Satellite Modem Market Size 2024-2028

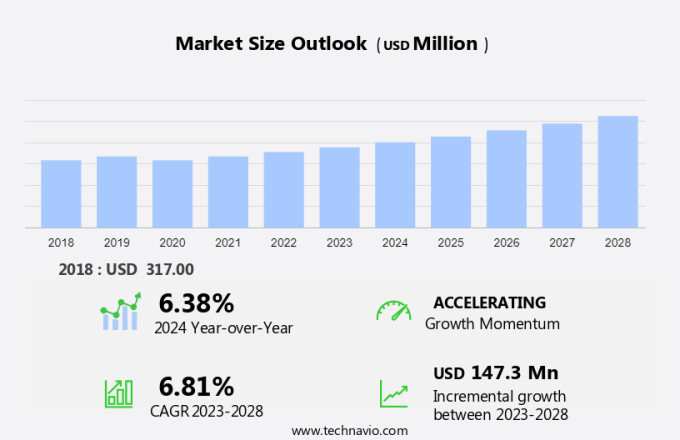

The satellite modem market size is forecast to increase by USD 147.3 million, at a CAGR of 6.81% between 2023 and 2028. The market is experiencing significant growth due to the increasing need to enhance offshore communication, particularly in remote and underdeveloped regions. A key trend in the market is the high preference for Medium Earth Orbit (MEO) and Low Earth Orbit (LEO) satellites over Geostationary Earth Orbit (GEO) satellites, as they offer lower latency and higher throughput. However, the high investments required for satellite internet and connectivity infrastructure remain a challenge for market growth. Despite this, advancements in technology and increasing demand for reliable and uninterrupted connectivity are expected to drive market expansion. The market is poised for robust growth in the coming years, with key players focusing on innovation and cost reduction to cater to the evolving needs of consumers and businesses.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The market is a dynamic and growing industry that focuses on transmitting and receiving communication signals via satellites. This market caters to various sectors including Military and Defense, Mining, Oil & Gas, Telecommunication, Transportation, Rural areas, Finance, Healthcare, and IT connectivity. Advanced satellite broadband is a key driver of this market, providing broadband access to remote and hard-to-reach areas. Innovative technologies such as CubeSats, GPS, and constellation launches are propelling the market forward. Satellite modems are essential for digital communications in various industries, including telecommunication and transportation. PSTN modems and ADSL modems are being gradually replaced by satellite modems due to their ability to provide reliable connectivity in areas where optical fiber cable is not available. Satellite antennae, frequency converters, and symbol clocks are crucial components of satellite modems. The market is expected to witness significant growth due to the increasing demand for digital communications and broadband access in various sectors.

Key Market Driver

Increasing need to enhance offshore communication is notably driving the market growth. Satellite communication plays a crucial role in addressing the connectivity needs of various industries and communities, particularly in offshore environments where laying optical fiber cables or installing cell towers is a significant challenge. Offshore teams, including those in the fishing, sailing, engineering, and tourism industries, require efficient communication networks for transmitting essential information, such as weather updates and operational data. The oil and gas industry, defense and military sectors, and telecommunication companies are major consumers of satellite communication services. Advanced satellite broadband and innovative technologies, such as Low-Earth orbit (LEO) satellites, constellations, and CubeSats, are transforming the satellite industry. These technologies enable high-speed internet access in rural areas and remote locations, enhancing IT connectivity and broadband access. LEO satellites, IoT systems, and 5G networks are expected to revolutionize digital communications, offering faster data transfer rates and lower latency.

In addition, satellite TV services, modem manufacturers, and service providers cater to various industries, including the oil and gas industry, finance, healthcare, and transportation. Satellite antennae, frequency converters, symbol clocks, and PSTN modems are essential components of satellite communication systems. The space economy is growing, with emerging countries investing in satellite technology to improve connectivity and expand their digital infrastructure. Satellite communication is also used in military and defense applications, providing secure and reliable communication channels for various missions. GPS and MEO satellites are critical components of defense and military communication systems. In summary, satellite communication is a vital technology for various industries and communities, enabling efficient communication networks in remote and offshore environments. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

A high preference for MEO and LEO over GEO satellites is the key trend in the market. Satellite modems play a crucial role in facilitating communication signals between Earth and satellites in various orbits, including Geostationary Orbit (GEO) and Low-Earth Orbit (LEO). GEO satellites, situated approximately 35,800 km above the equator, offer extensive coverage but come with challenges such as greater delay and signal losses due to their distance from Earth stations. In contrast, LEO satellites, with their closer proximity to Earth, enable advanced satellite broadband and IoT systems with lower latency. Several industries, including military, defense, mining, oil & gas, telecommunication, transportation, and emerging countries, rely on satellite communication for IT connectivity and broadband access in rural areas.

Innovative technologies like SCPC modems, frequency converters, symbol clock, and CubeSats have revolutionized digital communications, enabling satellite TV services, GPS, MEO satellites, and 5G networks. Modem manufacturers and service providers cater to diverse industries, with the oil & gas industry and finance sectors being significant contributors to the space economy. The healthcare sector also benefits from satellite connectivity for remote patient monitoring and telemedicine services. Despite the advancements in optical fiber cable and ADSL modems, satellite communication continues to play a vital role in ensuring connectivity in regions with limited infrastructure. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

High investments required for satellite internet and connectivity is the major challenge that affects the growth of the market. Satellite modems play a crucial role in facilitating communication signals between Earth and satellites, enabling various industries such as military, defense, mining, oil & gas, telecommunication, transportation, and IT connectivity to access broadband and digital communications in remote areas. Satellite Internet, which utilizes a satellite dish and modem for connectivity, is particularly valuable in rural regions and emerging countries. However, the high investment required for satellite Internet infrastructure poses a significant challenge to market growth. This includes the cost of advanced satellite broadband equipment, such as satellite modems, antennae, frequency converters, and symbol clocks.

Additionally, installation expenses, including professional services for satellite dish installation, add to the overall cost. The oil & gas industry and service providers are major consumers of satellite Internet, utilizing it for operations in harsh environments and offshore drilling sites. Low-Earth orbit satellites, constellations, and innovative technologies, including CubeSats, GPS, and MEO satellites, are driving the space economy by enhancing connectivity in various sectors, including finance, healthcare, and IoT systems. The integration of satellite technology with 5G networks and SCPC Modems further expands its applications and potential for growth. Despite the high investment, satellite modems offer unparalleled connectivity solutions for industries and consumers in need of reliable, high-speed communication in remote locations. Hence, the above factors will impede the growth of the market during the forecast period

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Baylin Technologies Inc - The company offers satellite modem namely AMT 83L through its subsidiary Advantech Wireless.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Applied Satellite Technology Ltd.

- Comtech

- Datum Systems Inc

- EchoStar Corp.

- Gilat Satellite Networks Ltd.

- Iridium Communications Inc.

- NovelSat

- ORBCOMM Inc.

- SATCOM Services Corp.

- SatExpander

- Singapore Technologies Engineering Ltd.

- skyDSL Global GmbH

- Teledyne Technologies Inc.

- THISS Technologies Pte Ltd.

- Thuraya Telecommunications Co.

- Viasat Inc.

- WORK Microwave GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Application

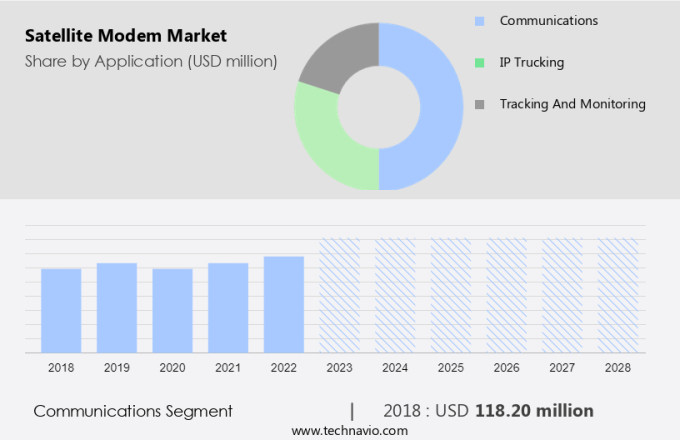

The communication segment is estimated to witness significant growth during the forecast period. Satellite modems play a crucial role in transmitting communication signals between Earth and satellites in various industries such as military and defense, mining, oil & gas, telecommunication, transportation, and internet. With the increasing demand for IT connectivity and broadband access in rural areas, advanced satellite broadband solutions using low-Earth orbit satellites and constellations are gaining popularity. Innovative technologies like digital communications, optical fiber cable, and symbol clock are being integrated into satellite modems to enhance performance. Satellite modems are essential for industries like oil & gas, where real-time data transmission is critical.

Get a glance at the market share of various regions Download the PDF Sample

The communication segment was the largest and was valued at USD 118.20 million in 2018. Service providers and modem manufacturers are investing in research and development to offer superior solutions. Emerging countries are also investing in satellite technology to improve connectivity in remote areas. LEO satellites, IoT systems, 5G networks, and CubeSats are the latest trends in the satellite industry. The space economy is expanding, with applications in finance, healthcare, and other sectors. Military and defense use satellite modems for secure communication, while satellite TV services use them for broadcasting. Satellite antennae, frequency converters, and SCPC modems are some of the key components of satellite communication systems. GPS and MEO satellites are also used for navigation and location-based services.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

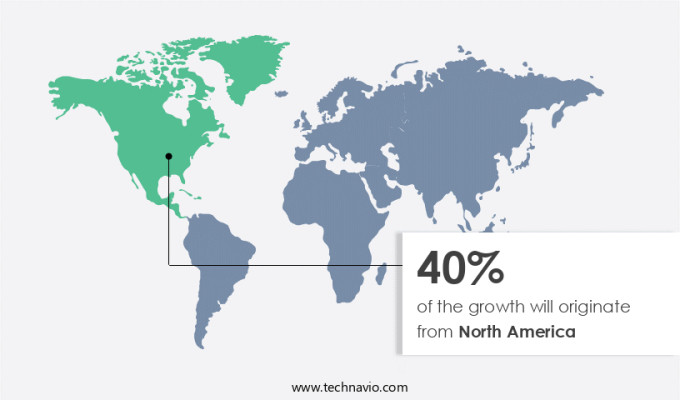

North America is estimated to contribute 40% to the growth of the global market during the forecast period. The market encompasses various applications such as MCPC Modem for Multichannel Multipoint Distribution System, Mobile & Backhaul for wireless communication, IP-trunking for voice over IP services, Media & Broadcast for television and radio transmission, Marine for maritime communication, Military & Defense for secure communication, and Transportation & Logistics for fleet management and tracking. These applications are witnessing significant growth due to the increasing demand for reliable and high-speed connectivity in remote areas and critical industries. MCPC Modems enable efficient use of satellite bandwidth by multiplexing multiple signals into a single transponder, while IP-trunking provides cost-effective voice services over satellite. Media & Broadcast applications require high-quality, real-time transmission, making satellite modems an essential component. Marine and Military & Defense industries require secure and uninterrupted communication, making satellite modems a preferred choice. Transportation & Logistics sector uses satellite modems for real-time tracking and monitoring of fleets.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD million" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Application Outlook

- Communications

- IP trucking

- Tracking and monitoring

- Type Outlook

- MCPC

- SCPC

- Region Outlook

- North America

- The U.S.

- Canada

- South America

- Chile

- Brazil

- Argentina

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

- Airborne Satcom Market Analysis Europe, North America, APAC, South America, Middle East and Africa - US, UK, France, China, Germany - Size and Forecast

- Gigabit Passive Optical Network (Gpon) Technology Market Analysis APAC, North America, Europe, South America, Middle East and Africa - US, China, Japan, UK, Germany - Size and Forecast

- Home Wi-Fi Router Market Analysis North America, APAC, Europe, South America, Middle East and Africa - US, China, India, Germany, Japan - Size and Forecast

Market Analyst Overview

The market is experiencing significant growth, driven by advancements in satellite technology and increasing demand for connectivity across various sectors. Small Earth Station Terminals and SCPC modems are essential for robust digital communications, enabling high-speed internet and reliable communication signals. PSTN modems and ADSL modems cater to traditional setups, while advanced satellite broadband and LEO satellites push the envelope in connectivity solutions. Emerging constellations and CubeSats enhance broadband access and IT connectivity. Military, defense, oil & gas, and mining industries leverage satellite TV services, GPS, and frequency converters for critical applications. Innovative technologies and 5G networks further boost the market, with service providers and modem manufacturers playing key roles. Emerging countries and space economy developments expand market opportunities in rural areas and transportation sectors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.81% |

|

Market growth 2024-2028 |

USD 147.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.38 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 40% |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Amplus Communication Pte Ltd., Applied Satellite Technology Ltd., AYECKa Ltd., Baylin Technologies Inc, Comtech, Datum Systems Inc, EchoStar Corp., Gilat Satellite Networks Ltd., Iridium Communications Inc., NovelSat, ORBCOMM Inc., SATCOM Services Corp., SatExpander, Singapore Technologies Engineering Ltd., skyDSL Global GmbH, Teledyne Technologies Inc., THISS Technologies Pte Ltd., Thuraya Telecommunications Co., Viasat Inc., and WORK Microwave GmbH |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies