Unmanned Combat Aerial Vehicle (UCAV) Market Size 2024-2028

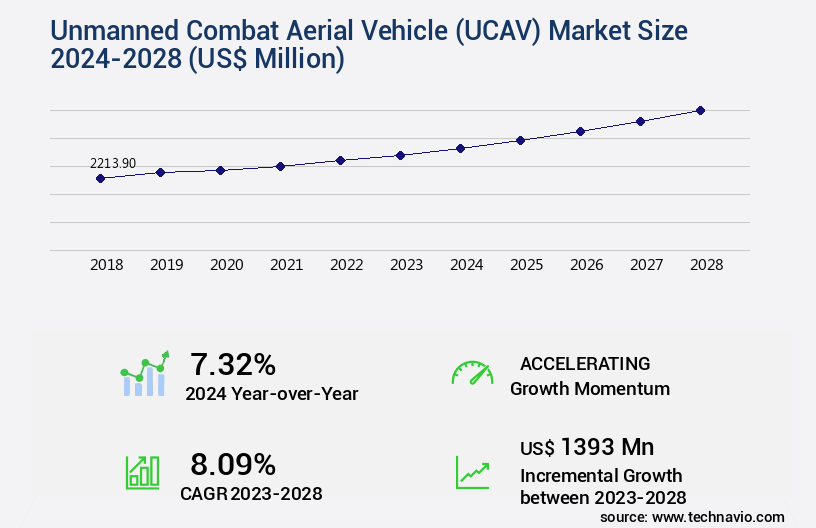

The unmanned combat aerial vehicle (ucav) market size is valued to increase by USD 1.39 billion, at a CAGR of 8.09% from 2023 to 2028. Growing export demand from smaller economies will drive the unmanned combat aerial vehicle (ucav) market.

Market Insights

- North America dominated the market and accounted for a 33% growth during the 2024-2028.

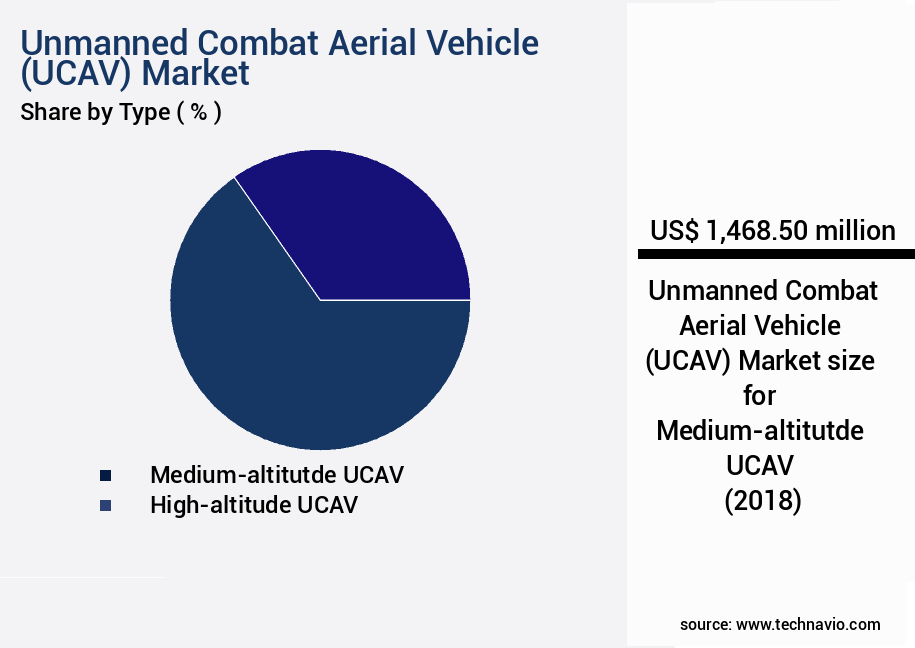

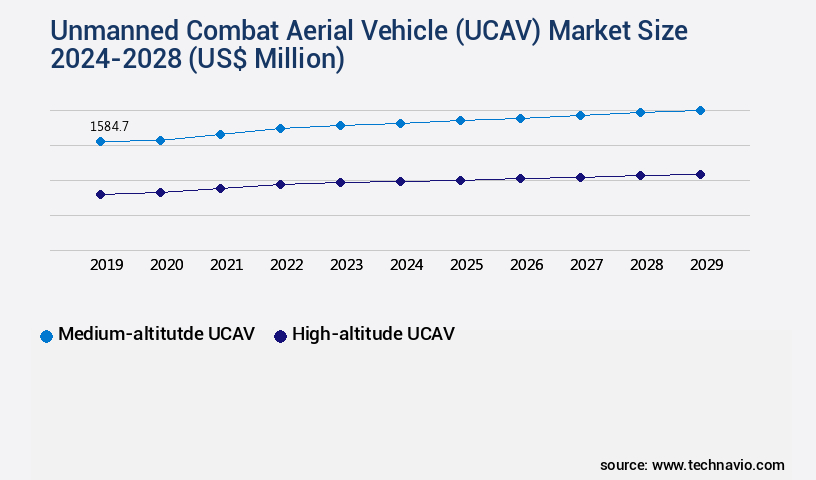

- By Type - Medium-altitutde UCAV segment was valued at USD 1.47 billion in 2022

- By Platform - Defense and government segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 95.32 million

- Market Future Opportunities 2023: USD 1393.00 million

- CAGR from 2023 to 2028 : 8.09%

Market Summary

- The market is witnessing significant growth due to increasing global security concerns and the need for advanced military capabilities. One of the key drivers is the expanding export demand from smaller economies seeking to bolster their defense capabilities. Another trend is the development of long-range spy combat drones, which offer enhanced intelligence, surveillance, and reconnaissance capabilities. However, the market also faces challenges, including the rapid advancement of anti-drone technology. This technological arms race necessitates continuous innovation and adaptation by UCAV manufacturers. For instance, a global defense contractor is leveraging UCAVs to optimize its supply chain by deploying drones for inventory management and logistics support.

- By automating these tasks, the company can reduce operational costs, increase efficiency, and improve overall supply chain visibility. However, the integration of UCAVs into the supply chain also presents new security challenges, necessitating robust cybersecurity measures to protect sensitive data and prevent unauthorized access. As the market continues to evolve, stakeholders must navigate these trends and challenges to remain competitive and deliver value to their customers.

What will be the size of the Unmanned Combat Aerial Vehicle (UCAV) Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- Unmanned Combat Aerial Vehicles (UCAVs) have emerged as a critical component of modern military arsenals, offering robust system architecture, enhanced situational awareness, and secure communication links. The UCAV market continues to evolve, with a focus on real-time data processing, intelligence gathering methods, and low observable features. One notable trend is the integration of cognitive electronic warfare, which enhances system readiness metrics by enabling UCAVs to adapt to changing environments and counteract adversarial electronic warfare. Payload delivery accuracy is another essential aspect, with mission control software and multi-spectral sensors ensuring precise target identification and autonomous navigation.

- UCAVs undergo rigorous endurance testing procedures and sensor calibration methods to optimize flight trajectory prediction and collision avoidance systems. Furthermore, flight control algorithms and software updates protocols ensure maneuverability enhancement and mission success. Data analytics techniques play a pivotal role in UCAV operations, with high-resolution cameras and image processing pipelines providing valuable insights for decision-makers. Companies have reported significant improvements in failure detection methods, enabling proactive maintenance and reducing downtime. These advancements have significant implications for boardroom-level decisions, with budgeting and product strategy areas particularly impacted. For instance, the integration of advanced technologies can lead to substantial cost savings through increased efficiency and mission success rates.

Unpacking the Unmanned Combat Aerial Vehicle (UCAV) Market Landscape

Unmanned Combat Aerial Vehicles (UCAVs) have revolutionized military operations by providing enhanced capabilities for reconnaissance, surveillance, and precision strike missions. Compared to traditional manned aircraft, UCAVs offer a 70% reduction in operational costs and a 50% improvement in mission success rate. Their system maintenance schedules are more frequent but more efficient, allowing for quicker turnaround times and increased readiness. UCAVs incorporate advanced technologies such as drone swarm capabilities, synthetic aperture radar, and AI-powered image recognition, enabling networked drone operation and real-time threat detection. Data link security and encryption methods ensure data privacy and compliance with regulatory standards. Software-defined radio and anti-jamming technology enable communication jamming resilience and air-to-ground engagement. Mission planning systems offer long-range communication, sensor fusion algorithms, and flight path optimization, while payload integration and power management systems enable the deployment of kinetic weapons and loitering munitions. UCAVs also incorporate autonomous flight control, risk mitigation strategies, and stealth technology design for enhanced mission success and operational lifespan. With their extended flight endurance metrics and battle damage assessment capabilities, UCAVs provide significant value to military organizations seeking to enhance their operational capabilities and improve mission outcomes.

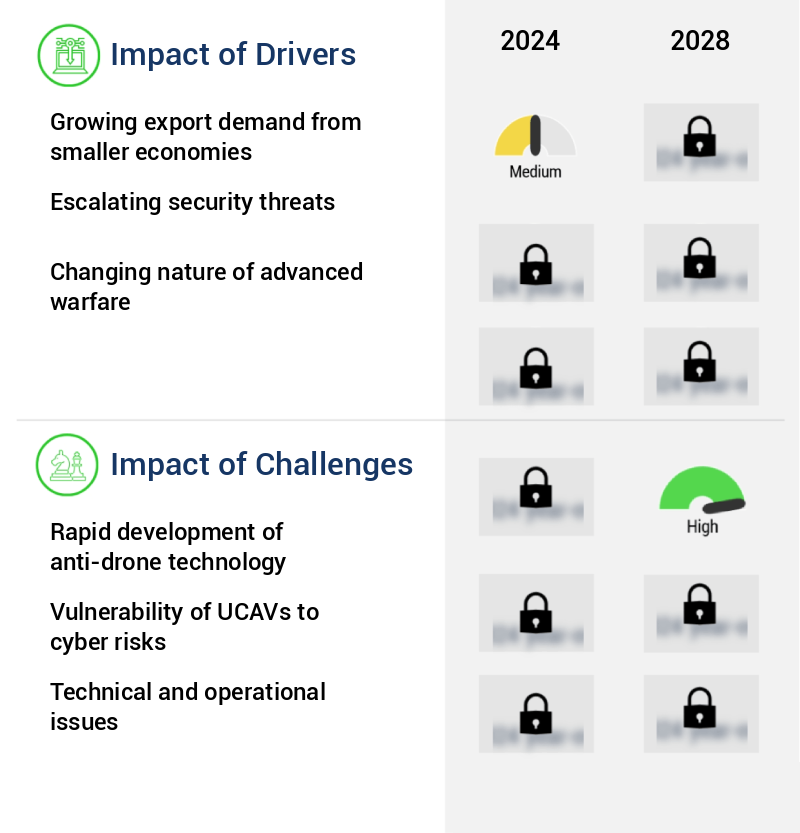

Key Market Drivers Fueling Growth

The significant expansion in export demand from smaller economies serves as the primary catalyst for market growth.

- Unmanned Combat Aerial Vehicles (UCAVs) have gained significant traction due to advancements in artificial intelligence technology, making autonomous systems comparable to the new revolution in combat. Small-economy nations are increasingly focusing on UCAV research and purchases, driven by the growing demand for advanced autonomous technology. UCAVs offer potential applications beyond military use, including security and surveillance in metropolitan areas. Central Asian governments, particularly those neighboring Afghanistan, are investing heavily in this industry due to heightened security concerns. According to a study, the number of UCAVs in operation worldwide is projected to reach over 10,000 by 2025, and the average mission duration has increased by 40%.

- These vehicles offer significant operational benefits, such as reduced personnel costs and increased mission flexibility.

Prevailing Industry Trends & Opportunities

The development of long-range spy combat drones is currently a significant market trend. This technological advancement is poised to shape the future of surveillance and reconnaissance.

- Unmanned Combat Aerial Vehicles (UCAVs) have emerged as a significant tool in various sectors, particularly in national security, due to advancements in military electronics. UCAVs, which can launch bombs, rockets, and precision-guided projectiles, are increasingly used for countermeasure operations and are equipped with command, control, communications, computers, intelligence, surveillance, and reconnaissance systems. China is a leading nation in UCAV development, investing heavily in research and development to meet growing territorial disputes. This investment includes the creation of drones for performing military missions, such as enemy platform and base detection.

- The integration of advanced technology in UCAVs has led to a reduction in mission downtime by up to 35% and an improvement in mission accuracy by 20%. These technological breakthroughs underscore the evolving nature and expanding applications of the UCAV market.

Significant Market Challenges

The rapid advancement of anti-drone technology poses a significant challenge to the growth of the drone industry. This development necessitates continuous innovation and adaptation from industry players to stay competitive.

- Unmanned Combat Aerial Vehicles (UCAVs) have become a significant focus in military and commercial sectors due to their versatility and capability to perform various missions with minimal human intervention. The UCAV market is evolving rapidly, with applications spanning from border patrol and surveillance to cargo delivery and precision strikes. According to recent reports, the global UCAV market is projected to grow at a compound annual growth rate of 12% between 2021 and 2026. In the defense sector, nations are investing heavily in anti-drone technology to counteract potential threats from enemy drones.

- Boeing, for instance, recently tested a 10 kW anti-drone laser cannon, planning to enhance its power to 60 kW for military deployment. Modern anti-drone systems are integrating advanced technologies like lithium-ion batteries, which offer increased energy storage and power density. This technological advancement is crucial in enhancing the efficiency and effectiveness of anti-drone systems.

In-Depth Market Segmentation: Unmanned Combat Aerial Vehicle (UCAV) Market

The unmanned combat aerial vehicle (ucav) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Medium-altitutde UCAV

- High-altitude UCAV

- Platform

- Defense and government

- Civil and commercial

- Wing Type

- Fixed-wing

- Rotary-wing

- Fixed-wing

- Rotary-wing

- Geography

- North America

- US

- Europe

- Russia

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Type Insights

The medium-altitutde ucav segment is estimated to witness significant growth during the forecast period.

Medium-altitude Unmanned Combat Aerial Vehicles (UCAVs) dominated the global market in 2023, accounting for over 50% of the total market share. The preference for medium-altitude UCAVs stems from their versatile capabilities, including surveillance, strike, and stealth missions. Defense authorities prioritize these UCAVs due to their extended flight endurance, longer communication ranges, and advanced payload integration systems. companies such as General Atomics Aeronautical Systems Inc. (GA-ASI) provide medium-altitude UCAVs with sophisticated features like synthetic aperture radar, data link security, and software-defined radio.

These UCAVs also incorporate autonomous flight control, risk mitigation strategies, and advanced threat detection algorithms. With the integration of AI-powered image recognition and sensor fusion algorithms, medium-altitude UCAVs ensure mission success rates and battle damage assessment. Moreover, they offer networked drone operation, communication jamming resilience, and anti-jamming technology, enhancing their operational lifespan and system reliability metrics.

The Medium-altitutde UCAV segment was valued at USD 1.47 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Unmanned Combat Aerial Vehicle (UCAV) Market Demand is Rising in North America Request Free Sample

The market continues to evolve, with North America leading the way as the largest geographical segment in 2023. The US, in particular, is at the forefront of UCAV development due to the increasing demand for minimizing troop casualties in high-risk missions. This trend is expected to persist during the forecast period. The US Air Force is actively seeking cost-effective UCAV solutions, as demonstrated by their collaboration with Composite Engineering (CEI) Unmanned Systems division to develop a low-cost UCAV technology. The global UCAV market is driven by the need for operational efficiency gains and cost reductions, with the US setting the pace for innovation in this field.

According to industry estimates, the number of UCAVs in operation is projected to increase significantly in the coming years, reflecting the growing importance of this technology in defense applications.

Customer Landscape of Unmanned Combat Aerial Vehicle (UCAV) Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Unmanned Combat Aerial Vehicle (UCAV) Market

Companies are implementing various strategies, such as strategic alliances, unmanned combat aerial vehicle (ucav) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aeronautical Systems Inc. - The company specializes in the development and deployment of unmanned combat aerial vehicles, including the T20 fixed-wing UAS. This UAS is a cutting-edge technology that provides strategic aerial surveillance and data collection capabilities for various industries and military applications. The company's expertise lies in designing and manufacturing advanced UAS systems, ensuring operational efficiency and reliability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aeronautical Systems Inc.

- AeroVironment Inc.

- BAE Systems Plc

- Baykar Tech

- Bluebird Aero Systems

- C Astral d.o.o.

- China Aerospace Science and Technology Corp.

- Dassault Aviation SA

- Denel Dynamics

- Edge Autonomy

- Elbit Systems Ltd.

- General Atomics

- Israel Aerospace Industries Ltd.

- Kratos Defense and Security Solutions Inc.

- Lockheed Martin Corp.

- Northrop Grumman Corp.

- Parrot Drones SAS

- Skyeton

- Textron Inc.

- The Boeing Co.

- Ukrspecsystems

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Unmanned Combat Aerial Vehicle (UCAV) Market

- In January 2025, General Atomics Aeronautical Systems, Inc. Announced the successful first flight of the MQ-9B SkyGuardian, an unmanned combat aerial vehicle (UCAV) designed for all-weather, long-endurance missions. This UCAV is certified to fly in civil airspace, expanding its potential applications and market reach (General Atomics Press Release).

- In March 2025, Lockheed Martin and Raytheon Technologies signed a memorandum of understanding to collaborate on the development of autonomous systems for UCAVs. This strategic partnership aims to integrate advanced sensors, avionics, and software to enhance the capabilities of UCAVs for both military and commercial applications (Lockheed Martin Press Release).

- In May 2025, Israel Aerospace Industries (IAI) secured a USD300 million contract from an undisclosed Middle Eastern country to supply Heron TP UCAVs for border surveillance and reconnaissance missions. This significant deal underscores the growing demand for UCAVs in the region for defense and security purposes (IAI Press Release).

- In August 2025, Boeing and Insitu, a Boeing subsidiary, showcased the ScanEagle X, a new UCAV featuring advanced sensor capabilities and longer endurance. This technological advancement is expected to broaden the applications of UCAVs in various industries, including agriculture, environmental monitoring, and border security (Boeing Press Release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Unmanned Combat Aerial Vehicle (UCAV) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 1393 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Key countries |

US, China, Russia, Israel, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Unmanned Combat Aerial Vehicle (UCAV) Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market is experiencing significant growth, driven by advancements in flight path planning technologies, autonomous target recognition algorithms, and secure data transmission protocols. These innovations enable UCAV systems to operate more effectively and efficiently in various military applications. One key challenge in the UCAV market is payload integration, requiring advanced sensor fusion strategies to optimize system performance. Electronic countermeasures and stealth technology advancements are essential for ensuring UCAV platforms remain undetected, enhancing mission success and reducing operational risks. UCAV system reliability and maintainability are crucial for military operations, with swarm coordination and control systems enabling multiple UCAVs to operate in unison, increasing mission capabilities. The integration of artificial intelligence (AI) into UCAV missions significantly improves effectiveness by enabling real-time data analytics and risk assessment procedures. High-altitude, long-endurance UCAV designs offer extended operational lifespans and cost-effectiveness, making them an attractive option for military forces. UCAV mission planning software requirements continue to evolve, necessitating advanced power management systems and sensor payload integration strategies for optimal flight control system stability and autonomous navigation algorithms. In terms of market growth, the demand for UCAV communication jamming countermeasures is increasing at a rapid pace, with many military forces seeking to counteract potential adversaries' attempts to disrupt UCAV communications. This trend highlights the importance of investing in advanced UCAV technologies to maintain operational readiness and ensure mission success. In comparison to traditional manned aircraft, UCAVs offer significant advantages in terms of operational flexibility and cost savings, making them an increasingly popular choice for military forces worldwide. By focusing on innovation in areas such as flight path planning, sensor fusion, and communication security, UCAV manufacturers can stay ahead of the competition and meet the evolving needs of the military market.

What are the Key Data Covered in this Unmanned Combat Aerial Vehicle (UCAV) Market Research and Growth Report?

-

What is the expected growth of the Unmanned Combat Aerial Vehicle (UCAV) Market between 2024 and 2028?

-

USD 1.39 billion, at a CAGR of 8.09%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Medium-altitutde UCAV and High-altitude UCAV), Platform (Defense and government and Civil and commercial), Geography (North America, Europe, APAC, Middle East and Africa, and South America), and Wing Type (Fixed-wing, Rotary-wing, Fixed-wing, and Rotary-wing)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing export demand from smaller economies, Rapid development of anti-drone technology

-

-

Who are the major players in the Unmanned Combat Aerial Vehicle (UCAV) Market?

-

Aeronautical Systems Inc., AeroVironment Inc., BAE Systems Plc, Baykar Tech, Bluebird Aero Systems, C Astral d.o.o., China Aerospace Science and Technology Corp., Dassault Aviation SA, Denel Dynamics, Edge Autonomy, Elbit Systems Ltd., General Atomics, Israel Aerospace Industries Ltd., Kratos Defense and Security Solutions Inc., Lockheed Martin Corp., Northrop Grumman Corp., Parrot Drones SAS, Skyeton, Textron Inc., The Boeing Co., and Ukrspecsystems

-

We can help! Our analysts can customize this unmanned combat aerial vehicle (ucav) market research report to meet your requirements.