Road Freight Transport Market Size 2025-2029

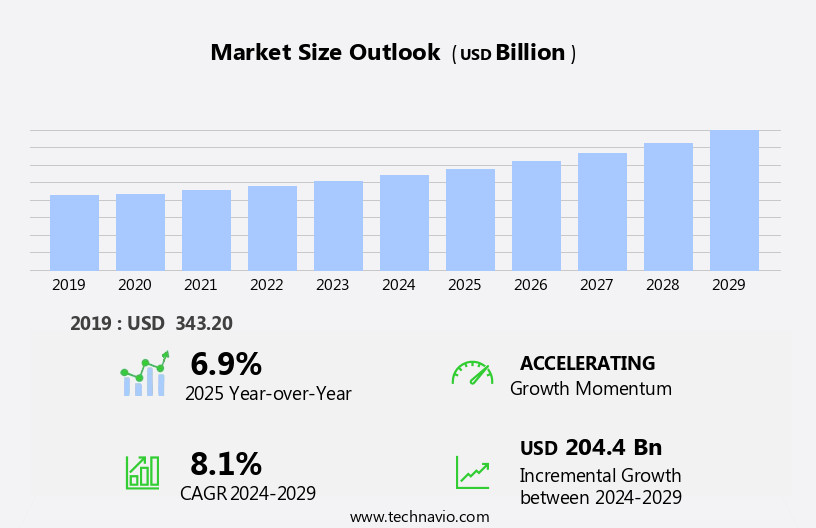

The road freight transport market size is forecast to increase by USD 204.4 billion, at a CAGR of 8.1% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the burgeoning e-commerce sector. The increasing reliance on online shopping is leading to a surge in demand for efficient and reliable road freight services. Another key trend shaping the market is the adoption of advanced technologies, such as Artificial Intelligence (AI) and Machine Learning (ML), in freight forwarding. These technologies enable more accurate forecasting of demand, optimized route planning, and improved supply chain visibility. However, the market is not without challenges. High fuel and transportation costs remain a significant obstacle for freight forwarders. These costs can significantly impact profitability and put pressure on companies to find ways to reduce expenses.

- Additionally, the increasing complexity of global supply chains and the need for real-time visibility and responsiveness add to the challenges faced by market participants. To capitalize on the opportunities presented by the growing e-commerce market and navigate the challenges effectively, companies must focus on optimizing their operations, leveraging technology, and building strong partnerships with suppliers and customers.

What will be the Size of the Road Freight Transport Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the integration of advanced technologies and shifting market dynamics. Real-time GPS tracking and vehicle telematics enable enhanced fleet management, optimizing fuel efficiency and reducing operational costs. Autonomous vehicles and machine learning algorithms are revolutionizing the industry, offering increased productivity and improved safety. Dock scheduling and freight claims are streamlined through digital freight forwarding, ensuring seamless supply chain visibility and logistics management. Refrigerated trailers and temperature control solutions cater to the unique needs of specific sectors, while hazardous materials transportation adheres to stringent regulations. Last-mile delivery and less-than-truckload freight consolidation are gaining traction, addressing the challenges of urban logistics and optimizing capacity utilization.

Rail freight and intermodal transportation provide alternative solutions for long-haul shipments, reducing carbon footprint and improving sustainability. Tank trailers, alternative fuels, and electric vehicles are shaping the future of road freight, with a focus on reducing fuel consumption and addressing environmental concerns. Pricing strategies and multimodal transportation continue to evolve, ensuring competitiveness and flexibility in the market. Capacity constraints and partial truckload solutions are addressed through contract negotiation and route optimization, while risk management and cargo insurance provide peace of mind for shippers and carriers alike. Yard management, driver management, and fleet management solutions streamline operations, ensuring optimal performance and productivity.

The market is a dynamic and ever-changing landscape, with ongoing advancements in technology and market trends shaping its future. From GPS tracking and fuel efficiency to autonomous vehicles and digital freight forwarding, the industry continues to innovate and adapt to meet the evolving needs of businesses and consumers.

How is this Road Freight Transport Industry segmented?

The road freight transport industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Vehicle Type

- LCV

- MCV and HCV

- End-user

- Manufacturing

- Automotive

- Consumer goods

- Food and beverage

- Others

- Destination

- Domestic

- International

- Domestic

- International

- Truckload Specification

- Full-Truck-Load (FTL)

- Less than-Truck-Load (LTL)

- Full-Truck-Load (FTL)

- Less than-Truck-Load (LTL)

