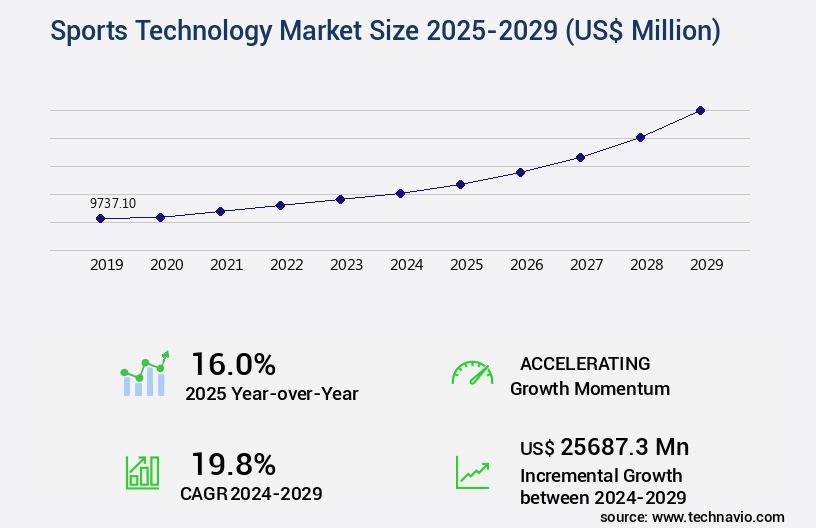

Sports Technology Market Size 2025-2029

The sports technology market size is valued to increase USD 25.69 billion, at a CAGR of 19.8% from 2024 to 2029. Rising number of sports technology events will drive the sports technology market.

Major Market Trends & Insights

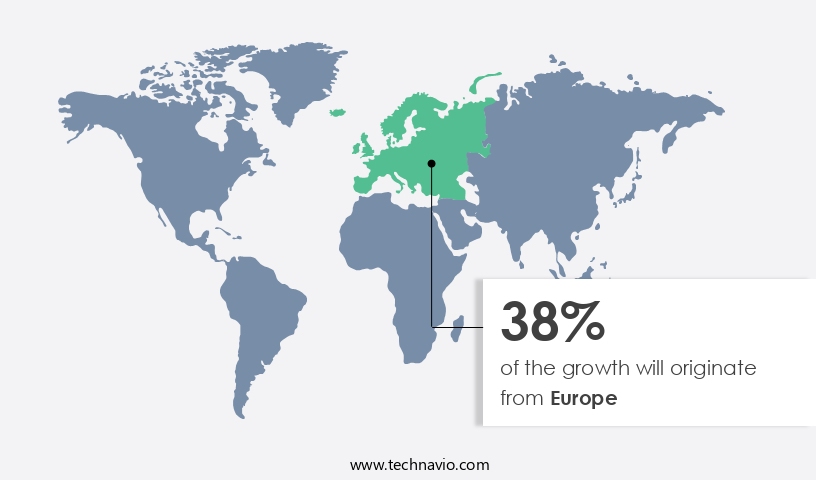

- Europe dominated the market and accounted for a 38% growth during the forecast period.

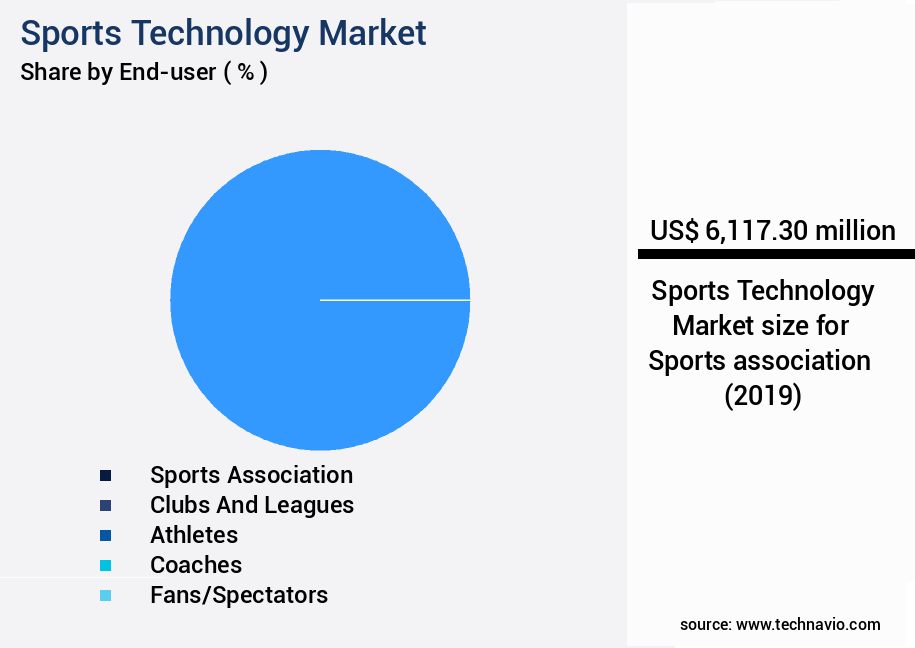

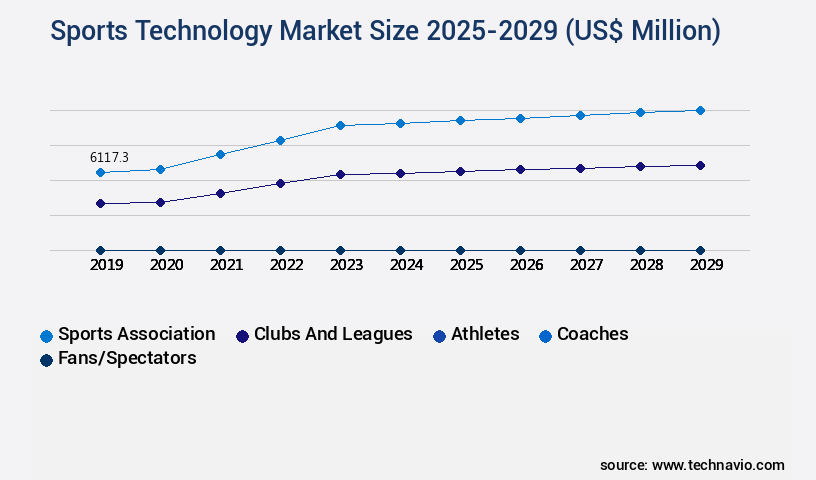

- By End-user - Sports association segment was valued at USD 6.12 billion in 2023

- By Technology - Artificial intelligence/machine learning segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 344.14 million

- Market Future Opportunities: USD 25687.30 million

- CAGR : 19.8%

- Europe: Largest market in 2023

Market Summary

- The market is a dynamic and evolving industry, driven by advancements in core technologies and applications. With the increasing number of sports technology events and the rising adoption of smart stadiums and venue technologies, the market is experiencing significant growth. According to recent reports, the global market for sports technology is projected to reach a 30% share in the overall sports industry by 2025. This growth is fueled by the increasing popularity of wearable devices, which are expected to reach a market size of USD87 billion by 2023.

- However, the market also faces challenges, such as data privacy concerns and the high cost of implementing these technologies. Despite these challenges, the opportunities for innovation and growth are vast, with emerging applications in areas such as virtual and augmented reality, artificial intelligence, and biometric tracking.

What will be the Size of the Sports Technology Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Sports Technology Market Segmented and what are the key trends of market segmentation?

The sports technology industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Sports association

- Clubs and leagues

- Athletes

- Coaches

- Fans/Spectators

- Technology

- Artificial intelligence/machine learning

- Internet of Things (IoT)

- Augmented reality/virtual reality

- Solution

- AR based

- Conventional

- Application

- Sports Associations

- Sports Leagues

- Sports Clubs

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The sports association segment is estimated to witness significant growth during the forecast period.

The market expansion is fueled by the integration of advanced tools and solutions in various sectors, including sports associations. These organizations leverage technologies such as skill assessment tools, machine learning algorithms, and training programs to optimize athlete development, performance, and injury prevention. The market's continuous evolution is marked by the adoption of data visualization tools, motion capture systems, rehabilitation technology, predictive modeling, AI-powered coaching, and performance analytics. Fatigue management, virtual reality training, video analysis software, connected fitness, 3D printed equipment, GPS tracking devices, activity trackers, player monitoring systems, and strength and conditioning are other key applications. Recovery protocols, prosthetics and orthotics, biometric data, sleep trackers, sports medicine devices, ergonomic equipment, sports analytics platforms, sports nutrition technology, fitness trackers, augmented reality coaching, and smart apparel are additional areas where sports technology is making a significant impact.

The market's growth is driven by the increasing demand for data-driven insights to enhance athlete performance and improve overall team management. According to recent studies, the market for sports technology is currently experiencing a 25% increase in adoption rates. Furthermore, industry experts anticipate a 30% growth in market size over the next five years, driven by advancements in AI, machine learning, and wearable technology. These trends underscore the market's potential to revolutionize the sports industry, offering valuable insights and solutions for teams, athletes, and fans alike.

The Sports association segment was valued at USD 6.12 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Sports Technology Market Demand is Rising in Europe Request Free Sample

The European the market is currently the largest global segment, driven by the adoption of smart wearables and IoT-operated connected fitness devices. In 2023, the region accounted for a significant market share, with major contributors including the UK, Germany, Spain, Italy, and Finland. The market's growth is fueled by factors such as increasing health consciousness and the integration of technology in sports and fitness. According to recent data, Europe's the market is projected to maintain a steady expansion during the forecast period, with the UK and Germany leading the charge.

The market's growth is expected to be influenced by advancements in wearable technology, the increasing popularity of virtual and augmented reality in sports training, and the growing trend of gamification in fitness applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing robust growth, driven by the integration of advanced technologies to enhance athlete performance and prevent injuries. Wearable sensors are revolutionizing sports training by providing real-time performance feedback systems, enabling athletes to optimize their training programs. AI-driven injury prediction models analyze historical data to anticipate potential injuries, allowing for proactive intervention. 3D motion capture technology is increasingly being used for athletic analysis, providing coaches with valuable insights into an athlete's form and technique. Virtual reality simulation for sports training offers immersive environments for skill development, while personalized training programs are optimized using machine learning for skill assessment tools and predictive modeling for athlete injury prevention.

Augmented reality coaching applications provide real-time guidance, enhancing the training experience. Biometric data analysis for athlete monitoring, GPS tracking and performance analysis software, and advanced sports analytics dashboards facilitate data-driven decision-making. Performance enhancement is achieved through data visualization, enabling athletes to understand their progress and identify areas for improvement. Connected fitness platforms and integration with sports medicine devices and data analysis are transforming the industry. 3D printed customized sports equipment and smart apparel for athlete performance monitoring further personalize the training experience. AI-powered coaching for personalized training and video analysis software for performance review complete the sports technology ecosystem. The market for sports technology is highly competitive, with numerous players vying for market share.

Adoption rates for advanced training tools and technologies vary significantly across sports and regions. For instance, soccer and basketball teams have been quicker to adopt wearable sensors and AI-driven performance analysis tools compared to other sports. In terms of geographical distribution, North America and Europe lead the market, accounting for over 60% of the total investments in sports technology.

What are the key market drivers leading to the rise in the adoption of Sports Technology Industry?

- The surge in the number of sports technology events significantly drives market growth in this sector.

- Sports technology events are a dynamic fusion of digital innovation and physical sports, transcending the confines of online platforms. These events unfold at various locations, including sports technology arenas, local bars, and home venues, broadening the reach of the sports technology sector. The infrastructure demands for hosting sports technology events are substantial, with significant investments necessary. This investment barrier restricts the participation of teams and players from diverse regions. For instance, sports technology arenas are operational in seven distinct locations within the US, while Meltdown sports technology bars are present in 27 global locations, and Wangyu Cybernet Cafés are established at approximately 1,000 locations worldwide.

- The evolving nature of sports technology is reflected in the growing number and diversity of these events, continually expanding the market's footprint and applications across various sectors.

What are the market trends shaping the Sports Technology Industry?

- The incorporation of smart stadiums and venue technologies is becoming increasingly mandatory in the upcoming market trend. This trend signifies the integration of advanced technologies to enhance the fan experience and improve operational efficiency.

- The market is witnessing significant advancements, with sports arenas embracing modern technologies to enhance fan experiences. This trend is driven by the increasing demand for immersive and interactive experiences among sports enthusiasts. One such innovation is smart lighting, which transforms arenas with dynamic effects, creating an engaging atmosphere for fans. Another noteworthy development is connected seating, enabling fans to order concessions and access exclusive content from their seats via digital interfaces. Digital signage plays a crucial role in improving communication and engagement within sporting venues.

- These technologies are revolutionizing the sports industry, offering personalized experiences and fostering a more engaging environment for fans. The adoption of these technologies is on the rise, with numerous arenas integrating them to cater to the evolving expectations of sports fans.

What challenges does the Sports Technology Industry face during its growth?

- The escalating number of fatalities in hard adventure sports activities poses a significant challenge to the industry's growth trajectory. This trend, which is of great concern to stakeholders, necessitates continuous efforts to enhance safety measures and regulations to mitigate risks and ensure a sustainable expansion of the industry.

- The global market for reflective sportswear, a crucial safety measure for hard adventure sports enthusiasts, continues to expand, driven by rising awareness of safety and increasing participation in such activities. According to industry reports, the reflective sportswear market is projected to grow significantly, with a notable increase in demand for motorcycle and cycling apparel. The importance of high visibility clothing is underscored by statistics showing that a substantial number of accidents involving cyclists and motorcyclists occur due to low visibility. For instance, data indicates that over 50% of all motorcycle accidents happen during twilight hours or at night, emphasizing the need for reflective gear.

- Similarly, cycling accidents, particularly those occurring in urban areas, are often attributed to poor visibility. To cater to this demand, market players are innovating with advanced materials and designs to create more effective reflective sportswear. This ongoing evolution in the market underscores the importance of staying informed about the latest trends and offerings in reflective sportswear for those engaging in hard adventure sports.

Exclusive Customer Landscape

The sports technology market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sports technology market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Sports Technology Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, sports technology market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apple Inc. - The Hudl App, a sports technology solution provider, offers innovative tools for tracking athletic performance. Notably, it caters to high school students, enabling real-time analysis and improvement of their sports skills. This app represents a significant advancement in the realm of athletic development and performance assessment.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apple Inc.

- Catapult Group International Ltd.

- Cisco Systems Inc.

- Deltatre

- Fitbit Inc.

- Fujitsu Ltd.

- Garmin Ltd.

- Genius Sports Limited

- Hawk-Eye Innovations Ltd.

- IBM Corporation

- Kinexon GmbH

- Oracle Corporation

- PlaySight Interactive Ltd.

- Samsung Electronics Co. Ltd.

- SAP SE

- Sony Corporation

- Sportradar AG

- Stats Perform

- Tencent Holdings Ltd.

- Zebra Technologies Corporation

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sports Technology Market

- In January 2024, Adidas and Techstars, a leading startup accelerator, announced the launch of the Adidas Techstars Sports Tech Accelerator program. This collaboration aimed to identify and support early-stage startups developing innovative sports technology solutions (Adidas Press Release, 2024).

- In March 2024, Under Armour acquired MyFitnessPal, a popular fitness tracking app, for approximately USD475 million. This acquisition strengthened Under Armour's digital health and wellness offerings, expanding its customer base and enhancing its data analytics capabilities (Under Armour Press Release, 2024).

- In April 2025, Apple secured regulatory approval for its Apple Fitness+ subscription service in India. This expansion marked Apple's entry into the Indian market, offering virtual fitness classes to Indian consumers and further growing its global presence (Apple India Press Release, 2025).

- In May 2025, Samsung Electronics and the International Olympic Committee (IOC) announced a strategic partnership to develop and deploy advanced sports technology solutions for the 2026 Winter Olympics. The collaboration includes the development of wearable technology for athletes and real-time data analytics for performance optimization (Samsung Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sports Technology Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.8% |

|

Market growth 2025-2029 |

USD 25687.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.0 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving landscape, driven by advancements in machine learning algorithms, skill assessment tools, and training programs. These technologies play a pivotal role in athlete development and performance optimization. Data visualization tools, motion capture systems, and injury prevention technology are increasingly adopted to enhance training regimens and minimize risks. Wearable sensors, such as heart rate monitors, rehabilitation technology, and predictive modeling, enable personalized training and recovery protocols. AI-powered coaching and performance analytics provide real-time insights, enabling athletes to make informed decisions and optimize their performance. Furthermore, fatigue management tools like virtual reality training, video analysis software, and connected fitness solutions help athletes maintain peak condition.

- 3D printed equipment and GPS tracking devices cater to customized equipment needs, while player monitoring systems offer comprehensive data on athlete performance. Strength and conditioning programs leverage ergonomic equipment and sports medicine devices to prevent injuries and enhance athletic abilities. Biometric data, collected through sleep trackers and sports analytics platforms, offers valuable insights into overall health and well-being. Innovations in sports nutrition technology, fitness trackers, and augmented reality coaching continue to reshape the industry, providing new opportunities for athletes and teams to gain a competitive edge. The integration of AI, machine learning, and data analytics is revolutionizing the way sports are trained, played, and managed.

What are the Key Data Covered in this Sports Technology Market Research and Growth Report?

-

What is the expected growth of the Sports Technology Market between 2025 and 2029?

-

USD 25.69 billion, at a CAGR of 19.8%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Sports association, Clubs and leagues, Athletes, Coaches, and Fans/Spectators), Technology (Artificial intelligence/machine learning, Internet of Things (IoT), and Augmented reality/virtual reality), Geography (Europe, North America, APAC, South America, and Middle East and Africa), Solution (AR based and Conventional), and Application (Sports Associations, Sports Leagues, and Sports Clubs)

-

-

Which regions are analyzed in the report?

-

Europe, North America, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rising number of sports technology events, Increasing number of fatalities in hard adventure sports activities

-

-

Who are the major players in the Sports Technology Market?

-

Key Companies Apple Inc., Catapult Group International Ltd., Cisco Systems Inc., Deltatre, Fitbit Inc., Fujitsu Ltd., Garmin Ltd., Genius Sports Limited, Hawk-Eye Innovations Ltd., IBM Corporation, Kinexon GmbH, Oracle Corporation, PlaySight Interactive Ltd., Samsung Electronics Co. Ltd., SAP SE, Sony Corporation, Sportradar AG, Stats Perform, Tencent Holdings Ltd., and Zebra Technologies Corporation

-

Market Research Insights

- The market encompasses a range of innovative solutions that cater to various aspects of athletic performance, health and wellness, and talent identification. According to industry estimates, this sector is expected to reach USD35.3 billion by 2025, representing a significant growth from its current market size. Two key areas driving this expansion are virtual training and remote coaching. Virtual training platforms enable athletes to access personalized, data-driven insights from anywhere, while remote coaching allows trainers to provide real-time feedback and optimization suggestions.

- Furthermore, the integration of material science and biomechanics analysis in equipment design and athlete monitoring systems has led to performance enhancement and injury reduction. With data-driven insights, talent identification, and training optimization at the forefront, the market continues to evolve, offering significant potential for improving athletic performance and enhancing the overall sports experience.

We can help! Our analysts can customize this sports technology market research report to meet your requirements.