Solar Simulator Market Size 2024-2028

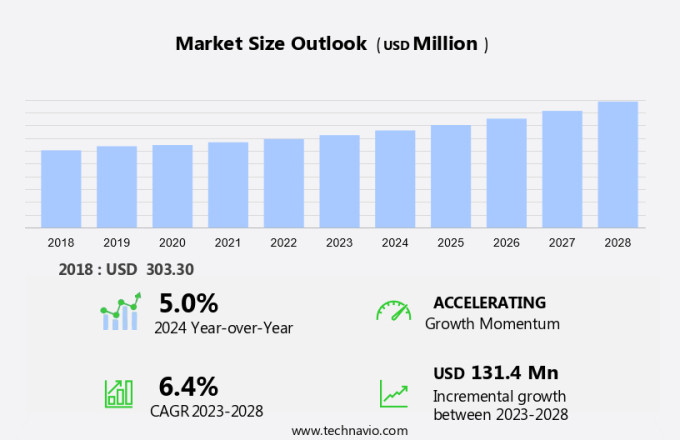

The solar simulator market size is forecast to increase by USD 131.4 million at a CAGR of 6.4% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing adoption of photovoltaic (PV) systems in the renewable energy sector. One key trend driving market expansion is the launch of new solar simulators with advanced features, such as air mass control, which ensure accurate testing of PV modules under various climate conditions. Another trend is the rental equipment segment, allowing companies to access advanced testing equipment without the high upfront cost. Material durability testing is also a critical application area, as the industry shifts towards the development and testing of new materials for solar technologies. The market faces challenges, including the high initial cost and the need for continuous innovation to keep up with the rapid advancements in solar technology. To stay competitive, market players are focusing on offering cost-effective solutions and collaborating with research institutions to develop new testing methods and technologies.

What will be the Size of the Market During the Forecast Period?

- Solar simulators play a crucial role in the testing and evaluation of solar cells, solar modules, and other solar-related components in the renewable energy sector. These devices provide controlled illumination that closely resembles natural sunlight, enabling accurate performance testing and weathering studies. They are used extensively in testing solar photovoltaic (PV) cells and modules, ensuring their optimal functionality and output power under various environmental conditions. The solar energy market relies on these tools to assess the efficiency, durability, and reliability of solar technology components.

- Natural sunlight simulation is a critical aspect, allowing for precise testing of solar cells and modules under various weather conditions, including ultraviolet (UV) exposure. This is particularly important for automotive components testing, where solar panels and electric vehicles require rigorous evaluation to ensure optimal performance and safety. The use of solar simulators extends beyond solar PV applications. They are also employed in material testing for textiles, biomass studies, and weathering studies to assess the impact of sunlight on various materials and components. Two primary types are pulsed solar simulators and standard sun simulators.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Class A solar simulators

- Class B solar simulators

- Class C solar simulators

- Source

- Xenon lamps

- Metal halide lamps

- LEDs

- Others

- Geography

- North America

- US

- APAC

- China

- India

- Japan

- Europe

- UK

- South America

- Middle East and Africa

- North America

By Type Insights

- The class A solar simulators segment is estimated to witness significant growth during the forecast period.

In the market, Class A solar simulators are experiencing significant growth due to the heightened demand for precise testing and certification within the solar panel manufacturing sector. Adhering to the IEC 60904-9 standards for spectral match, temporal stability, and spatial uniformity, these high-end simulators are essential for solar technology validators seeking global acceptance. The transition towards advanced solar cell technologies, such as multi-junction and heterojunction, underscores the importance of the superior accuracy and reliability provided by Class A simulators. Leading research institutions and certification laboratories are making substantial investments in these advanced systems to facilitate the development and validation of next-generation solar technologies.

Further, Solar energy storage resources rely on testing equipment like sun simulators to ensure the optimal performance of solar panels under various conditions. Hence, such factors are fuelling the growth of this segment during the forecast period.

Get a glance at the market report of share of various segments Request Free Sample

The class A solar simulators segment was valued at USD 168.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is witnessing significant expansion due to the growing focus on renewable energy sources and the necessity for reliable and efficient solar technologies. Solar simulators, which mimic sunlight to assess the performance of Photovoltaic (PV) modules, are indispensable for validating the output power and spectrum response of PV systems. This expansion is primarily fueled by government initiatives and policies encouraging the adoption of green energy, coupled with advancements in PV cell and module technology. The development of more efficient solar cells and modules necessitates rigorous testing to ensure their optimal performance under diverse conditions. Consequently, the North American market is poised for continued growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Solar Simulator Market?

The launch of new solar simulators is the key driver of the market.

- Solar simulators play a crucial role in the global market, fueled by continuous innovation and the escalating need for sophisticated testing solutions. In June 2024, Wavelabs, a German company renowned for LED-based testing instruments, introduced a novel solar simulator. This device is engineered for characterizing thin-film and perovskite mini-modules, offering a customizable spectrum through tunable LEDs and a 306 mm x 306 mm illuminated area. By enabling adjustments to the spectrum, this solar simulator ensures precise testing and optimization of various solar cell technologies, making it an indispensable tool for research and development. Moreover, on October 3, 2024, Effizency, a Portuguese developer of sales software for solar PV and heat pump solutions, unveiled a new web-based solar simulator module.

- This cutting-edge technology offers significant advantages, allowing users to evaluate solar panel performance under various conditions with ease. Solar simulators are essential for testing solar cells and panels, ensuring optimal functionality and efficiency under natural sunlight simulation. Ultraviolet (UV) testing is a critical aspect of solar panel testing, and solar simulators enable accurate and reliable UV testing. Furthermore, they are indispensable for automotive components testing, as they simulate the harsh conditions that solar panels endure in vehicles. Performance testing is another key application of solar simulators, enabling manufacturers to assess the capabilities of their products under different lighting conditions.

What are the market trends shaping the Solar Simulator Market?

Innovation in solar simulators is the upcoming trend in the market.

- The market is experiencing notable advancements, specifically in the realm of research laboratories. An illustrative instance is the introduction of a steady-state solar simulator by Lumartix, a Swiss company, in December 2023. This system utilizes plasma light engine technology to execute essential tests, encompassing characterization, aging, and stabilization of photovoltaic (PV) cells. Lumartix's solar simulator boasts an exceptional light emitter lifespan, surpassing 20,000 hours, ensuring enduring dependability and minimal maintenance requirements.

- Moreover, this simulator offers additional capabilities such as light-soaking and solar simulation, amplifying its adaptability and efficacy in research settings. As the market strives to meet its climate goals and embrace renewable energy, the demand for advanced solar technologies continues to escalate. Material durability testing is a crucial aspect of this progress, and solar simulators play a pivotal role in this process. By testing new materials under controlled conditions, researchers can optimize their performance and enhance the overall efficiency of PV systems.

What challenges does Solar Simulator Market face during the growth?

The high initial cost of solar simulator is a key challenge affecting the market growth.

- The market faces a substantial challenge due to the high cost of these advanced systems. Solar simulators, which are essential for material testing, weathering studies, and research in Electric Vehicles, Solar PV, Off-grid Solar Power, Concentrated Solar Power, and other applications, come with a hefty price tag. The expense is primarily attributed to the sophisticated components required, including specialized light sources, precision optics, advanced cooling systems, and complex control electronics. These components ensure accurate solar spectrum matching and stable output.

- Moreover, the total cost of ownership for solar simulators is increased by the need for regular maintenance, replacement of expensive components such as xenon bulbs, and calibration services. Multi-lamp Solar Simulators and LED-based Solar Simulators, which offer varying specifications and capabilities, further add to the financial burden. Despite these challenges, the market for solar simulators is expected to grow due to the increasing demand for renewable energy technologies and advancements in solar cell manufacturing.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abet Technologies Inc.

- ADTEC Engineering Co. Ltd.

- AMETEK Programmable Power Inc.

- Angstrom Designs Inc.

- Asahi Spectra Co Ltd

- Ecoprogetti srl

- Endeas Oy

- Eternal Sun B.V.

- G2V Optics Inc

- Gsolar Power Co. Ltd

- InfinityPV

- Iwasaki Electric Co. Ltd.

- Lumartix SA

- Meyer Burger Technology AG

- Newport Corp.

- OAI

- Ossila Ltd.

- Peccell Technologies Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Solar simulators play a crucial role in the renewable energy sector, particularly in solar cells and solar panels testing. These advanced testing equipment provide natural sunlight simulation, enabling the assessment of solar PV modules' performance under various weather conditions. UV testing is a significant application of solar simulators, ensuring material durability and testing new materials for advanced solar technologies. Solar simulators are essential for automotive components testing, electric vehicles, and off-grid solar power systems. Concentrated solar power and multi-lamp solar simulators are used for photovoltaic systems' performance testing, providing high-intensity beams for PV module testing. Sun simulators offer illumination control, air mass control, and pulsed solar simulators with single pulse and multi-pulse options.

Further, rental equipment is also available for various applications, including material testing, weathering studies, and biomass studies. Solar energy generation relies on solar simulators for testing solar cells, solar modules, and solar materials. Renewable energy's climate goals depend on the accurate assessment of solar energy resources and the durability of solar technology. Solar simulators are indispensable for solar panel manufacturers, ensuring the output power and spectrum response of their products meet industry standards. Light source technology advancements continue to improve solar simulators' efficiency and accuracy, contributing to the growth of the solar energy market and the adoption of sustainable energy sources.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2024-2028 |

USD 131.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.0 |

|

Key countries |

US, China, Japan, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch