Train Communication Gateways Systems Market Size 2024-2028

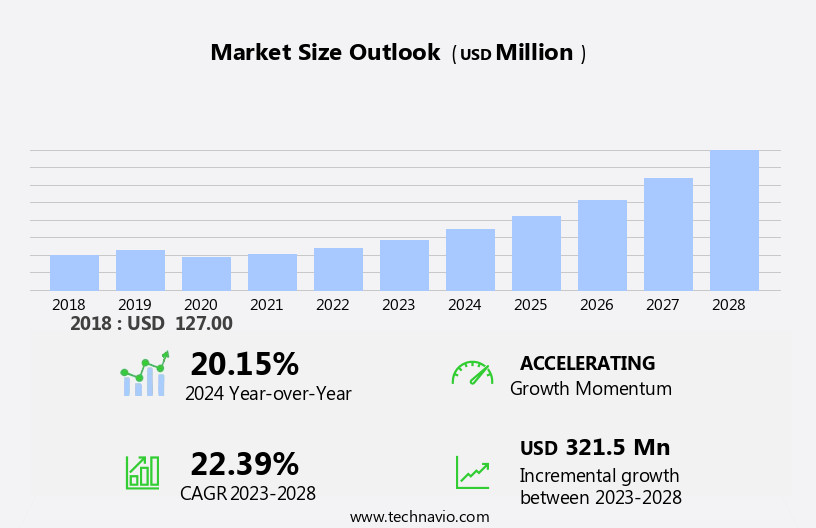

The train communication gateways systems market size is forecast to increase by USD 321.5 million at a CAGR of 22.39% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for passenger connectivity and the implementation of intelligent transport systems (ITS). These technologies enable real-time communication between trains and infrastructure, improving safety, efficiency, and overall passenger experience. The economic, social, and political significance of rail transport necessitates the implementation of cutting-edge technologies to ensure data security and cybersecurity. The railway industry's adoption of 5G networks, IoT, and rail transit communication networks continues to expand, further fueling market expansion. However, the high cost associated with rail infrastructure development and implementation remains a challenge for market growth. To address this, market participants are exploring cost-effective solutions such as shared infrastructure and public-private partnerships. Additionally, advancements in wireless communication technologies and the integration of cloud-based services are expected to drive market growth. Overall, the market is poised for expansion, with a focus on enhancing passenger comfort, safety, and operational efficiency In the rail sector.

What will be the Size of the Train Communication Gateways Systems Market During the Forecast Period?

- The market encompasses subsystems such as propulsion systems, brakes, signaling systems, passenger information systems, and intelligent transport systems. These systems leverage advanced technologies like artificial intelligence (AI) and machine learning (ML) to optimize rail infrastructure performance and enhance user experience. Distributed computing, data filtering solutions, and interoperability are key trends driving market growth. Customers seek reliable communication mediums to ensure rail requirements are met, including real-time data transfer and threat landscapes mitigation. Intelligent transportation systems, mobility, and public-private partnerships are shaping the market's future. Supply chain disruptions and cyberattacks pose challenges, necessitating rugged phone companies' involvement. Rail infrastructure modernization and the integration of various communication systems are essential for efficient and secure train operations.

How is this Train Communication Gateways Systems Industry segmented and which is the largest segment?

The train communication gateways systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Rapid transit railways

- Conventional railways

- Type

- Wire train bus (WTB) gateway

- Multifunction vehicle bus (MVB) gateway

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- Middle East and Africa

- South America

- North America

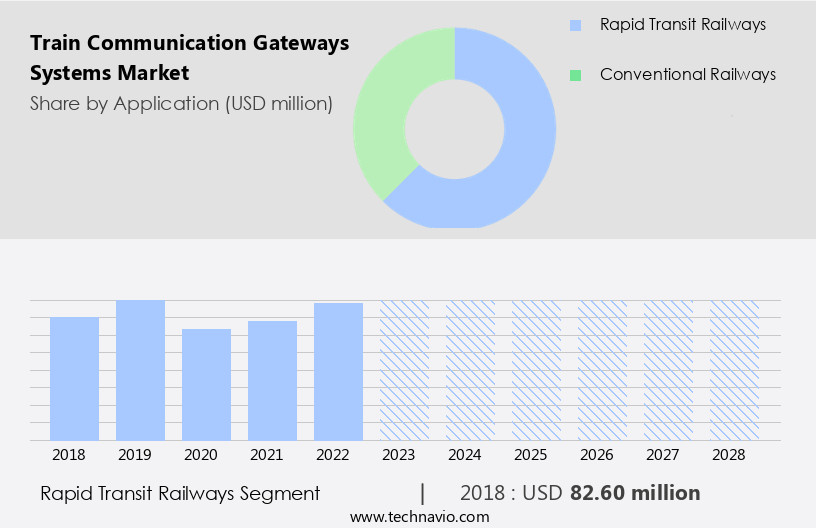

By Application Insights

- The rapid transit railways segment is estimated to witness significant growth during the forecast period. In the rapidly evolving railway sector, communication gateway systems play a pivotal role in enhancing operational efficiency, safety, and passenger experience in rapid transit railways, including metro, subway, and light rail networks. These systems facilitate real-time data exchange and connectivity between onboard and wayside subsystems, such as propulsion systems, brakes, signaling systems, passenger information systems, and surveillance systems. Integration of artificial intelligence, machine learning, distributed computing, and customized data filtering solutions further optimizes performance and user experience. The rail industry faces various challenges, including interoperability issues, regulatory standards, and security threats. Communication gateway systems enable seamless interoperability between different train architectures and rail infrastructure, ensuring end-to-end connection for train control and management systems.

- Furthermore, these systems provide real-time monitoring, data analytics, and automation capabilities, addressing the need for intelligent, interoperable systems. The implementation of communication gateway systems also supports the deployment of cutting-edge train technologies, such as intelligent transportation systems, 5G networks, and the Internet of Things. These advancements help mitigate supply chain disruptions, improve train efficiency, and enhance passenger safety. Cybersecurity measures, including encryption technology, secure communication protocols, and subject-related expert advice, ensure data security and protect against cyberattacks. Thus, communication gateway systems are essential for the railway sector, enabling efficient data exchange, enhancing operational performance, and ensuring passenger safety In the context of the evolving transportation landscape.

Get a glance at the market report of share of various segments Request Free Sample

- The rapid transit railways segment was valued at USD 82.60 million in 2018 and showed a gradual increase during the forecast period.

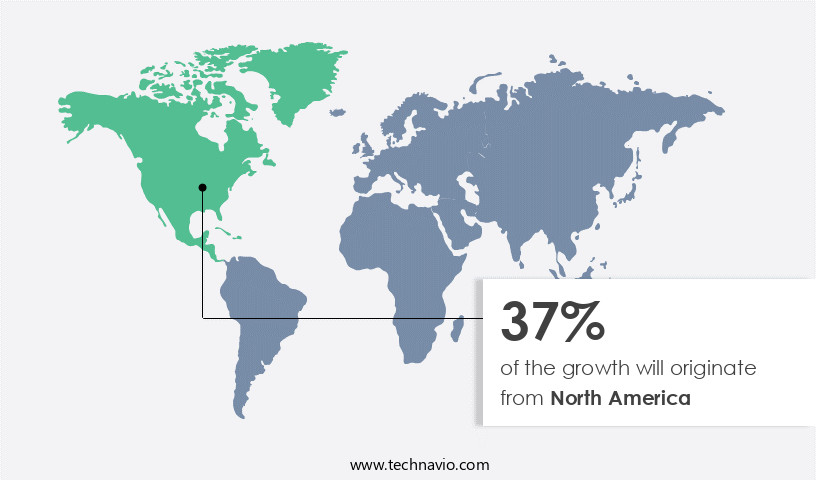

Regional Analysis

- North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The North American market encompasses freight and passenger rail sectors. Freight rail, fueled by cross-border trade between the US, Canada, and Mexico, accounts for a significant market share.

For more insights on the market size of various regions, Request Free Sample

- In contrast, passenger rail growth is attributed to population expansion in metropolitan areas of the US and Canada. The US passenger transit industry relies on government funding, with a five-year transportation bill allocating approximately USD 11 billion until 2020. However, developing countries are surpassing North America in transit development. Subsystems, such as propulsion systems, brakes, signaling systems, passenger information systems, and artificial intelligence/machine learning, are integral to train communication gateways. Distributed computing, data filtering solutions, user experience, and interoperability are crucial considerations.

- Threat landscapes, rail requirements, and regulatory standards shape the market. Intelligent transport systems, mobility, and rail infrastructure are key areas of focus. Communication mediums, product types, and train architectures impact operational performance, safety, and passenger experience. Technological expenses, incompatibilities, and interoperability issues influence the competitive advantage. Train communication gateways ensure end-to-end connection, managing onboard and external subsystems, and facilitating real-time monitoring, data analytics, and automation. Security infrastructure, data security, and cybersecurity are essential aspects of communication technologies, including IoT and 5G networks. Subject-related expert advice, economic, social, and political factors, and regulations shape the industry landscape.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Train Communication Gateways Systems Industry?

