Transradial Access Devices Market Size 2024-2028

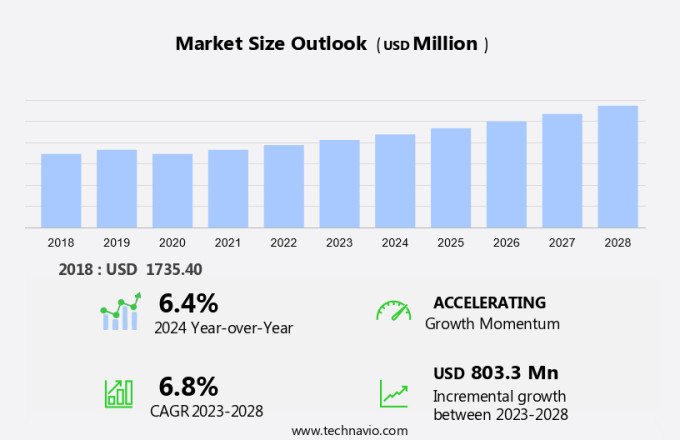

The transradial access devices market size is forecast to increase by USD 803.3 million, at a CAGR of 6.8% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing number of Percutaneous Coronary Intervention (PCI) procedures. PCI is a minimally invasive treatment for coronary artery disease (CAD), and the rising prevalence of CAD globally is fueling market expansion. Furthermore, government initiatives aimed at increasing awareness of CAD and providing affordable treatment options are also contributing to market growth. However, the lack of skilled interventional cardiologists poses a significant challenge to market expansion. As the use of transradial access devices becomes more widespread, there is a growing demand for specialized professionals to perform these procedures effectively and safely. Companies seeking to capitalize on market opportunities must focus on addressing this challenge by investing in training and education programs for healthcare professionals.

- Additionally, collaborations and partnerships with medical institutions and training centers can help address the shortage of skilled interventional cardiologists and expand market reach. Overall, the market holds immense potential for growth, with increasing PCI procedures and government initiatives driving demand, while the challenge of a shortage of skilled interventional cardiologists presents an opportunity for companies to differentiate themselves through targeted training and education programs.

What will be the Size of the Transradial Access Devices Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and growing application across various sectors in healthcare. Radial artery cannulation, a minimally invasive procedure, is increasingly preferred due to reduced radiation exposure and improved patient comfort. Thrombosis prevention methods, such as heparin-bonded sheaths and vascular closure devices, are essential for ensuring post-procedure bleeding is minimized. Understanding radial artery anatomy is crucial for successful radial artery occlusion during coronary angiography procedures. Ultrasound imaging technology plays a pivotal role in assessing artery size, reducing hematoma risk, and guiding sheath insertion and removal techniques. Device material compatibility, procedural time reduction, and complication management strategies are key considerations for device selection.

Angiographic guidewire use, patient comfort measures, and puncture site preparation are essential elements of the procedure, with clinical outcome measures, long-term patency rate, and access site complications closely monitored. Artery size assessment, radial artery spasm management, and procedural success rate are also critical factors influencing market dynamics. Device-related complications, such as access site infection, sheath insertion technique, and guidewire manipulation techniques, are ongoing concerns for healthcare providers. Continuous innovation in vascular access devices and evolving patterns in patient selection criteria aim to mitigate these risks and improve overall patient care.

How is this Transradial Access Devices Industry segmented?

The transradial access devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Drug administration

- Fluid and nutrition administration

- Diagnostics and testing

- Blood transfusion

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The drug administration segment is estimated to witness significant growth during the forecast period.

The transradial approach to percutaneous coronary procedures has gained significant popularity over the past two decades, as an alternative to the traditional transfemoral method. This shift is driven by several factors, including reduced radiation exposure, improved patient comfort, and procedural time reduction. However, the transradial approach is not without challenges. Radial artery spasm (RAS), which occurs in 5-30% of cases, is a major concern. Predictors of RAS include younger age, female gender, diabetes, smaller wrist circumference, and lower body weight. To mitigate this risk, the use of thrombosis prevention methods, such as heparin-bonded sheaths, and proper sheath removal techniques have been advocated.

Ultrasound imaging technology plays a crucial role in artery size assessment, puncture site preparation, and transradial hemostasis. Vascular access devices, including radial artery cannulas, and angiographic guidewires, are essential tools in the transradial approach. Patient selection criteria, access site complications, and clinical outcome measures are critical factors in ensuring procedural success. Effective complication management strategies, including proper guidewire manipulation techniques and vascular closure devices, are necessary to minimize device-related complications and access site hematomas. In conclusion, the transradial approach to percutaneous coronary procedures offers numerous benefits, but the risk of radial artery spasm remains a significant challenge. Ongoing research focuses on improving thrombosis prevention methods, optimizing sheath insertion techniques, and developing new devices to enhance patient comfort and procedural success.

The Drug administration segment was valued at USD 689.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing substantial growth due to the large number of coronary artery disease (CAD) cases and increasing awareness of advanced medical technologies. In 2023, North America held the largest market share in the global transradial access devices industry. The US is the primary revenue contributor, with approximately 180,000 fractional flow reserve (FFR) procedures performed annually. Canada is another significant market, driven by rising healthcare expenditure and a growing CAD patient population. Advanced transradial access devices are preferred due to their benefits, such as reduced radiation exposure, puncture site complications, and procedural time.

Radial artery cannulation and ultrasound-guided access techniques facilitate accurate artery size assessment and minimize complications. Thrombosis prevention methods, such as heparin-bonded sheaths, ensure long-term patency rates. Patient comfort measures, like transradial hemostasis and radial artery spasm management, enhance the procedural success rate. Complication management strategies, such as access site hematoma risk reduction and puncture site preparation, contribute to overall patient safety. The market is further propelled by procedural success rates and the adoption of percutaneous transluminal angioplasty and radial artery access. Vascular closure devices and guidewire manipulation techniques enable efficient sheath removal and minimize complications. Clinical outcome measures, including patient selection criteria and access site infection rates, are essential considerations for market growth.

Artery size assessment and device material compatibility are crucial factors influencing market trends. In conclusion, the North American market is thriving due to the high prevalence of CAD, increasing healthcare expenditure, and the benefits of advanced medical technologies. The market is characterized by the adoption of ultrasound imaging technology, thrombosis prevention methods, and patient comfort measures, leading to improved procedural success rates and reduced complications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Transradial access devices have revolutionized interventional procedures by offering several advantages over traditional femoral access. Complications management is a critical aspect of transradial access, and ultrasound-guided cannulation ensures accurate placement and reduces the risk of complications such as hematoma formation. Heparin-bonded sheaths and effective vascular closure devices further minimize bleeding and enhance patient comfort. The choice of sheath insertion technique and material biocompatibility of transradial access devices plays a significant role in post-procedure bleeding control and infection prevention. Artery size assessment and radial artery anatomy consideration are essential for successful transradial access. Thrombosis prevention methods and radial artery spasm management strategies are also crucial to ensure optimal clinical outcomes. Device design features and operator experience significantly impact the success of transradial access procedures. Procedural time reduction techniques and reduced radiation exposure are additional benefits of transradial access devices. According to market research reports, the market is expected to grow due to these advantages and the increasing preference for minimally invasive procedures. Overall, the effective management of complications, improved patient comfort, and enhanced clinical outcomes make transradial access devices an attractive option for interventional procedures.

What are the key market drivers leading to the rise in the adoption of Transradial Access Devices Industry?

- The significant rise in the performance of percutaneous coronary interventions (PCI), a common cardiac procedure, is the primary growth factor influencing the market's expansion.

- Coronary artery disease (CAD) remains a significant health concern, leading to numerous percutaneous coronary interventions (PCI) each year. PCI is a non-surgical, invasive procedure that enhances blood flow to the heart by addressing narrowed or occluded coronary arteries, typically through ballooning or stent deployment. With over 500,000 procedures performed annually in the US, PCI is a crucial treatment for CAD. Researchers are dedicated to improving PCI techniques, focusing on patient comfort and procedural success. Radial artery access, using a sheath insertion technique, has gained popularity due to its advantages, such as reduced complications and enhanced patient comfort.

- Ultrasound-guided access and advanced guidewire manipulation techniques have further streamlined the procedure, ensuring precision and minimizing access site hematomas. The procedural success rate of PCI continues to improve, making it an essential tool in interventional cardiology.

What are the market trends shaping the Transradial Access Devices Industry?

- The growing emphasis on government initiatives, which include raising awareness of Cardiovascular Diseases (CADs) and offering affordable treatment options, is currently shaping the healthcare market trend. This proactive approach aims to improve public health and reduce the economic burden of CADs.

- The global market for vascular access devices, specifically those used in radial artery cannulation for procedures like coronary angiography, is witnessing significant growth due to the increasing awareness and prevention of post-procedure bleeding and radial artery occlusion. Radial artery anatomy makes it an attractive alternative to traditional femoral artery access, as it reduces the risk of complications such as thrombosis and sheath removal-related issues. Ultrasound imaging technology plays a crucial role in ensuring accurate radial artery cannulation and monitoring for any potential complications. Government and non-profit organizations worldwide are taking initiatives to increase awareness about heart diseases, including coronary artery diseases (CADs).

- For instance, in the US, the National Heart, Lung, and Blood Institute (NHLBI) and other organizations like the National Institutes of Health (NIH), the Centers for Disease Control and Prevention (CDC), and the University of Oxford and Health Economics Research Centre, are committed to raising awareness about heart health and CADs, particularly among vulnerable communities. This growing awareness and the need for minimally invasive procedures are driving the demand for radial artery vascular access devices.

What challenges does the Transradial Access Devices Industry face during its growth?

- The scarcity of proficient interventional cardiologists poses a significant challenge to the expansion and progression of the industry.

- The market is gaining significance due to the benefits it offers in reducing radiation exposure for both patients and healthcare professionals. However, the market is not without challenges, as device-related complications and access site infection remain concerns. Device material compatibility and angiographic guidewire use are critical factors influencing clinical outcome measures. The long-term patency rate and patient selection criteria are essential considerations in minimizing access site complications. The shortage of cardiologists, including interventional specialists, is a significant challenge in the healthcare industry.

- Experts discussed this issue at the FEhealthcare.Com Cardiology Summit 2021, along with remote cardiac care, the increasing risk of cardiovascular diseases during the COVID-19 pandemic, and digital technology's role in addressing these challenges. The market dynamics revolve around these factors, with the ultimate goal of improving patient care and outcomes while minimizing risks.

Exclusive Customer Landscape

The transradial access devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the transradial access devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, transradial access devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company specializes in providing transradial access devices, including coaxial and tearaway micropuncture kits, for medical procedures.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AngioDynamics Inc.

- Becton Dickinson and Co.

- BIOTRONIK SE and Co. KG

- Boston Scientific Corp.

- Cordis Corp.

- Edwards Lifesciences Corp.

- Integer Holdings Corp.

- Medtronic Plc

- Merit Medical Systems Inc.

- Newtech Medical Devices

- Nipro Corp.

- OSCOR Inc.

- QApel Medical Inc.

- Surmodics Inc.

- Teleflex Inc.

- Terumo Medical Corp.

- Toray Industries Inc.

- TZ Medical

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Transradial Access Devices Market

- In January 2024, Medtronic, a leading medical technology company, announced the FDA approval of its new transradial access system, the Innova Wireless Peripheral Duo. This system allows for real-time monitoring of blood flow during procedures, enhancing safety and efficiency (Medtronic Press Release, 2024).

- In March 2024, Terumo Corporation, a major player in the market, entered into a strategic partnership with the University of California, San Francisco (UCSF) to collaborate on research and development of next-generation transradial access technologies. This partnership aims to improve patient outcomes and reduce complications (Terumo Corporation Press Release, 2024).

- In May 2024, Merit Medical Systems, Inc. completed the acquisition of Endovascular Technologies, a company specializing in transradial access devices. This acquisition strengthened Merit Medical's product portfolio and expanded its market presence in the interventional cardiology space (Merit Medical Systems, Inc. Press Release, 2024).

- In February 2025, Edwards Lifesciences Corporation received CE Mark approval for its Sapien 3 Transcatheter Valve System, which now includes a transradial delivery option. This expansion allows for more minimally invasive procedures, addressing the growing demand for less invasive treatment options (Edwards Lifesciences Corporation Press Release, 2025).

Research Analyst Overview

- The market is experiencing significant advancements, driven by the importance of operator experience level and clinical outcome assessment. Device insertion force and post-procedure monitoring are critical factors in ensuring successful radial artery catheterization. Clinical trial data and vascular access training are essential for complication prevention and improving patient age considerations. Cost-effectiveness analysis, patient recovery time, and radial artery diameter are key elements in the decision-making process for healthcare providers. Safety profile evaluation, hemostasis management, and angiographic image quality are crucial aspects of device selection. Flow rate measurements, anticoagulation protocol, and device durability testing contribute to procedure standardization. Patient weight considerations, sheath introducer size, and sheath size selection are essential factors in infection prevention measures.

- Device design features, such as radial artery catheterization, are essential for minimizing thrombosis risk factors and improving device trackability. Device material science plays a vital role in enhancing safety and durability. Incorporating artery palpation technique and proper anticoagulation protocols can lead to improved clinical outcomes and better patient experiences.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Transradial Access Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2024-2028 |

USD 803.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.4 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Transradial Access Devices Market Research and Growth Report?

- CAGR of the Transradial Access Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the transradial access devices market growth of industry companies

We can help! Our analysts can customize this transradial access devices market research report to meet your requirements.