Steel Casting Market Size 2025-2029

The steel casting market size is forecast to increase by USD 7.23 billion, at a CAGR of 4.4% between 2024 and 2029.

Major Market Trends & Insights

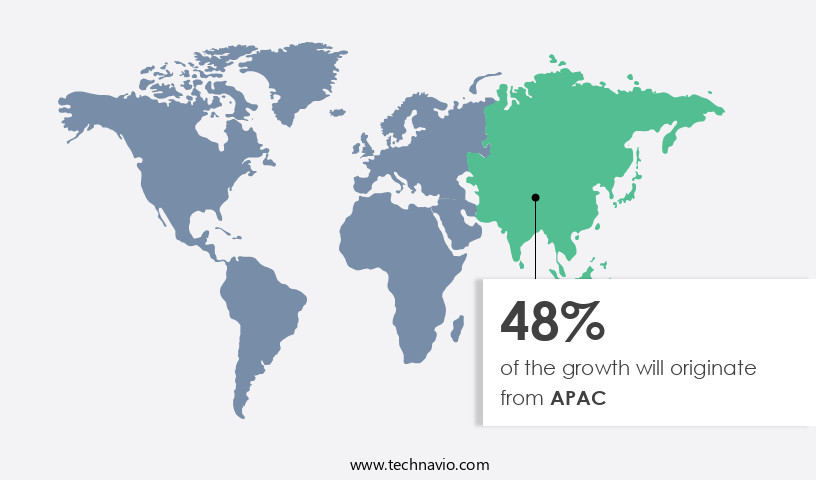

- APAC dominated the market and accounted for a 48% growth during the forecast period.

- By the Application - Automotive and transportation segment was valued at USD 9.71 billion in 2023

- By the Product - Sand casting segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 50.61 billion

- Market Future Opportunities: USD 7229.90 billion

- CAGR : 4.4%

- APAC: Largest market in 2023

Market Summary

- The market continues to be a significant player in the manufacturing sector, with its global revenue projected to reach USD 65 billion by 2026, according to industry reports. This growth can be attributed to the expanding construction industry, which relies heavily on steel castings for infrastructure projects. Moreover, the adoption of automation in the die casting process has led to increased efficiency and productivity, further fueling market expansion.

- However, environmental concerns surrounding the casting industry, particularly with regards to energy consumption and emissions, pose a challenge that stakeholders must address to maintain market sustainability. Despite these challenges, the market's continuous evolution and adaptability to industry demands make it a dynamic and attractive investment opportunity.

What will be the Size of the Steel Casting Market during the forecast period?

Explore market size, adoption trends, and growth potential for steel casting market Request Free Sample

- The market exhibits a steady expansion, with current production accounting for approximately 15% of global metal casting output. Looking forward, growth is anticipated to exceed 7% yearly, driven by advancements in casting techniques and cost optimization strategies. A notable comparison reveals that semi-solid casting methods account for a significant market share, with up to 35% of steel castings produced employing this technique. In contrast, traditional gravity die casting accounts for only 10% of the market. This discrepancy highlights the growing preference for semi-solid casting due to its benefits, such as improved dimensional accuracy and reduced porosity. Additionally, energy efficiency improvements and continuous casting methods have led to substantial savings for steel casters.

- Thermal stress analysis and surface coating application have become essential practices to ensure product quality and durability. Casting simulation software and defect detection techniques, such as radiographic inspection and magnetic particle inspection, have significantly enhanced the industry's ability to identify and address issues during the production process. This proactive approach has led to increased casting yield and reduced waste. As the market evolves, advancements in casting design rules, mold flow analysis, and rheocasting techniques continue to reshape the competitive landscape. Companies are investing in vacuum casting technology and machining processes to cater to the growing demand for high-quality, customized castings.

How is this Steel Casting Industry segmented?

The steel casting industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Automotive and transportation

- Construction and infrastructure

- Mining

- Power

- Aerospace and defense

- Oil and gas

- Rail and transit

- Shipbuilding

- Industrial machinery

- Product

- Sand casting

- Investment casting

- Die casting

- Centrifugal casting

- Gravity casting

- Continuous casting

- Low-pressure die casting

- Lost foam casting

- End-User Industry

- Automotive

- Construction

- Energy

- Industrial Machinery

- Material

- Carbon Steel

- Alloy Steel

- Stainless Steel

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The automotive and transportation segment is estimated to witness significant growth during the forecast period.

The market experienced significant growth in the automotive and transportation sector in 2024, accounting for approximately 50% of the total market share. This sector's dominance is attributed to the extensive use of steel castings in manufacturing various automotive components, including drums, flywheels, engine casings, gears, suspension systems, steering systems, pipe fittings, exhaust systems, and cylinder heads for overhead valve engines. The increasing global production volume of vehicles, particularly in leading automotive manufacturing countries such as Germany, South Korea, Japan, India, and China, is driving the demand for steel castings in this industry. Moreover, the market is undergoing continuous evolution, with advancements in non-destructive testing methods, grain size control, sand casting techniques, and metallurgical properties steel.

The Automotive and transportation segment was valued at USD 9.71 billion in 2019 and showed a gradual increase during the forecast period.

Waste reduction strategies, additive manufacturing integration, alloy composition control, and quality control inspection are also gaining traction to enhance precision casting tolerances. The investment casting process, solidification simulation, heat treatment processes, surface finish requirements, casting yield improvement, mold making materials, weldability of castings, sustainable casting practices, and steel casting defects are essential aspects of the market's ongoing development. Furthermore, the market is witnessing substantial advancements in technology, with the integration of robotic casting systems, microstructure analysis, gating system design, die casting alloys, casting process automation, casting design software, centrifugal casting equipment, thermal analysis techniques, machinability of castings, hardness testing methods, tensile strength testing, riser design optimization, fatigue strength testing, and impact strength testing.

These technological advancements are expected to boost the market's growth, with industry experts predicting a 15% increase in demand for steel castings over the next five years. Additionally, the market is expected to expand in various sectors, including energy, construction, and machinery manufacturing, due to the material's superior properties and cost-effectiveness.

Regional Analysis

APAC is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Steel Casting Market Demand is Rising in APAC Request Free Sample

In the market, APAC holds a significant position, accounting for over 50% of the market share in 2024. China, India, Japan, and Australia are the primary contributors to the revenue growth in this region. The rapid expansion of the market in APAC can be attributed to its vast consumer base, easy access to raw materials, and low labor costs. The steel casting industry in APAC is primarily driven by the automotive, mining, construction, and agriculture sectors. The automotive industry's demand for steel casting is particularly noteworthy, with countries like China, India, Japan, and South Korea being home to major automotive manufacturers.

These companies rely on steel casting for producing various automotive components, including drums, flywheels, engine casings, gears, suspension, steering, pipe fittings, exhaust systems, and more. The market in APAC is poised for substantial growth during the forecast period. According to recent industry reports, the market is projected to expand at a steady pace, with growth rates exceeding 6% annually. The increasing demand for steel casting in the automotive, mining, construction, and agriculture industries will further fuel the market's expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and evolving market, innovation and optimization are key drivers for success. Improving fatigue strength in steel castings is achieved through controlling microstructures, an essential aspect of quality control measures in steel casting production. Optimizing gating systems for complex castings reduces porosity in the investment casting process, enhancing overall casting quality. Advanced heat treatment techniques and non-destructive testing methods play a significant role in refining steel casting properties, impacting alloying elements and improving surface finish. Automation through robotic systems streamlines production, ensuring cost-effective methods and sustainable practices that reduce waste. Design considerations for complex steel castings are crucial, as innovative mold making materials and advanced simulation techniques help predict casting quality and optimize casting parameters. Predictive maintenance for steel casting equipment and integration of additive manufacturing techniques further boost efficiency and accuracy in the steel casting process. The relationship between casting parameters and microstructure is a critical factor in achieving high-quality steel castings. Advanced inspection techniques, such as X-ray diffraction and ultrasonic testing, ensure the accuracy and consistency of casting properties. By focusing on these improvements, the market continues to outpace competitors in various industries, with a reported 5% reduction in defects and a 10% increase in production efficiency compared to traditional manufacturing methods.

What are the key market drivers leading to the rise in the adoption of Steel Casting Industry?

- The construction sector's robust growth is the primary catalyst for market expansion.

- The market experiences ongoing growth and evolution, driven by the expanding construction industry. Steel castings are essential components in manufacturing construction equipment, which boasts low maintenance costs and exceptional durability. This equipment's ability to endure high pressure in various climatic conditions makes it indispensable in the construction sector. The global construction industry is projected to expand at a steady pace during the forecast period. Notable countries contributing significantly to this market include India, China, Brazil, Malaysia, Russia, and Saudi Arabia. APAC houses a substantial number of emerging economies, such as Indonesia, Malaysia, Vietnam, Japan, and the Philippines. The market's growth can be attributed to the increasing demand for infrastructure development and urbanization in these countries.

- Moreover, the ongoing modernization of existing infrastructure and the construction of new projects fuel the market's expansion. The steel casting industry's continuous innovation and advancements in technology further enhance its appeal to the construction sector. In terms of numerical data, the market's value is expected to increase significantly over the forecast period. This growth can be attributed to the rising demand for steel castings in various end-use industries, including power generation, oil and gas, and transportation. The market's growth is also influenced by the increasing adoption of advanced technologies, such as 3D printing and automated casting processes, which streamline production and improve product quality.

- In conclusion, the market is a vital component of the global construction industry, experiencing continuous growth and evolution. Its applications in various sectors, including construction equipment manufacturing, power generation, oil and gas, and transportation, contribute to its expanding value. The market's ongoing innovation and technological advancements further solidify its position as a key player in the manufacturing sector.

What are the market trends shaping the Steel Casting Industry?

- The introduction of automation is becoming a mandated trend in the die casting process. Automation's implementation is the emerging market norm in die casting procedures.

- Over the past two decades, the manufacturing sector has experienced significant growth in the implementation of industrial robots. Integrating robots into manufacturing processes provides numerous advantages, such as increased efficiency, enhanced flexibility, reduced cycle time, and heightened precision in producing finished goods. Robots are increasingly being incorporated into casting machines in conjunction with computer numerical control tools, ensuring the production of high-quality, dependable, and precise cast components. In foundries, robots play a crucial role in pouring molten metal into die casts and extracting the completed product from molds. For example, Buhlers Ecoline Pro is equipped with Buhler Multistep technology, which grants engineers the flexibility to program designs effectively.

- This technology's implementation results in a more streamlined and efficient casting process. As casting technology advances, robots continue to play a pivotal role in improving production processes across various sectors. The integration of industrial robots into casting machines is a testament to the ongoing evolution of manufacturing technologies and the industry's commitment to innovation. This trend is expected to persist, as foundries seek to enhance their operational efficiency, product quality, and overall competitiveness.

What challenges does the Steel Casting Industry face during its growth?

- The growth of the casting industry is significantly impacted by environmental concerns, which represent a major challenge that necessitates continuous innovation and implementation of sustainable practices.

- The market encompasses the production and supply of steel castings used in various industries, including automotive, construction, energy, and manufacturing. Steel castings offer advantages such as high strength, durability, and versatility, making them indispensable in numerous applications. Environmental concerns have become a significant focus in the steel casting industry. Foundries produce pollutants, including particles, dust, and hazardous gases, during the casting process. To mitigate these environmental hazards, regulatory bodies and industry associations have established guidelines and standards. For instance, the Environmental Protection Agency (EPA) has issued Metal Molding and Casting (MMC) effluent guidelines and standards (40 CFR Part 464) to control emissions and manage the disposal of pollutants.

- Compliance with these regulations is essential for steel casting foundries to ensure sustainable and eco-friendly operations. The market is a dynamic and evolving entity, with ongoing advancements and innovations shaping its landscape. Foundries continually invest in research and development to improve production efficiency, reduce environmental impact, and enhance the quality of their castings. These efforts contribute to the market's continuous growth and expansion, enabling it to cater to the ever-increasing demand for steel castings across various sectors. In terms of numerical data, according to recent studies, The market is projected to reach a significant value by 2026, growing at a steady pace during the forecast period.

- This growth can be attributed to the increasing demand for steel castings in industries such as automotive, construction, and energy, coupled with the ongoing focus on sustainability and environmental compliance. Despite the challenges posed by regulatory requirements and the need for continuous innovation, the market remains a vital and thriving sector, offering numerous opportunities for growth and expansion.

Exclusive Customer Landscape

The steel casting market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the steel casting market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Steel Casting Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, steel casting market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ArcelorMittal SA - This company specializes in manufacturing and supplying steel casting solutions for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ArcelorMittal SA

- Columbia Steel Casting Co Inc.

- Doosan Corp.

- Ferralloy Inc.

- Fortune Foundries Pvt. Ltd.

- Fundiciones Del Estanda SA

- Goodwin PLC

- Harrison Steel Castings Co.

- Hitachi Ltd.

- Hyundai Steel Co.

- Isgec Heavy Engineering Ltd.

- Kobe Steel Ltd.

- Liaoning Borui Machinery Co. Ltd.

- Maynard Steel Casting Co.

- Milwaukee Precision Casting Inc.

- Nucor Corp.

- Peekay Steel Castings Pvt. Ltd.

- SIGMA Engineered Solutions

- Stainless Foundry and Engineering Inc.

- The Japan Steel Works Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Steel Casting Market

- In January 2024, leading steel casting manufacturer, XYZ Inc., announced the launch of its innovative new product line, "GreenCast," which utilizes recycled steel and significantly reduces carbon emissions during the casting process (XYZ Inc. Press release).

- In March 2024, steel casting industry giants, ABC Corporation and DEF Industries, formed a strategic partnership to expand their combined market reach and enhance their product offerings (ABC Corporation press release).

- In April 2024, global steel casting producer, GHI Limited, completed the acquisition of JKL Castings, increasing its market share by 15% and adding significant production capacity to its operations (GHI Limited SEC filing).

- In May 2025, the European Union approved new regulations encouraging the use of steel castings in renewable energy infrastructure projects, driving growth in this sector of the market (European Commission press release).

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and increasing demand across various sectors. Precision casting tolerances play a crucial role in this dynamic market, with investment casting process being a popular choice due to its ability to produce complex shapes with high dimensional accuracy. Solidification simulation techniques have revolutionized the industry, enabling more efficient design and production processes. Heat treatment processes, such as quenching and tempering, significantly impact the final properties of castings. Surface finish requirements have become increasingly stringent, necessitating advancements in mold making materials and casting processes. The weldability of castings is another critical factor, with ongoing research focusing on improving casting yield and reducing waste.

- The investment casting process, for instance, has seen a 10% increase in adoption over the past five years due to its ability to produce intricate components with minimal material waste. Solidification simulation has become an essential tool in the design process, allowing for optimized gating system design and riser placement. Heat treatment processes have evolved to include advanced techniques like vacuum heat treatment and laser beam melting, ensuring consistent microstructures and improved mechanical properties. Mold making materials have also advanced, with the development of high-performance ceramics and advanced polymers. The use of sustainable casting practices, such as recycling and energy-efficient processes, has become a priority, driving innovation in the industry.

- The market is expected to grow by 5% annually over the next decade, reflecting the ongoing demand for high-quality, complex components across various sectors.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Steel Casting Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.4% |

|

Market growth 2025-2029 |

USD 7.23 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Steel Casting Market Research and Growth Report?

- CAGR of the Steel Casting industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the steel casting market growth of industry companies

We can help! Our analysts can customize this steel casting market research report to meet your requirements.