- The rising demand for passenger connectivity is the key driver of the market. Train Communication Gateways Systems (TCGS) have emerged as a critical component in modern rail transportation, facilitating secure and efficient data exchange between trains and ground control systems. Encryption technology and secure communication protocols are essential elements of TCGS, safeguarding sensitive information from unauthorized access. Subject-matter experts advise that active implementation of these technologies is vital in the face of escalating cyber threats.

- Economic factors, such as increasing investments in rail infrastructure and the growing demand for real-time data exchange, further underscore the importance of TCGS. Social factors, including passenger safety and comfort, also necessitate robust data security measures. Political factors, including regulations and compliance requirements, are driving the adoption of TCGS. Innovators in this field are focusing on product strategy and business strategy to offer advanced solutions that cater to the unique requirements of the rail transportation sector. By prioritizing data security and cybersecurity, TCGS are poised to revolutionize the rail industry and enhance overall operational efficiency. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the Train Communication Gateways Systems Industry?

- The rising demand for intelligent transport system (ITS) is the upcoming market trend. Train communication gateways systems play a crucial role in ensuring secure and efficient data transmission between trains and ground control centers. The economic, social, and political factors driving the demand for advanced train communication systems are compelling market innovators to develop cutting-edge solutions. Data security and cybersecurity are paramount considerations in this domain, necessitating the use of encryption technology and secure communication protocols.

- Subject-matter experts advise that product and business strategies must prioritize these aspects to mitigate potential risks. Regulations mandating secure communication in the rail industry further underscore the importance of these systems. As the market evolves, active collaboration between stakeholders and continuous innovation will be essential to stay competitive. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does the Train Communication Gateways Systems Industry face during its growth?

- The high cost associated with rail infrastructure is a key challenge affecting the industry growth. Train communication gateways systems play a crucial role in ensuring secure and efficient data transmission between trains and ground control centers. With the increasing economic, social, and political significance of rail transportation, the demand for advanced communication systems is escalating. Data security and cybersecurity are paramount concerns in this context. Encryption technology and secure communication protocols are essential components of modern train communication gateways systems. Subject-matter experts advise that these systems must be active, innovative, and adhere to the latest regulations.

- Economic, social, and political factors influence the product and business strategies of key players in the train communication gateways systems market. Regulations, such as the European Union's Rail Interoperability Directive, mandate the use of specific communication technologies and protocols. Innovative companies in this market leverage cutting-edge technology to offer advanced features, such as real-time data analysis and predictive maintenance. These capabilities help rail operators improve efficiency, reduce downtime, and enhance passenger safety. In summary, the train communication gateways systems market is a dynamic and evolving landscape. Players must stay abreast of the latest trends, technologies, and regulations to remain competitive and provide value to their customers. Hence, the above factors will impede the growth of the market during the forecast period.

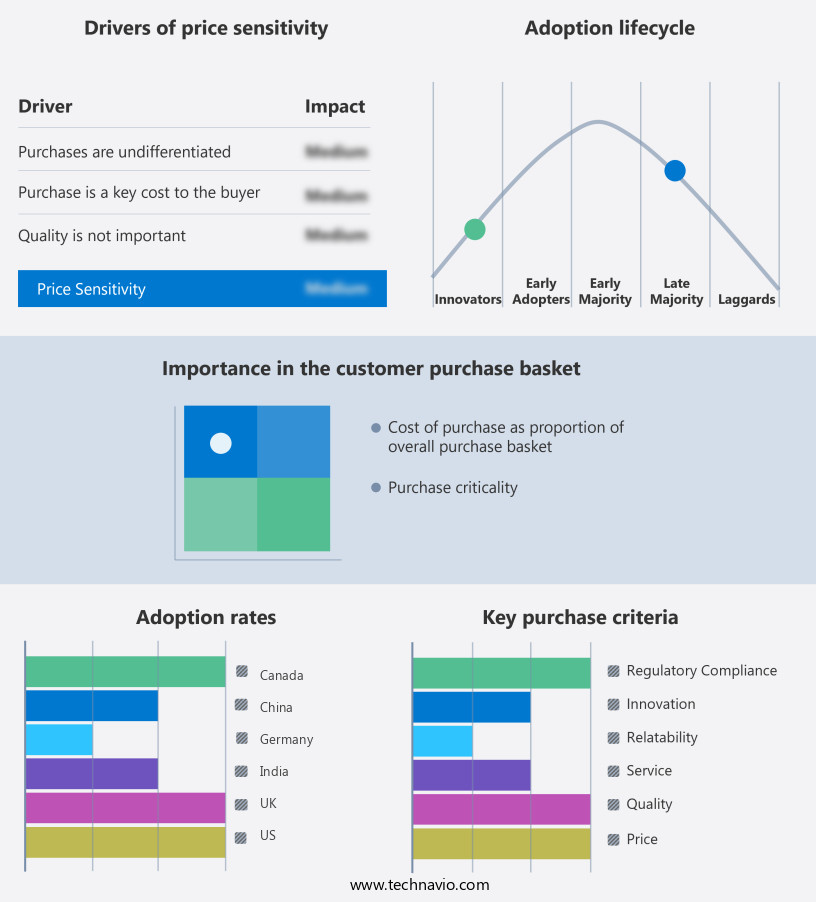

Exclusive Customer Landscape

The train communication gateways systems market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the train communication gateways systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, train communication gateways systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Advantech Co. Ltd.

- ALSTOM SA

- AMiT spol. s r.o.

- Cisco Systems Inc.

- CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES S.A.

- duagon AG

- EKE Electronics Ltd.

- Hitachi Ltd.

- Huawei Technologies Co. Ltd.

- Ingeteam Corp. S.A.

- Knorr Bremse AG

- Mitsubishi Electric Corp.

- Moxa Inc.

- Nokia Corp.

- Quester Tangent

- Secheron SA

- Siemens AG

- SYS TEC electronic AG

- WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORP.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Train communication gateways systems have become an essential component of modern rail transportation, facilitating the seamless exchange of data between onboard trains and external subsystems. These systems enable intelligent transportation systems (ITS) to optimize operational performance, enhance safety, and improve passenger experience. Communication gateways serve as the bridge between train architectures and external networks, connecting vehicle buses and train buses to various interfaces and networks. They facilitate end-to-end connections, ensuring the interoperability of various subsystems, including signaling systems, passenger information systems, and train control management systems. The rail sector is witnessing significant technological improvements, with the integration of communication gateway systems becoming a key focus area. The use of communication gateways enables real-time monitoring, data analytics, and automation, leading to increased train efficiency and passenger safety. The rail industry is undergoing a digital transformation, with the adoption of cutting-edge train technologies such as artificial intelligence (AI) and machine learning (ML) becoming increasingly common. Communication gateways play a crucial role in enabling these technologies by providing secure communication channels and data interchange capabilities.

However, the implementation of communication gateway systems also presents several challenges. Interoperability issues, regulatory standards, and cybersecurity concerns are some of the key challenges that need to be addressed. The rail sector is also grappling with supply chain disruptions and the impact of economic, social, and political factors on the industry. Despite these challenges, the use of communication gateway systems offers significant competitive advantages. They enable rail companies to provide better passenger experiences, improve operational efficiency, and ensure regulatory compliance. The adoption of 5G networks and the Internet of Things (IoT) is expected to further revolutionize the rail sector, enabling new applications and use cases. The rail sector is witnessing a wave of mergers and partnerships, with public-private partnerships becoming increasingly common. Communication gateway systems are a key focus area for these partnerships, as they enable the integration of various subsystems and improve overall connectivity and interoperability.

Thus, rugged phone companies are also playing a crucial role In the adoption of communication gateway systems In the rail sector. These companies provide ruggedized devices that can withstand the harsh conditions of the rail environment and ensure reliable communication between trains and external subsystems. Thus, communication gateway systems are a critical component of modern rail transportation, enabling the integration of various subsystems and improving overall operational performance, safety, and passenger experience. The rail sector is witnessing significant technological improvements, and communication gateways are expected to play a key role in enabling these advancements while addressing the challenges of interoperability, regulatory compliance, and cybersecurity.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 22.39% |

|

Market growth 2024-2028 |

USD 321.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

20.15 |

|

Key countries |

US, China, Germany, India, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Train Communication Gateways Systems Market Research and Growth Report?

- CAGR of the Train Communication Gateways Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the train communication gateways systems market growth of industry companies

We can help! Our analysts can customize this train communication gateways systems market research report to meet your requirements.