Transmission And Distribution (T And D) Equipment Market Size 2025-2029

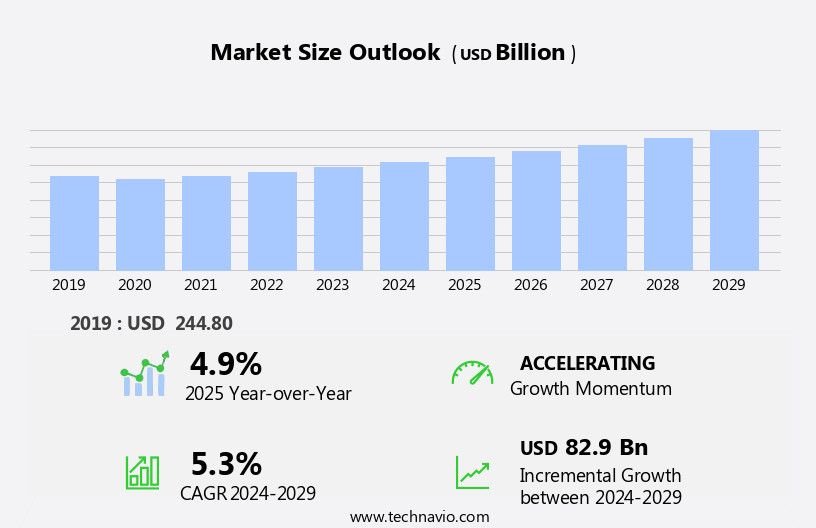

The transmission and distribution (t and d) equipment market size is forecast to increase by USD 82.9 billion, at a CAGR of 5.3% between 2024 and 2029.

- The Transmission and Distribution (T&D) Equipment Market is experiencing significant growth, driven by the increased demand for power generation and the growing focus on energy efficiency. With the global energy landscape undergoing a transformation, there is a heightened emphasis on modernizing existing infrastructure and integrating renewable energy sources into the grid. The rise of distributed generation, particularly solar and wind energy, is a key trend shaping the market. As renewable energy sources become more cost-effective and efficient, there is a growing need for advanced T&D equipment to ensure reliable power transmission and distribution. However, challenges persist, including the integration of intermittent renewable energy sources and the need to upgrade aging infrastructure to accommodate increasing power demands.

- Effective management of these challenges will be crucial for market participants seeking to capitalize on the opportunities presented by this dynamic market. Companies must focus on developing innovative solutions to address the unique demands of renewable energy integration and infrastructure modernization, while also ensuring regulatory compliance and maintaining a strong focus on energy efficiency.

What will be the Size of the Transmission And Distribution (T And D) Equipment Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The Transmission and Distribution (T&D) equipment market continues to evolve, driven by the dynamic interplay of various factors. Power system analysis tools, such as circuit breakers and transient analysis systems, ensure the reliable operation of electrical grids. SCADA systems facilitate remote monitoring and control, while underground cables and installation and commissioning services enable efficient power transmission. Grid modernization initiatives, fueled by advances in AI and distribution automation systems, are transforming the industry. Insulation coordination, protective relays, and network planning are crucial components of these modernization efforts. Data analytics and high voltage (HV) equipment play a pivotal role in optimizing grid performance.

Outage management and maintenance services are essential for maintaining grid reliability. Power electronics, potential transformers (PT), engineering services, and field testing are integral to these services. Renewable energy integration and energy storage systems are shaping the future of the power sector, necessitating the adoption of advanced technologies like fiber optic cables and substation automation. Voltage regulation and voltage regulators are vital for maintaining consistent power quality. Low voltage (LV) and medium voltage (MV) equipment cater to diverse power requirements. Current transformers (CT) and surge arrestors ensure safety and protection against power surges. The evolving market landscape also includes the integration of smart grid technologies, such as demand response, fault detection, and load forecasting.

Harmonic analysis and overhead lines are critical components of power quality management. Safety standards continue to evolve, driving the need for advanced protective systems and network optimization.

How is this Transmission And Distribution (T And D) Equipment Industry segmented?

The transmission and distribution (t and d) equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Power cables

- Switchgears

- Transformers

- Installation Sites

- Overhead

- Underground

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The power cables segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of technologies essential to the reliable delivery of electricity. Key components include circuit breakers, power system analysis, SCADA systems, underground cables, installation and commissioning, transient analysis, grounding systems, grid modernization, asset management, artificial intelligence (AI), distribution automation systems, insulation coordination, protective relays, network planning, data analytics, high voltage (HV) equipment, outage management, maintenance services, power electronics, potential transformers (PT), engineering services, field testing, renewable energy integration, energy storage systems, substation automation, voltage regulation, voltage regulators, low voltage (LV) equipment, current transformers (CT), fiber optic cables, reliability assessment, power quality, medium voltage (MV) equipment, safety standards, demand response, fault detection, smart grid technologies, load forecasting, surge arrestors, harmonic analysis, overhead lines, remote monitoring, and power factor correction.

The power cables segment dominates the market, driven by the surge in grid expansion projects, interconnection projects between countries, and the addition of renewable power generation. Urbanization and population growth fuel the demand for electricity, making it a vital commodity for economic development. These factors underpin the expansion of T and D infrastructure to connect more populations to the grid. Grid modernization and the integration of AI, distribution automation systems, and smart grid technologies are also crucial trends, enhancing grid reliability and efficiency. Additionally, the integration of renewable energy and energy storage systems is transforming the power sector, necessitating advanced T and D equipment to ensure a stable and resilient power grid.

The Power cables segment was valued at USD 139.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 54% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in the Asia Pacific (APAC) region. In 2024, APAC held the largest market share and is projected to experience the fastest expansion during the forecast period. This growth can be attributed to substantial investments in capacity additions for renewable and fossil fuel-fired power plants, as well as efforts to increase electricity access in countries like China, India, Australia, and Southeast Asian economies. Moreover, there is a substantial investment planned for developing power infrastructure to fuel economic growth and industrialization. For instance, India's government has initiated various initiatives to meet the country's increasing power demands.

Power system analysis, SCADA systems, and network planning play crucial roles in optimizing T and D systems. Underground cables and fiber optic communication lines ensure reliable power transmission and enable remote monitoring. Renewable energy integration and energy storage systems are essential components of modern power grids. Grid modernization, asset management, and demand response are key trends driving the market. Artificial intelligence (AI), distribution automation systems, insulation coordination, protective relays, and voltage regulation are essential technologies for maintaining grid stability and reliability. Transient analysis, grounding systems, surge arrestors, harmonic analysis, and power quality ensure optimal power flow and protect against power fluctuations.

Safety standards, voltage regulators, and maintenance services are essential for ensuring the safe and efficient operation of T and D equipment. Power electronics, potential transformers, and current transformers are critical components of power transmission and distribution systems. Outage management and fault detection are essential for minimizing power disruptions. Load forecasting, smart grid technologies, and remote monitoring enable efficient power management and grid optimization. Substation automation and voltage regulation systems ensure grid stability and reliability. Overall, the T and D equipment market is evolving to meet the demands of modern power grids, with a focus on efficiency, reliability, and sustainability.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Transmission And Distribution (T And D) Equipment Industry?

- The primary factor fueling market growth is the heightened demand for power generation.

- The Transmission and Distribution (T&D) Equipment Market is experiencing significant growth due to the increasing global electricity demand driven by population growth and industrialization. Urbanization, a key driver of both population growth and industrialization, necessitates the expansion of power distribution networks through investment in new generation plants. A reliable power distribution network is essential for industrialization, which not only generates employment but also indicates economic progress. To ensure safety and efficiency in power transmission and distribution, advanced technologies such as demand response, fault detection, smart grid technologies, load forecasting, surge arrestors, harmonic analysis, and power factor correction are being adopted.

- These technologies enable remote monitoring, surge protection, and improved power quality. Overhead lines, a common form of power transmission, are being upgraded with advanced insulation materials and smart sensors to enhance their performance and reliability. Smart grid technologies, including advanced metering infrastructure and distribution automation systems, are becoming increasingly important in managing the complexities of modern power systems. These technologies enable real-time monitoring and control of power flow, improving grid stability and reducing power losses. The integration of renewable energy sources into the power grid also requires advanced T&D equipment to ensure reliable and efficient power transmission and distribution.

- In conclusion, the T&D Equipment Market is experiencing significant growth due to the increasing global electricity demand driven by population growth and industrialization. Advanced technologies, such as demand response, fault detection, smart grid technologies, load forecasting, surge arrestors, harmonic analysis, and power factor correction, are being adopted to ensure safety and efficiency in power transmission and distribution. These technologies enable remote monitoring, surge protection, and improved power quality, making the power grid more reliable and efficient.

What are the market trends shaping the Transmission And Distribution (T And D) Equipment Industry?

- The increasing importance of energy efficiency is a notable market trend. It is essential for businesses and individuals to prioritize energy efficiency to remain competitive and reduce costs.

- The Transmission and Distribution (T&D) equipment market encompasses various technologies that ensure the efficient and reliable delivery of electrical power from generation sources to end-users. This includes circuit breakers, power system analysis tools, SCADA systems, underground cables, installation and commissioning services, transient analysis software, grounding systems, and grid modernization solutions. Circuit breakers are essential components of electrical power systems, protecting against overcurrents, short circuits, and other electrical faults. Power system analysis tools enable engineers to assess the stability and performance of the power grid, while SCADA systems facilitate remote monitoring and control of electrical infrastructure. Underground cables offer advantages in terms of aesthetics, safety, and reduced environmental impact compared to overhead power lines.

- Installation and commissioning services are crucial for ensuring the proper integration of new T&D equipment into existing power systems. Transient analysis software helps engineers assess the performance of electrical systems during power system disturbances, such as voltage surges or power outages. Grounding systems are essential for protecting electrical equipment from lightning strikes and other electrical transients. Grid modernization initiatives focus on enhancing the efficiency, reliability, and resilience of the power grid through the adoption of advanced technologies, such as distribution automation systems, artificial intelligence (AI), and smart grid technologies. Asset management systems enable utilities to optimize the maintenance and replacement of T&D equipment, reducing downtime and improving overall system performance.

What challenges does the Transmission And Distribution (T And D) Equipment Industry face during its growth?

- The increase in distribution generation poses a significant challenge to the industry's growth, requiring continuous adaptation and innovation to ensure efficient and effective energy distribution.

- The Transmission and Distribution (T&D) equipment market is experiencing significant growth due to the increasing adoption of distributed generation technologies and the shift towards decarbonization in the energy sector. Distributed generation refers to small-scale electricity generation at the point of consumption, which is gaining popularity due to the decreasing cost of energy systems like solar PV and support from governments. This trend is particularly prominent in developed countries, including the US, where institutions, businesses, and households are investing in decentralized power systems. End-users have evolved into prosumers, producing and consuming power through distributed generation technologies such as solar and wind installations.

- The integration of these prosumers into the power system necessitates advanced T&D equipment to ensure insulation coordination, network planning, and outage management. Moreover, the increasing use of high voltage (HV) equipment, power electronics, potential transformers (PT), and protective relays necessitates the need for engineering services, maintenance services, and data analytics to optimize grid performance and reliability. Field testing is also crucial to ensure the proper installation and functioning of these advanced T&D equipment. In conclusion, the T&D equipment market is expected to continue growing as the energy production and consumption patterns evolve, with a focus on enhancing grid resilience, reliability, and efficiency through advanced technologies and services.

Exclusive Customer Landscape

The transmission and distribution (t and d) equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the transmission and distribution (t and d) equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, transmission and distribution (t and d) equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company specializes in providing T&D (Transmission and Distribution) equipment solutions, ensuring secure and productive electricity transfer. Our product offerings encompass medium-voltage switchgear, gas-insulated switchgear, transformers, and mobile substations. These advanced technologies optimize electrical systems, enhancing safety and efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Bharat Heavy Electricals Ltd.

- Daihen Corp.

- Eaton Corp.

- Furukawa Electric Co. Ltd.

- General Electric Co.

- Hitachi Ltd.

- Hubbell Inc.

- Hyundai Electric and Energy Systems Co. Ltd.

- Mitsubishi Corp.

- Nexans SA

- Prysmian SpA

- S and C Electric Co.

- Schneider Electric SE

- Siemens AG

- SPX Technologies Inc.

- TBEA Co. Ltd.

- Toshiba Corp.

- Wilson Power Solutions Ltd.

- Wilson Transformer Company Pty Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Transmission And Distribution (T And D) Equipment Market

- In February 2024, Siemens Energy and Ãrsted, a leading renewable energy company, announced a strategic collaboration to develop and manufacture high-voltage direct current (HVDC) transmission systems. This partnership aims to strengthen the integration of renewable energy into the power grid and reduce carbon emissions (Siemens Energy press release, 2024).

- In March 2025, ABB, a global leader in power technologies, unveiled its latest gas-insulated switchgear (GIS) product, the GIS X2, which offers increased capacity and improved efficiency. This innovation is expected to cater to the growing demand for reliable and efficient T&D equipment in the power sector (ABB press release, 2025).

- In May 2024, General Electric (GE) completed the acquisition of Converteam, a leading provider of power conversion and power grid automation solutions. This strategic move bolstered GE's T&D equipment portfolio and expanded its global footprint in the power electronics market (GE press release, 2024).

- In July 2025, the European Union (EU) approved the Grid Connection Europe project, which aims to strengthen the EU's power grid and facilitate the integration of renewable energy sources. This initiative is expected to create significant opportunities for T&D equipment manufacturers and installers in the region (European Commission press release, 2025).

Research Analyst Overview

- The Transmission and Distribution (T&D) equipment market is witnessing significant advancements driven by the integration of technology and the shift towards decentralized power generation. Distributed generation (DG) is playing a pivotal role in this transformation, enabling power flow studies to optimize grid performance. Augmented Reality (AR) and Virtual Reality (VR) technologies are revolutionizing T&D equipment design and maintenance, offering remote control and real-time fault analysis capabilities. Automation solutions, including machine learning and AI, are streamlining network operations and improving grid reliability through demand side management and real-time energy efficiency analysis. Wireless communication, Big Data, and Cloud Computing are facilitating data-driven decision-making, enhancing network security and privacy.

- Regulatory compliance, environmental impact assessment, and construction management are also critical factors shaping the market. The integration of renewable energy sources, electric vehicles (EVs), and cybersecurity threats further adds complexity to T&D equipment design and operation. Grid optimization, energy efficiency, and network security are key priorities as the industry navigates this evolving landscape.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Transmission And Distribution (T And D) Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2025-2029 |

USD 82.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.9 |

|

Key countries |

China, US, India, Japan, South Korea, Germany, UK, Canada, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Transmission And Distribution (T And D) Equipment Market Research and Growth Report?

- CAGR of the Transmission And Distribution (T And D) Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the transmission and distribution (t and d) equipment market growth of industry companies

We can help! Our analysts can customize this transmission and distribution (t and d) equipment market research report to meet your requirements.