Romania Power EPC Market Size 2024-2028

The Romania power EPC market size is forecast to increase by USD 155.89 million at a CAGR of 3.84% between 2023 and 2028.

- The Romania Power Engineering, Procurement, and Construction (EPC) market is experiencing significant growth due to several key trends. One of the primary drivers is the increasing investments in solar power projects, as the country aims to expand its renewable energy capacity. Another trend is the rapid decline in greenhouse gas (GHG) emissions, with the Romanian government committed to phasing out the use of fossil fuels, promoting clean energy, and incorporating biogas and solar energy storage solutions. These factors are expected to boost the demand for Power EPC services in the country. Additionally, the European Union's Green Deal initiative, which aims to make Europe carbon neutral by 2050, is also likely to have a positive impact on the Romanian Power EPC market.

What will be the size of the Romania Power EPC Market during the forecast period?

- The Power EPC (Engineering, Procurement, and Construction) market in Romania is experiencing significant growth, driven by the increasing demand for power transmission and the integration of renewable energy sources into the grid. Renewable capacity expansion is a key focus, with uncertainties surrounding project delays and approvals posing challenges for developers. Power supply reliability is a critical concern, with natural gas and coal-fired power generation continuing to play a significant role in meeting energy needs. However, the shift towards renewable energy and carbon alternatives is gaining momentum, driven by government policies and economic growth. The market is witnessing innovation in areas such as ultra-supercritical and supercritical coal-fired power plants, which offer improved efficiency and reduced emissions.

- Procurement processes are changing to accommodate the integration of renewable energy sources, with utility providers seeking integrated solutions to manage the complexities of the energy mix. Project initiation faces challenges due to adverse impacts on infrastructure development, including delays in approvals and financing. Private developers are increasingly seeking government backing to mitigate risks and ensure the long-term viability of their projects. Energy demand continues to grow, with oil-based power generation remaining a significant contributor to the energy mix. The role of turbines in power generation is evolving, with a focus on efficiency and emissions reduction. The market is poised for continued growth, with a focus on delivering innovative solutions to meet the evolving energy needs of the country.

How is this market segmented and which is the largest segment?

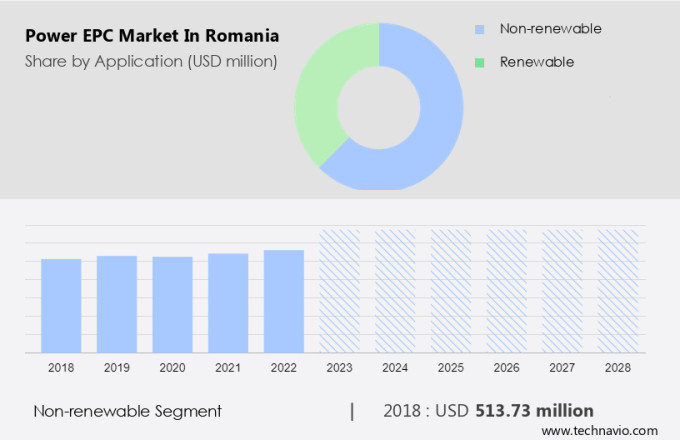

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Non-renewable

- Renewable

- End-user

- Private

- Government

- Technology

- Thermal

- Hydroelectric

- Renewables

- Nuclear

- Geography

- Romania

By Application Insights

- The non-renewable segment is estimated to witness significant growth during the forecast period.

The Power Engineering, Procurement, and Construction (EPC) market in Romania is primarily driven by the non-renewable energy segment. This segment is dominated by conventional thermal power plants that utilize fossil fuels such as coal, oil, and natural gas for energy generation. In 2023, non-renewable energy sources accounted for over 70% of Romania's total primary energy supply. The country's energy security is ensured by its significant natural gas and oil reserves and a large power generation sector. Approximately 98% of coal and 73% of fossil gas units in Romania are state-owned, and managed by the Romanian Ministry of Economy, Energy, and Business.

Renewable energy projects, sustainable energy solutions, and energy storage solutions are also gaining traction in Romania, driven by the need for carbon emissions reduction and the adoption of clean energy technologies. The country's energy access is relatively high, with a focus on energy efficiency and smart grid technologies.

Get a glance at the market share of various segments Request Free Sample

The non-renewable segment was valued at USD 513.73 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Romania Power EPC Market?

Growing investments in solar power projects is the key driver of the market.

- Romania's power sector is witnessing significant growth in sustainable energy, with renewable energy accounting for a 28% share of the country's total installed capacity of 20.61 GW. Solar energy is a key contributor to this trend, with solar capacity expected to reach 4.25 GW by 2030, up from 1.39 GW in 2020. This expansion is driven by increasing investments in renewable energy projects. EPC (Engineering, Procurement, and Construction) contracts have been awarded to various market companies for solar power projects in Romania.

