Ports And Terminal Operations Market Size and Forecast 2025-2029

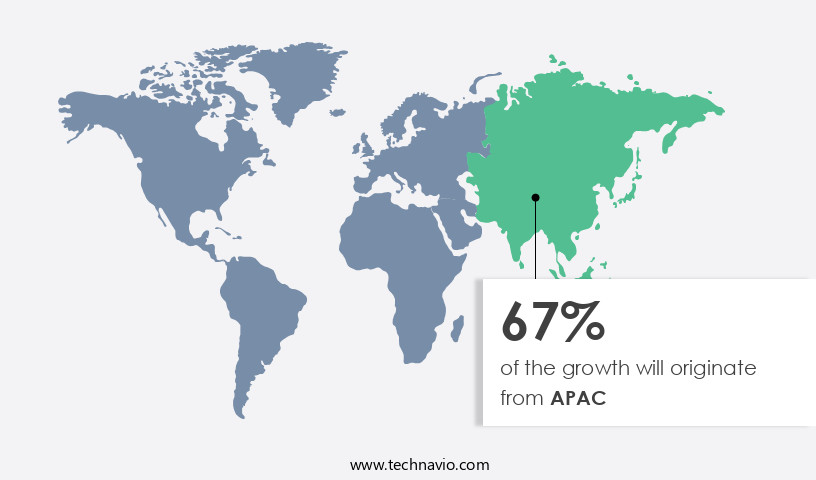

The ports and terminal operations market size estimates the market to reach by USD 62.88 billion, at a CAGR of 12% between 2024 and 2029. APAC is expected to account for 67% of the growth contribution to the global market during this period. In 2019 the food transportation segment was valued at USD 16.09 billion and has demonstrated steady growth since then.

|

Report Coverage |

Details |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

| Market structure | Fragmented |

|

Market growth 2025-2029 |

USD 62.88 billion |

- The market is witnessing significant growth due to the increasing adoption of containerization as a preferred method for transporting goods. This shift towards containerization has led to an escalating demand for efficient and effective port and terminal operations. Another key trend in the market is the emergence of real-time location systems (RTLS), which enable real-time monitoring and tracking of containers and cargo, enhancing operational efficiency and reducing the risk of loss or theft. However, managing congestion risk remains a significant challenge for port and terminal operators. With the increasing volume of cargo shipping and vessels, congestion at ports can lead to delays, higher operating costs, and decreased customer satisfaction.

- To navigate this challenge, operators must invest in advanced technologies and infrastructure to optimize their operations and improve turnaround times for vessels and cargo. Additionally, collaboration and coordination between various stakeholders, including shipping lines, customs agencies, and logistics providers, is essential to mitigate congestion and ensure smooth and efficient port and terminal operations.

What will be the Size of the Ports And Terminal Operations Market during the forecast period?

The market continues to evolve, driven by the increasing demand for efficient and secure supply chain solutions. Container inspection systems play a crucial role in ensuring cargo security, with infrastructure maintenance a constant priority to maintain optimal performance. The integration of technology, such as blockchain and digital twin tech, streamlines customs clearance procedures and enhances intermodal transportation. Dredging operations and port community systems are essential for accommodating larger vessels, while risk management strategies and terminal optimization software improve yard management and real-time vessel tracking. Automated guided vehicles and cargo handling equipment, powered by predictive maintenance models, increase throughput and reduce downtime.

Freight forwarding processes benefit from logistic management systems, enabling supply chain visibility and enhancing overall efficiency. Terminal operating systems (TOS systems), port security systems, and container handling systems, including automated stacking cranes, ensure smooth dock operations and cargo tracking. Integration of bulk cargo solutions, automation infrastructure, and digital twins further strengthens operational precision. Big data platforms and IoT sensors enhance data-driven decision-making, while the adoption of AGVs and remote-controlled cranes improves terminal productivity. Vessel traffic management and ship scheduling software facilitate efficient berth allocation and congestion management, contributing to environmental impact assessments and maritime security measures. The industry anticipates a robust growth of over 5% annually, underscoring the market's continuous dynamism. For instance, a major port implemented an advanced terminal operating system, resulting in a 20% increase in container handling efficiency. This transformation underscores the potential for technology to revolutionize port operations and boost supply chain resilience.

How is this Ports And Terminal Operations Industry segmented?

The ports and terminal operations industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Food transportation

- Steel transportation

- Coal transportation

- Others

- Service Type

- Stevedoring

- Cargo handling and transportation

- Others

- Type

- Container Terminals

- Bulk Terminals

- Roll-on/Roll-off (Ro-Ro) Terminals

- Liquid Terminals

- General Cargo Terminals

- Ownership

- Public

- Private

- Public-Private Partnership (PPP)

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Greece

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- Singapore

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The food transportation segment is estimated to witness significant growth during the forecast period.

In the dynamic world of ports and terminal operations, advanced technologies are revolutionizing the way goods are moved and managed. Container inspection systems ensure the secure and efficient handling of cargo, while infrastructure maintenance keeps terminals in optimal condition. Blockchain technology streamlines customs clearance procedures, reducing delays and increasing transparency. Intermodal transportation is enhanced through real-time vessel tracking and automated guided vehicles, enabling precise scheduling and efficient freight forwarding processes. Dredging operations maintain accessibility to deeper waters, allowing larger vessels to dock. Port community systems facilitate seamless communication between stakeholders, improving supply chain visibility. Risk management strategies employ predictive maintenance models for cargo handling equipment, reducing downtime and increasing throughput.

Terminal optimization software, digital twin technology, and vessel traffic management optimize berth allocation and minimize port congestion. Environmental impact assessments and maritime security measures ensure sustainable and secure operations. Container terminal design incorporates gate automation systems and logistic management systems to improve dock operations efficiency. Throughput optimization and berth allocation algorithms enable efficient use of resources and reduce wait times. For instance, a major port implemented a terminal operating system that increased container handling capacity by 25%. Furthermore, industry growth in the market is expected to reach 5% annually, driven by the increasing demand for efficient and secure logistics solutions.

As of 2019 the Food transportation segment estimated at USD 16.09 billion, and it is forecast to see a moderate upward trend through the forecast period.

Regional Analysis

During the forecast period, APAC is projected to contribute 67% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific is experiencing significant growth due to increasing trade volumes and economic expansion in the region. With many businesses relocating manufacturing and production activities to Asia, the demand for efficient and robust port and terminal facilities to handle import and export goods is on the rise. This includes the implementation of advanced technologies such as container inspection systems, terminal optimization software, and real-time vessel tracking to streamline operations and enhance supply chain visibility. Infrastructure maintenance, including dredging operations and port community systems, is essential to ensure the smooth flow of goods and adhere to customs clearance procedures.

Risk management strategies, such as predictive maintenance models and digital twin technology, are also becoming increasingly important to mitigate potential disruptions and ensure supply chain resilience. For example, India's Ministry of Commerce and Industry reported that the country's overall imports expanded by 25% during the global downturn, despite domestic demand remaining constant. The market in Asia Pacific is expected to continue growing at a substantial rate, with industry experts projecting a 15% increase in market size over the next five years. This growth will be driven by the ongoing need for efficient and advanced port and terminal facilities to support the region's economic growth and expanding supply chains.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The ports and terminal operations market is evolving with a focus on improving efficiency in container handling and integrating logistics and terminal management. Operators are adopting advanced technologies for port security and working on reducing environmental impact of port activities. Key strategies include enhancing supply chain visibility in ports and improving vessel turnaround time at terminals through dockside operations efficiency improvements. Efficiency also depends on customs clearance process optimization and adherence to safe cargo handling procedures in ports. Automation leads with container terminal automation solutions, optimization strategies for port operations, and implementation of port community systems. Sustainability is driven by sustainable port operations and design and managing risk in port and terminal operations. Digital transformation includes real-time data analytics for port management, predictive maintenance for port equipment, automated guided vehicles in container yards, berth allocation strategies for efficient operations, digital twin modeling for port simulation, and blockchain implementation for cargo tracking.

What are the key market drivers leading to the rise in the adoption of Ports And Terminal Operations Industry?

- The significant growth in the adoption of containerization technology is the primary catalyst driving market expansion. Containerization plays a pivotal role in optimizing port operations by standardizing cargo units and streamlining handling processes. This results in faster loading and unloading times, increasing overall efficiency. Containers' stackability enables ports to maximize storage space, leading to increased capacity and decreased congestion. The intermodal flexibility of containers, allowing seamless transfer between ships, trains, and trucks, creates a well-connected secured logistics network. According to industry reports, containerization reduces turnaround times at ports by an average of 30%. This significant improvement is attributed to the standardized loading and unloading processes and the ease of transferring containers between various transport modes.

- The market is projected to grow by over 5% annually, driven by the increasing demand for efficient and cost-effective logistics solutions. For instance, the implementation of automated container handling systems and the expansion of container terminals are key factors fueling market growth.

What are the market trends shaping the Ports And Terminal Operations Industry?

- Real-time location systems (RTLS) represent a significant market trend due to their emergence and growing adoption in various industries. These advanced technologies enable real-time tracking and monitoring of assets, people, and resources, enhancing operational efficiency and productivity.

- In the dynamic world of ports and terminal operations, Real-Time Location Systems (RTLS) technology plays a pivotal role in enhancing operational efficiency. By tracking the real-time location of assets, such as containers, vehicles, and equipment, ports can optimize asset utilization and reduce the risk of asset loss. For instance, real-time container tracking helps prevent misplaced or lost containers, thereby improving inventory management accuracy. Moreover, RTLS facilitates better yard management by providing instant information about the location of containers and equipment in the terminal yard.

- This optimization results in reduced congestion, improved turnaround times, and a more harmonious flow of cargo. According to recent market analysis, the global RTLS market in the logistics sector is expected to grow by 15% based on revenue by 2026. This surge in demand for RTLS technology is due to its robust capabilities in improving port operations and overall supply chain efficiency.

What challenges does the Ports And Terminal Operations Industry face during its growth?

- Effective management of congestion risk is a crucial challenge that significantly impacts the growth of the industry. By implementing advanced strategies and technologies, industry professionals strive to mitigate potential congestion issues and ensure uninterrupted business operations. This not only enhances productivity but also fosters customer satisfaction and trust. Thus, addressing congestion risk is an essential aspect of industry growth and success.

- The global port and terminal operations market has experienced significant growth due to the surge in international trade and the transportation of goods. This trend has resulted in an increase in the number of ships and vessel traffic at ports, leading to congestion and longer waiting times for ships in queues. The congestion at ports causes operational inefficiencies for terminal operators, disrupting their loading and unloading schedules. For instance, a study revealed that the average waiting time for a container ship at a European port is approximately 3.5 days.

- This delay results in substantial financial losses for shipping companies, as well as decreased productivity for terminal operators. According to industry reports, the port and terminal operations market is expected to grow by over 5% annually in the coming years, driven by the increasing demand for efficient logistics and supply chain solutions.

Exclusive Customer Landscape

The ports and terminal operations market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ports and terminal operations market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ports and terminal operations market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adani Group - The private port operator, APSEZ, specializes in ports and terminals operations, acting as a comprehensive logistics provider. Their services span from port management to cargo handling and value-added services, ensuring efficient supply chain solutions for diverse industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adani Group

- AP Moller Maersk AS

- Asian Terminals Inc.

- CK Hutchison Holdings Ltd.

- Copenhagen Malmo Port

- COSCO Shipping Ports Ltd.

- Crescent Group

- Delo Group

- DP World

- EUROKAI GmbH and Co. KGaA

- International Container Terminal Services Inc.

- Klaipedos Smelte

- Ocean Network Express Pte. Ltd.

- Ports America

- PSA International

- PT Pelabuhan Indonesia III

- Terminal Investment Ltd. Sarl

- Yildirim Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ports And Terminal Operations Market

- In January 2024, DP World, a leading global provider of smart logistics solutions, announced the launch of its new digital platform, 'DP World TradeFlow,' in collaboration with IBM and Maersk, aimed at digitizing and streamlining global trade processes (DP World Press Release, 2024).

- In March 2024, Hutchison Ports, a prominent port operator, completed the acquisition of a 51% stake in the Pakistan International Bulk Terminal from the National Bank of Pakistan for approximately USD 240 million, marking its entry into the Pakistani bulk terminal market (Reuters, 2024).

- In April 2025, the European Union approved the merger of Danish port operators A.P. Moller-Maersk and MSC Mediterranean Shipping Company's container terminal businesses, subject to certain conditions, which will create one of the largest container terminal operators in Europe (European Commission Press Release, 2025).

- In May 2025, the Chinese government announced a USD 1.5 billion investment in the development of the Xiong'an New Area Port, aiming to create a major international logistics hub and boost the region's economic growth (Xinhua News Agency, 2025).

Research Analyst Overview

- The market continues to evolve, driven by the need for efficient and sustainable supply chain solutions. Warehouse management systems and staff training programs optimize operations, while inland transportation networks management and port infrastructure planning reduce operational costs. Smart port technologies, such as cargo handling safety systems and cargo damage prevention, ensure the secure and timely movement of goods. Maintenance scheduling, energy efficiency measures, and import export procedures streamline processes and enhance productivity. One example of market innovation is the implementation of a digital port solution, which increased quay crane productivity by 20% and reduced vessel turnaround time by 15%.

- The industry anticipates a 12% growth in container terminal automation over the next five years, driven by the integration of shipping lines and safety management systems, as well as the adoption of cybersecurity protocols and data analytics dashboards for remote container operations. Environmental sustainability and terminal capacity planning remain key priorities, with a focus on labor productivity metrics, equipment lifecycle management, and empty container management.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ports And Terminal Operations Market insights. See full methodology.

Ports And Terminal Operations Market Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12% |

|

Market growth 2025-2029 |

USD 62.88 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.4 |

|

Key countries |

Singapore, China, US, Germany, Greece, UK, Brazil, Canada, France, UAE, India, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ports And Terminal Operations Market Research and Growth Report?

- CAGR of the Ports And Terminal Operations industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ports and terminal operations market growth of industry companies

We can help! Our analysts can customize this ports and terminal operations market research report to meet your requirements.