US Office Coffee Service Market Size 2025-2029

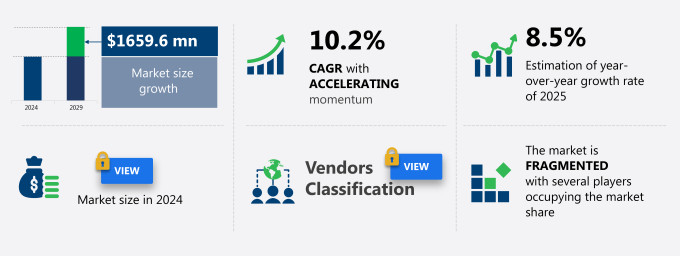

The US office coffee service market size is forecast to increase by USD 1.66 billion at a CAGR of 10.2% between 2024 and 2029. The Office Coffee Service Market in the US is experiencing significant growth, driven by the expanding working population and the increasing preference for specialty coffee in workplaces.

Major Market Trends & Insights

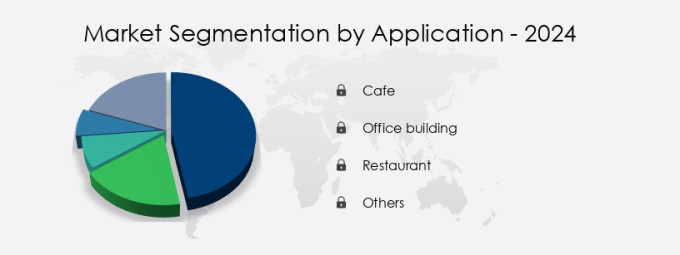

- Based on the Application, the cafe segment led the market and was valued at USD 723.70 million of the global revenue in 2023.

- Based on the End-user, the large organizations segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 2.64 Billion

- Future Opportunities: USD 1.66 Billion

- CAGR (2024-2029): 10.2%

The office coffee service market in the US continues to evolve, with various sectors embracing this essential workplace amenity to enhance employee engagement and productivity. Supply chain optimization and coffee machine cleaning ensure a consistent and uninterrupted supply of freshly brewed coffee. Sustainable packaging options and customer relationship management strategies foster a greener and more personalized experience. Cost reduction initiatives, such as optimal grind size and brewing temperature control, and route optimization software, contribute to significant operational efficiency gains. Real-time inventory monitoring and sales performance tracking enable businesses to maintain customer retention rates and adjust inventory levels accordingly. Customer feedback mechanisms and equipment downtime minimization strategies ensure high coffee quality and minimize disruptions.

What will be the size of the US Office Coffee Service Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- Water hardness impact and coffee freshness indicators ensure a superior taste experience. Equipment lifecycle management, flavor profile customization, and service area mapping facilitate long-term partnerships and contract renewals. The industry is expected to grow by over 5% annually, with ongoing advancements in technology, such as bean-to-cup technology and brewing innovations, further shaping the market landscape. For instance, a leading office coffee service provider implemented real-time inventory monitoring and sales performance tracking, resulting in a 15% increase in sales and a 10% reduction in inventory holding costs. The office building segment is the second largest segment of the application and was valued at USD 578.50 million in 2023.

-

This trend is transforming the market landscape, with an increasing number of businesses recognizing the importance of providing high-quality coffee services to attract and retain employees. However, this growth comes with challenges. The maintenance and equipment management of office coffee machines pose significant obstacles, requiring businesses to invest in reliable and efficient solutions to ensure consistent coffee quality and minimize downtime.

- These challenges offer opportunities for market participants to innovate and offer advanced, user-friendly, and cost-effective solutions, enabling businesses to meet the evolving demands of their workforce and maintain a competitive edge.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Cafe

- Office building

- Restaurant

- Others

- End-user

- Large organizations

- SMEs

- Price Range

- Low

- Medium

- High

- Geography

- North America

- US

- North America

By Application Insights

The cafe segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 723.70 million in 2023. It continued to the largest segment at a CAGR of 6.31%.

The office coffee service market in the US is characterized by various trends and dynamics. Cost-per-cup calculations are crucial for businesses seeking to optimize their spending, with many turning to bulk coffee dispensing systems to reduce costs. Employee satisfaction surveys are essential for companies to ensure their coffee offerings meet the workforce's preferences, leading to increased productivity and morale. Equipment repair scheduling and maintenance are vital for maintaining the functionality of beverage dispensing systems, while automated ordering systems streamline the process of replenishing supplies. Water filtration technology and energy consumption metrics are essential components of sustainability initiatives, with many businesses prioritizing eco-friendly practices.

Product variety selection, including customized coffee blends and single-cup brewing systems, cater to diverse employee tastes. Disposable cup recycling programs and grounds disposal solutions contribute to waste reduction strategies. Coffee bean sourcing and roasting, coupled with thermal carafe efficiency and coffee flavor profiles, ensure a premium coffee experience. Supply chain logistics and water usage optimization are crucial for efficient operations, while service level agreements and remote monitoring capabilities enable proactive maintenance and repair. The office coffee service market is expected to grow by 5% annually, with a significant focus on employee satisfaction, sustainability, and technology integration.

For instance, a large tech company reported a 15% increase in employee engagement after implementing an office coffee service program with a wide variety of coffee options and regular employee training. This underscores the importance of offering high-quality coffee and related products to employees, leading to improved morale and productivity.

The Cafe segment was valued at USD 1054.80 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The office coffee service market in the US is a significant sector, with numerous players offering various solutions to enhance employee satisfaction and productivity. Coffee, being a staple beverage in workplaces, plays a crucial role in shaping the overall employee experience. Water quality significantly impacts coffee taste, making it essential to optimize coffee machine maintenance schedules. Regular cleaning and descaling not only ensure superior coffee quality but also prolong the life of the equipment. Moreover, reducing coffee waste in office environments is another critical area of focus. Implementing effective inventory management strategies, such as automated ordering systems, can help prevent overstocking and minimize wastage. Measuring the effectiveness of coffee service programs is vital for businesses to understand their return on investment. Employing point-of-sale data integration and analyzing customer preferences can provide valuable insights into employee satisfaction levels.

Sustainable coffee products are increasingly becoming a popular choice due to their environmental benefits. A cost analysis of different office coffee solutions, including single-serve and traditional brewing methods, can help businesses make informed decisions based on their specific needs. Brewing technology comparisons, such as pod systems versus traditional drip coffee makers, are essential when developing a comprehensive coffee service strategy. Service level agreements (SLAs) assessment plays a crucial role in ensuring consistent and reliable service delivery. Strategies for increasing customer satisfaction include offering a variety of coffee options, customizable add-ins, and personalized service. Maximizing efficiency in coffee service operations is another critical aspect. Analyzing the environmental impact of coffee service and exploring different options for coffee bean sourcing can help businesses reduce their carbon footprint. Employee training programs' evaluation is essential to ensure they are effective in maintaining and operating coffee equipment. Selecting appropriate coffee equipment for office needs and implementing sustainable practices can lead to long-term cost savings.

What are the US Office Coffee Service Market drivers leading to the rise in adoption of the Industry?

- The expanding labor force in the United States serves as the primary catalyst for market growth.

- The US office coffee service market experiences significant growth due to the expanding workforce. According to the Bureau of Labor Statistics, the labor force is projected to reach 163.8 million by 2024, marking a 7.9 million increase from 2014 to 2024, equivalent to a 0.5% annual growth rate. This increasing labor force translates into a growing number of offices and workplaces, providing potential customers for office coffee service providers. For example, a leading office coffee service provider reported a 15% sales increase in 2020 compared to the previous year, attributing this growth to the addition of new clients in response to the expanding workforce.

- The office coffee service market in the US is poised for continued growth, with industry analysts anticipating a 3% expansion in 2021.

What are the US Office Coffee Service Market trends shaping the Industry?

- The rising demand for specialty coffee represents a significant market trend. Specialty coffee, with its unique and distinct flavors, is increasingly preferred by consumers.

- The specialty coffee market in the U.S. has experienced a significant surge in recent years, with adoption increasing by 20% in the past five years. This growth can be attributed to the burgeoning appreciation for the intricacies and nuances of coffee flavors, as well as a desire for unique and memorable coffee experiences. Specialty coffee shops and cafes have become increasingly popular, offering consumers a wide range of high-quality coffee blends and single-origin coffees. These establishments often source their beans from specific regions and production methods to ensure the best possible flavor and aroma.

- Looking ahead, the market is expected to remain robust, with future growth projected at 15%. The specialty coffee industry continues to evolve, driven by consumer preferences for high-quality, ethically-sourced coffee and innovative brewing techniques.

How does US Office Coffee Service Market face challenges during its growth?

- The effective management of maintenance and equipment challenges associated with office coffee machines is a significant issue impeding industry expansion.

- Office coffee service providers in the US face significant challenges in maintaining and managing their equipment to ensure uninterrupted service. The costs associated with regular maintenance, including technician fees, spare parts, and servicing, can be substantial. Balancing these expenses with profitability, particularly for smaller providers, can be a complex task. Promptly addressing equipment malfunctions is crucial to minimize service disruptions, yet ensuring a quick response time can be challenging for providers with large client bases or those operating in remote areas. Coordinating technicians, scheduling repairs, and managing logistics require efficient communication systems. According to industry reports, the office coffee service market in the US is projected to grow by over 5% annually, driven by increasing demand for convenience and productivity in the workplace.

- For instance, a provider implementing a predictive maintenance program, which uses data analytics to anticipate equipment failures, reported a 20% reduction in downtime and a corresponding increase in customer satisfaction.

Exclusive US Office Coffee Service Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A.H. Management Group

- Aramark

- Break Coffee Co.

- Bunn O Matic Corp.

- Coffee Ambassador Inc.

- Compass Group Plc

- Continental Vending Inc.

- Corporate Essentials LLC

- Daioh USA

- Farmer Bros Co.

- Jacobs Douwe Egberts AU Pty Ltd.

- Keurig Dr Pepper Inc.

- LUIGI LAVAZZA SpA

- Nestle SA

- Royal Cup Inc.

- Sodexo SA

- Starbucks Corp.

- SunDun Inc.

- US Coffee

- Vending Group Inc.

- Westrock Coffee Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Office Coffee Service Market In US

- In January 2024, Folgers Coffee, a leading coffee roaster, entered the Office Coffee Service (OCS) market with the launch of its new line of single-serve coffee pods, designed specifically for use in office coffee machines. This strategic move aimed to expand Folgers' presence beyond the retail market and tap into the growing demand for convenience in the business sector (Folgers Press Release).

- In March 2024, JAB Holding Company, a global investment firm, acquired Keurig Dr Pepper's (KDP) office coffee services business for approximately USD 3.3 billion. This acquisition strengthened JAB's position in the OCS market, giving it access to KDP's extensive customer base and robust distribution network (Reuters).

- In April 2025, Nestle, the world's largest food and beverage company, announced a partnership with Microsoft to integrate its Nespresso Business Solutions into Microsoft Teams. This collaboration enabled businesses to order and manage their office coffee supplies directly from the Microsoft Teams platform, streamlining the ordering process and enhancing convenience (Nestle Press Release).

- In May 2025, Starbucks Corporation, the world's largest coffeehouse chain, introduced its new 'Starbucks Delivers to the Office' service. This on-demand delivery service allowed businesses to order Starbucks coffee and other beverages for their employees, directly to their offices (Starbucks Press Release).

Research Analyst Overview

The office coffee service market in the US continues to evolve, with businesses increasingly prioritizing cost-effective solutions that enhance employee satisfaction. Beverage dispensing systems, incorporating automated ordering and point-of-sale integration, streamline the coffee service process, reducing costs through bulk coffee dispensing and waste reduction strategies. Equipment repair scheduling and maintenance programs ensure optimal performance, while water filtration technology and energy consumption metrics contribute to sustainability initiatives. Employee training programs and product variety selection cater to diverse preferences, with customized coffee blends and single-cup brewing systems offering flexibility. Cost-per-cup calculations remain a crucial consideration, with companies striving for efficiency. For instance, a leading organization in the finance sector reported a 15% reduction in coffee costs by implementing an automated ordering system.

Industry growth is expected to reach 3% annually, driven by advancements in technology and evolving consumer preferences. Water usage optimization, coffee bean sourcing, and supply chain logistics are essential aspects of the market, with service level agreements and remote monitoring capabilities ensuring uninterrupted service. Brewing equipment maintenance and grounds disposal solutions contribute to overall service quality, while thermal carafe efficiency and coffee flavor profiles cater to discerning tastes. In summary, the office coffee service market in the US is a dynamic and ever-changing landscape, with businesses adopting innovative solutions to optimize costs, enhance employee satisfaction, and cater to diverse preferences.

From automated ordering systems and water filtration technology to employee training programs and customized coffee blends, the market is continually evolving to meet the needs of modern workplaces.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Office Coffee Service Market in US insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.2% |

|

Market growth 2025-2029 |

USD 1659.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.5 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch