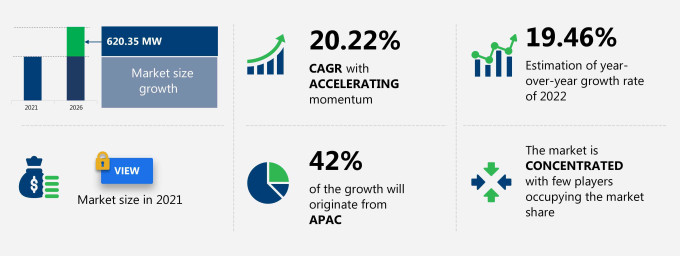

The residential fuel cell market share is expected to increase to 620.35 megawatts from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 20.22%.

This residential fuel cell market research report extensively covers residential fuel cell market segmentation by product (PEMFC and SOFC) and geography (North America, APAC, Europe, South America, and MEA). The residential fuel cell market report also offers information on several market vendors, including Adaptive Energy LLC, Aisin Corp., Bloom Energy Corp., Freudenberg SE, HORIBA Ltd., Loop Energy Inc., Nedstack Fuel Cell Technology BV, Panasonic Corp., SolidPower Spa, and Viessmann Family Holding among others Download for Full Vendor List

What will the Residential Fuel Cell Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Residential Fuel Cell Market Size for the Forecast Period and Other Important Statistics

Parent Market Analysis

Technavio categorizes the global residential fuel cells market as a part of the global renewable electricity market. Our Technavio Research categorizes the Global Residential Fuel Cell Market as belonging to the Utilities Industry market. Our Research Report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the forecast year.

Residential Fuel Cell Market: Key Drivers, Trends, and Challenges

The growing demand for efficient and cleaner technologies is notably driving the residential fuel cell market growth, although factors such as competition from alternative technologies may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic's impact on the residential fuel cell industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Residential Fuel Cell Market Driver

One of the key factors driving the global residential fuel cell market growth is the growing demand for efficient and cleaner technologies. Most power needs are met by fossil fuels, a major contributor to harmful emissions into the atmosphere. Thus, to mitigate climate change, cleaner and more efficient power sources are being adopted. Fuel cells are considered an extremely reliable and efficient technology as they are capable of supplying heat and power at high efficiency. In fuel cells, power is produced through an electrochemical reaction and does not involve any combustion for the conversion of fuel to electricity. The residential fuel cells market is seeing significant advancements, particularly in solid oxide fuel cells, which offer efficient and sustainable energy solutions for home use. The benefits have resulted in the high adoption of fuel cell technologies in small devices as well as by large intermediaries, which will drive market growth in the forecast period.

Key Residential Fuel Cell Market Challenge

One of the key challenges to the global residential fuel cell market growth is the competition from alternative technologies such as microturbines, backup generators, energy storage systems providers, and renewable energy system providers. Energy storage systems are simple to operate and can be used in any type of residential dwelling. Fuel cell applications in the residential sector are relatively new, and the technology still lags behind other renewable technologies. Conventional technologies such as diesel generators for backup power or rooftop solar PV systems for generating power have gained prominence in the market owing to their easy availability at various power ranges and scalability factors. Developing fuel cells for the residential sector is still expensive, and their acceptance is limited. This may limit the market growth in the forecast period.

Key Residential Fuel Cell Market Trend

Growing affinity for self-generation is one of the key residential fuel cell market trends that is expected to impact the industry positively in the forecast period. The adoption of distributed energy generation is primarily driven by the growing need for uninterrupted and reliable power supplies in developed countries, while it is used in developing countries to increase the electrification rate. Of the various renewable-based hybrid systems technologies available, energy storage and diesel generators have been the most commonly-used distributed energy sources. However, fuel cells offer greater advantages when compared with both these technologies as it has silent operation over diesel generators, making them ideal for residential use and it is not affected by weather conditions as well. Thus, such factors will further support the market growth in the coming years.

This residential fuel cell market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Who are the Major Residential Fuel Cell Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Adaptive Energy LLC

- Aisin Corp.

- Bloom Energy Corp.

- Freudenberg SE

- HORIBA Ltd.

- Loop Energy Inc.

- Nedstack Fuel Cell Technology BV

- Panasonic Corp.

- SolidPower Spa

- Viessmann Family Holding

This statistical study of the residential fuel cell market encompasses successful business strategies deployed by the key vendors. The residential fuel cell market is concentrated and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Adaptive Energy LLC - Through the unified segment, the company designs and manufactures solid oxide fuel cells for backup and portable power applications.

- Adaptive Energy LLC - The company offers fuel cell technologies such as SOFC, fuel handling systems, and mounting assemblies.

To make the most of the opportunities and recover from post-COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The residential fuel cell market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Residential Fuel Cell Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the residential fuel cell market and power supply which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

Which are the Key Regions for the Residential Fuel Cell Market?

Everything you wanted to know about Region Request for a FREE sample now!

42% of the market’s growth will originate from APAC during the forecast period. Japan, South Korea (Republic of Korea), and China are the key markets for residential fuel cells in APAC. Market growth in this region will be faster than the growth of the market in other regions.

The increase in investment in fuel cell devices and the promotion of ENE-FARM installation in countries such as Japan will facilitate the residential fuel cell market growth in APAC over the forecast period. Apart from Japan, fuel cell installation are also promoted in South Korea, wherein the government has set renewable energy mandates for the transition from nuclear and fossil fuel power generation to clean energy generation. The government is investing in renewable energy technologies as well as in the R&D of technologies such as fuel cells installation and hydrogen to expand clean energy options. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans. China is another potential country for the adoption of fuel cells, where the government has set targets for the construction of zero-energy buildings that are expected to boost residential fuel cell installation adoption as fuel cells check carbon emissions.

COVID Impact and Recovery Analysis

The outbreak of COVID-19 in the region slowed down the growth rate of the regional residential fuel cell market in APAC in 2020. However, in 2021, owing to the reduction in the number of new infections due to the increased vaccination rates, the governments of China, Japan, and South Korea resumed the production of fuel cells for residential purposes. This will help the regional residential fuel cell market grow during the forecast period.In 2021, the large-scale COVID-19 vaccination drives in the region led to the removal of COVID-19-related restrictions and increased the number of transportation and construction activities in MEA, and this trend will continue to drive the growth of the regional residential fuel cell market during the forecast period.

What are the Revenue-generating Product Segments in the Residential Fuel Cell Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The residential fuel cell market share growth by the PEMFC segment will be significant during the forecast period. It offers a fast start-up time, low operating temperature, compactness, sustainable operations in high energy density, and low emissions. The benefits of PEMFC have led the segment to be the prominent fuel cell type in one of the largest commercial fuel cell programs, the ENE-FARM scheme in Japan. Such factors will drive segment growth in the coming years.The success of the ENE-FARM program in Japan has also encouraged the development of a similar system in Germany called the ENE.field scheme, which aims at installing micro-CHP systems in Germany.

This report provides an accurate prediction of the contribution of all the segments to the growth of the residential fuel cell market size and actionable market insights on post-COVID-19 impact on each segment.

|

Residential Fuel Cell Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.22% |

|

Market growth 2022-2026 |

620.35 MW |

|

Market structure |

Concentrated |

|

YoY growth (%) |

19.46 |

|

Regional analysis |

North America, APAC, Europe, South America, and MEA |

|

Performing market contribution |

APAC at 42% |

|

Key consumer countries |

US, Japan, South Korea (Republic of Korea), Germany, and China |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Adaptive Energy LLC, Aisin Corp., Bloom Energy Corp., Freudenberg SE, HORIBA Ltd., Loop Energy Inc., Nedstack Fuel Cell Technology BV, Panasonic Corp., SolidPower Spa, and Viessmann Family Holding |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Residential Fuel Cell Market Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive residential fuel cell market growth during the next five years

- Precise estimation of the residential fuel cell market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the residential fuel cell industry across North America, APAC, Europe, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of residential fuel cell market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch