machinery. In the textile industry, they are used to produce fibers and films. In the electrical and electronics sector, they are utilized In the production of components for building and construction, aerospace, and automotive applications.

The demand for polyamides is driven by their versatility and superior performance in various applications. For instance, In the automotive industry, they are used in vehicle production to manufacture engine covers, fuel systems, electrical connectors, and interior parts. In the aerospace sector, they are used In the production of lightweight components for aircraft, including engine parts and electrical insulation. The global revenue generated from the sales of polyamides is significant, with the market size estimated to be in billions of USD. The growth of this market can be attributed to technological innovation and the increasing demand for lightweight and high-performance materials in various industries.

The market for polyamides is influenced by several factors, including the demand for bio-based polyamides, the shift towards digitalization and automation, and the growing trend towards sustainability and environmental awareness. The pandemic has also had an impact on the supply chain, leading to disruptions and delays in production and delivery. The market for polyamides is expected to continue growing, driven by the increasing demand for polyamides in emerging nations and the growing popularity of electric vehicles (EVs). The use of polyamides in EVs is expected to increase due to their excellent electrical insulation properties and design flexibility. The market for polyamides is highly competitive, with several players offering a range of products to meet the diverse needs of various industries.

The market is also witnessing significant R&D activity, with companies investing In the development of new and innovative polyamide products to meet the evolving needs of their customers. Polyamides are also used in various industries outside of engineering and electronics. For instance, they are used In the production of coatings, films, precursors, and adhesives. In the textile industry, they are used to produce fibers and films for use in clothing and other textile products. The market for polyamides is expected to remain strong, driven by the increasing demand for high-performance materials in various industries. The market is also expected to be influenced by several trends, including the growing popularity of bio-based polyamides, the shift towards digitalization and automation, and the increasing focus on sustainability and environmental awareness.

In conclusion, the market for polyamides is a dynamic and growing one, driven by the increasing demand for high-performance materials in various industries. The market is expected to be influenced by several trends, including the growing popularity of bio-based polyamides, the shift towards digitalization and automation, and the increasing focus on sustainability and environmental awareness. The market is highly competitive, with several players offering a range of products to meet the diverse needs of various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

187 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.56% |

|

Market growth 2024-2028 |

USD 5.18 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.39 |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Polyamide Market Research and Growth Report?

- CAGR of the Polyamide industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the polyamide market growth of industry companies

We can help! Our analysts can customize this polyamide market research report to meet your requirements.