Smartphone RF Power Amplifier Market Size 2024-2028

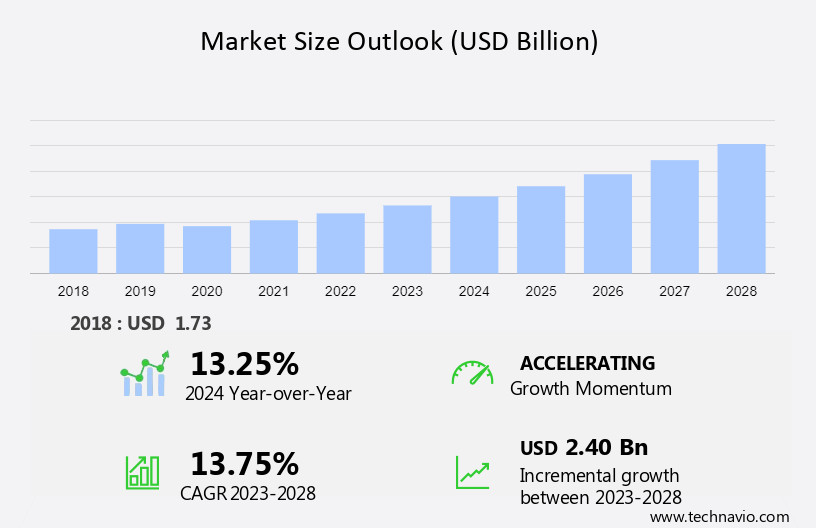

The smartphone rf power amplifier market size is forecast to increase by USD 2.40 bn at a CAGR of 13.75% between 2023 and 2028.

- The market is experiencing significant growth due to the rising adoption of smartphones and the emergence of high-powered electronic devices. The complexity of RF power amplifier designs is increasing in response to the demand for improved signal quality and power efficiency. This trend is driving innovation In the market, with manufacturers focusing on developing advanced technologies such as gallium nitride (GaN) and silicon carbide (SiC) power amplifiers to meet the demands of the industry.

- Additionally, the integration of features like adaptive power control and dynamic power management is becoming increasingly important to optimize power consumption and enhance user experience. Overall, the market is expected to continue its growth trajectory In the coming years, driven by these key trends and the ongoing development of advanced technologies.

What will be the Size of the Smartphone RF Power Amplifier Market During the Forecast Period?

- The RF power amplifier market for smartphones is experiencing significant growth due to the increasing demand for advanced wireless communication technologies. Dynamic power ranges are essential to accommodate various RF applications, including satellite communications, radar systems, and cellular networks. The market is witnessing a shift towards higher frequencies, requiring amplifiers with lower noise parameters to maintain signal integrity. Gallium nitride (GaN) and gallium arsenide (GaAs) are popular materials for RF power amplifiers due to their high power handling capabilities and efficiency. The proliferation of RF technologies in consumer electronics, such as Android and iOS system smartphones, is driving the market's expansion.

- The market's size is expected to grow substantially, fueled by the increasing adoption of 5G applications and the need for linearity, power consumption efficiency, and energy dissipation management in wireless transmitters. Modulation oscillator circuits, buffer stages, and intermediate amplification stages are critical components of RF power amplifiers, while antennas and receivers ensure optimal signal-to-noise ratios. Silicon germanium (SiGe) is another emerging material for RF power amplifiers, offering improved power efficiency and linearity. Overall, the RF power amplifier market is poised for continued growth, driven by the ubiquity of wireless communication technologies and the increasing demand for high-performance, energy-efficient solutions.

How is this Smartphone RF Power Amplifier Industry segmented and which is the largest segment?

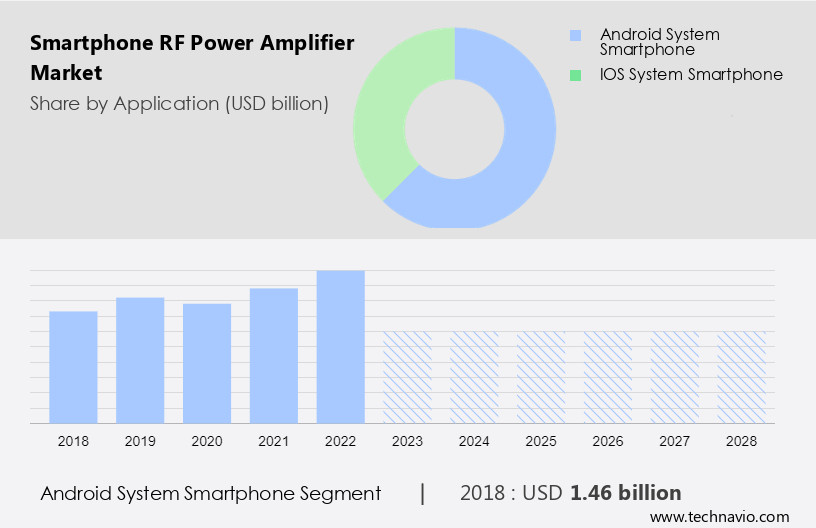

The smartphone rf power amplifier industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Android system smartphone

- iOS system smartphone

- Technology

- GaAs

- GaN

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Europe

- South America

- Middle East and Africa

- APAC

By Application Insights

- The android system smartphone segment is estimated to witness significant growth during the forecast period.

The global RF power amplifier market encompasses various industries, including consumer electronics, aerospace and defense, automotive, medical, semiconductor, satellite communications, radar systems, cellular networks, and more. RF power amplifiers are essential components in wireless transmitters, modulation oscillator circuits, buffer stages, intermediate amplification stages, antennas, receivers, and signal-to-noise ratio enhancement. Technologies such as gallium nitride (GaN), gallium arsenide (GaAs), CMOS, silicon germanium, and next-generation electronic components are driving the market's growth. The market caters to diverse applications, including 5G networks, mobile devices, Internet of Things, connected cars, variable gain amplifiers, signal reception, signal transmission, audio systems, music streaming services, home theater systems, and digital audio formats.

Millimeter-wave applications, defense, aerospace, telecommunications industries, wireless communication systems, and energy and utilities are also significant end-users. Key factors influencing the market include linearity, power consumption, energy dissipation, battery life, portability, and millimeter-wave applications. High linearity amplifiers are essential for maintaining signal quality in wireless communication systems, while power consumption and energy dissipation are crucial for extending battery life and ensuring portability. The RF power amplifier market is expected to grow significantly due to the increasing demand for wireless communication systems, 5G applications, and the proliferation of smart homes, voice assistants, and wireless audio systems. The market is expected to witness substantial growth In the defense, aerospace, and satellite communication sectors due to the need for high-power amplifiers for defense avionics, broadcast transmitters, and defense avionics.

Get a glance at the market report of various segments Request Free Sample

The Android system smartphone segment was valued at USD 1.46 bn in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 74% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is a significant segment of the Electronic Amplifier Market, driven by the increasing demand for advanced wireless communication systems in consumer electronics, aerospace and defense, automotive, medical, and semiconductor industries. The market is characterized by the adoption of next-generation RF technologies, including Gallium nitride (GaN), Gallium arsenide (GaAs), CMOS, silicon germanium, and dynamic power ranges. These technologies enable higher frequencies, lower noise parameters, and improved linearity, power consumption, and signal-to-noise ratio. Key applications include satellite communications, radar systems, cellular networks, and 5G networks. The market caters to various sectors, including defense, aerospace, telecommunications, mobile devices, Internet of Things, connected cars, and consumer electronics.

Millimeter-wave applications are gaining traction due to the growing demand for high-speed wireless communication (sensor) systems. The APAC region is the largest market for RF power amplifiers, driven by the presence of major smartphone OEMs, low production costs, and business-friendly government policies. Key players include Texas Instruments, Analog Devices, and other semiconductor IC manufacturers. The market is expected to grow due to the increasing adoption of RF power amplifiers in wireless transmitters, modulation oscillator circuits, buffer stages, intermediate amplification stages, antennas, receivers, and other wireless communication systems. Energy dissipation and battery life remain critical challenges, necessitating the development of high linearity amplifiers and efficient power management systems.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Smartphone RF Power Amplifier Industry?

Rising adoption of smartphones is the key driver of the market.

- The RF power amplifier market is experiencing significant growth due to the increasing demand for advanced RF technologies in various industries, including consumer electronics, aerospace and defense, automotive, medical, and semiconductor industries. RF power amplifiers are essential components in wireless communication systems, such as satellite communications, radar systems, cellular networks, and 5G applications. These amplifiers enable efficient signal transmission and reception, with dynamic power ranges and lower noise parameters becoming increasingly important for next-generation electronic components. GaAs and gallium nitride (GaN) are popular materials for RF power amplifiers due to their high power handling capabilities and frequency compatibility with various wireless communication systems.

- In the consumer electronics sector, the proliferation of Android system smartphones and the increasing adoption of 5G technologies are driving the demand for RF power amplifiers with higher linearity, lower power consumption, and improved energy efficiency. Moreover, the growth of wireless transmitters, modulation oscillator circuits, buffer stages, and intermediate amplification stages in wireless communication systems necessitates the use of advanced RF power amplifiers. These components are crucial in antenna design, receiver sensitivity, and signal-to-noise ratio, all of which are essential for high-performance wireless communication systems. The telecommunications industries, including defense, aerospace, and energy and utilities, also rely heavily on RF power amplifiers for their wireless communication systems.

- Millimeter-wave applications, such as defense avionics and broadcast transmitters, require high linearity amplifiers for efficient signal transmission and reception. In summary, the RF power amplifier market is poised for substantial growth due to the increasing demand for advanced wireless communication systems in various industries. The use of next-generation electronic components, such as GaAs and GaN, and the adoption of 5G technologies are key drivers of this growth. The market dynamics are shaped by factors such as linearity, power consumption, energy dissipation, battery life, portability, and millimeter-wave applications.

What are the market trends shaping the Smartphone RF Power Amplifier Industry?

Emergence of high-powered electronic devices is the upcoming market trend.

- RF power amplifiers play a crucial role in enabling advanced functionalities in consumer electronic devices, including satellite communications, radar systems, cellular networks, and 5G applications. These amplifiers require next-generation electronic components, such as gallium nitride (GaN) and gallium arsenide (GaAs), to meet the demands for higher frequencies, lower noise parameters, and higher linearity. GaAs and GaN semiconductor devices offer energy efficiency and compactness, making them suitable for use in mobile devices, wireless transmitters, modulation oscillator circuits, buffer stages, and intermediate amplification stages. The semiconductor industries are investing heavily In the development of these components to cater to the needs of various industries, including aerospace and defense, automotive, medical, and telecommunications.

- The RF power amplifier market is driven by the increasing demand for wireless communication systems, 5G networks, and the Internet of Things, which require high-performance, energy-efficient components for signal reception and transmission. The market is also influenced by the growing popularity of audio systems, music streaming services, home theater systems, and digital audio formats, which require high linearity amplifiers for superior sound quality. Energy dissipation and battery life are critical concerns in portable devices, making the development of power-efficient RF power amplifiers essential. Millimeter-wave applications, defense, aerospace, and broadcast transmitters also require high-power RF amplifiers for efficient signal transmission. Overall, the RF power amplifier market is expected to grow significantly due to the increasing demand for wireless communication systems, energy-efficient components, and advanced functionalities in various industries.

What challenges does the Smartphone RF Power Amplifier Industry face during its growth?

Increase in design complexity of RF power amplifiers is a key challenge affecting the industry growth.

- The RF power amplifier market is experiencing significant growth due to the increasing complexity of consumer electronics, particularly in smartphones. As devices become more advanced, with larger screens, metallic cases, and higher camera resolutions, the demand for stronger RF signals to maintain connectivity is increasing. This requires RF power amplifiers to deliver more power, leading to a greater focus on next-generation electronic components such as gallium nitride, gallium arsenide, CMOS, silicon germanium, and variable gain amplifiers. The integration of various functionalities and applications on a single IC has increased the complexity of RF power amplifier design. In response, manufacturers are constantly innovating and adapting to new technologies, including 5G applications, satellite communications, radar systems, cellular networks, and millimeter-wave applications.

- The semiconductor industries, aerospace and defense, automotive, medical, telecommunications, and defense avionics sectors are major contributors to the RF power amplifier market. Key applications include wireless transmitters, modulation oscillator circuits, buffer stages, intermediate amplification stages, and antennas in receivers and signal transmission systems. The importance of RF power amplifiers extends beyond consumer electronics to include industries such as energy and utilities, broadcast transmitters, and Internet of Things applications. With the growing importance of wireless communication systems, including 5G networks, mobile devices, and connected cars, the demand for high linearity amplifiers and efficient power consumption is increasing. Signal-to-noise ratio and energy dissipation are critical factors In the design and development of RF power amplifiers.

- Ensuring low noise parameters and minimizing energy dissipation are essential for maintaining battery life and portability in mobile devices. In summary, the RF power amplifier market is driven by the increasing complexity of electronic devices and the growing importance of wireless communication systems. Manufacturers must continually innovate and adapt to new technologies to meet the demands of various industries, including consumer electronics, aerospace and defense, automotive, medical, and telecommunications.

Exclusive Customer Landscape

The smartphone rf power amplifier market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smartphone rf power amplifier market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smartphone rf power amplifier market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Analog Devices Inc. - The company specializes in manufacturing RF power amplifier modules for smartphones, delivering superior performance with high linearity, minimal noise figures, and reduced phase noise.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Analog Devices Inc.

- Broadcom Inc.

- CML Microcircuits UK Ltd.

- Eliterfllc

- Empower RF Systems Inc.

- Frontgrade Technologies

- Infineon Technologies AG

- KeyLink Microwave

- MACOM Technology Solutions Inc.

- Mercury Systems Inc.

- Microchip Technology Inc.

- Murata Manufacturing Co. Ltd.

- NXP Semiconductors NV

- Qorvo Inc.

- QSC LLC

- Qualcomm Inc.

- SHF Communication Technologies AG

- Skyworks Solutions Inc.

- Spectrum Control Microelectronics Ltd.

- Texas Instruments Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The RF power amplifier market encompasses a diverse range of technologies and applications, driven by the increasing demand for advanced wireless communication systems. These amplifiers play a crucial role in enhancing the power and efficiency of radio frequency signals, enabling seamless connectivity in various industries. RF power amplifiers are integral components in numerous applications, including satellite communications, radar systems, and cellular networks. In satellite communications, these amplifiers amplify the power of transmitted signals to ensure reliable and robust communication over long distances. In radar systems, they amplify the power of transmitted radio waves to detect and locate objects. In cellular networks, they amplify the power of signals to extend coverage and improve network performance.

The RF power amplifier market is witnessing significant growth due to the increasing adoption of next-generation electronic components, such as gallium nitride (GaN), gallium arsenide (GaAs), CMOS, silicon germanium, and other advanced materials. These components offer higher frequencies, lower noise parameters, and improved linearity, making them ideal for use in RF power amplifiers. The demand for RF power amplifiers is also driven by the proliferation of wireless communication systems in various industries. In the telecommunications industry, the rollout of 5G networks is expected to fuel the growth of the RF power amplifier market, as these networks require more powerful and efficient amplifiers to support higher frequencies and lower latency.

In the consumer electronics industry, the increasing popularity of mobile devices, smart homes, and voice assistants is driving the demand for RF power amplifiers in wireless transmitters and receivers. The RF power amplifier market is also witnessing significant growth In the aerospace and defense industry, where these amplifiers are used in defense avionics, satellite communication, and radar systems. In the automotive industry, RF power amplifiers are used in wireless communication systems for connected cars. In the medical industry, they are used in wireless transmitters and receivers for medical telemetry and imaging systems. The RF power amplifier market is characterized by dynamic power ranges, energy dissipation, signal-to-noise ratio, and power consumption.

These factors are critical in determining the performance and efficiency of RF power amplifiers. Higher linearity amplifiers are preferred in applications where low distortion is essential, such as in audio systems, music streaming services, and home theater systems. Variable gain amplifiers are used in applications where the gain needs to be adjusted dynamically, such as in mobile devices and wireless audio systems. The RF power amplifier market is also witnessing significant growth in millimeter-wave applications, where the demand for high-power and efficient amplifiers is increasing due to the proliferation of 5G networks and other wireless communication systems. The market is expected to continue growing In the coming years, driven by the increasing demand for wireless communication systems in various industries and the ongoing development of next-generation electronic components.

In conclusion, the RF power amplifier market is a dynamic and growing market, driven by the increasing demand for advanced wireless communication systems in various industries. The market is characterized by the adoption of next-generation electronic components, the proliferation of wireless communication systems, and the ongoing development of advanced materials and technologies. The market is expected to continue growing In the coming years, driven by the increasing demand for wireless communication systems in various industries and the ongoing development of next-generation electronic components.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.75% |

|

Market growth 2024-2028 |

USD 2.40 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

13.25 |

|

Key countries |

US, China, India, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smartphone RF Power Amplifier Market Research and Growth Report?

- CAGR of the Smartphone RF Power Amplifier industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smartphone rf power amplifier market growth of industry companies

We can help! Our analysts can customize this smartphone rf power amplifier market research report to meet your requirements.