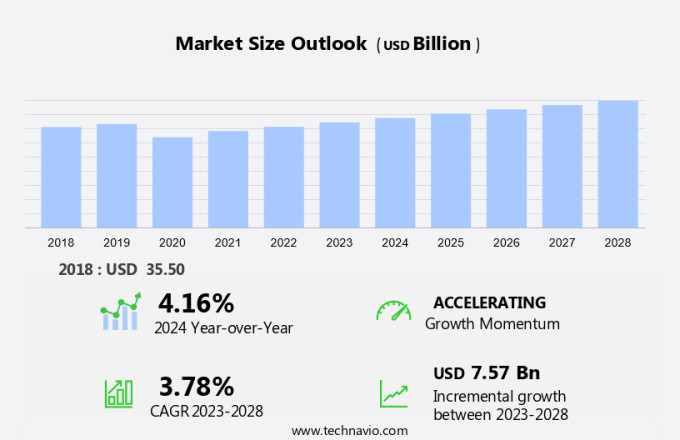

Ship Loader And Unloader Market Size 2024-2028

The ship loader and unloader market size is forecast to increase by USD 7.57 billion at a CAGR of 3.78% between 2023 and 2028. The market is witnessing significant growth due to the increasing demand for handling bulk cargo at cargo terminals. This trend is driven by the surge in government spending on infrastructure development, particularly in the construction sector, which relies heavily on the transportation of cement and other bulk materials via ships. Technological advancements in ship loaders and unloaders, such as the use of high-rise structures and automation, are also contributing to market growth. However, the high cost of installation and maintenance of these systems remains a challenge for market participants.

The market is witnessing significant growth due to the increasing demand for efficient cargo handling solutions in various industries such as mining, construction, manufacturing, and sea ports and cargo terminals. The market is driven by the need to transport large quantities of raw materials like grains, coal, composites, metals, and cement with high tonnage capacity. The unloader machine plays a crucial role in the efficient operation of sea ports and cargo terminals. These machines are designed to handle bulk type cargoes, including grains, coal, and other commodities, with ease and precision.

The technology used in ship loaders and unloaders has evolved significantly over the years, enabling faster and more efficient cargo handling. The mining industry is a major consumer of ship loader and unloader technology due to the large volumes of raw materials that need to be transported. The construction industry also relies heavily on these machines to transport cement and other building materials to high-rise structures. In the manufacturing sector, the need for just-in-time delivery of raw materials has led to an increased demand for efficient cargo handling solutions. Sea ports and cargo terminals are the primary users of ship loaders and unloaders.

The surge in government spending on infrastructure development and the relaxation of lockdown measures have led to an increase in cargo handling activities at these facilities. The demand for these machines is expected to remain strong in the coming years. The product type of ship loaders and unloaders can vary based on the specific application and the type of cargo being handled. Bulk type cargoes require specialized equipment, such as conveyor belts and cranes, to ensure efficient and safe handling. The technology used in these machines is constantly evolving to meet the changing demands of the industry. The region's strategic location and robust infrastructure make it an ideal hub for the transportation of raw materials and finished goods. The growth of the region's manufacturing sector is also expected to drive demand for these machines in the coming years. In conclusion, the market is expected to grow significantly in the coming years due to the increasing demand for efficient cargo handling solutions in various industries. The technology used in these machines is constantly evolving to meet the changing demands of the industry, and the need for faster and more efficient cargo handling is driving innovation in this space.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product Type

- Stationary

- Mobile

- Type

- Dry

- Liquid

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Product Type Insights

The stationary segment is estimated to witness significant growth during the forecast period. The stationary segment of the global market for ship loaders and unloaders plays a pivotal role in ensuring efficient and dependable bulk cargo handling at ports and terminals globally. These stationary installations are designed to load and unload bulk materials, including coal, ore, grains, and other commodities, onto and off shipping vessels with accuracy and speed. The stationary segment comprises a vast array of equipment and systems that remain fixed in place, delivering consistent and durable performance in managing diverse types of cargo. One significant advantage of stationary ship loaders and unloaders is their stability and reliability in handling bulk cargo operations.

These systems offer enhanced productivity and minimize downtime, making them indispensable in the maritime industry. Despite the challenges posed by lockdowns and other disruptions, the demand for stationary ship loaders and unloaders remains strong due to the increasing need for efficient and effective bulk cargo handling. In the US market, Newport News and other major ports continue to invest in advanced technology and innovative solutions to optimize their bulk cargo handling capabilities. These investments are expected to drive growth in the stationary the market in the coming years. Overall, the stationary segment is poised to continue its dominance in The market, providing essential services to keep international trade flowing smoothly.

Get a glance at the market share of various segments Request Free Sample

The Stationary segment accounted for USD 20.19 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market for ship loading and unloading machinery in the Asia Pacific (APAC) region is projected to expand significantly over the upcoming years. The region's high trading volumes and robust economic growth fuel the necessity for efficient port and shipping terminal operations. Countries such as China, Japan, South Korea, and Singapore, which are home to some of the world's busiest ports, manage a substantial share of global maritime trade. To accommodate larger vessels and enhance cargo-handling efficiency, these nations have invested heavily in expanding and modernizing their port facilities. For instance, China's Belt and Road Initiative (BRI) has led to the establishment of new ports and the expansion of existing ones along the Maritime Silk Road, thereby strengthening the region's connectivity and trade relationships with Europe, Africa, and the Middle East.

Mechanical, pneumatic, and liquid handling systems dominate the market in APAC, with revenue predominantly generated from the loading and unloading of containers and bulk cargo.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing demand for handling of bulk cargo is the key driver of the market. Marine transport plays a crucial role in global trade and the manufacturing supply chain, as approximately 70% of the world's merchandise is transported via sea. This volume has grown by nearly 10% over the last decade due to rising consumer demand in developing countries. As a result, the need for efficient loading and unloading of goods at ports has become increasingly important. Ship loaders and unloaders, also known as unloader machines, play a vital role in this process for commodities such as grains, coal, and composites. The demand for these machines has increased significantly in the past five years due to the surge in international trade.

The maritime transport sector has experienced notable growth, leading to a substantial increase in imports and exports worldwide. Consequently, the demand for ship loaders and unloaders is expected to continue growing during the forecast period.

Market Trends

Technological advancements in ship loaders and unloaders is the upcoming trend in the market. companies in the market are expanding their businesses to enhance their presence and gain a larger market share. One example is Liebherr, which invested approximately USD60 million in July 2020 to expand its campus in Newport News, Virginia. This expansion added 251,000 sq. Ft. To the existing facility in North America, including new warehouse space, equipment repair facilities, modern office buildings, and a maintenance workshop for ship loaders and related products. By expanding, Liebherr aims to strengthen its competitive position and better serve customers at cargo terminals across the region. Other companies are also pursuing similar growth strategies to meet the increasing demand for efficient cargo handling solutions at high-rise structures, such as those used for handling cement and other bulk materials.

Key trends in the market include the increasing adoption of automation and electrification, the growing demand for larger and more versatile ship loaders and unloaders, and the rising focus on sustainability and energy efficiency. Companies are also investing in research and development to introduce new products and technologies that meet the evolving needs of their customers. For instance, Liebherr recently launched its new LHM 550 HS ship loader, which features a new design and advanced technology to improve productivity and reduce emissions. Similarly, Konecranes introduced its new Generation 6 mobile harbor cranes, which offer increased lifting capacity, improved energy efficiency, and enhanced safety features.

Overall, the market is a dynamic and innovative industry that is poised for significant growth in the coming years. Companies that can adapt to changing market conditions and customer needs will be well-positioned to succeed in this competitive landscape.

Market Challenge

High cost of installation and maintenance of ship loaders and unloaders is a key challenge affecting the market growth. Ship loaders and unloaders are essential components in the maritime industry, particularly in the handling of metals such as iron and steel. The cost and availability of these raw materials significantly impact the shipbuilding market. The price of iron and steel has experienced volatility since 2016, and this trend is anticipated to continue during the forecast period. This price instability may pose challenges for the growth of the market, particularly in industries such as mining, construction, and manufacturing, which rely heavily on these materials. Sea ports also play a crucial role in the supply chain of these industries, and any disruptions in their operations due to raw material price fluctuations can further impede market expansion. Therefore, monitoring and managing the cost and availability of raw materials is crucial for the success of businesses in the shipbuilding sector.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Astec Industries Inc. - Our company provides a range of ship loading and unloading solutions, including mobile radial telescopic loaders, truck unloaders, direct feed ship loaders, and rail-mounted ship loaders. These advanced systems ensure efficient and effective cargo handling at ports and terminals. By utilizing the latest technology and engineering innovations, we cater to the diverse needs of our clients in the maritime industry. Our offerings enhance operational productivity and contribute to the smooth flow of global trade.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Astec Industries Inc.

- AUMUND Fordertechnik GmbH

- Beumer Group GmbH and Co. KG

- Buhler AG

- Cargotec Corp.

- Dana Inc.

- EMS Tech Inc.

- FLSmidth and Co. AS

- Jiangsu Rainbow Heavy Industries Co. Ltd.

- Konecranes

- Liebherr International AG

- Metso Outotec Corp.

- NEUERO Industrietechnik fur Forderanlagen GmbH

- Sandvik AB

- SENNEBOGEN Maschinenfabrik GmbH

- Shanghai Zhenhua Heavy Industries Co. Ltd.

- SMB International GmbH

- Sumitomo Heavy Industries Ltd.

- Telestack Ltd.

- Tenova Spa

- thyssenkrupp AG

- VIGAN Engineering SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the sales of various types of machinery used for loading and unloading bulk materials from ships at sea ports and cargo terminals. These machines are essential for handling grains, coal, composites, metals, and other raw materials with high tonnage capacity. The mining, construction, and manufacturing industries heavily rely on these machines to ensure a steady supply chain. The unloader market includes both stationary and mobile machines, available in dry and liquid variants, and operated mechanically or pneumatically. The technology used in these machines has seen significant advancements, enabling higher tonnage capacities and improved efficiency. The surge in government spending on infrastructure development, particularly in urbanisation and the Gulf Cooperation Council (GCC) region, has led to a growing demand for ship loaders and unloaders.

The market for these machines is expected to witness robust growth in the coming years, with revenue dominance from bulk materials such as cement and coal. The competitive outlook for the market is positive, with numerous opportunities for growth. The market is expected to benefit from the increasing demand for high-rise structures and the need for efficient and cost-effective solutions for handling bulk materials. The lockdowns and disruptions caused by the pandemic have highlighted the importance of a reliable and efficient supply chain, further boosting the demand for these machines.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.78% |

|

Market growth 2024-2028 |

USD 7.57 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.16 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 42% |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Astec Industries Inc., AUMUND Fordertechnik GmbH, Beumer Group GmbH and Co. KG, Buhler AG, Cargotec Corp., Dana Inc., EMS Tech Inc., FLSmidth and Co. AS, Jiangsu Rainbow Heavy Industries Co. Ltd., Konecranes, Liebherr International AG, Metso Outotec Corp., NEUERO Industrietechnik fur Forderanlagen GmbH, Sandvik AB, SENNEBOGEN Maschinenfabrik GmbH, Shanghai Zhenhua Heavy Industries Co. Ltd., SMB International GmbH, Sumitomo Heavy Industries Ltd., Telestack Ltd., Tenova Spa, thyssenkrupp AG, and VIGAN Engineering SA |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch