Refrigerated Trailer Market Size 2024-2028

The refrigerated trailer market size is forecast to increase by USD 1.53 billion at a CAGR of 4.83% between 2023 and 2028.

- The market is experiencing significant growth due to the rising consumption of frozen food and the adoption of electrified trailer technologies. The increasing popularity of frozen food items, particularly in the US, is driving the demand for refrigerated trailers. Moreover, the implementation of electrified trailer technologies, such as plug-in electric and hybrid refrigeration systems, is gaining traction in the market, offering energy efficiency and reduced operating costs.

- However, the high operating costs of refrigerated trailers and refrigerated road transportation remain a challenge for market growth. Despite this, the market is expected to witness steady expansion In the coming years, with the adoption of advanced technologies and increasing focus on sustainability playing a key role in market development.

What will be the Refrigerated Trailer Market Size During the Forecast Period?

- The market caters to the transportation and storage needs of perishable goods, including fruits, vegetables, fish, meat, dairy food, and flowers, within a negative and positive temperature range. With the increasing demand for fresh food and nuclear family setups, the market for refrigerated trailers has experienced significant growth. These trailers play a crucial role in the cold chain, ensuring the health benefits of perishable food items reach consumers while maintaining their freshness and nutritional value.

- Refrigerated trailers are essential for various industries, such as food processing, logistics, and retail, as they enable the transportation of temperature-sensitive goods over long distances.

- Additionally, the market is witnessing a trend towards low weight vehicles, making it easier for office goers and students to transport their perishable food items. Overall, the market continues to evolve, offering solutions for reducing food wastage and catering to the growing demand for fresh and healthy food options.

How is this Refrigerated Trailer Industry segmented and which is the largest segment?

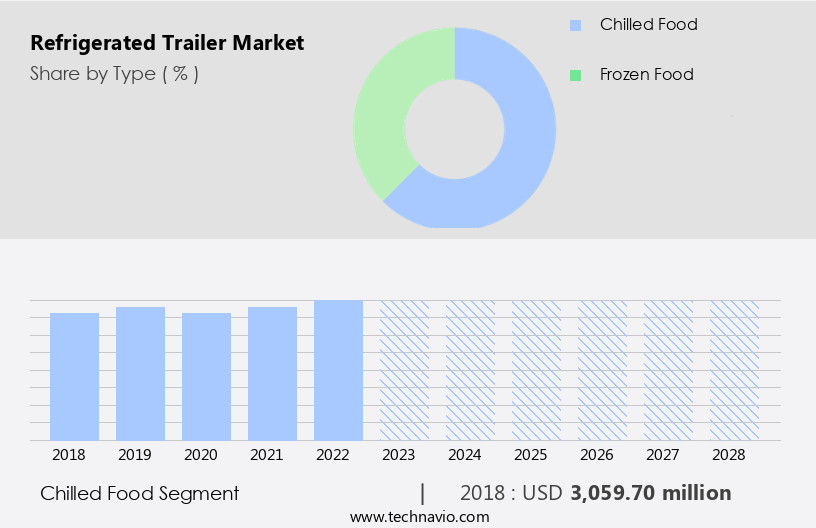

The refrigerated trailer industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Chilled food

- Frozen food

- Geography

- North America

- US

- APAC

- China

- India

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Type Insights

- The chilled food segment is estimated to witness significant growth during the forecast period.

The market caters to the transportation and storage of perishable goods, including food cargo, in temperature-controlled trailers. These trailers maintain a temperature range between positive and negative degrees Celsius, suitable for various food items such as frozen food, fresh fruits, vegetables, dairy products, meat, fish, poultry products, specialty pharmaceuticals, and beverages. The primary objective is to ensure product freshness and maintaIn the required temperature for optimal preservation. Chilled refrigerated trailers are used for products with a positive temperature range, while frozen refrigerated trailers are utilized for goods requiring a negative temperature range. The market's growth is driven by increasing consumer demand for fresh and high-quality food products, particularly from the foodservice industry, including restaurants, hotels, and foodservice establishments.

Additionally, the rise of nuclear family setups, online grocery shopping, and cold storage facilities contribute to the market's expansion. Key considerations include load and pallet capacity, fuel efficiency, and carbon emissions. The market's importance lies In the preservation of product freshness, health benefits, and minimizing food wastage.

Get a glance at the Refrigerated Trailer Industry report of share of various segments Request Free Sample

The Chilled food segment was valued at USD 3.06 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

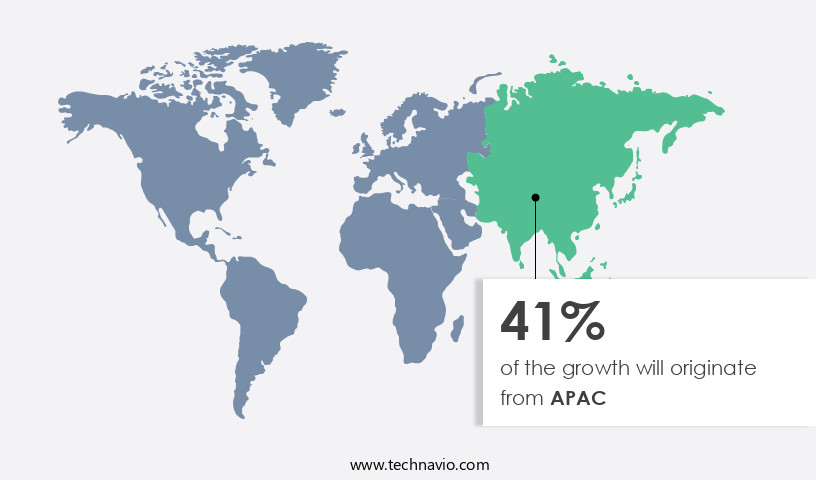

- APAC is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American the market is projected to expand due to the increasing demand for transporting perishable goods, including fruits, vegetables, meat, and dairy products. The US, in particular, has witnessed a rise in imports of these items due to limited arable land and growing consumer preferences for a protein-rich diet. Additionally, the surge in online grocery sales is fueling market growth. Perishable food items, such as fish, meat, vegetables, fruits, flowers, and dairy products, require temperature-controlled transportation to maintain product freshness. Refrigerated trailers cater to this need, offering negative temperature ranges for frozen food and positive temperature ranges for refrigerated food.

These trailers have varying load and pallet capacities, making them suitable for various applications, including fish, meat, and produce transportation. Key industries, such as restaurants, hotels, foodservice establishments, and nuclear family setups, rely on refrigerated trailers for their fresh food requirements. The market is also driven by the health benefits associated with consuming fresh food and the growing trend of fresh cooking. However, factors such as fuel prices, carbon emissions, and fuel efficiency are important considerations for market participants.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Refrigerated Trailer Industry?

Rising consumption of frozen food is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for perishable goods, particularly In the food industry. Refrigerated trucks play a crucial role in transporting temperature-sensitive cargo, including frozen food, dairy products, fish, meat, vegetables, fruits, flowers, and specialty pharmaceuticals. These goods require specific temperature ranges, either negative for frozen food or positive for refrigerated food, to maintain product freshness and preserve their health benefits. The convenience of ready-to-eat meals and the growing trend of online grocery shopping have fueled the demand for refrigerated trailers with increased load and pallet capacity. The foodservice industry, including restaurants, hotels, and foodservice establishments, also relies heavily on refrigerated trailers to ensure the freshness and quality of their perishable inventory.

- Moreover, the increasing popularity of nuclear family setups and fresh cooking at home has led to a rise In the consumption of perishable food items. The cold chain capacity of refrigerated trailers is essential in reducing food wastage and ensuring the health benefits of protein-rich foods such as meat and seafood, dairy products, and beverages like milk, cheese, yogurt, butter, and fresh fruit and vegetables. The growing demand for frozen desserts, fresh fruit, and fresh vegetables also contributes to the market's growth. Factors such as fuel prices and carbon emissions are driving the need for fuel efficiency and eco-friendly refrigerated trailers, with chilled refrigerated trailers and frozen refrigerated trailers gaining popularity.

- The market's growth is further driven by the increasing demand for meat and seafood, vaccines, baked goods, packaged meat, and packaged seafood. In conclusion, the market is expected to continue its growth trajectory due to the increasing demand for perishable goods, convenience, and the need to maintain product freshness and health benefits. The market's growth is driven by various factors, including the foodservice industry, online grocery shopping, and the increasing popularity of perishable food items.

What are the market trends shaping the Refrigerated Trailer Industry?

Adoption of electrified trailer technologies is the upcoming market trend.

- Refrigerated trailers play a crucial role in transporting perishable goods, including food cargo, such as frozen food, fish, meat, vegetables, fruits, flowers, dairy products, poultry products, specialty pharmaceuticals, and beverages. These trailers maintain a specific temperature range, either negative for frozen goods or positive for refrigerated food, ensuring product freshness and preserving the health benefits of perishable items. The load capacity and pallet capacity of refrigerated trailers vary, catering to different market segments. The refrigerated truck market is experiencing significant growth due to increasing consumer demand for fresh food, online grocery shopping, and the expansion of the foodservice industry, including restaurants, hotels, and foodservice establishments.

- Nuclear family setups and fresh cooking trends also contribute to the demand for temperature-controlled trailers. To address concerns related to fuel prices, carbon emissions, and fuel efficiency, trailer manufacturers are exploring alternative solutions. One such innovation is the electrification of refrigerated trailers, including hybridization, solar power, and optimizing the efficiency of incumbent technology. For instance, Carrier Transicold's eCool is the first fully autonomous, all-electric engineless trailer system, while Schmitz Cargobull AG's refrigerated trailers utilize electrification to reduce fuel consumption and carbon emissions. In conclusion, the market is witnessing substantial growth due to the increasing demand for temperature-controlled transportation solutions.

- The emergence of electrification as a viable alternative to traditional diesel engines is expected to further drive market growth, providing a more sustainable and efficient solution for transporting perishable goods.

What challenges does the Refrigerated Trailer Industry face during its growth?

High operating costs of refrigerated trailer is a key challenge affecting the industry growth.

- Refrigerated trailers play a crucial role in transporting perishable goods, including food cargo such as fish, meat, vegetables, fruits, flowers, dairy products, poultry products, specialty pharmaceuticals, and frozen desserts. These trailers are designed to maintain specific temperature ranges, either negative for frozen food or positive for refrigerated food. The load capacity and pallet capacity of these trailers vary, making them suitable for various types of cargo. Maintaining the correct temperature is essential to ensure product freshness and prevent food wastage. However, challenges arise when temperatures are not set correctly, leading to increased operating costs for carriers. For instance, if the intended temperature for frozen food is -18 degC and it is loaded at -15 degC, the refrigeration unit will work harder to reach the intended temperature, increasing fuel consumption and energy costs.

- Carriers also face challenges in complying with regulations, such as the California Air Resources Board (CARB) emission standards In the US, and the initial cost, maintenance, and repair costs of refrigerated trailers. Fuel prices and carbon emissions are other concerns for carriers, as fuel efficiency is a critical factor in reducing operating costs. Online grocery shopping, restaurants, hotels, foodservice establishments, nuclear family setups, and fresh cooking are some of the key industries that rely on refrigerated trailers to transport perishable goods. Ensuring the cold chain capacity is robust and maintaining product freshness is essential for these industries to provide high-quality products and services to their customers.

- In conclusion, refrigerated trailers play a vital role In the transportation of perishable goods, but carriers face challenges in maintaining the correct temperature, complying with regulations, and managing costs. Despite these challenges, the benefits of refrigerated trailers, including the preservation of product freshness and the health benefits of perishable goods, make them an essential component of the supply chain.

Exclusive Customer Landscape

The refrigerated trailer market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the refrigerated trailer market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, refrigerated trailer market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bay and Bay Transportation

- Gray and Adams Ltd.

- Great Dane LLC

- Halvor Lines Inc.

- Humbaur GmbH

- Hyundai Motor Co.

- KRONE GMBH and CO. KG

- LAMBERET SAS

- Manac Inc.

- Montracon Ltd.

- Polarking Mobile

- Premier Trailer Mfg. Inc.

- Randon Implementos S.A.

- Schmitz Cargobull AG

- Stevens Transport

- STI HOLDINGS Inc.

- Trane Technologies Plc

- TW Transport

- Utility Trailer Manufacturing Co.

- Vanguard National Trailer Corp.

- Wabash National Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of trailers designed to transport perishable goods within a specific temperature range. These trailers play a crucial role in maintaining the freshness and quality of various commodities, including but not limited to, fruits, vegetables, dairy products, meat, seafood, and specialty pharmaceuticals. Refrigerated trailers are available in both chilled and frozen variants, catering to the varying temperature requirements of different cargo. Chilled trailers operate within a positive temperature range, while frozen trailers function In the negative temperature range. The load and pallet capacity of these trailers vary, depending on the size and type of the vehicle.

The market serves numerous industries, including foodservice establishments, restaurants, hotels, online grocery shopping, and cold storage facilities. Perishable goods transported via refrigerated trailers include fresh fruits, fresh vegetables, dairy, beverages, milk, cheese, yogurt, butter, and baked goods. Additionally, temperature-sensitive commodities such as vaccines, flowers, and seafood are transported using these trailers. The importance of refrigerated trailers lies In their ability to preserve product freshness and extend the shelf life of perishable goods. This is particularly important for industries such as foodservice and retail, where product quality and freshness are essential for customer satisfaction. Moreover, the health benefits associated with consuming fresh produce and dairy products further underscore the importance of an efficient and reliable the market.

The market for refrigerated trailers is driven by several factors. The increasing demand for fresh and healthy food options, particularly among office goers and students, is a significant growth driver. Additionally, the rise in online grocery shopping and the subsequent need for efficient and reliable transportation of perishable goods is also fueling market growth. The market faces several challenges, including fuel prices and carbon emissions. Low weight vehicles and fuel efficiency are crucial considerations for trailer manufacturers and operators to mitigate these challenges. Furthermore, the increasing popularity of nuclear family setups and fresh cooking trends are driving the demand for high-quality, fresh produce and dairy products, further bolstering the market.

The market plays a vital role in the transportation and preservation of perishable goods, catering to various industries and commodities. Market growth is driven by factors such as the increasing demand for fresh and healthy food options and the rise in online grocery shopping. Challenges such as fuel prices and carbon emissions continue to pose challenges for market participants, necessitating innovation and efficiency in trailer design and operation.

|

Refrigerated Trailer Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

132 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.83% |

|

Market growth 2024-2028 |

USD 1.53 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.37 |

|

Key countries |

US, China, Germany, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Refrigerated Trailer Market Research and Growth Report?

- CAGR of the Refrigerated Trailer industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the refrigerated trailer market growth of industry companies

We can help! Our analysts can customize this refrigerated trailer market research report to meet your requirements.