Premium Cosmetics Market Size 2024-2028

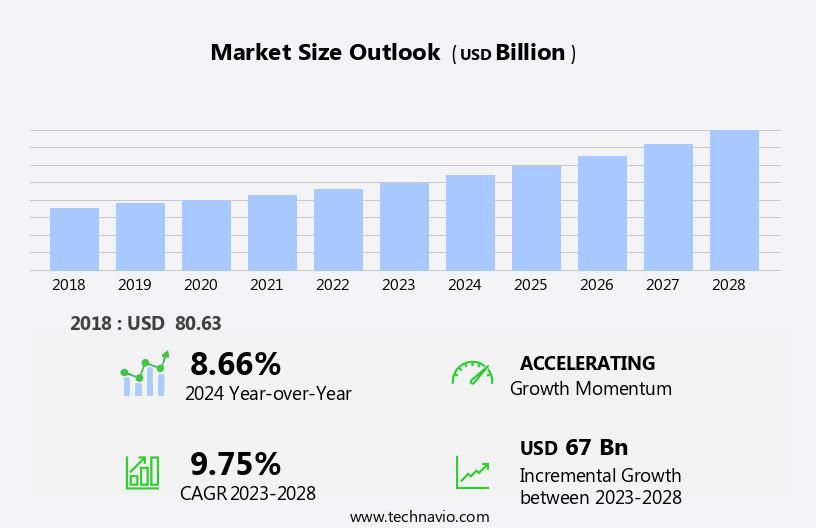

The premium cosmetics market size is forecast to increase by USD 67 billion at a CAGR of 9.75% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing demand for high-end skincare products. Consumers are becoming more conscious of their health and appearance, leading them to invest in premium cosmetics that offer superior quality and effectiveness. This trend is particularly prominent in developed regions, where consumers have higher disposable income and a greater appreciation for luxury brands. However, there are challenges that market players must navigate to capitalize on this growth. One such challenge is the lack of consumer reach and premium brand penetration in major parts of developing regions. Multichannel marketing strategies, including e-commerce and social media, offer a potential solution to this issue.

- By expanding their distribution channels and leveraging digital marketing tools, cosmetics companies can reach a wider audience and build brand awareness in these markets. Additionally, partnerships with local distributors and strategic collaborations with influencers can help premium brands establish a foothold in developing regions. Overall, the market presents significant opportunities for growth, particularly for companies that can effectively navigate the challenges of consumer reach and brand penetration in developing regions.

What will be the Size of the Premium Cosmetics Market during the forecast period?

- The market is experiencing dynamic shifts as consumers prioritize personalized beauty solutions and ethical practices. Indie beauty brands and niche players are gaining traction, offering unique offerings and luxury customer service. Advanced formulas, such as hair repair and skincare technology, are driving innovation, while active ingredients and botanical extracts are at the forefront of data-driven beauty trends. Beauty influencer marketing and content marketing are essential channels for reaching consumers, with luxury beauty events and exclusive services further enhancing the experience. Sustainable packaging and eco-friendly practices are becoming increasingly important, as is the focus on skin hydration and barrier repair.

- Premium ingredients, including matte finish, signature scents, and high-pigment formulas, continue to be in demand. Beauty subscription services and online communities cater to consumers' evolving preferences, with beauty tourism and luxury retail experiences offering immersive, personalized journeys. Hair care products, color cosmetics, and skincare technology are key areas of investment, as brands strive to deliver advanced formulas and luxury fragrances. Hair growth, skin brightening, and social media marketing are also significant trends shaping the market.

How is this Premium Cosmetics Industry segmented?

The premium cosmetics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Skincare products

- Fragrances

- Color cosmetics

- Hair care products

- Others

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- APAC

- China

- Japan

- South America

- Rest of World (ROW)

- North America

By Product Insights

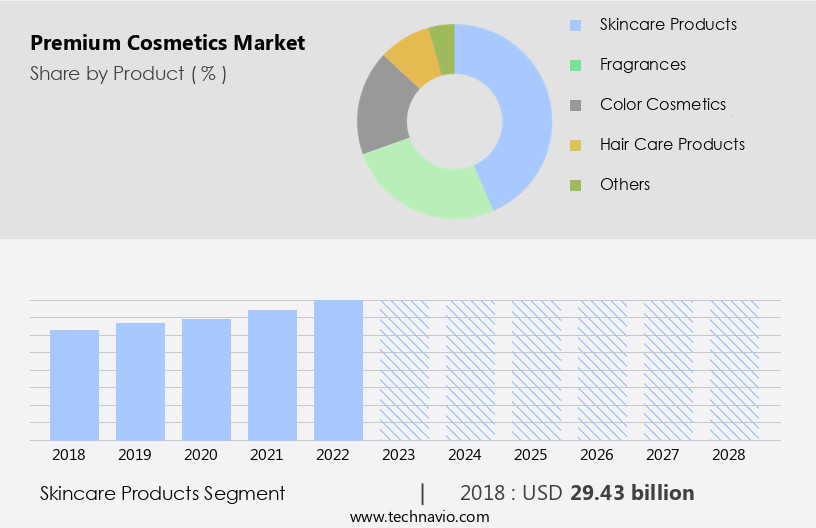

The skincare products segment is estimated to witness significant growth during the forecast period.

The premium skincare market is experiencing growth as an increasing number of individuals, both men and women, prioritize better skincare solutions. This segment's expansion is driven by the desire for personalized, scientifically formulated products that cater to individual skin needs. The integration of technology, such as artificial intelligence and virtual try-on, enables personalized recommendations, enhancing the customer experience. Moreover, ethical sourcing, sustainability, and environmental responsibility are becoming essential factors in consumer purchasing decisions. Brands that emphasize cruelty-free cosmetics, vegan options, and eco-friendly packaging are gaining popularity among Gen Z consumers and millennials. The luxury experience is also a significant influencer, with exclusive brands offering personalized consultations and concierge services to cater to their high-value clientele.

The global skincare market's expansion is not limited to established markets. Emerging markets, particularly in Asia, are witnessing a surge in demand for premium skincare products. Luxury retailers are capitalizing on this trend by offering exclusive services and collaborating with influencers to reach a broader audience. The clean beauty movement is another trend shaping the market, with consumers seeking products free from harsh chemicals and synthetic ingredients. This shift is leading to the development of scientifically formulated, natural ingredient-based skincare products. Subscription boxes and makeup trends are also contributing to the market's growth, offering customers regular access to new products and personalized recommendations.

Skin analysis and makeup trends are becoming increasingly popular, with many consumers seeking expert advice and personalized solutions to enhance their beauty rituals. In conclusion, the premium skincare market is evolving, with a focus on technology, personalization, and sustainability. Brands that prioritize these trends and effectively communicate their brand story will likely capture the attention of consumers and drive growth in the market.

Get a glance at the market report of share of various segments Request Free Sample

The Skincare products segment was valued at USD 29.43 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

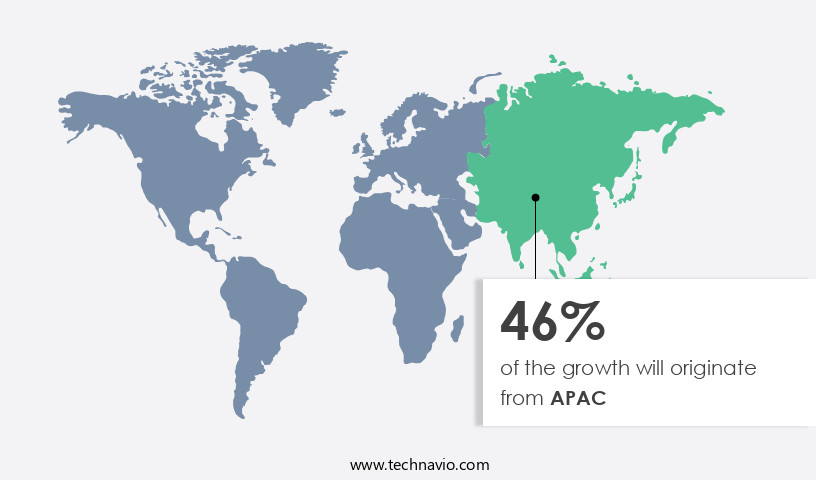

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In the dynamic world of cosmetics, APAC holds a significant position with its substantial market share in the premium segment. Skincare products, hair care, baby care, sun care, deodorants, and fragrances are popular categories in this region. The region's growth can be attributed to the increasing access to e-commerce platforms and advanced technology, such as artificial intelligence and personalized recommendations, catering to the unique needs of consumers. Brands focusing on ethical sourcing, sustainable beauty, and luxury experiences have gained traction among consumers, particularly millennials and Gen Z. Premium pricing and virtual try-on technology have also contributed to the market's expansion.

In APAC, companies like Shiseido, L'Oreal, Procter and Gamble, and Beiersdorf lead the market. The clean beauty movement, cruelty-free cosmetics, and vegan cosmetics have become essential trends, with a growing emphasis on environmental responsibility and social impact. Luxury brand positioning, exclusive services, and concierge services further enhance the consumer experience. Skincare routines and beauty rituals are evolving, with scientifically formulated products and personalized consultations becoming increasingly popular. Innovations in beauty technology, such as augmented reality and skin analysis, are transforming the industry. Subscription boxes and emerging markets offer new opportunities for growth. Luxury retail and duty-free shopping continue to be significant channels for sales.

The premium haircare and luxury skincare segments are expected to maintain their dominance in the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Premium Cosmetics Industry?

- Increased demand for premium skincare products is the key driver of the market.

- Premium skincare product manufacturers cater to consumers' increasing demand for innovative, professional treatments and high-end products. Consumers are more conscious of skincare concerns such as aging spots, acne, and pigmentation, leading them to invest in premium skincare items. The superior-quality ingredients in these products contribute to their premiumization. With rising disposable income, consumers are willing to spend more on such offerings, boosting the demand for premium cosmetics, particularly skincare products.

- Brands distinguish themselves from pharmaceutical companies by investing in advanced ingredients and technologies to enhance the health and aesthetics of customers' skin.

What are the market trends shaping the Premium Cosmetics Industry?

- Multichannel marketing is the upcoming market trend.

- Social media significantly influences the market by increasing product awareness and engagement with consumers. This digital trend has become a powerful tool for companies to promote their offerings and connect with their audience. Platforms such as Facebook, Twitter, Instagram, and YouTube are particularly effective for cosmetics brands due to their visual nature and large user base. Successful social media campaigns, like Procter and Gamble's "Your Best Beautiful" for Olay, Beiersdorf's "Nivea Tan Tag and Win" for Nivea, L'Oreal's "Rock Your Style" for Garnier, and Shiseido's "Beauty vs.

- You," have effectively leveraged these platforms to reach and engage consumers. By utilizing social media, companies can create immersive experiences, respond to consumer inquiries, and build brand loyalty. This digital strategy not only increases product awareness but also fosters a two-way communication channel between companies and consumers.

What challenges does the Premium Cosmetics Industry face during its growth?

- Lack of consumer reach and premium brand penetration in major parts of developing regions is a key challenge affecting the industry growth.

- In the market, effective distribution and strategic partnerships are crucial for manufacturers. The primary distribution channels for luxury beauty products include specialty retail stores, department stores, and e-retailers. These channels cater to the niche market for premium cosmetics, which is predominantly located in developed nations and major cities worldwide. For instance, in the US, cities such as New York, San Francisco, Chicago, and Los Angeles have the highest penetration of these retail formats. Similarly, in the UK, cities like London, Manchester, Bristol, Liverpool, and Leeds are significant markets. In China, Shanghai and Beijing lead the way, while Japan's major cities, Tokyo and Osaka, also hold substantial market share.

- In Brazil, Curitiba, Salvador, Rio de Janeiro, and Sao Paulo are key markets, and in Germany, Berlin and Hamburg are the major hubs. By focusing on these channels and locations, premium cosmetics manufacturers can expand their reach and cater to the demands of their target audience.

Exclusive Customer Landscape

The premium cosmetics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the premium cosmetics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, premium cosmetics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amway Corp. - The company specializes in innovative sports products, delivering top-tier solutions for athletes and enthusiasts worldwide. Our offerings encompass a wide range of categories, including equipment, apparel, and accessories. By leveraging cutting-edge technology and research, we continually push the boundaries of performance and design. Our commitment to quality and customer satisfaction sets us apart in the global market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amway Corp.

- Avon Products

- Beiersdorf AG

- Chanel Ltd.

- Coty Inc.

- Groupe Clarins

- Henkel AG and Co. KGaA

- Honasa Consumer Pvt. Ltd.

- Johnson and Johnson Services Inc.

- Kao Corp.

- Laboratoires Expanscience

- LOreal SA

- LVMH Moet Hennessy Louis Vuitton SE

- Natura and Co Holding SA

- NUDE Beauty Brands

- Revlon Inc.

- Shiseido Co. Ltd.

- The Estee Lauder Companies Inc.

- The Procter and Gamble Co.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to evolve, driven by various trends and consumer preferences. Organic cosmetics, with their natural and ethically sourced ingredients, have gained significant traction among consumers seeking healthier and more sustainable options. The demand for luxury packaging and a premium experience is also on the rise, as consumers are willing to pay a premium for high-value products that offer an exclusive and indulgent experience. Artificial intelligence and personalized recommendations have become essential tools for brands looking to cater to the unique needs and preferences of their customers. E-commerce platforms have leveraged these technologies to offer personalized consultations and virtual try-on features, making it easier for consumers to find products that suit them.

Luxury salon services and skincare regimens have become an integral part of the premium beauty experience. Consumers are increasingly seeking out professional services to enhance their beauty routines and address specific concerns. Environmental responsibility and social impact are also becoming essential factors in consumers' purchasing decisions, with many opting for cruelty-free and vegan cosmetics. The luxury lifestyle segment of the market is experiencing significant growth, with consumers seeking out exclusive brands and services. Global expansion and exclusive services are key strategies for luxury brands looking to reach new markets and expand their customer base. Augmented reality and beauty technology are also transforming the way consumers engage with beauty products, offering new opportunities for brands to differentiate themselves.

The clean beauty movement is gaining momentum, with consumers increasingly seeking out products formulated with natural and scientifically proven ingredients. Subscription boxes and makeup trends are also driving innovation in the market, offering consumers a curated selection of products and the latest makeup styles. The premium haircare segment is also experiencing growth, with consumers seeking out high-end products and services to enhance their haircare routines. Luxury spa treatments and skincare rituals are also popular offerings, providing consumers with an indulgent and relaxing experience. The millennial and Gen Z consumer segments are driving innovation in the market, with their preferences for personalized and sustainable beauty products.

Brands are responding by offering customized skincare regimens and eco-friendly packaging options. In the luxury retail sector, duty-free shopping and travel retail are key growth areas, offering consumers unique and exclusive products and experiences. Anti-aging products and brand storytelling are also popular offerings, providing consumers with a compelling reason to invest in premium beauty products. Overall, the market is a dynamic and evolving landscape, driven by consumer preferences for sustainable, personalized, and indulgent beauty experiences. Brands that can effectively meet these needs and offer unique and exclusive offerings are well-positioned to succeed in this competitive market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.75% |

|

Market growth 2024-2028 |

USD 67 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.66 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Premium Cosmetics Market Research and Growth Report?

- CAGR of the Premium Cosmetics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the premium cosmetics market growth of industry companies

We can help! Our analysts can customize this premium cosmetics market research report to meet your requirements.