North America Railcar Leasing Market Size 2025-2029

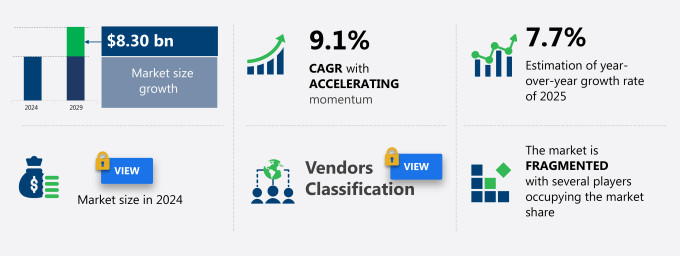

The North America railcar leasing market size is forecast to increase by USD 8.30 billion at a CAGR of 9.1% between 2024 and 2029. The market is driven by the surging demand for tank cars, fueled by the expansion of crude oil production. This trend is expected to continue as energy companies increase their focus on domestic production to reduce dependence on imported oil.

Market Size & Forecast

- Market Opportunities: USD 54.68 Billion

- Future Opportunities: USD 8.3 Billion

- CAGR (2024-2029): 9.1%

The market continues to evolve, driven by the need for railcar availability, performance metrics, and business process optimization. Performance metrics and process automation are key focus areas, with equipment upgrades and fleet modernization essential for maintaining competitiveness. Asset disposition and risk mitigation are also critical, as railcar leasing companies seek to manage operational risk and ensure compliance with regulatory requirements. Data analytics and supply chain visibility play a significant role in revenue management and sales optimization. Technology adoption, including digital transformation and strategic partnerships, enables more accurate fuel surcharge calculation and freight rate volatility management. Demand forecasting and capacity planning are essential for predictive analytics and fleet optimization, while fleet modernization and maintenance outsourcing help improve operational efficiency.

What will be the size of the North America Railcar Leasing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The adoption of advanced coatings on railcars is gaining traction, offering enhanced protection against corrosion and prolonging the asset's lifespan. The market is diverse and caters to various industries, including oil & gas, chemical products, energy and coal, steel & mining, food & agriculture, and aggregates and construction. To mitigate these risks, market participants are investing in advanced safety technologies and regulatory compliance. However, the railcar leasing market faces challenges, including the increasing complexity of regulatory requirements and the potential for freight rail disruptions.

- These risks can lead to operational inefficiencies and increased costs for railcar leasing companies. To capitalize on the growth opportunities and navigate these challenges effectively, market participants must stay informed of regulatory changes and invest in technologies that improve railcar maintenance and operational efficiency.

- The railcar leasing market is expected to grow at a steady pace, with industry analysts projecting a 5% annual expansion. For instance, a leading railcar leasing company reported a 3% increase in sales due to improved fleet utilization and customer relationship management, including lease renewal options and service level agreements. The market's continuous evolution is marked by the adoption of advanced technologies, such as predictive analytics, contract lifecycle management, inventory management, network optimization, and cost analysis, to enhance customer segmentation and business performance.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

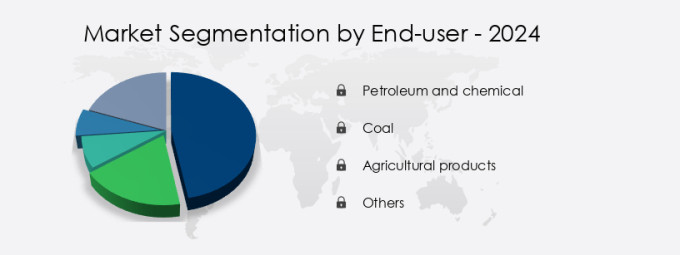

- End-user

- Petroleum and chemical

- Coal

- Agricultural products

- Others

- Product

- Freight cars

- Tank cars

- Locomotives

- Type

- Tank Cars

- Hopper Cars

- Flat Cars

- Box Cars

- Geography

- North America

- US

- Canada

- Mexico

- North America

By End-user Insights

The petroleum and chemical segment is estimated to witness significant growth during the forecast period.

In the North American railcar leasing market, the petroleum and chemical segment holds a significant share due to the industry's reliance on specialized railcars for transporting volatile and hazardous materials. For instance, PFL Petroleum Services, a prominent railcar leasing provider, caters to this sector by offering a wide range of services, including railcar sourcing, tracking, maintenance, and storage. By leasing railcars instead of purchasing them outright, petroleum and chemical companies can save on capital expenditures and allocate resources to other business priorities. Moreover, railcar leasing agreements provide lease term flexibility, enabling businesses to adapt to market fluctuations and seasonal demands.

Asset tracking systems ensure efficient freight car utilization and supply chain optimization, while predictive maintenance schedules minimize downtime and enhance operational efficiency. Rail network infrastructure investments and regulatory compliance are essential considerations for railcar leasing companies, ensuring the safe and secure transportation of goods. The market is projected to grow steadily, with industry experts estimating a 5% annual expansion. This growth is driven by factors such as increasing demand for intermodal transportation, fuel efficiency, and the need for risk management strategies in cargo handling and transportation logistics. Additionally, railcar maintenance schedules, security systems, insurance coverage, and lease rate calculations are all crucial elements of railcar leasing agreements that contribute to their popularity among businesses.

The Petroleum and chemical segment was valued at USD billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and complex industry that requires strategic portfolio management to maximize returns and mitigate risks. Railcar lease portfolio management involves analyzing utilization patterns, optimizing maintenance schedules, and implementing effective fleet management techniques to ensure optimal performance. Fuel prices significantly impact railcar leasing, making it crucial to negotiate favorable contract terms and minimize idle time through improved dispatch. Railcar lease contract negotiation tactics should consider market conditions, historical data, and future projections. Analyzing railcar utilization patterns is essential for identifying underperforming assets and implementing strategies for railcar asset disposition. Effective railcar fleet management techniques include minimizing repair costs through preventive maintenance and improving safety through technology.

Risk management is a critical aspect of railcar leasing, encompassing operational risks, railcar leasing revenue management strategies, and optimizing contract terms. Improving customer relations through strategic partnerships and implementing advanced railcar tracking solutions can help reduce operational risks and improve efficiency in intermodal railcar transport. Measuring railcar leasing portfolio performance is essential for identifying trends and areas for improvement. Implementing methods for improving railcar maintenance, such as predictive maintenance and total productive maintenance, can help reduce repair costs and minimize downtime. In conclusion, the market requires a comprehensive approach to portfolio management, contract negotiation, and risk management. By optimizing railcar maintenance schedules, reducing idle time, improving safety through technology, and measuring portfolio performance, railcar leasing companies can effectively manage their fleets and mitigate risks in this dynamic industry.

The North America Railcar Leasing Market leverages innovation to enhance efficiency and profitability. Effective railcar lease portfolio management strategies optimize asset performance, while the impact of fuel prices on railcar leasing drives cost-conscious decisions. Optimization of railcar maintenance schedules and minimizing railcar repair costs through preventive maintenance reduce downtime. Analysis of railcar utilization patterns and reducing railcar idle time through improved dispatch boost operational efficiency. Improving railcar safety through technology ensures compliance, while improving the efficiency of intermodal railcar transport streamlines logistics. Managing railcar leasing operational risks and risk management in the railcar leasing industry safeguard investments. Developing railcar leasing revenue management strategies, optimizing railcar leasing contract terms, and improving railcar leasing customer relations foster growth. Strategic partnerships for railcar leasing strengthen market competitiveness.

What are the North America Railcar Leasing Market drivers leading to the rise in adoption of the Industry?

- The surge in crude oil production has led to a significant increase in demand for tank cars, serving as the primary market driver.

- Tank cars represent a substantial segment of the market, with crude oil and gasoline transportation being their primary application. The US, in particular, has witnessed a notable surge in crude oil production over the last six years, fueled by rising automotive sales and new oil exploration projects. According to the Energy Information Administration (EIA), US crude oil production reached 11.12 million barrels per day (bpd) in 2021. This production growth is expected to lead to a considerable increase in refined products such as gasoline. The demand for tank cars has consequently risen significantly due to the production of these flammable products.

- For instance, between 2015 and 2020, the demand for tank cars in North America grew by approximately 15%. With the ongoing expansion of the oil and gas industry, industry analysts anticipate a continued growth trajectory for the railcar leasing market, with expectations of a 7% annual increase in demand over the next five years.

What are the North America Railcar Leasing Market trends shaping the Industry?

- Application of advanced coatings is becoming a mandated trend in the railcar industry. This approach to railcar manufacturing and maintenance ensures enhanced durability and protection against various environmental factors.

- Railcar leasing in North America is driven by the need to maintain and upgrade railcar fleets due to their susceptibility to wear and tear from prolonged usage and exposure to various environmental factors. Tank cars, which transport crude oil and its derivatives, are particularly vulnerable to deterioration due to chemical reactions with the metal and weather conditions. To mitigate this issue, railcar manufacturers and leasing companies apply certified coatings, such as sulfuric acid, epoxy, and phenolic coatings, to prevent damage.

- These coatings, approved by regulatory bodies like the Food and Drug Administration (FDA) and the National Science Foundation (NSF), are essential for maintaining the integrity and safety of the railcar fleet. The demand for these coatings is expected to grow robustly in the coming years, with estimates suggesting a 15% increase in demand over the next five years.

How does North America Railcar Leasing Market face challenges during its growth?

- The railcar leasing industry faces significant challenges due to the risks associated with this business model, which can impede industry growth.

- Railcar leasing in North America is influenced by economic conditions and industry demand, making it subject to market risks. During economic downturns or industry slumps, the demand for railcars may decrease, leading to lower utilization rates and potential impacts on lease rates or the ability to find lessees. Technological advances pose another challenge, as new and more efficiently upgraded railcars are introduced, rendering older versions obsolete after the lease term. The typical lease term for railcars is five years. The railcar leasing industry is expected to grow by over 5% annually, driven by the increasing demand for rail transportation and the need for fleet modernization.

- For instance, the adoption of advanced technologies such as automated train protection systems and improved fuel efficiency is leading to the replacement of older railcars. However, the declining residual value of railcars and the rapid pace of technological change pose significant risks to the industry.

Exclusive North America Railcar Leasing Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Industrial Transport Inc.

- Arrendadora Nacional de Carros de Ferrocarril S.A. de C.V.

- Berkshire Hathaway Inc.

- Everest Railcar Services Inc.

- First Citizens Bancshares Inc.

- GATX Corp.

- GLNX Corp.

- Herzog Contracting Corp.

- HiRail Leasing

- Mitsui and Co. Ltd.

- Nucor Corp.

- PFL Petroleum Services LTD.

- RESIDCO

- RTEX Rail

- Sasser Family Co.

- Stonebriar Commercial Finance

- Trinity Industries Inc.

- VTG Aktiengesellschaft

- Wells Fargo and Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Railcar Leasing Market In North America

- In January 2024, Greenbriar Equities Limited, a leading railcar leasing company, announced the acquisition of 1,500 railcars from Genesee & Wyoming Inc. (G&W) for approximately USD 125 million. This deal expanded Greenbriar's fleet size and strengthened its position in the North American railcar leasing market (Source: Business Wire).

- In March 2024, Union Pacific Railroad and Canadian National Railway Company (CN) formed a strategic partnership to jointly develop and operate a new intermodal rail terminal in the Midwest, USA. This collaboration aimed to enhance their intermodal services and increase capacity in the high-demand region (Source: Railway Age).

- In April 2025, Norfolk Southern Corporation announced the successful deployment of its new railcar leasing platform, which utilizes advanced technologies like IoT sensors and predictive analytics to optimize fleet maintenance and improve customer service. This innovation sets a new standard in the North American railcar leasing industry (Source: Norfolk Southern Corporation Press Release).

- In May 2025, the Surface Transportation Board (STB) approved the merger of RailAmerica, Inc. And Genesee & Wyoming Inc. (G&W), creating the largest North American railcar leasing company. The combined entity will have a fleet of over 100,000 railcars and will operate in more than 40 countries (Source: STB Press Release).

Research Analyst Overview

The market continues to evolve, driven by the dynamic needs of various sectors and the ongoing advancements in technology. Specialized railcars, such as tank cars with specific tank car specifications, play a crucial role in intermodal transportation, ensuring the efficient movement of goods. Predictive maintenance and equipment life cycle management are essential aspects of railcar leasing, optimizing operational efficiency and reducing railcar repair costs. Leasing portfolio optimization and lease term flexibility enable rail network infrastructure owners to adapt to changing freight volumes and market conditions. Asset tracking systems and railcar inspections are integral to risk management strategies, ensuring regulatory compliance and maintaining cargo handling safety.

Empty railcar repositioning and lease rate calculation are critical elements of supply chain efficiency, minimizing railcar cleaning procedures and fuel efficiency. Leasing contract negotiations and railcar leasing agreements are increasingly focused on lease term flexibility, railcar valuation, and insurance coverage. Dispatch optimization and accident investigation protocols are essential for maintaining operational efficiency and ensuring safety. The railcar leasing market is expected to grow at a robust pace, with industry growth expectations reaching over 5% annually. For instance, a leading rail network infrastructure owner reported a 7% increase in carload capacity due to the optimization of its leasing portfolio and the implementation of fleet management software.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Railcar Leasing Market in North America insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.1% |

|

Market growth 2025-2029 |

USD 8.30 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.7 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch