Snack Market Size 2025-2029

The snack market size is valued to increase USD 387.9 billion, at a CAGR of 7.4% from 2024 to 2029. Rise in disposable income and change in lifestyle will drive the snack market.

Major Market Trends & Insights

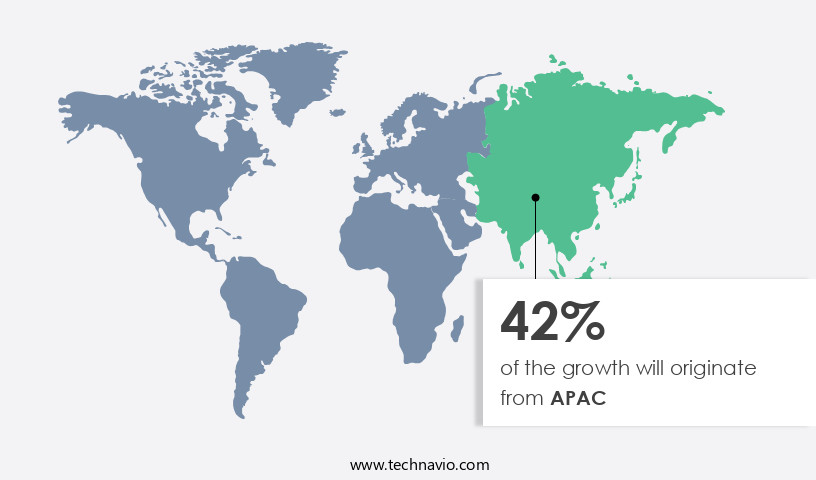

- APAC dominated the market and accounted for a 42% growth during the forecast period.

- By Product - Bakery products segment was valued at USD 383.70 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 96.26 billion

- Market Future Opportunities: USD 387.90 billion

- CAGR from 2024 to 2029: 7.4%

Market Summary

- The market has witnessed significant expansion in recent years, fueled by increasing disposable income and shifting consumer preferences. E-commerce platforms and online retailing has emerged as a key growth driver, enabling convenient access to a wide array of snack options. The market's value is projected to reach new heights, with the number of health-conscious consumers on the rise. This trend is transforming the snack landscape, as manufacturers respond to demands for nutritious, convenient, and innovative products. Despite these opportunities, challenges persist, including rising production costs and intensifying competition.

- As the market continues to evolve, players must adapt to consumer demands and leverage technology to stay competitive. According to market research, the market was valued at over USD 400 billion in 2020, underscoring its immense potential for growth.

What will be the Size of the Snack Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Snack Market Segmented?

The snack industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Bakery products

- Chocolate

- Savory snacks

- Frozen snacks

- Others

- Distribution Channel

- Offline

- Online

- Packaging

- Bags and pouches

- Boxes

- Cans

- Jars

- Others

- Nature

- Conventional

- Organic

- Gluten-Free

- Vegan

- Reduced Fat/Sugar/Salt

- Flavor

- Salty

- Sweet

- Spicy

- Savory

- Tangy

- Unflavored

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The bakery products segment is estimated to witness significant growth during the forecast period.

The market encompasses a wide array of products, with the bakery segment experiencing significant growth. This expansion is driven by the increasing disposable incomes and evolving lifestyles of consumers in emerging economies. Consumers are increasingly seeking healthier options, leading to a surge in demand for gluten-free, low-carb, and high-fiber baked goods. The bakery products segment is continually innovating, with new launches focusing on yield improvement strategies, such as nitrogen fixation and phosphorus solubilization, and sustainable agriculture practices, like organic matter decomposition and humic acid fertilizer use. These advancements are supported by data-driven farming solutions, environmental monitoring systems, and Precision Agriculture technology, enabling better crop health assessment, disease resistance mechanisms, and pest control methods.

The Bakery products segment was valued at USD 383.70 billion in 2019 and showed a gradual increase during the forecast period.

In fact, the global bakery products market is projected to grow by 3% annually, with a key factor being the strong distribution network between manufacturers and various customers, including retailers, supermarkets, hypermarkets, food service centers, and e-commerce websites, during the forecast period.

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Snack Market Demand is Rising in APAC Request Free Sample

The market is experiencing significant expansion in response to the burgeoning food retail sector, particularly in developing nations within the Asia Pacific (APAC) region. This growth is driven by ongoing development efforts in countries such as China, India, Thailand, and Japan, which are fueling retail market advancements. Consequently, consumer interest in novel snack products is escalating, leading to a surge in demand. Packaged snacks, with their convenience and ready-to-eat (RTE) attributes, are among the top categories experiencing growth.

In China, for instance, snacking has emerged as a popular alternative to traditional meals, further boosting the demand for snacks.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing robust growth, driven by consumers' increasing preference for convenient, on-the-go food options. This trend is particularly pronounced in emerging economies, where urbanization and changing lifestyles are fueling demand. However, the industry's growth trajectory is not without challenges. Sustainability is a major concern, with farmers and food processors seeking ways to improve nutrient uptake efficiency in crops, impact microbial communities on soil health, and optimize water use efficiency in agriculture. Innovations in agriculture are playing a crucial role in addressing these challenges. For instance, the application of precision agriculture technologies, such as drones and data analytics, is enabling farmers to measure soil health using remote sensing and assess crop quality using advanced techniques.

Sustainable practices, like sustainable practices for yield enhancement, are also gaining traction, with farmers adopting techniques like sustainable irrigation, crop rotation, and cover cropping to improve soil fertility and reduce the use of synthetic fertilizers and pesticides. Moreover, the role of plant hormones in stress tolerance and the effectiveness of biofertilizers on crop growth are areas of active research. The integration of agroforestry in farming systems is another promising approach, as it promotes biodiversity and helps manage abiotic stresses through soil amendment. The benefits of organic matter in soil carbon sequestration are also being recognized, with farmers increasingly focusing on reducing their carbon footprint.

Despite these advancements, the market faces significant challenges, particularly in the context of climate change. Developing climate-resilient agricultural practices is a priority, as extreme weather events and changing climate patterns threaten crop yields and food security. In this regard, assessing the impact of climate change on agriculture and implementing strategies for reducing pesticide use in farming are key areas of focus. Adoption rates of precision agriculture technologies in developed regions are nearly double those in developing regions, underscoring the need for targeted investments and capacity building efforts. Furthermore, the role of government policies and public-private partnerships in promoting sustainable agriculture and driving innovation cannot be overstated.

By working together, stakeholders can create a more resilient and sustainable market that meets the evolving needs of consumers while minimizing its environmental footprint.

What are the key market drivers leading to the rise in the adoption of Snack Industry?

- The primary factors driving market growth are the increase in disposable income and resulting shifts in consumer lifestyle.

- Disposable income has witnessed a significant rise globally, as reported by various statistical bodies. In the US, for instance, the US Bureau of Economic Analysis (BEA) indicates a USD 37.7 billion (0.2%) increase in disposable personal income in June 2024. This trend is not limited to developed economies alone; the Organization for Economic Co-operation and Development (OECD) reports an increase in household disposable income across all member countries since 2021.

- Factors contributing to this expansion include the rise in dual household income, per capita income, and a robust employment rate. The escalating disposable income is projected to amplify consumer spending and purchasing power, thereby impacting businesses across sectors.

What are the market trends shaping the Snack Industry?

- Online retailing is experiencing significant growth and is emerging as the next market trend.

- The global e-commerce market's expansion is primarily driven by the increasing internet penetration and the convenience it offers to consumers. This shift in shopping behavior has opened new opportunities for snack suppliers to expand their sales, reach broader markets, and enhance customer relationships. Manufacturers and distributors can leverage online platforms to boost product visibility and explore prospects in emerging markets. The preference for online shopping continues to grow, with consumers drawn to the ease of product discovery, appealing offers, and competitive pricing.

- This trend is not limited to developed markets; developing regions are also witnessing a surge in online shopping adoption. The e-commerce landscape is dynamic, with ongoing market activities and evolving patterns shaping the industry's future.

What challenges does the Snack Industry face during its growth?

- The escalating health concerns posing significant risks to workers and consumers represent a major challenge to the industry's growth trajectory.

- The cheese market experiences ongoing dynamics driven by various factors, including health concerns related to high-calorie intake. Cheese, a rich source of essential nutrients, contains high levels of saturated fat, which can increase cholesterol levels. Elevated cholesterol poses risks for heart disease. Moreover, cheese is high in sodium, contributing to maintaining water balance in cells. However, excessive sodium consumption can lead to high blood pressure and associated health issues, including kidney disease, heart disease, and osteoporosis. Despite these health implications, cheese remains a significant contributor to caloric intake.

- Consumers' likelihood of acquiring weight from high-calorie foods hinders market growth. The cheese industry continues to evolve, with innovations in production methods and product offerings catering to diverse consumer preferences and health-conscious trends.

Exclusive Technavio Analysis on Customer Landscape

The snack market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the snack market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Snack Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, snack market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agthia Group PJSC - This company specializes in providing a range of savory snacks, including poppy and garlic flatbreads, and sandwich spreads.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agthia Group PJSC

- B and G Foods Inc.

- Calbee Inc.

- Conagra Brands Inc.

- Cooperatie Koninklijke Cosun UA

- Deco Food Service

- Ferrero International S.A.

- General Mills Inc.

- Happytizers Pvt Ltd

- Harvest Almond Snacks

- Hormel Foods Corp.

- J and J Snack Foods Corp.

- Kind LLC

- McCain Foods Ltd.

- Mondelez International Inc.

- Nestle SA

- NutriAsia Inc.

- PepsiCo Inc.

- Popcorn Shed Ltd.

- Rich Products Corp.

- Sargento Foods Inc.

- The Hain Celestial Group Inc.

- The Hershey Co.

- The Kraft Heinz Co.

- Tyson Foods Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Snack Market

- In January 2024, Quaker Oats, a leading snack manufacturer, introduced a new line of gluten-free, plant-based protein snacks, called "Quaker Protein Bites," in response to the growing consumer demand for healthier snack options (Quaker Oats Press Release).

- In March 2024, PepsiCo and Nestlé, two snack industry giants, announced a strategic partnership to expand their reach in the market by combining their complementary product portfolios and distribution networks (PepsiCo Press Release).

- In May 2024, Frito-Lay, a subsidiary of PepsiCo, completed the acquisition of the South American snack business of Grupo Bimbo, marking Frito-Lay's entry into the South American market and expanding its global footprint (Frito-Lay Press Release).

- In April 2025, the European Commission approved the acquisition of Hershey's European chocolate business by Ferrero, subject to certain conditions, paving the way for Ferrero's expansion into the European chocolate market and increasing competition in the snack industry (European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Snack Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

237 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 387.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Amidst the dynamic landscape of consumer preferences and evolving production methods, the market continues to thrive, offering a rich tapestry of innovation and growth. Soil microbial communities play a pivotal role in this realm, with health indicators serving as crucial benchmarks for optimizing crop yields. Data-driven farming solutions are revolutionizing the sector, integrating advanced technologies like precision agriculture and environmental monitoring systems to enhance nutrient uptake efficiency and improve crop health assessment. Weed management practices and yield improvement strategies, such as nitrogen fixation and phosphorus solubilization, are essential components of sustainable agriculture. Vegetable production techniques, underpinned by expertise in plant hormone modulation and root development enhancers, contribute significantly to the market's growth.

- Sustainable agriculture practices, including humic acid fertilizer and crop stress tolerance mechanisms, are gaining traction, driven by consumer demand for eco-friendly options. Post-harvest preservation techniques, like potassium availability and water use efficiency, ensure optimal product quality and longevity. Biotic stress management, achieved through microbial inoculants and disease resistance mechanisms, bolsters crop resilience. Enhanced photosynthesis rates and pest control methods further fortify the sector's robustness. The market's continuous evolution is marked by a staggering 20% increase in the adoption of precision agriculture technology over the past five years. This growth underscores the industry's commitment to innovation and its ability to adapt to consumer demands and production challenges.

- The sector's future promises a myriad of opportunities, from abiotic stress mitigation and enzyme activity levels to fruit quality parameters and soil nutrient cycling.

What are the Key Data Covered in this Snack Market Research and Growth Report?

-

What is the expected growth of the Snack Market between 2025 and 2029?

-

USD 387.9 billion, at a CAGR of 7.4%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Bakery products, Chocolate, Savory snacks, Frozen snacks, and Others), Distribution Channel (Offline and Online), Packaging (Bags and pouches, Boxes, Cans, Jars, and Others), Geography (APAC, Europe, North America, South America, and Middle East and Africa), Nature (Conventional, Organic, Gluten-Free, Vegan, and Reduced Fat/Sugar/Salt), and Flavor (Salty, Sweet, Spicy, Savory, Tangy, and Unflavored)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rise in disposable income and change in lifestyle, Rising number of health effects

-

-

Who are the major players in the Snack Market?

-

Agthia Group PJSC, B and G Foods Inc., Calbee Inc., Conagra Brands Inc., Cooperatie Koninklijke Cosun UA, Deco Food Service, Ferrero International S.A., General Mills Inc., Happytizers Pvt Ltd, Harvest Almond Snacks, Hormel Foods Corp., J and J Snack Foods Corp., Kind LLC, McCain Foods Ltd., Mondelez International Inc., Nestle SA, NutriAsia Inc., PepsiCo Inc., Popcorn Shed Ltd., Rich Products Corp., Sargento Foods Inc., The Hain Celestial Group Inc., The Hershey Co., The Kraft Heinz Co., and Tyson Foods Inc.

-

Market Research Insights

- The market continues to evolve, driven by consumer preferences for convenient, nutritious, and sustainable options. According to recent estimates, the global snack food market size was valued at USD 425 billion in 2020, projected to reach USD 608 billion by 2027. Quality assessment tools play a crucial role in maintaining the standard of snack production, ensuring consumer safety and satisfaction. For instance, soil carbon sequestration and crop yield maximization techniques contribute significantly to agricultural productivity, reducing the environmental impact of snack production. Integrated pest management, resource-efficient farming, and Precision Farming methods are employed to minimize the use of synthetic fertilizers and pesticides, aligning with the trend towards sustainable food production.

- Water conservation methods and soil amendment strategies are essential for maintaining the health of crops and reducing the environmental footprint of snack production. Yield monitoring systems and variable rate technology enable farmers to optimize their use of resources, contributing to resource-efficient farming practices. Climate-smart agriculture, precision fertilizer placement, and integrated nutrient management further enhance the efficiency of snack production, ensuring a consistent supply of high-quality raw materials. Data analytics platforms and GIS mapping techniques facilitate the implementation of these strategies, providing valuable insights into crop health, resource utilization, and market trends. Biofertilizer application and organic farming practices are also gaining popularity, as they offer sustainable alternatives to synthetic fertilizers and contribute to nutrient use efficiency.

- Cover cropping techniques and remote sensing applications further support sustainable snack production, ensuring the long-term viability of the industry.

We can help! Our analysts can customize this snack market research report to meet your requirements.