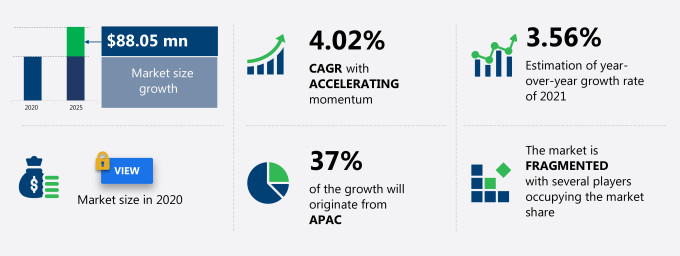

The returnable transport packaging market share in brazil is expected to increase by USD 88.05 million from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 4.02%.

This returnable transport packaging market in brazil research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers returnable transport packaging market in brazil segmentation by product (containers, pallets, drums and barrels, and others), circulation method (pooling system, open loop system, and closed loop system), and geography (Brazil). The returnable transport packaging market in brazil report also offers information on several market vendors, including Brambles Ltd., DHL International GmbH, GEFCO Group, IFCO Management GmbH, Kuehne + Nagel International AG, Mugele Group, Nefab AB, Signode Brasileira, SSI SCHAEFER Group, and Tosca Services LLC among others.

What will the Returnable Transport Packaging Market In Brazil Size be During the Forecast Period?

Download Report Sample to Unlock the Returnable Transport Packaging Market in Brazil Size for the Forecast Period and Other Important Statistics

Returnable Transport Packaging Market In Brazil: Key Drivers, Trends, and Challenges

Based on our research output, there has been a positive impact on the market growth during and after post COVID-19 era. The lower handling and product damage is notably driving the returnable transport packaging market in brazil growth, although factors such as high upfront initial capital cost required for rtp may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the returnable transport packaging in the brazil industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Returnable Transport Packaging Market In Brazil Driver

Lower handling and product damage are one of the key factors driving the growth of the returnable transport packaging market in brazil. RTPs are designed in a way to improve the handling of products through the provision of features such as handles, lids, and wheels. These features not only improve handling but also increases productivity. For example, containers with wheels are easy to move around, even when loaded at a faster rate. This reduces human hazards and increases productivity. Brazil has customer cycle times of about two weeks, which is high. The use of RTP will reduce the cycle times in the country. Moreover, RTPs are durable and strong products made from wood and plastic. Therefore, these products suffer less damage than the goods being transported could cause. Compared with corrugated boxes, RTPs offer more protection. Corrugated boxes are susceptible to moisture and impact. RTP, on the other hand, has lower handling requirements and incurs less product damage. As a result, the demand for RTP will increase, thereby driving the growth of the RTP market in Brazil.

Key Returnable Transport Packaging Market In Brazil Trend

Decreasing demand for wooden RTP will fuel the returnable transport packaging market growth in brazil. Many RTP products such as wooden pallets or wooden crates are significantly used RTPs in Brazil. Companies dealing in the transportation and storage of goods use the RTPs. The wooden pallets come in different sizes. However, the use of wooden RTP products is reducing due to the availability of plastic pallets that are lighter in weight and also durable. Moreover, to make wooden RTP, wood is required. At present, there is a scarcity of wood due to curbs on deforestation across the world and in Brazil. This can affect the availability of raw materials for making wooden pallets or wooden crates. Moreover, due to the increase in deforestation, the government implemented countermeasures to reduce deforestation. The measures to prevent deforestation would affect the sales and production of vendors dealing with wood products such as wooden containers and pallets. This is expected to increase the prices of raw materials.

Key Returnable Transport Packaging Market In Brazil Challenge

The high upfront initial capital cost required for RTP is a major challenge for the returnable transport packaging market growth in brazil. The initial cost required to adopt the RTP system is steep. This is one of the significant market growth obstacles. The high rental and procurement costs to set up an RTP system leads to the high initial cost. The initial investment depends on the length of the shipping line and the types of containers required. The length of the shipping line includes the total time the container is at the transporter's place, in shipment, at the receiver's place, and in return shipment. In addition, it also contains any cleaning and sorting processes if required in between the whole shipment procedure. However, the slowdown of the manufacturing industry in Brazil in 2020 and the outbreak of COVID-19 have negatively impacted many companies and, consequently, limited the adoption of RTP systems. The increasing number of cases of COVID-19 resulted in the lockdown of the country in the first half of 2020. The increasing number of cases and economic volatility have discouraged companies from making high-cost commitments. Furthermore, significant savings would be required over time to justify the high initial capital investments.

This returnable transport packaging market in brazil analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the returnable transport packaging (RTP) market in Brazil as a part of the global metal and glass containers market within the overall global containers and packaging market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the returnable transport packaging market in brazil during the forecast period.

Who are the Major Returnable Transport Packaging Market In Brazil Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Brambles Ltd.

- DHL International GmbH

- GEFCO Group

- IFCO Management GmbH

- Kuehne + Nagel International AG

- Mugele Group

- Nefab AB

- Signode Brasileira

- SSI SCHAEFER Group

- Tosca Services LLC

This statistical study of the returnable transport packaging market in brazil encompasses successful business strategies deployed by the key vendors. The returnable transport packaging market in brazil is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Brambles Ltd. - The company offers a wide range of containers, liners, accessories, and sand solutions under its brand CHEP.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The returnable transport packaging market in brazil forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Returnable Transport Packaging Market In Brazil Value Chain Analysis

Our report provides extensive information on the value chain analysis for the returnable transport packaging market in brazil, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the global containers and packaging market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by service providers to ensure a sustainable market presence.

Which are the Key Regions for Returnable Transport Packaging Market In Brazil?

For more insights on the market share of various regions Request PDF Sample now!

37% of the market’s growth will originate from South America during the forecast period. Brazil is the key market for returnable transport packaging market in brazil in APAC. Market growth in this region will be faster than the growth of the market in regions.

Lower handling and product damage will facilitate the returnable transport packaging market growth in brazil in South America over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The COVID-19 pandemic resulted in a slowdown in the manufacturing and retail sectors in the country in 2020. The rise in the number of COVID-19 cases in Brazil in the first half of 2020 led to the imposition of lockdowns in major cities in the country, which reduced industrial production and retail sales. Hence, the demand for RTP decreased in the country in 2020. Most business operations and investments in the manufacturing sector were stalled in the first half of 2020, which negatively impacted the growth of the market. However, after the lifting of lockdowns, the manufacturing and supply chain operations have resumed, and hence, the market is expected to recover during the forecast period. Also, to avoid the risk of COVID-19, people are inclining toward online platforms for shopping, which will drive the market during the forecast period.

What are the Revenue-generating Product Segments in the Returnable Transport Packaging Market In Brazil?

To gain further insights on the market contribution of various segments Request PDF Sample

The returnable transport packaging market share growth in brazil by the Containers segment will be significant during the forecast period. The containers are available in various sizes that are compatible with industry-standard racking, conveyors, and pallets. The nature of the material makes the packaging solutions durable and can offer good protection to the encased products. Moreover, they are easy to clean and resistant to moisture and many chemicals. The plastic containers cost less than the metal ones. Moreover, totes or boxes made from corrugated plastic can be folded flat when not in use. This saves storage space in warehouses and during transportation, saving logistics costs.

This report provides an accurate prediction of the contribution of all the segments to the growth of the returnable transport packaging market in brazil size and actionable market insights on post COVID-19 impact on each segment.

|

Returnable Transport Packaging Market In Brazil Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.02% |

|

Market growth 2021-2025 |

$ 88.05 million |

|

Market structure |

Fragmented |

|

YoY growth (%) |

3.56 |

|

Regional analysis |

Brazil |

|

Performing market contribution |

APAC at 37% |

|

Key consumer countries |

Brazil |

|

Competitive landscape |

Leading companies, Competitive Strategies, Consumer engagement scope |

|

Key companies profiled |

Brambles Ltd., DHL International GmbH, GEFCO Group, IFCO Management GmbH, Kuehne + Nagel International AG, Mugele Group, Nefab AB, Signode Brasileira, SSI SCHAEFER Group, and Tosca Services LLC |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Returnable Transport Packaging Market In Brazil In Country Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive returnable transport packaging market in brazil growth during the next five years

- Precise estimation of the returnable transport packaging market in brazil size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the returnable transport packaging industry across Brazil

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of returnable transport packaging market in brazil vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch

4.jpg?format=webp)