Scientific Instrument Market Size 2024-2028

The scientific instrument market size is forecast to increase by USD 19.97 billion at a CAGR of 5.45% between 2023 and 2028. The market is witnessing significant growth due to several key drivers. One of the primary factors is the increasing investment in the pharmaceutical sector for drug discovery and development. Additionally, the growing adoption of portable scientific instruments in various settings, including hospitals and diagnostic laboratories, is fueling market expansion. However, the lack of adequately trained professionals poses a challenge to the market's growth. Moreover, the public health emergency caused by chronic conditions such as diabetes, respiratory diseases, cardiovascular diseases, and neurological diseases is driving the demand for advanced scientific instruments in healthcare settings. The research segment is also experiencing significant growth due to the increasing focus on developing new therapeutics and treatments for various diseases, particularly in areas like sample preparation and genomics. Laboratory automation is another trend gaining traction in the market due to its ability to increase efficiency and reduce errors in scientific research, genomic studies, and diagnostic proce The market is poised for growth due to the increasing investment in drug discovery, the adoption of portable instruments, and the growing demand for advanced instruments in healthcare and research settings. However, the lack of trained professionals remains a significant challenge that needs to be addressed to fully capitalize on the market opportunities.

What will be the Size of the Market During the Forecast Period?

The market encompasses a wide range of tools utilized in various sectors for measuring, analyzing, verifying, and understanding physical quantities. These instruments play a crucial role in research institutions, laboratories, government agencies, and the pharmaceutical industry, among others. Instruments such as microscopes, spectrometers, x-ray diffraction systems, and thermal analyzers are integral components of scientific research. They facilitate the investigation of various phenomena, from microscopic structures to complex chemical reactions. Laboratories, including those in universities, research institutions, hospitals, and government agencies, are significant consumers of scientific instruments. These facilities rely on advanced, often automated, solutions to ensure accurate data analysis and maintain high standards of research and development.

Moreover, portable and handheld instruments have gained popularity in recent years due to their convenience and versatility. They enable field research, making it possible to collect data in real-time and in various environments. These instruments have proven particularly valuable in sectors like drug safety, public health emergencies, and clinical analyzers. The market caters to diverse industries, including pharmaceuticals, where precise measurements are essential for ensuring product quality and safety. In the context of a public health emergency, these instruments can be invaluable in diagnosing and understanding the nature of the crisis. Data analysis is a critical aspect of scientific research, and scientific instruments play a pivotal role in this process.

Market Segmentation

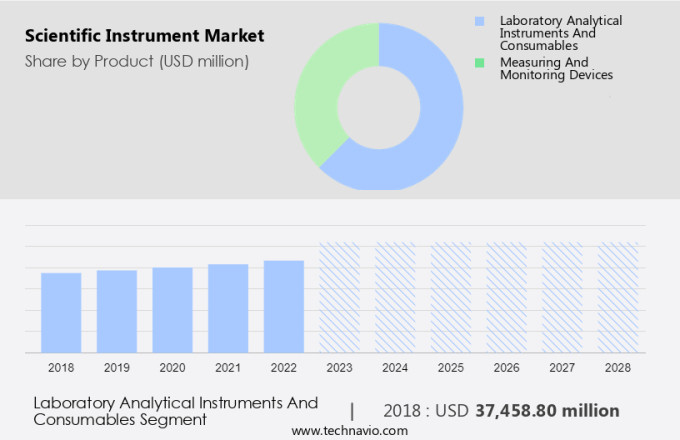

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Laboratory analytical instruments and consumables

- Measuring and monitoring devices

- End-user

- Pharmaceutical and biotechnology companies

- Hospitals and diagnostic laboratories

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- India

- Rest of World (ROW)

- North America

By Product Insights

The laboratory analytical instruments and consumables segment is estimated to witness significant growth during the forecast period. The market encompasses a range of laboratory analytical tools and consumables, such as mass spectrometers, chromatographs, and electron microscopes, which are essential for Environmental Science research in various fields, including metabolomics, genomics, and proteomics. These instruments facilitate the identification and analysis of specific substances using techniques like spectroscopy, mass spectrometry, electrochemical analysis, thermal analysis, separation analysis, and microscopy. Raman spectroscopy, specifically, has gained significant attention in the pharmaceutical industry due to its ability to reveal the chemical structure, concentration, and behavior of molecules in various forms, including solids, liquids, gels, gases, slurries, and powders.

Furthermore, in this sector, Raman spectroscopy plays a crucial role in drug development by determining the structural composition of therapeutic drug agents, defining the structural properties of dynamic molecules, and characterizing intermolecular interactions for drug discovery. Post-approval, Raman spectroscopy is employed to ensure the manufactured drug consists of the intended compound and to detect any potentially harmful substances from packaging that may contaminate the drug. This non-destructive technique offers numerous advantages, such as high sensitivity, rapid analysis, and minimal sample preparation, making it an indispensable tool in the pharmaceutical industry.

Get a glance at the market share of various segments Request Free Sample

The laboratory analytical instruments and consumables segment was valued at USD 37.46 billion in 2018 and showed a gradual increase during the forecast period.

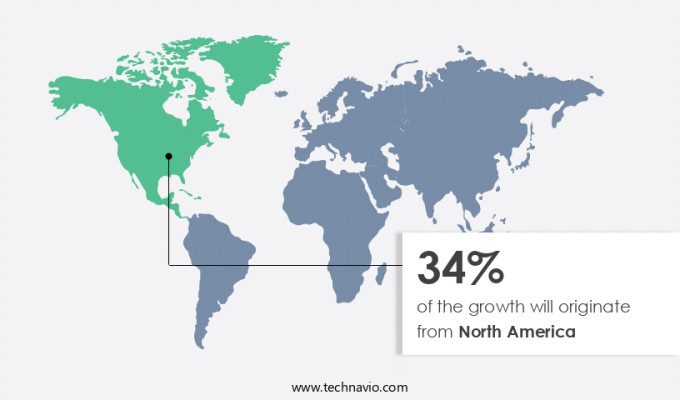

Regional Insights

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market for scientific instruments experiences significant growth due to substantial investments in healthcare research and testing, particularly in the United States. The region's well-established distribution networks for scientific instruments in countries like the US and Canada contribute to market expansion. Furthermore, pharmaceutical companies' heightened focus on drug discovery and development drives the market's growth in North America. Notably, countries in the region have increased their healthcare funding activities, further boosting the demand for scientific instruments. Advanced technologies, such as avionics and environmental monitoring, are essential components of the market in North America. These instruments find extensive applications in various industries, including healthcare, food and beverage, and environmental monitoring.

Specifically, in healthcare, scientific clinical analyzers, chromatographs, and particle analyzers are widely used for analyzing biological samples like blood, urine, and tissue. These instruments aid in determining critical health indicators, such as glucose levels and cholesterol levels, as well as blood cell counts. The market for these instruments is expected to continue growing in the forecast period due to the increasing demand for accurate and efficient diagnostic tools.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing investments in drug discovery is the key driver of the market. In the realm of pharmaceutical and biotech research, the identification of new drugs to combat chronic diseases and personalized medicine is a priority. This focus has led to a significant increase in research and development (R&D) investments. Consequently, the demand for scientific instruments is on the rise, particularly during the initial stages of drug discovery. These instruments facilitate the screening of various compounds, enhancing efficiency, consistency, and precision. Protein targets are crucial in drug discovery, and techniques such as protein crystallization and crystallography are employed to identify them. By determining the structural components of a protein that can be manipulated to suppress or amplify a specific therapeutic function, these methods contribute significantly to the drug discovery process.

Clinical laboratories, medical diagnosis, cancer research, and theoretical research all rely on scientific instruments for measuring, analyzing, and verifying physical quantities. These instruments play a pivotal role in the diagnosis and treatment planning of various diseases, including infectious diseases and cancer. In the biotech and pharmaceutical industries, scientific instruments are indispensable tools for advancing research and development.

Market Trends

The growing adoption of portable scientific instruments is the upcoming trend in the market. The market has witnessed a significant trend towards the development of compact and portable devices to cater to the space constraints in laboratories, particularly for outpatient and inpatient facilities. This demand has driven companies to innovate and redesign their traditional scientific equipment using advanced miniaturization technologies such as fluidics and integrated printed circuit boards (PCBs). Conventional scientific instruments, including laboratory centrifuges, often have wires and components located at the bottom and rear, making them bulky and inefficient.

However, the integration of circuit-based and fluidics-based miniaturization technologies has enabled the elimination of complex wires, pumps, and valves in miniaturized equipment, leading to more compact designs. The use of these technologies not only saves space but also streamlines laboratory workflows, making scientific research more efficient. From a business perspective, this trend presents an opportunity for companies to differentiate themselves in the market and cater to the evolving needs of healthcare and research institutions.

Market Challenge

Lack of trained professionals is a key challenge affecting the market growth. In the dynamic landscape of scientific instruments, advancements are continually reshaping the industry. For industries such as pharmaceuticals and healthcare, staying current with these technological innovations is crucial. However, keeping up with these changes can be challenging for end-users due to the complex nature of scientific instruments and the high cost of acquiring and training a skilled workforce. Clinical analyzers, a significant segment of scientific instruments, are extensively used in hospitals and diagnostic laboratories to diagnose and monitor chronic conditions like diabetes, respiratory diseases, cardiovascular diseases, and neurological diseases. Proper calibration of these instruments is essential to ensure their accuracy and reliability in delivering results.

The research segment, which includes the development of new therapeutics, also relies heavily on scientific instruments for research and development. The use of laboratory automation has become increasingly popular to streamline processes and improve efficiency. Calibration of scientific instruments is a specialized skill that requires technical expertise. Outsourcing this function to third-party providers can help ensure that instruments are calibrated correctly and maintain their accuracy. This approach can save time and resources for end-users, allowing them to focus on their core business functions. In conclusion, scientific instruments play a vital role in the healthcare industry, particularly in the diagnosis and monitoring of chronic conditions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ABB Ltd. - The company offers a wide range of scientific instruments. Under the electrification segment, the company offers solutions across the full electrical value chain from the substation to the point of consumption.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACMAS Technologies Pvt. Ltd.

- Agilent Technologies Inc.

- Alcon Scientific

- Bio Rad Laboratories Inc.

- Bruker Corp.

- Carl Zeiss AG

- Danaher Corp.

- Hitachi Ltd.

- HORIBA Ltd.

- Labappara

- M.K.Scientific Instruments

- MAC

- Merck KGaA

- Oxford Instruments plc

- Shimadzu Corp.

- SM Scientific Instruments Pvt. Ltd.

- Thermo Fisher Scientific Inc.

- Thorlabs Inc.

- Waters Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of tools utilized in various industries for measuring, analyzing, and verifying physical quantities. These instruments play a crucial role in sectors such as biotechnology, materials science, environmental science, and healthcare companies. Products include microscopes like electron and DNA sequencers, spectrometer systems, mass spectrometers, particle accelerators, and molecular analyzers. Biomarker detection systems, drug development, and precision medicine are significant applications. Pharmaceutical companies, academic institutions, private organizations, and startups are key buyers. Portable and handheld instruments facilitate field research and biotechnology research.

Further, applications span from chronic diseases like diabetes and its complications, infectious diseases, and cancer to aerospace engineering, celestial bodies exploration, and avionics technology. Environmental monitoring, quality control, and laboratory automation are other essential areas. Scientific clinical analyzers process biological samples such as blood, urine, and tissue for medical diagnosis and treatment planning. Instruments are used in pharmaceutical sectors, public health emergencies, hospitals, and diagnostic laboratories. The research segment focuses on developing automated solutions for data analysis and improving instruments for therapeutics, outpatients, and inpatients.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.45% |

|

Market Growth 2024-2028 |

USD 19.97 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.77 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 34% |

|

Key countries |

US, China, Germany, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ABB Ltd., ACMAS Technologies Pvt. Ltd., Agilent Technologies Inc., Alcon Scientific, Bio Rad Laboratories Inc., Bruker Corp., Carl Zeiss AG, Danaher Corp., Hitachi Ltd., HORIBA Ltd., Labappara, M.K.Scientific Instruments, MAC, Merck KGaA, Oxford Instruments plc, Shimadzu Corp., SM Scientific Instruments Pvt. Ltd., Thermo Fisher Scientific Inc., Thorlabs Inc., and Waters Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch