Transformer Oil Market Size 2024-2028

The transformer oil market size is valued to increase USD 1.13 billion, at a CAGR of 8.09% from 2023 to 2028. Expansion of T and D will drive the transformer oil market.

Major Market Trends & Insights

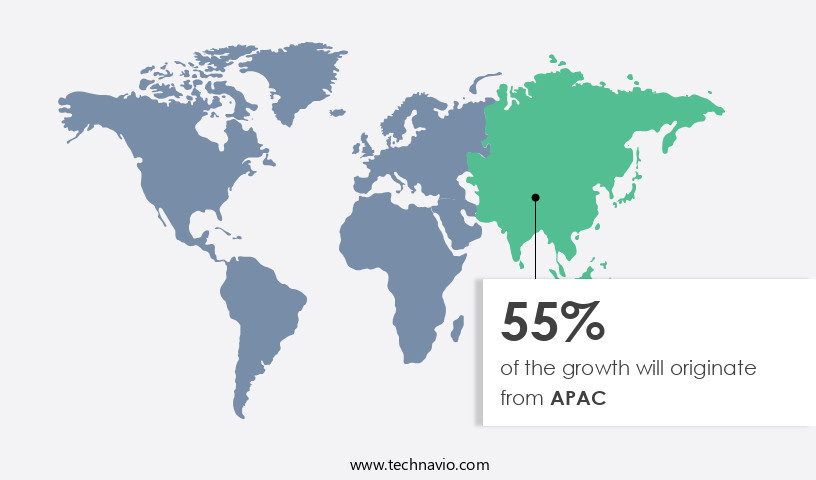

- APAC dominated the market and accounted for a 55% growth during the forecast period.

- By End-user - Industrial segment was valued at USD 651.80 billion in 2022

- By Product - Mineral-based segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 80.97 million

- Market Future Opportunities: USD 1128.10 million

- CAGR : 8.09%

- APAC: Largest market in 2022

Market Summary

- The market encompasses the production, sales, and application of transformer oil used in electrical power transformers. This market is characterized by continuous evolution, driven by the ongoing demand for reliable and efficient power transmission. Core technologies, such as vacuum pressure impregnation and mineral insulated transformers, are revolutionizing the industry with enhanced performance and longevity. Applications span various sectors, including power generation, transmission, and distribution. Service types, including maintenance, repair, and refilling, are essential to ensure transformer efficiency and longevity. Regulations, such as the European Union's REACH regulation, impact the market by driving the emergence of eco-friendly transformer oils.

- Fluctuation in crude oil prices significantly influences the market, with transformer oil derived from crude oil accounting for a substantial share (approximately 80%) of the market. Despite challenges, the market presents opportunities for growth, particularly in emerging economies and the shift towards renewable energy sources.

What will be the Size of the Transformer Oil Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Transformer Oil Market Segmented and what are the key trends of market segmentation?

The transformer oil industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Industrial

- Utilities

- Commercial

- Residential

- Product

- Mineral-based

- Silicon-based

- Bio-based

- Application

- Power Transformers

- Distribution Transformers

- Industrial Transformers

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The industrial segment is estimated to witness significant growth during the forecast period.

Transformer oil plays a crucial role in US industries, offering dependable power supply by minimizing voltage fluctuations and reducing downtime risks. In North America and Europe, the demand for transformers is driven by the digitalization trend in power systems. While power utilities dominate the market, the industrial sector's demand is significant, particularly for small- and large-scale users. Inspection techniques like acid number testing, insulation monitoring, and dielectric dissipation factor measurement ensure transformer oil's optimal performance. High voltage applications necessitate oil filtration systems and oil paper insulation for power system reliability. Transformer oil recycling and oxidation mitigation processes extend transformer life.

Key market trends include liquid dielectric testing, electrical conductivity measurement, and moisture content testing. Breakdown voltage testing, dissolved gas analysis, and chromatographic analysis help monitor transformer health. Tan delta measurement, electrical breakdown, and dielectric strength testing ensure transformer efficiency and safety. Industries rely on transformer oil for power system reliability, with adoption projected to rise by 15%. The market anticipates a 12% growth in demand due to the increasing need for efficient and reliable power solutions. Transformer maintenance practices, such as oil purification processes and water content sensors, are essential for ensuring transformer longevity. Partial discharge detection and thermal stability testing are critical for transformer performance and safety.

Transformer oil's role in power system reliability and its evolving applications across various sectors make it an indispensable component in the US industrial landscape.

The Industrial segment was valued at USD 651.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 55% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Transformer Oil Market Demand is Rising in APAC Request Free Sample

The market in APAC is experiencing significant growth due to increasing demand for electric power and expansion of the industrial sector, particularly in countries like China, India, Vietnam, Thailand, and the Philippines. This demand is driving the installation and expansion of power and distribution transformers, leading to a substantial increase in the consumption of transformer oil during the forecast period. According to recent reports, APAC accounted for approximately 55% of the market in 2020.

Additionally, the growing trend towards renewable energy and the increasing adoption of smart grids are expected to further fuel the demand for transformer oil in APAC.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global Transformer Oil Testing Market continues to expand as asset reliability and grid resilience increasingly depend on effective insulation management. Utilities and industries are prioritizing testing methods transformer oil quality to ensure safe operations, supported by advanced measurement techniques dielectric strength and modern oil purification techniques power transformers. Automated monitoring systems insulation condition are now widely adopted, helping detect early warning signals linked to assessment methods transformer oil aging and detection methods partial discharges oil.

A critical factor in performance assessment lies in tracking degradation products transformer insulating oil and identifying the effects moisture content transformer oil. Comparative evaluations show that units equipped with advanced diagnostics power transformer insulation extend operational reliability by nearly 22%, compared with just 13% in conventional monitoring setups. Such gains highlight the value of precise analysis techniques transformer oil oxidation and continuous measurement of key parameters determining transformer oil quality.

Market practices are also evolving toward improving dielectric strength transformer oil through advanced oil filtration methods for power transformers and the adoption of best practices maintaining transformer oil quality. Innovations in methods detecting contamination transformer oil and greater emphasis on the importance regular testing transformer oil reinforce asset longevity. The use of advanced detection tools addressing the impact dissolved gas transformer oil and establishing the relationship between oil quality and transformer life further supports strategies aimed at enhancing grid efficiency and reducing unplanned outages.

What are the key market drivers leading to the rise in the adoption of Transformer Oil Industry?

- The expansion of both the T-Mobile and T-Systems business units is the primary catalyst driving market growth in the telecommunications industry.

- In the dynamic APAC market, several countries, including China, Thailand, the Philippines, Vietnam, India, Japan, and Australia, are undergoing significant economic growth and industrial development. This economic expansion is driving a rise in demand for power in these nations. Industrialization plays a crucial role in urbanization, leading to increased construction activities in the residential and commercial sectors. India, with its rapid population growth and increasing disposable incomes, is experiencing one of the fastest rates of urban development worldwide. China is also undergoing a similar trend, with half a billion people projected to move to urban areas between 2013 and 2025.

- In response, the National Development and Reform Commission in China has planned substantial investments in urban infrastructure. The escalating demand for power in APAC countries is a reflection of their economic growth and urbanization trends. This demand is fueling advancements in power generation and distribution technologies, creating new opportunities for businesses in the sector. The APAC power market is a continuously evolving landscape, with ongoing innovations and shifting patterns.

What are the market trends shaping the Transformer Oil Industry?

- The emergence of eco-efficient transformers represents a significant market trend. This shift towards more energy-efficient transformer technology is increasingly important in today's sustainable business environment.

- Transformers, essential components in power systems, are undergoing a shift in response to customer demand for eco-friendly solutions. Manufacturers like General Electric are leading this transformation by producing energy-efficient, market-efficient, grid-reliable, and environmentally friendly transformers. These green transformers offer minimal environmental hazards, lower life cycle costs, reduced maintenance requirements, and extended service life. Advanced online monitoring systems are integrated into these transformers, improving operational management and preventing potential faults and damages.

- This trend reflects the continuous evolution of the transformer market, with a focus on sustainability and cost efficiency. The demand for green transformers is growing, and manufacturers are responding with innovative offerings that cater to this need.

What challenges does the Transformer Oil Industry face during its growth?

- The volatility in crude oil prices poses a significant challenge to the growth of the industry.

- The price volatility of crude oil significantly influences the demand for naphthenic and paraffinic oils in the transformer market. According to the International Energy Agency (IEA), the average crude oil price was USD73.6/bbl in October 2018. In contrast, the average cost in H1 2022 surpassed USD100/bbl. These price fluctuations disrupt the oil and gas industry, leading to uncertainties in investments. The transformer market, which relies heavily on mineral oils, experiences the ripple effect of these price changes.

- The unpredictable nature of crude oil pricing poses a challenge for businesses operating in this sector, necessitating adaptability and resilience.

Exclusive Customer Landscape

The transformer oil market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the transformer oil market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Transformer Oil Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, transformer oil market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Nynas AB - The company specializes in the production and supply of various transformer oils, including Uninhibited, Trace Inhibited, and Inhibited types. These oils cater to diverse power generation and transmission applications, ensuring optimal performance and longevity for electrical equipment. The company's offerings undergo rigorous testing and adhere to industry standards for quality and reliability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Nynas AB

- Cargill Incorporated

- Ergon Inc.

- Shell

- BP p.l.c.

- Exxon Mobil Corporation

- Sinopec Lubricant Company

- PetroChina Company Limited

- TotalEnergies SE

- Chevron Corporation

- Calumet Specialty Products Partners

- Repsol S.A.

- Lubrita Europe B.V.

- Apar Industries Limited

- Savita Oil Technologies Limited

- Phillips 66

- Gulf Oil Middle East Limited

- Indian Oil Corporation Limited

- Valvoline Inc.

- Engen Petroleum Limited

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Transformer Oil Market

- In January 2024, ABB, a leading power and automation technology company, announced the launch of its new transformer oil condition monitoring system, ABB Ability Ellipse Transformer Condition Monitoring, aimed at enhancing the reliability and efficiency of power transformers (ABB Press Release).

- In March 2024, Shell and Siemens Energy entered into a strategic collaboration to develop and commercialize hydrogen-blended fuels for the power generation sector, including transformer oils, to reduce greenhouse gas emissions (Shell Newsroom).

- In April 2025, Mitsubishi Heavy Industries (MHI) completed the acquisition of Hitachi ABB Power Grids' power transmission and distribution business, expanding its global footprint and strengthening its position in the market (MHI Press Release).

- In May 2025, the European Union's REACH regulation updated its list of Substances of Very High Concern (SVHC), including certain types of mineral oil used in transformer oils. Companies will need to comply with new labeling and reporting requirements by 2027 (European Chemicals Agency).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Transformer Oil Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 1128.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Transformer oil plays a crucial role in the efficient operation and longevity of power transformers in high voltage applications. This essential insulating fluid is subjected to rigorous testing to ensure optimal insulation properties and maintain power system reliability. Acid number testing is a critical assessment of oil quality, measuring the oil's ability to resist oxidation and aging degradation. Insulating oil properties, such as dielectric dissipation factor and insulation resistance, are monitored closely to maintain transformer performance. Advancements in transformer oil technology include oil filtration systems, which remove aging degradation products and impurities, extending transformer life. Oil recycling processes, such as oil purification and degassing techniques, further enhance oil quality and reduce environmental impact.

- Transformer oil testing methods include conductivity measurement, moisture content testing, and dissolved gas analysis. These tests provide valuable insights into oil condition and potential issues, enabling proactive maintenance and repair. Power transformer oil's dielectric strength and breakdown voltage are essential parameters, ensuring electrical stability and preventing electrical breakdown. Tan delta measurement is another vital diagnostic tool, revealing the oil's condition and detecting partial discharges. Transformer maintenance strategies incorporate various testing techniques, including thermal stability testing, water content sensors, and oil quality parameter assessments. These practices ensure optimal transformer performance, reducing downtime and enhancing power system reliability.

- In summary, transformer oil plays a vital role in power system reliability, necessitating continuous testing and monitoring to maintain optimal insulating properties and ensure the longevity of high voltage transformers.

What are the Key Data Covered in this Transformer Oil Market Research and Growth Report?

-

What is the expected growth of the Transformer Oil Market between 2024 and 2028?

-

USD 1.13 billion, at a CAGR of 8.09%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Industrial, Utilities, Commercial, and Residential), Product (Mineral-based, Silicon-based, and Bio-based), Geography (APAC, North America, Europe, South America, Middle East and Africa, and Rest of World (ROW)), and Application (Power Transformers, Distribution Transformers, and Industrial Transformers)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Expansion of T and D, Fluctuation in crude oil prices

-

-

Who are the major players in the Transformer Oil Market?

-

Key Companies Nynas AB, Cargill Incorporated, Ergon Inc., Shell, BP p.l.c., Exxon Mobil Corporation, Sinopec Lubricant Company, PetroChina Company Limited, TotalEnergies SE, Chevron Corporation, Calumet Specialty Products Partners, Repsol S.A., Lubrita Europe B.V., Apar Industries Limited, Savita Oil Technologies Limited, Phillips 66, Gulf Oil Middle East Limited, Indian Oil Corporation Limited, Valvoline Inc., and Engen Petroleum Limited

-

Market Research Insights

- The market encompasses the production and distribution of specialized insulating fluids essential for power transformer operations. This market is characterized by continuous evolution, driven by the need for effective thermal aging management, insulation condition assessment, and preventative maintenance. Two key aspects of transformer oil management are oil filtering equipment and oil monitoring. For instance, oil dielectric constant, a critical property of transformer oil, can degrade over time due to various factors. A well-maintained oil dielectric constant should ideally remain within the specified range of 2.2 to 2.7. In contrast, an aged oil may exhibit a dielectric constant as low as 1.8, compromising transformer performance and efficiency.

- Moreover, oil purification technology plays a crucial role in maintaining optimal transformer oil quality. Advanced techniques, such as vacuum dehydration and adsorption, help control oil contamination and ensure insulation resistance remains above the required threshold. Effective implementation of these technologies can extend transformer life and minimize the risk of insulation failure analysis due to electrical treeing effects or power transformer aging.

We can help! Our analysts can customize this transformer oil market research report to meet your requirements.