Surfing Apparel And Accessories Market Size 2025-2029

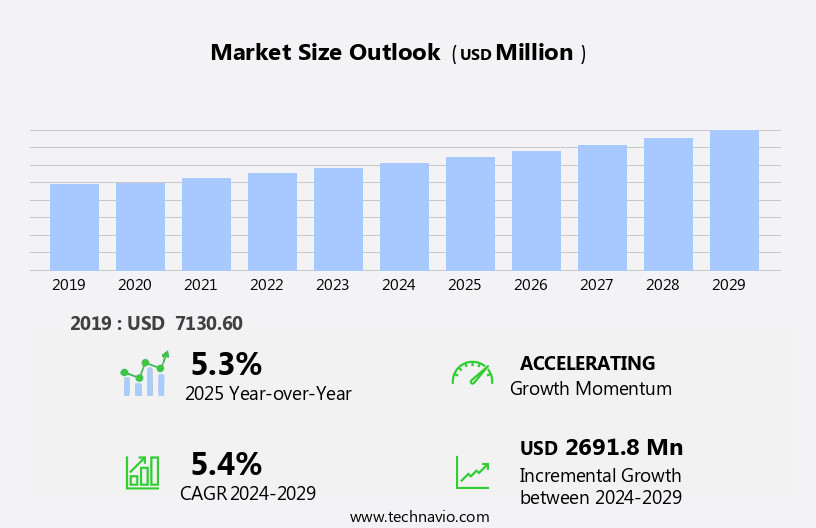

The surfing apparel and accessories market size is forecast to increase by USD 2.69 billion, at a CAGR of 5.4% between 2024 and 2029.

- The market is driven by the increasing popularity of surfing as a recreational activity and a lifestyle choice. This trend is fueled by the growing number of surf schools, competitions, and events worldwide, which attract both beginners and professionals. Additionally, the market is witnessing a significant shift towards sustainability and eco-friendly materials in response to rising environmental concerns. Materials such as recycled rubber and chlorine-resistant neoprene, are gaining traction in the market. Wearable technology, including polarized sunglasses and flip flops with built-in arch support, is also becoming increasingly popular. However, the seasonal nature of surfing poses a challenge to market growth, as demand is primarily concentrated in specific geographical locations and during certain months. Companies in this market can capitalize on the rising trend of sustainability by offering eco-friendly products made from recycled materials or using sustainable manufacturing processes.

- To navigate the challenge of seasonality, they can explore diversification into related markets, such as snow sports or outdoor apparel, or expand their customer base to non-surfing markets. Overall, the market offers opportunities for growth, particularly for companies that can effectively address the trends and challenges shaping the market.

What will be the Size of the Surfing Apparel And Accessories Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, reflecting the dynamic nature of the sport and its diverse applications. Soft tops and hard tops cater to various wave riding conditions, while wave-riding enthusiasts explore the latest offerings in fish surfboards and epoxy surfboards. Bluetooth speakers provide an enhanced surfing experience, enabling users to enjoy their favorite tunes while hitting the waves. Ethical sourcing and sustainability are increasingly important considerations in the market. Surfboard shapers and manufacturers prioritize the use of eco-friendly materials, such as recycled polyester, in the production of surfboards, wetsuits, and other accessories. Paddle float and surfboard trays facilitate easier transport and storage, while paddle adjustment and water resistance ensure optimal performance in various conditions.

Surf schools and surf technique training programs further expand the market, catering to beginners and experienced surfers alike. Surf paddles, fin systems, and surfboard repair services address the needs of those seeking to improve their skills and maintain their equipment. UV protection, surf hats, and jackets ensure surfers' comfort and safety in various weather conditions. Environmental impact remains a significant concern, with companies focusing on reducing their carbon footprint and minimizing waste. Surfboard rocker, volume, and fin systems continue to evolve, reflecting the ongoing innovation in surfing technology. Customer loyalty is fostered through high-quality products and exceptional customer service, ensuring a strong market presence for leading brands.

The market for surfing apparel and accessories encompasses a wide range of offerings, from surfboard bags and paddle shafts to surf traction and surf wax. Action cameras capture and share the thrill of surfing, while surfboard rails, fin plugs, and surf grip enhance the overall surfing experience. Waterproof cases and dry bags protect valuable equipment from the elements, ensuring that surfers are prepared for any condition. In the ever-changing landscape of the surfing market, companies must remain agile and responsive to the needs and preferences of their customers. The integration of technology, sustainability, and innovation continues to shape the market, creating new opportunities and challenges for players in the surfing apparel and accessories industry.

How is this Surfing Apparel And Accessories Industry segmented?

The surfing apparel and accessories industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Surf apparel

- Surf accessories

- Distribution Channel

- Offline

- Online

- Type

- Wetsuits

- Boardshorts and bikinis

- Rash guards and sun shirts

- Boots and gloves

- Others

- Material

- Neoprene

- Lycra

- Nylon

- Polyester

- Others

- Gender

- Men

- Women

- Unisex

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

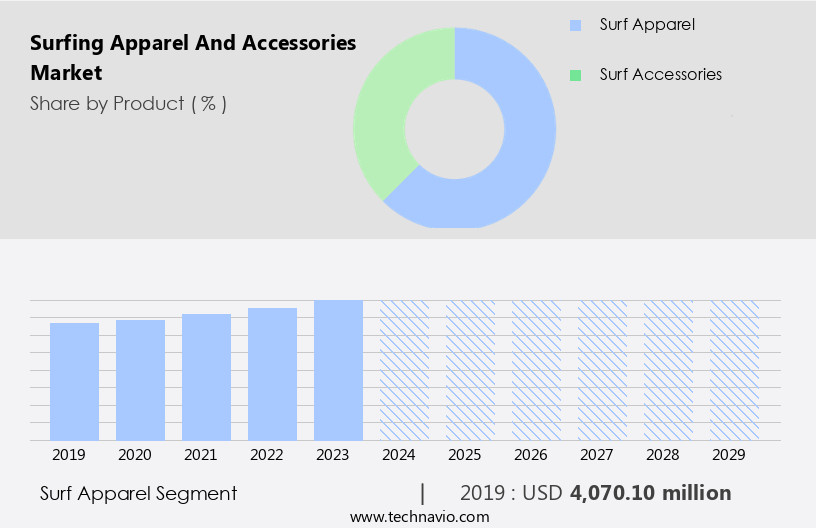

The surf apparel segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of products essential for surfers, from functional surfboard racks to fashionable surf ponchos. Hybrid surfboards combine the best of both worlds, offering the maneuverability of shortboards and the buoyancy of longboards. Online sales dominate the market, allowing customers to conveniently purchase epoxy surfboards, surf watches, and other accessories from the comfort of their homes. Surf culture influences the demand for surfboard shapers, who craft gun surfboards, fish surfboards, and other custom boards based on the surfer's skill level and wave riding preferences. Paddle shafts, paddle blades, and fin systems optimize paddling efficiency and surfboard performance.

Eco-conscious surfers seek out environmentally friendly options, such as polyester surfboards and fin boxes made from recycled materials. Surf schools teach essential surf techniques, while surf traction pads and surf paddles enhance the learning experience. Surfboard repair services ensure the longevity of surfboards, addressing issues like fin damage and surfboard rocker. UV protection, offered through surf jackets and waterproof bags, safeguards against sunburn and water damage. Soft tops and hard tops cater to different user preferences, while surf leggings and surf hats provide additional coverage and comfort. Action cameras capture the thrill of wave riding, and waterproof cases ensure their protection.

Surfboard accessories like fin plugs, surf grip, and surf trays streamline the surfing experience, while surf wax and surfboard rails ensure a secure grip on the board. Quality control measures ensure the durability and safety of surfboards and accessories. Surfboard volume and fin systems impact the overall performance of the board, while ethical sourcing and sustainability initiatives gain importance in the market. Bluetooth speakers and dry bags offer added convenience for surfers. In summary, the market caters to the diverse needs of surfers, from functional equipment to fashionable accessories, ensuring an immersive and harmonious wave riding experience.

The Surf apparel segment was valued at USD 4.07 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

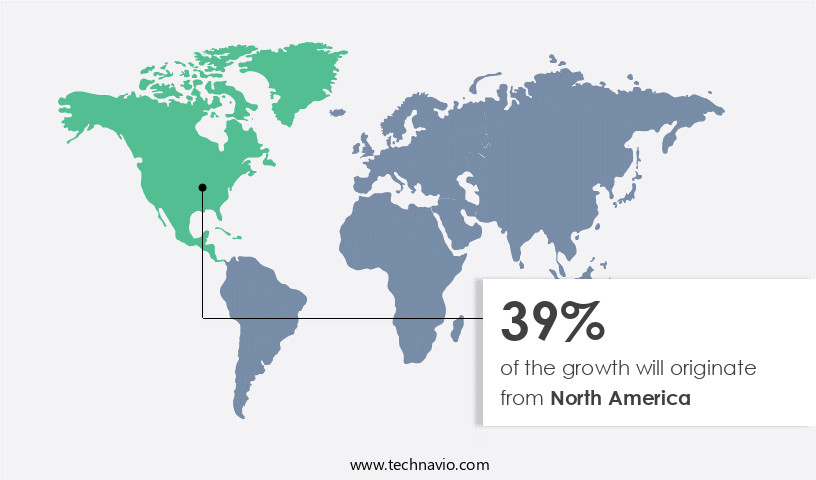

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is experiencing notable growth, driven by the region's renowned surfing culture and diverse surfing spots. Surfers from around the world flock to North America for ideal wave conditions, boosting demand for gear such as surfboards, racks, and accessories. Hybrid surfboards, epoxy surfboards, gun surfboards, and fish surfboards are popular choices among enthusiasts. Surf schools and lessons further fuel demand, as students require essential equipment like surf paddles, traction, and fins. Surfing apparel includes protective gear like hard tops, jackets, and ponchos, as well as performance-enhancing items such as leggings and rash guards.

Accessories like waterproof cases, bags, and hats ensure surfers' belongings stay dry and protected. Surfboard repair services and uv protection are also essential components of the market. Surf culture's influence extends to fin systems, paddle adjustment, and fin boxes. Environmental concerns are increasingly important, with a focus on ethical sourcing and sustainable materials. Quality control and customer loyalty are key factors for manufacturers, as is the integration of technology, such as action cameras and bluetooth speakers, into surfing equipment. Surfboard volume, rocker, and concaves are essential considerations for surfboard shapers and designers. Soft tops and wave riding are popular trends, catering to both beginners and experienced surfers.

The market's evolution reflects the dynamic and ever-changing nature of surfing and its devoted community.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market caters to the unique needs of surfers, offering a diverse range of products designed to enhance their experience and safety in the water. Wetsuits, a must-have for cold water surfing, come in various types such as full suits, spring suits, and shorties. Boardshorts and rash guards protect the skin from the sun, abrasion, and rashes. Surf leashes ensure board retention, while surf wax provides grip on the board. Sunscreen and hats shield surfers from harmful UV rays. Accessories like fins, traction pads, and surf bags complete the essentials. Surfing backpacks, wet bags, and changing mats simplify travel and post-surf activities. Swim fins, booties, and hooded wetsuits cater to different water temperatures and conditions. All these products contribute to the dynamic and thriving market.

What are the key market drivers leading to the rise in the adoption of Surfing Apparel And Accessories Industry?

- The surge in the popularity of surfing serves as the primary catalyst for market growth.

- The market has witnessed significant growth due to the increasing participation of individuals in surfing activities. This trend is driven by the attraction of surfing destinations worldwide, which draw tourists seeking the exhilarating experience of riding waves. Surfers, whether beginners or experienced, require essential equipment such as UV protection apparel, surfboard accessories, surf wax, and action cameras. Surfboard design elements like rocker, volume, and rails also influence purchasing decisions. Customer loyalty is fostered through fin systems and quality control measures. Brands cater to the youth demographic, who are drawn to the sport's adventurous and active nature, by offering trendy and youth-oriented designs.

- Environmental impact is a growing concern in the industry, with the shift towards eco-friendly materials, such as polyester surfboards, becoming increasingly popular. As the market continues to evolve, it is essential for brands to stay attuned to consumer preferences and market trends while maintaining product quality and sustainability.

What are the market trends shaping the Surfing Apparel And Accessories Industry?

- The increasing importance of sustainability and the use of eco-friendly materials is a prominent trend in the market. Businesses are prioritizing this approach to meet consumer demands and reduce their environmental footprint.

- Surfing apparel and accessory brands prioritize sustainability in their product offerings, utilizing recycled materials like polyester, nylon, and ocean plastic for manufacturing. This eco-conscious approach helps mitigate the environmental impact of the fashion industry and prevents waste from accumulating in landfills and oceans. Brands are also turning to organic and natural fabrics, such as organic cotton and hemp, for their surfing apparel. These materials are grown without harmful pesticides and chemicals, making them more sustainable. Sustainable manufacturing practices are being adopted, including water and energy conservation, eco-friendly dyeing processes, and minimizing production waste. Consumer preferences are shifting towards ethically sourced and environmentally responsible products.

- Surfing accessories, such as paddle floats, surfboard trays, and paddle adjustment systems, are being developed with water resistance and durability in mind. Bluetooth speakers and dry bags are popular accessories that offer functionality and convenience for wave riders. Surf fins are designed with various materials and concaves to enhance performance and reduce environmental impact. Brands are focusing on creating high-quality, functional, and sustainable surfing apparel and accessories that align with consumers' values.

What challenges does the Surfing Apparel And Accessories Industry face during its growth?

- The seasonal nature of surfing significantly limits industry growth due to inconsistent demand. Surfing's dependence on favorable weather and wave conditions restricts sales and revenue flow, making it a challenge for businesses to maintain steady growth.

- Surfing is a popular sport that relies on suitable weather and ocean conditions, making it seasonal in nature. The demand for surfing apparel and accessories experiences a significant surge during the peak season, which can differ by region but generally aligns with warmer summer months and consistent waves. Surfers and enthusiasts require various items such as swimwear, wetsuits, board shorts, rash guards, and surfboard accessories like surfboard racks, paddle shafts, and fin boxes to fully engage in the sport. In contrast, the off-season sees a substantial decrease in demand for these products due to unfavorable conditions. The market for surfing apparel and accessories is driven by advancements in surfboard technology, including the production of hybrid surfboards, gun surfboards, and epoxy surfboards, as well as the integration of technology into surfing equipment, such as surf watches and waterproof cases.

- Surf culture continues to influence the design and functionality of these products, ensuring they cater to the unique needs of surfers and enthusiasts. Surfboard shapers and manufacturers prioritize the development of innovative materials and designs to enhance the overall surfing experience.

Exclusive Customer Landscape

The surfing apparel and accessories market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the surfing apparel and accessories market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, surfing apparel and accessories market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adidas AG - This company specializes in providing high-quality surf apparel and accessories.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- Agit Global Inc.

- Authentic Brands Group LLC

- Boardriders

- Cobra International Co. Ltd.

- EssilorLuxottica

- FCS EU

- Firewire Surfboards LLC

- Haydenshapes Pty Ltd.

- Huizhou Xinyitong Sports Equipment Co. Ltd.

- Hurley Inc.

- KMD Brands Ltd.

- Nike Inc.

- ONeill Europe BV

- Patagonia Inc.

- Rusty Surfboards Inc.

- Simon Anderson Surfboards

- Tahe Kayaks OU

- Under Armour Inc.

- VF Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Surfing Apparel And Accessories Market

- In January 2024, Billabong International, a leading surf apparel and accessories company, announced the launch of its new eco-friendly wetsuit line, "Eco-Warrior," made from recycled materials (Billabong International Press Release, 2024). This strategic move aligns with the growing consumer demand for sustainable products in the surfing industry.

- In March 2024, Rip Curl, a major player in the market, entered into a partnership with a leading technology company to develop a smart wetsuit equipped with temperature sensors and a mobile application for real-time water temperature monitoring (Rip Curl Press Release, 2024). This technological advancement aims to enhance the user experience and cater to the evolving needs of surfers.

- In May 2024, Hurley, a subsidiary of Nike, Inc., announced a significant investment of USD15 million in its manufacturing facility in Indonesia to expand its production capacity and meet the increasing global demand for surf apparel and accessories (Hurley Press Release, 2024). This expansion marks Hurley's commitment to catering to the growing market and strengthening its competitive position.

- In February 2025, the European Union (EU) passed a new regulation mandating the use of eco-friendly materials in surf apparel and accessories, effective from January 2026 (European Parliament Press Release, 2025). This regulatory development is expected to significantly impact the market as companies will need to adapt to the new regulations and invest in sustainable materials to remain competitive.

Research Analyst Overview

- The surf apparel and accessories market exhibits dynamic trends, with retailer margins remaining competitive as technology advances in surf apparel and surfboard construction methods. Performance enhancement continues to drive innovation, as seen in the development of new materials for wetsuits and rashguards. Surf safety equipment, such as leashes and buoyancy vests, gains traction due to increasing consumer awareness of water safety. Surfboard technology evolves with new shapes, fin setups, and materials, influencing production costs and supply chain management. Marketing campaigns play a crucial role in customer segmentation, with brands employing various strategies to target diverse demographics.

- Branding strategies and design innovation are essential for product development, as companies strive to differentiate themselves in a saturated market. Consumer behavior analysis and price optimization are vital components of retail strategies, ensuring effective distribution channels and mitigating supply chain risks. Environmental sustainability practices are gaining importance, with surfboard and surf accessories materials being sourced responsibly. Surf training equipment and product lifecycle management are also key areas of focus, as the market segmentation analysis indicates a growing demand for high-performance gear. In the realm of surfboard construction, advancements in fin technology and surfboard designs offer enhanced functionality and durability.

- The integration of technology in surf apparel and accessories continues to reshape the market, with retailers and manufacturers adapting to meet evolving consumer needs.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Surfing Apparel And Accessories Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

241 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 2691.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Key countries |

US, China, Canada, Germany, Japan, UK, India, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Surfing Apparel And Accessories Market Research and Growth Report?

- CAGR of the Surfing Apparel And Accessories industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the surfing apparel and accessories market growth of industry companies

We can help! Our analysts can customize this surfing apparel and accessories market research report to meet your requirements.