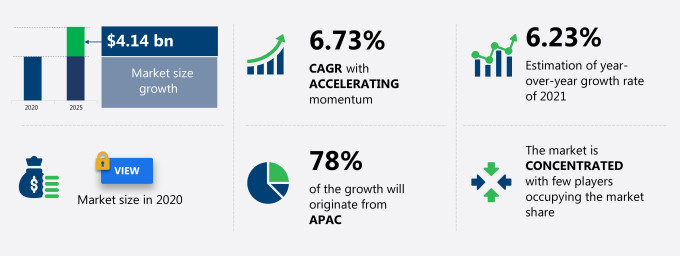

The semiconductor silicon wafer market share is expected to increase by USD 4.14 billion from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 6.73%.

This semiconductor silicon wafer market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers semiconductor silicon wafer market segmentation by application (consumer electronics, telecommunication, automotive, and others) and geography (APAC, North America, Europe, South America, and MEA). The semiconductor silicon wafer market report also offers information on several market vendors, including Addison Engineering Inc., GlobalWafers Co. Ltd., Lanco Infratech Ltd., Okmetic Oy, Shin-Etsu Chemical Co. Ltd., Siltronic AG, SK Siltron Co. Ltd., SUMCO Corp., Virginia Semiconductor Inc., and Wafer World Inc. among others.

What will the Semiconductor Silicon Wafer Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Semiconductor Silicon Wafer Market Size for the Forecast Period and Other Important Statistics

Semiconductor Silicon Wafer Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post-COVID-19 era. The emergence of advanced and compact consumer electronic devices is notably driving the semiconductor silicon wafer market growth, although factors such as high inventory levels in the supply chain may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the semiconductor silicon wafer industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Semiconductor Silicon Wafer Market Driver

One of the key factors driving growth in the semiconductor silicon wafer market is the emergence of advanced and compact consumer electronic devices. Smartphones have replaced feature phones, laptops have replaced PCs, and now tablets are replacing laptops. Light-emitting diode (LED) TVs and organic light-emitting diode (OLED) TVs, too, are replacing cathode-ray tube (CRT) TVs. Application developers and manufacturers are trying to incorporate further transformation by interconnecting household devices via a single unit called smart home, which is controlled by applications installed on smartphones. With fast innovation and the rising demand for advanced electronics, manufacturers are focusing on delivering better consumer products with enhanced functionalities. The demand for compact electronic devices in almost all sectors has forced semiconductor IC manufacturers to decrease the size and increase the performance of ICs, leading to the increased demand for silicon wafers.

Key Semiconductor Silicon Wafer Market Trend

The continuous decrease of lithography wavelength is another factor supporting the semiconductor silicon wafer market share growth. A photomask is an opaque plate with a precision image of ICs. On exposing the photomasks to ultraviolet light at wavelengths of 365 nm, 248 nm, and 193 nm, an identical image of the design onto the silicon wafers is produced. The ever-decreasing feature size and increase in chip density have increased the complexity of wafers. This has resulted in a steady reduction in lithography wavelength over the years from 365 nm to a now common 193 nm to manufacture a structure lower than 30 nm on the wafer. With the advent of 10 nm node size in 2017, extreme ultraviolet (EUV) lithography is anticipated to get commercialized for manufacturing ICs. Without EUV, chipmakers will have to use expensive multiple patterning systems to achieve the required feature sizes. Even for the 7-nm node size, which was commercialized by mid-2019, EUV lithography needs to be used. With the growing EUV lithography, the demand for silicon wafers is also increasing.

Key Semiconductor Silicon Wafer Market Challenge

The high inventory levels in the supply chain will be a major challenge for the semiconductor silicon wafer market vendors during the forecast period. The semiconductor industry is cyclical in nature, which affects the operating results of the semiconductor vendors due to severe downturns. Semiconductor manufacturers face risks such as overcapacity, decreased demand, and increased price competition. Changes in customer requirements due to new manufacturing capacity and advances in technology affect semiconductor manufacturers considerably. All these factors eventually result in excess inventory, which is a major challenge for the vendors. The global silicon wafers market also favors buyers. Wafer manufacturers are unable to enter into long-term contracts due to oversupply, forcing them to reduce contract volumes to maintain contract prices.

This semiconductor silicon wafer market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the semiconductor silicon wafer market as a part of the global semiconductors market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the semiconductor silicon wafer market during the forecast period.

Who are the Major Semiconductor Silicon Wafer Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Addison Engineering Inc.

- GlobalWafers Co. Ltd.

- Lanco Infratech Ltd.

- Okmetic Oy

- Shin-Etsu Chemical Co. Ltd.

- Siltronic AG

- SK Siltron Co. Ltd.

- SUMCO Corp.

- Virginia Semiconductor Inc.

- Wafer World Inc.

This statistical study of the semiconductor silicon wafer market encompasses successful business strategies deployed by the key vendors. The semiconductor silicon wafer market is concentrated and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

-

Addison Engineering Inc. - The company offers a range of silicon wafers such as extra thick wafers, extra thin wafers, silicon rings, quartz, pyrex among others.

To make the most of the opportunities and recover from the post-COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The semiconductor silicon wafer market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Semiconductor Silicon Wafer Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the semiconductor silicon wafer market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chains is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the global semiconductors market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Semiconductor Silicon Wafer Market?

For more insights on the market share of various regions Request for a FREE sample now!

78% of the market’s growth will originate from APAC during the forecast period. Taiwan, South Korea (Republic of Korea), China, and Japan are the key markets for semiconductor silicon wafers in APAC. Market growth in this region will be faster than the growth of the market in other regions.

The high quantity of raw materials and the low establishment and labor costs will facilitate the semiconductor silicon wafer market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

What are the Revenue-generating Application Segments in the Semiconductor Silicon Wafer Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The semiconductor silicon wafer market share growth in the consumer electronics segment will be significant during the forecast period. With the introduction of smartphones, which were quickly adopted by the masses, the demand for better-powered and smaller-sized ICs scaled up. Since 2016, there have been around 2 billion smartphone users. With such deep penetration of smartphones in the global market, silicon wafers, which form the core of performance for smartphones, are also in demand. An increasing number of consumers want smart, efficient, and power-saving household equipment.

This report provides an accurate prediction of the contribution of all the segments to the growth of the semiconductor silicon wafer market size and actionable market insights on post-COVID-19 impact on each segment.

|

Semiconductor Silicon Wafer Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.73% |

|

Market growth 2021-2025 |

$ 4.14 billion |

|

Market structure |

Concentrated |

|

YoY growth (%) |

6.23 |

|

Regional analysis |

APAC, North America, Europe, South America, and MEA |

|

Performing market contribution |

APAC at 78% |

|

Key consumer countries |

Taiwan, South Korea (Republic of Korea), China, Japan, and US |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Addison Engineering Inc., GlobalWafers Co. Ltd., Lanco Infratech Ltd., Okmetic Oy, Shin-Etsu Chemical Co. Ltd., Siltronic AG, SK Siltron Co. Ltd., SUMCO Corp., Virginia Semiconductor Inc., and Wafer World Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Semiconductor Silicon Wafer Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive semiconductor silicon wafer market growth during the next five years

- Precise estimation of the semiconductor silicon wafer market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the semiconductor silicon wafer industry across APAC, North America, Europe, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of semiconductor silicon wafer market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch