Restaurant Technology Market Size 2025-2029

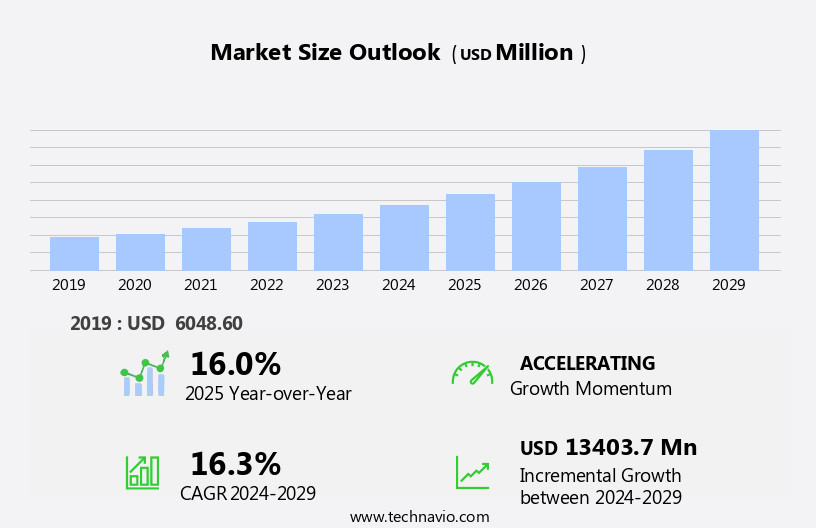

The restaurant technology market size is forecast to increase by USD 13.4 billion, at a CAGR of 16.3% between 2024 and 2029.

- The market is witnessing significant growth, driven primarily by the increasing demand for contactless and digital payment solutions. With the ongoing pandemic, the need for contactless transactions has become a priority for both customers and restaurant operators. This shift towards digital payments is expected to continue even post-pandemic, as consumers grow more accustomed to the convenience and safety it offers. Another key trend in the market is the introduction of new technology solutions. From mobile ordering and payment apps to self-service kiosks and automated delivery systems, restaurants are leveraging technology to enhance the customer experience and streamline operations.

- However, this adoption of technology also brings challenges, with data security and privacy concerns emerging as a major obstacle. As restaurants collect and store more customer data, ensuring its protection becomes crucial to maintain trust and avoid potential reputational damage. Companies must prioritize robust security measures and transparent data handling practices to navigate these challenges effectively and capitalize on the opportunities presented by the evolving restaurant technology landscape.

What will be the Size of the Restaurant Technology Market during the forecast period?

The market continues to evolve, with innovative solutions shaping the industry's landscape. Restaurant management software streamlines operations, optimizing inventory and cost management. Food ordering systems, including self-service kiosks and online platforms, enhance user experience (UX) and demand forecasting. Table management systems and API integrations facilitate seamless table reservations and third-party partnerships. Food waste reduction tools employ machine learning (ML) and predictive analytics to optimize inventory and reduce waste. Staff scheduling software ensures operational efficiency and labor cost management. Data security and food safety monitoring solutions prioritize customer satisfaction and regulatory compliance. Blockchain technology and digital menu boards revolutionize transparency and menu customization.

Payment processing systems offer contactless and mobile options, while customer feedback systems gather valuable insights. Table reservation systems and online ordering integrations provide a seamless guest experience. Restaurant website design and mobile app development cater to the digital age, with geolocation services and social media integration increasing reach. Compliance regulations, delivery services, and sustainable practices shape the industry's future. Cloud-based solutions, data analytics, and customer satisfaction remain key drivers. Facial recognition, loyalty programs, and artificial intelligence (AI) enhance personalization and automation. Data privacy, employee time tracking, and food cost management tools ensure operational efficiency. Voice ordering, smart kitchen equipment, augmented reality (AR), and inventory optimization continue to redefine the industry's technological advancements.

How is this Restaurant Technology Industry segmented?

The restaurant technology industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- RMS

- Point of sale systems

- Online ordering systems

- Payment processing solutions

- Others

- End-user

- Quick-service restaurants

- Full-service restaurants

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

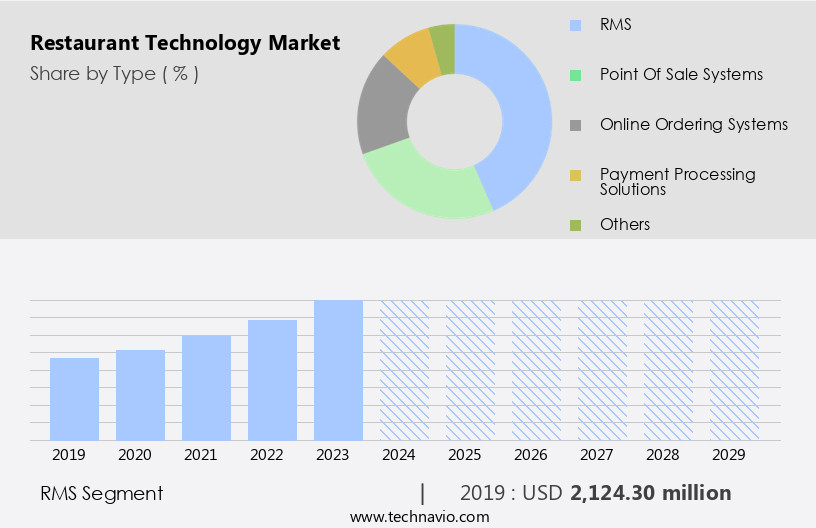

The rms segment is estimated to witness significant growth during the forecast period.

The market encompasses various solutions that enhance operational efficiency and customer experience in the food service industry. Restaurant management software is a significant segment, offering tools for managing day-to-day tasks from table reservations to kitchen workflows. Menu management within this software enables real-time updates across multiple locations, ensuring menu consistency and flexibility in response to inventory or customer preference changes. Kitchen display systems (KDS) are another essential component, streamlining order preparation and reducing delays by providing clear, organized displays for kitchen staff. Self-service kiosks and user interfaces (UI) offer contactless ordering and improved user experience (UX), while inventory management software optimizes stock levels and reduces food waste.

Cost optimization is a crucial factor, with solutions focusing on labor cost management and food cost management. Restaurant marketing automation integrates social media and predictive analytics to target customers effectively. Table management systems, API and hardware integrations, and delivery services cater to evolving customer demands. Compliance regulations, sustainable practices, and cloud-based solutions ensure business agility and data security. Customer satisfaction is prioritized through loyalty programs, customer feedback systems, and facial recognition technology. Food ordering optimization, restaurant operations research, and food waste reduction contribute to operational efficiency. Staff scheduling software, data privacy, employee time tracking, and data analytics support effective workforce management.

Blockchain technology, digital menu boards, machine learning, payment processing, and table reservation systems further enhance the technology landscape. Voice ordering, smart kitchen equipment, augmented reality, and inventory optimization are emerging trends, providing immersive and harmonious dining experiences. Overall, the market continues to evolve, focusing on improving operational efficiency, customer satisfaction, and sustainability.

The RMS segment was valued at USD 2.12 billion in 2019 and showed a gradual increase during the forecast period.

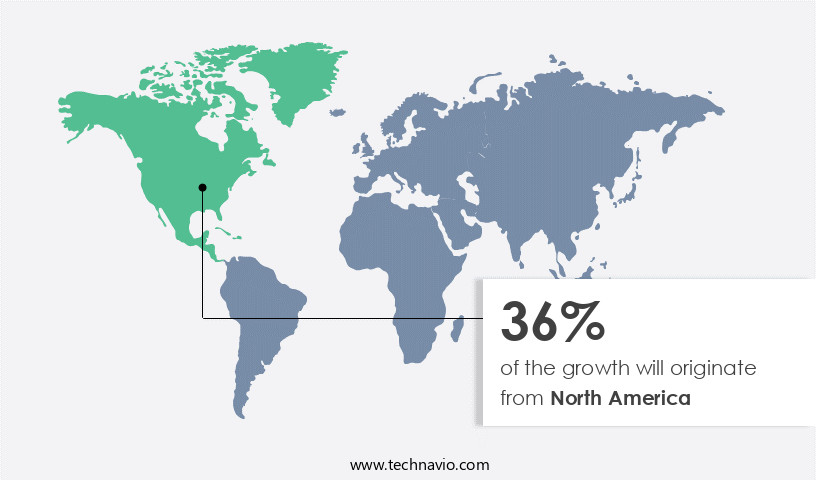

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is characterized by its advanced stage of development, fueled by high digital adoption rates and a consumer preference for convenience. The US dominates this market due to its extensive foodservice industry and early adoption of innovative solutions. Major QSR chains, such as McDonald's, Taco Bell, and Chipotle, are investing in self-order kiosks, AI-driven drive-thru systems, and contactless payment solutions to boost customer convenience. In contrast, full-service restaurants, including Outback Steakhouse and Olive Garden, focus on reservation management systems, digital menu boards, and CRM tools to enhance guest experiences. Self-service kiosks and user interfaces (UI) are increasingly popular, offering a more personalized and efficient ordering process.

Inventory management software and cost optimization tools help restaurants streamline operations and reduce food waste. Restaurant marketing automation and social media integration are essential for effective digital marketing strategies. Predictive analytics and demand forecasting enable restaurants to optimize food ordering and staff scheduling. Table management systems, API integration, and facial recognition technology improve operational efficiency and customer satisfaction. Loyalty programs, restaurant management software, and food ordering optimization tools strengthen customer engagement and retention. Compliance regulations, delivery services, and sustainable practices are key considerations for restaurant technology adoption. Cloud-based solutions, data analytics, and customer feedback systems provide valuable insights for continuous improvement.

Data security, food safety monitoring, and blockchain technology ensure data privacy and secure transactions. Machine learning (ML) and payment processing systems streamline operations and enhance the overall dining experience. Virtual reality (VR), augmented reality (AR), and voice ordering are emerging trends that offer immersive and interactive dining experiences. Guest wi-fi solutions, geolocation services, labor cost management, and employee time tracking are essential tools for managing restaurant operations effectively. Restaurant automation, data privacy, and food cost management are crucial aspects of maintaining a competitive edge in the industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Restaurant Technology Industry?

- The increasing preference for contactless and digital payment methods is the primary catalyst fueling market growth.

- The market is experiencing significant growth due to the increasing prioritization of customer satisfaction and operational efficiency. Contactless and digital payments, facilitated by mobile ordering apps, QR codes, and NFC-enabled mobile wallets, are becoming increasingly popular. These technologies offer enhanced transaction speed, security, and convenience, especially in the wake of changing consumer preferences and heightened hygiene concerns. Virtual reality (VR) technology is also gaining traction in the industry, providing immersive dining experiences and enabling restaurants to showcase their menus and offerings in a more engaging way. Guest Wi-Fi solutions and data analytics are essential tools for restaurants to gather valuable customer insights and improve their offerings.

- Compliance regulations, such as those related to data security and privacy, are driving the adoption of cloud-based solutions and customer feedback systems. Delivery services, sustainable practices, and loyalty programs are other key areas of investment for restaurants looking to stay competitive. Facial recognition technology is also being explored for contactless check-in and personalized marketing efforts. Overall, the market is poised for continued growth as restaurants seek to enhance the customer experience, streamline operations, and adapt to evolving consumer preferences.

What are the market trends shaping the Restaurant Technology Industry?

- The introduction of new solutions is a mandatory trend in the current market. Professionals and businesses are continually seeking innovative approaches to enhance efficiency and productivity.

- The market is experiencing notable progression, driven by the development of innovative solutions that boost operational efficiency, customer engagement, and profitability for establishments. In response to this demand, Oracle unveiled Oracle Restaurants in September 2023, an all-encompassing and cost-effective restaurant management system. Suitable for both quick service and table service restaurants, this platform integrates essential components such as POS hardware and software, online ordering, and payment processing. Key features include Oracle Payment Cloud Service, Workstation 8, and essential peripherals, which facilitate menu management, digital payments, and customer engagement. By streamlining these processes, Oracle Restaurants empowers operators to enhance their businesses, with transparent pricing and no hidden fees starting from USD99 per month.

- This cutting-edge technology is poised to revolutionize the industry by optimizing food ordering, enhancing restaurant operations research, reducing food waste, improving staff scheduling, ensuring data security, monitoring food safety, and implementing blockchain technology, digital menu boards, machine learning, and online ordering integrations.

What challenges does the Restaurant Technology Industry face during its growth?

- Data security and privacy concerns represent significant challenges that can impede industry growth. Companies must balance the need to collect and utilize data with the responsibility to protect it from unauthorized access and ensure its privacy is maintained in accordance with regulations and ethical standards.

- The market is witnessing significant advancements, with restaurant website design, mobile app development, and geolocation services becoming essential components for businesses. However, these innovations come with challenges, particularly in the realm of data privacy and security. With the increasing adoption of cloud-based solutions and mobile applications, safeguarding customer data has become a top priority for restaurant operators. Cybersecurity threats, data breaches, and hacking attempts pose substantial risks to both customer information and business operations. Compliance with data protection regulations, such as the General Data Protection Regulation (GDPR), adds another layer of complexity. A notable incident occurred on January 19, 2023, when Yum Brands, a leading restaurant company, experienced a ransomware attack.

- This cyberattack forced the temporary closure of around 300 restaurants and disrupted the company's IT systems, underscoring the importance of robust data security measures. Restaurant technology also includes labor cost management through AI, employee time tracking, food cost management, restaurant automation, voice ordering, smart kitchen equipment, augmented reality, and inventory optimization. Ensuring data privacy and security while implementing these technologies is crucial for restaurant businesses to maintain customer trust and protect their operations.

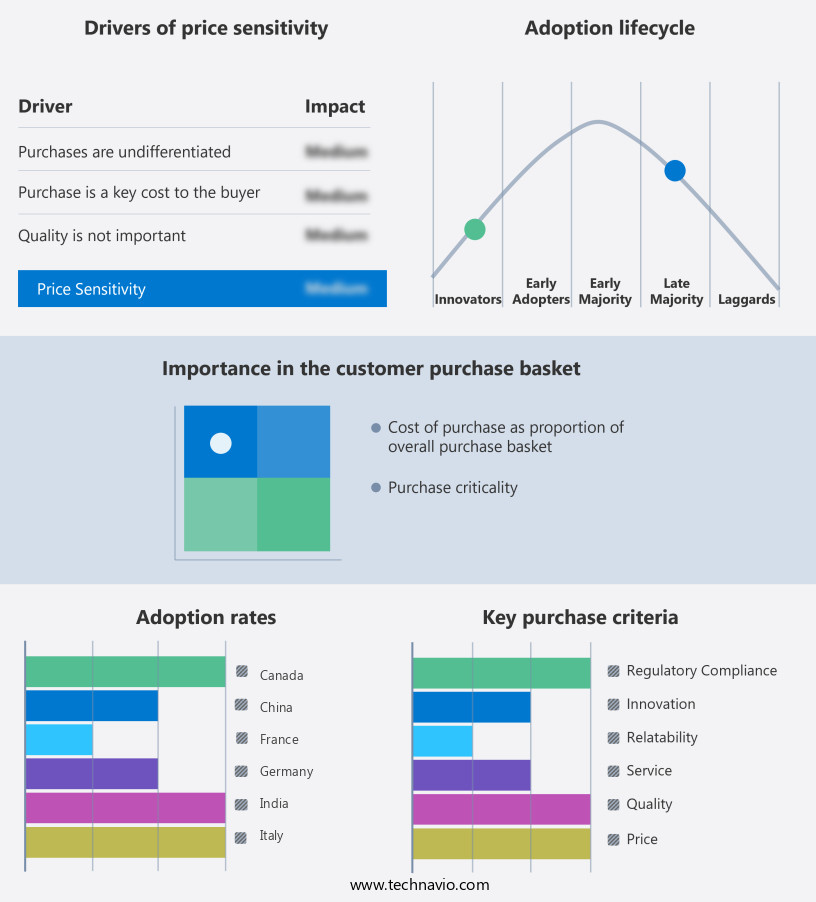

Exclusive Customer Landscape

The restaurant technology market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the restaurant technology market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, restaurant technology market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

7shifts Employee Scheduling Software Inc. - This company specializes in technology solutions for the restaurant industry, encompassing scheduling, payroll, and employee retention. The platform offers a user-friendly drag-and-drop scheduler and an intelligent auto-scheduler powered by machine learning. Time tracking is facilitated through geofencing technology, while tip management ensures accurate and transparent reporting. Seamless integration with POS systems optimizes labor costs and enhances operational efficiency for restaurants of all sizes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 7shifts Employee Scheduling Software Inc.

- Clear-solutions.com

- Cognizant Technology Solutions Corp.

- Digitory Solutions Pvt. Ltd.

- Fiserv Inc.

- Fishbowl

- Fourth Enterprises LLC

- International Business Machines Corp.

- Jolt Software Inc.

- MustHaveMenus Inc.

- NCR Voyix Corp.

- Olo Inc.

- OpenTable Inc.

- Oracle Corp.

- Panasonic Holdings Corp.

- PAR Technology Corp.

- Shift4 Payments Inc.

- Snappy Innovation Inc.

- Square Inc.

- TouchBistro Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Restaurant Technology Market

- In February 2023, Grubhub and Seamless, two leading online and mobile food ordering and delivery marketplaces, merged to form Just Eat Takeaway.Com. This strategic move aimed to strengthen their position in the competitive food tech industry and expand their reach in various markets (Business Wire).

- In May 2024, Starbucks announced the deployment of artificial intelligence (AI) and machine learning technology across its U.S. Stores, enabling personalized offers and recommendations for customers based on their ordering history (Starbucks Press Release).

- In September 2024, Square, Inc. Acquired the food delivery platform Caviar for approximately USD410 million. This acquisition was a strategic move to strengthen Square's food delivery business and compete with other major players in the market (Bloomberg).

- In January 2025, Apple introduced contactless ordering and payment solutions for restaurants through its Apple Pay service. This technological advancement aimed to streamline the ordering and payment process, enhancing the customer experience and promoting contactless services in the wake of the COVID-19 pandemic (Apple Newsroom).

Research Analyst Overview

- In the dynamic the market, data-driven insights play a pivotal role in driving operational intelligence and optimizing various aspects of the business. Reputation management is a key concern for restaurants, with technology solutions enabling real-time monitoring and response to online reviews. Restaurant design incorporates technology for brand building and customer engagement through digital signage and marketing strategies. Franchise management systems streamline processes, ensuring consistency across locations. Customer service optimization relies on AI-powered chatbots and CRM tools for personalized interactions. Employee training leverages technology for remote learning and performance tracking.

- Food safety & hygiene and food quality control are ensured through automated monitoring systems. Smart kitchen automation enhances service quality and workflow optimization. Restaurant consulting firms provide expertise in implementing technology solutions tailored to specific restaurant needs. Overall, the restaurant technology landscape continues to evolve, prioritizing guest experience, brand building, order fulfillment, and workflow efficiency.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Restaurant Technology Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.3% |

|

Market growth 2025-2029 |

USD 13403.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.0 |

|

Key countries |

US, UK, China, Germany, Canada, India, France, Japan, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Restaurant Technology Market Research and Growth Report?

- CAGR of the Restaurant Technology industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the restaurant technology market growth of industry companies

We can help! Our analysts can customize this restaurant technology market research report to meet your requirements.