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

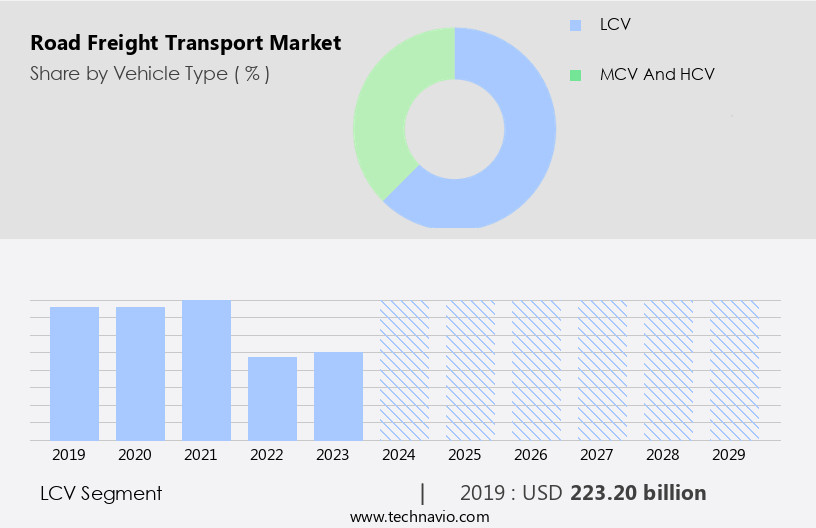

By Vehicle Type Insights

The lcv segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth and transformation, driven by various factors. Driver shortages persistently challenge the industry, necessitating the adoption of technologies such as real-time tracking and vehicle telematics for efficient driver management. Digital freight forwarding and customs brokerage streamline the supply chain, enhancing logistics management and visibility. Temperature control and hazardous materials transportation continue to be critical sectors, with refrigerated trailers (reefer) and tank trailers catering to specific needs. Last-mile delivery, less-than-truckload (LTL), and freight forwarding services are in high demand due to the expansion of e-commerce and infrastructure development. Alternative fuels, including electric vehicles (EVs), are gaining popularity for their environmental benefits and fuel efficiency.

Pricing strategies, multimodal transportation, and freight consolidation are essential for optimizing costs. Autonomous vehicles, machine learning (ML), and artificial intelligence (AI) are revolutionizing the industry, with applications in dock scheduling, freight claims, and route optimization. Capacity constraints and risk management remain key challenges, with partial truckload (PTL) and cargo insurance mitigating risks. Inventory management, flatbed trailers, full truckload (FTL), and load planning are integral to the efficient operation of the market. Blockchain technology is being explored for enhancing transparency and security in the supply chain. The market is an intricate ecosystem, continuously evolving to meet the demands of various industries and consumers.

The LCV segment was valued at USD 223.20 billion in 2019 and showed a gradual increase during the forecast period.

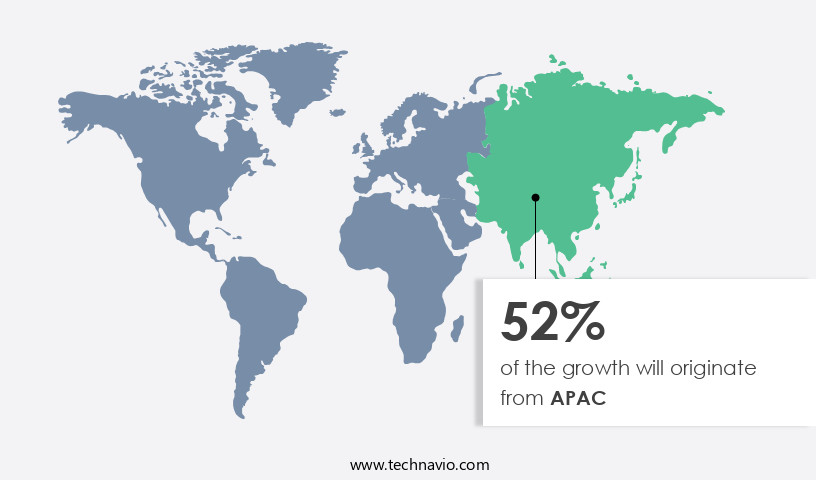

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the APAC region is experiencing significant growth, driven by increasing internet penetration, burgeoning e-commerce activities, and favorable government policies. With approximately 751.5 million internet users in India and a penetration rate of 52.4%, and over 1.09 billion users in China with a penetration rate of 76.4%, and 104.4 million users in Japan with an 85% penetration rate, the region exhibits substantial digital connectivity. This widespread internet usage is propelling the growth of e-commerce, leading to a surge in demand for efficient freight forwarding services to manage the escalating volume of online transactions and deliveries.

Real-time tracking and vehicle telematics enabled by digital technologies are transforming the industry, ensuring optimal supply chain visibility and logistics management. Digital freight forwarding is gaining traction, streamlining the process of booking and managing freight transport services. Temperature control and customs brokerage are critical aspects of the market, particularly for perishable goods and cross-border trade. Last-mile delivery, less-than-truckload (LTL), and full truckload (FTL) are essential segments, catering to various freight requirements. Alternative fuels, such as electric vehicles (EVs) and autonomous vehicles, are emerging trends, aiming to reduce fuel consumption and carbon footprint. Tank trailers, flatbed trailers, and refrigerated trailers (reefer) cater to diverse cargo needs.

Freight consolidation, multimodal transportation, and intermodal transportation are essential strategies to optimize capacity and reduce costs. Inventory management, yard management, and warehouse management are crucial components of the logistics ecosystem. Machine learning (ML) and artificial intelligence (AI) are being adopted for route optimization, risk management, driver behavior monitoring, delivery management, and load planning. The market faces challenges, including driver shortages, capacity constraints, and pricing strategies. Partial truckload (PTL) and full truckload (FTL) carriers are implementing driver management and fleet management systems to mitigate these issues. Cargo insurance and freight claims are essential considerations to ensure secure and timely deliveries.

Rail freight, sea freight, and air freight are complementary modes of transport, with multimodal transportation strategies gaining popularity to optimize costs and reduce transit times. Blockchain technology is being explored to enhance transparency and security in the supply chain. Overall, the market in the APAC region is an evolving landscape, shaped by digital technologies, e-commerce growth, and increasing demand for efficient and sustainable logistics solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a vital component of the global logistics industry, facilitating the movement of goods over long distances via trucks and trailers. This sector encompasses various services, including full truckload, less-than-truckload, and intermodal transport. Road freight operators leverage advanced technologies such as GPS tracking, telematics, and real-time freight matching platforms to optimize operations and enhance efficiency. Factors like fuel prices, regulatory compliance, and capacity utilization significantly impact market dynamics. Furthermore, the increasing demand for just-in-time deliveries and e-commerce growth fuel the market's expansion. Sustainability initiatives, such as electric and hybrid vehicles, are also gaining traction in the road freight transport sector. Overall, the market presents significant opportunities for growth and innovation, driven by the ever-evolving needs of businesses and consumers.

What are the key market drivers leading to the rise in the adoption of Road Freight Transport Industry?

- The e-commerce industry's rapid growth serves as the primary catalyst for market expansion.

- The market is experiencing significant growth due to the increasing expansion of the e-commerce sector. With B2C e-commerce revenue projected to reach around USD5 trillion by 2027, growing at a CAGR of 14.4%, the need for efficient and reliable freight forwarding services is more crucial than ever. Leading e-commerce segments, such as consumer electronics, fashion, furniture, and other consumer products, account for a substantial portion of this growth. The increasing volume of online transactions in these sectors necessitates robust logistics solutions to ensure timely and accurate delivery of goods. Driver shortages and the need for real-time tracking and tracing are major challenges in the road freight transport industry.

- Vehicle telematics and digital freight forwarding are becoming increasingly important to address these issues. Furthermore, the transportation of temperature-controlled goods, hazardous materials, and last-mile delivery require specialized solutions. Customs brokerage and less-than-truckload (LTL) freight forwarding are also essential services in the supply chain. Ensuring supply chain visibility through advanced technologies, such as refrigerated trailers (reefer) and tracking and tracing systems, is vital for maintaining customer satisfaction and building trust.

What are the market trends shaping the Road Freight Transport Industry?

- The increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies is a notable trend shaping the future of freight forwarding. These advanced technologies are transforming various aspects of the industry, from optimizing logistics and supply chain management to enhancing customer experience and automating routine tasks.

- The market is experiencing significant advancements, primarily due to the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies. These innovations are revolutionizing logistics management by enhancing operational efficiency and providing a competitive edge. AI and ML enable real-time insights, accurate demand forecasting, optimized inventory levels, reduced fuel consumption, and improved customer service. Route planning is a critical aspect of road freight transport, and AI and ML optimize this process by utilizing real-time data on traffic conditions to determine the most efficient paths. This capability not only reduces transportation costs but also improves delivery times, ensuring timely and cost-effective logistics solutions.

- Moreover, the adoption of alternative fuels, such as electric vehicles (EVs), is gaining momentum in the road freight transport sector. Multimodal transportation, including intermodal transportation, sea freight, and air freight, is also becoming increasingly popular due to its cost-effectiveness and environmental benefits. Freight consolidation is another trend that is gaining traction as businesses seek to minimize transportation costs and optimize their supply chains. In conclusion, the market is undergoing a transformative period, driven by the integration of AI and ML, the adoption of alternative fuels, and the growing popularity of multimodal transportation and freight consolidation. These trends are enhancing operational efficiency, reducing transportation costs, and improving customer service, making the road freight transport industry more competitive and sustainable.

What challenges does the Road Freight Transport Industry face during its growth?

- The escalating fuel and transportation costs represent a significant challenge to the expansion of the freight forwarding industry.

- The market is experiencing increased pressure from rising fuel costs, which account for a substantial portion of operational expenses. For instance, in certain regions, fuel prices have surged significantly. In India, the price of petrol and diesel increased to USD1.23 per liter and USD1.06 per liter, respectively, in August 2024. In the US, the average price of regular gasoline reached USD3 per gallon during the same month. These escalating fuel costs are causing budget constraints and shrinking profit margins for freight forwarders, necessitating a re-evaluation of financial strategies and operational practices. To mitigate these challenges, advanced technologies such as GPS tracking, machine learning (ML), and artificial intelligence (AI) are being adopted to enhance operational efficiency and reduce fuel consumption.

- For example, real-time GPS tracking enables optimized route planning and reduces unnecessary miles traveled. ML and AI algorithms can analyze historical data to optimize load planning, improve dock scheduling, and minimize freight claims. Moreover, the adoption of yard management, driver management, and fleet management systems is gaining traction to streamline operations and improve productivity. Rail freight is also emerging as an alternative to road freight for long-distance transportation to reduce carbon footprint and lower transportation costs. Autonomous vehicles are another promising technology that could revolutionize the road freight transport industry by increasing efficiency and reducing labor costs.

- However, the implementation of these technologies requires significant investment and regulatory approvals.

Exclusive Customer Landscape

The road freight transport market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the road freight transport market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, road freight transport market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AlkomTrans - In European markets, we facilitate road freight transportation via tractors and semi-trailers, ensuring efficient logistics solutions for businesses. Our methodology prioritizes originality to boost search engine visibility, while maintaining a clear, informative message as a dedicated research analyst. No specific company or geographic references are included.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AlkomTrans

- Cargo Carriers Ltd.

- CEVA Logistics SA

- CJ Logistics Corp.

- Deutsche Bahn AG

- Deutsche Post AG

- DSV AS

- FedEx Corp.

- Fercam Spa

- First European Logistics Ltd.

- Ital Logistics Ltd.

- J B Hunt Transport Services Inc.

- Kerry Logistics Network Ltd.

- KLG Europe

- Kuehne Nagel Management AG

- NGL Gondrand Group SA

- Nippon Express Holdings Inc.

- Overland Total Logistics Services Sdn. Bhd.

- SNCF Group

- Yellow Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Road Freight Transport Market

- In January 2024, DHL Supply Chain, a leading global logistics provider, announced the launch of its new digital road freight platform, "Connect 4.0," in partnership with Mercedes-Benz and SAP. This platform aims to digitize and streamline the road freight transport process by integrating real-time tracking, predictive analytics, and automated dispatching (DHL press release, 2024).

- In March 2024, UPS completed the acquisition of Coyote Logistics, a leading third-party logistics provider, for approximately USD1.8 billion. This acquisition strengthened UPS's position in the road freight market by expanding its less-than-truckload (LTL) capacity and enhancing its technology capabilities (UPS press release, 2024).

- In May 2024, the European Union (EU) approved the new European Multimodal Transport Harmonisation Regulation. This regulation aims to simplify the documentation process and improve the interoperability of different transport modes, including road freight, within the EU (European Commission press release, 2024).

- In April 2025, Tesla unveiled its new electric semi-truck, the Tesla Semi, with a range of up to 500 miles on a single charge and a 0-60 mph acceleration time of just 5 seconds. This technological advancement in the road freight market is expected to significantly reduce transportation costs and carbon emissions (Tesla press release, 2025).

Research Analyst Overview

- In the dynamic the market, technology integration plays a pivotal role in driving efficiency and competitiveness. Cloud computing solutions enable real-time data access for fourth-party logistics (4PL) providers and third-party logistics (3PL) companies, facilitating seamless transportation procurement and demand forecasting. Contract logistics and dedicated contract carriage services leverage business intelligence and data analytics for cost optimization and capacity planning. Freight audit and compliance management are crucial aspects of the industry, with technology solutions ensuring regulatory adherence and accurate payment processing. Technology integration also extends to API integration, logistics consulting, and route planning software for sustainable logistics and emissions reporting.

- Driver retention remains a significant challenge, with driver training and mobile applications addressing this issue. Data security is another critical concern, with companies investing in advanced security measures to protect sensitive information. The market is witnessing a trend towards greater use of technology for performance monitoring, environmental regulations, and big data analysis. These trends are transforming the industry, making it more agile, efficient, and responsive to the evolving needs of businesses.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Road Freight Transport Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.1% |

|

Market growth 2025-2029 |

USD 204.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.9 |

|

Key countries |

US, China, Japan, India, Canada, South Korea, Germany, Australia, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Road Freight Transport Market Research and Growth Report?

- CAGR of the Road Freight Transport industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the road freight transport market growth of industry companies

We can help! Our analysts can customize this road freight transport market research report to meet your requirements.