- Grid modernization is another focus area in Romania's energy policy, with investments in power plant optimization, power distribution, and energy storage solutions. Power companies are also investing in energy efficiency measures and natural gas power to reduce carbon emissions and improve energy security. The energy market analysis suggests that cost fluctuations and grid integration challenges will continue to influence the power generation market, making energy technology and project execution crucial for successful renewable energy deployment. The Romanian government is committed to climate change mitigation and sustainable development goals, and the energy sector is a key contributor to these initiatives.

What are the market trends shaping the Romania Power EPC Market?

The rapid decline in GHG emissions is the upcoming trend in the market.

- Romania's power sector is undergoing significant changes as the country focuses on sustainable energy and clean energy production to reduce carbon emissions and tackle climate change. According to the European Parliamentary Research Service (EPRS), over half of Romanians prioritize government action on climate change. With a significant presence of energy-intensive industries, Romania generated 3% of the EU-27's total greenhouse gas (GHG) emissions but reduced these emissions faster than the EU average between 2005 and 2020. To further reduce GHG emissions, Romania has adopted National Energy and Climate Plans (NECPs) for the 2021-2030 period, in line with the EU's binding climate and energy legislation for 2030.

- The energy policy focuses on renewable energy deployment, energy efficiency measures, and grid modernization. The power sector is witnessing substantial investment in renewable energy projects, including wind energy, solar, hydro, and biomass. Power companies are optimizing power plant operations, and there is a growing trend towards natural gas power and energy storage solutions. The power market is transforming, with the modernization of power lines and grid integration challenges being addressed through smart grid technologies. Energy infrastructure development is a priority, with EPC services playing a crucial role in project execution. The power sector is also witnessing a shift towards decentralized energy production through microgrid solutions and off-grid energy in rural areas.

What challenges does Romania Power EPC Market face during the growth?

Government commitments to phase out the use of fossil fuels is a key challenge affecting market growth.

- Romania's power sector is undergoing significant changes as the government aims to increase the use of sustainable and clean energy sources in response to the European Union's energy policy and the global push towards climate change mitigation. The country's energy infrastructure is being modernized to accommodate renewable energy production, including electricity generation from wind, solar, hydro, and biomass. This shift towards renewable energy is expected to lead to increased investment in renewable energy projects, energy storage solutions, and smart grid technologies. The power market in Romania is experiencing fluctuations in project costs due to the rising demand for energy efficiency measures and the setup costs of new renewable energy projects.

- Power companies are focusing on power plant optimization, grid integration challenges, and project delivery to ensure the successful execution of renewable energy projects. The energy transition also presents opportunities for power utilities to provide power EPC services, green energy initiatives, and energy consulting services. The government's energy policy targets a complete phase-out of coal-fired power plants by 2030, which is a significant shift from the original objective of 2032. This decision was made in response to the energy security concerns arising from the Russia-Ukraine conflict and the need to reduce carbon emissions. The modernization of the power grid and the integration of off-grid energy solutions, such as microgrid solutions and rura, are crucial to ensuring energy access and reliability in the country.

Exclusive Romania Power EPC Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Calik Holding

- E.ON SE

- Enel Spa

- Intec Energy Solutions

- JinkoSolar Holding Co. Ltd.

- Kohler Co.

- Mytilineos S.A.

- Romelectro S.A

- SC Electro-Alfa International srl

- Siemens AG

- SOLEK HOLDING SE

- TELENERGIA Europe S.R.L.

- Trina Solar Co. Ltd.

- WTS Energy Co.

- Zhejiang CHINT Electrics Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The Power Engineering, Procurement, and Construction (EPC) market in Romania is witnessing significant growth, driven by the country's commitment to sustainable energy and clean energy policies. The power sector in Romania is transforming, with a focus on modernizing energy infrastructure, optimizing power production, and increasing the deployment of renewable energy sources. The energy policy landscape in Romania is favorable for the growth of the power EPC market. The government is implementing measures to reduce carbon emissions and mitigate climate change, which is leading to an increased focus on renewable energy sources.

Moreover, the country has set ambitious targets for renewable energy capacity expansion, to generate 25% of its electricity from renewable sources by 2020. Power production in Romania is shifting towards cleaner sources, with renewable energy investment on the rise. The country's renewable energy sector is seeing significant growth, with wind, solar, hydro, and biomass being the primary sources of renewable energy. The EPC market is playing a crucial role in the execution of renewable energy projects, from power plant construction to grid integration and project delivery. Grid modernization is another key area of focus for the market.

Furthermore, the country's power grid is undergoing significant upgrades to accommodate the increasing share of renewable energy in the power mix. This includes the installation of power transformers, smart grid technologies, and energy storage solutions. The modernization of the power grid is essential for ensuring energy security and maintaining a reliable power supply. Energy efficiency measures are also a priority for the power sector in Romania. Power companies are investing in energy efficiency technologies and practices to reduce energy consumption and lower carbon emissions. This includes the optimization of power plant operations, the use of energy modeling to identify efficiency improvements, and the adoption of circular economy principles.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

148 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.84% |

|

Market growth 2024-2028 |

USD 155.89 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.68 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Romania

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch