US Pouches Market Size 2024-2028

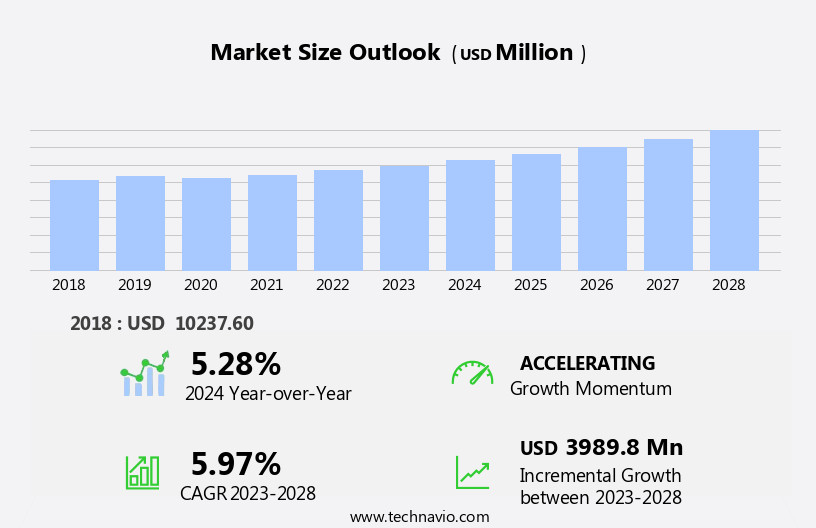

The us pouches market size is forecast to increase by USD 3.99 billion at a CAGR of 5.97% between 2023 and 2028.

What will be the size of the US Pouches Market during the forecast period?

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Flat

- Stand-up

- Spout

- End-user

- Food and beverages

- Personal care and cosmetics

- Healthcare

- Others

- Geography

- US

By Product Insights

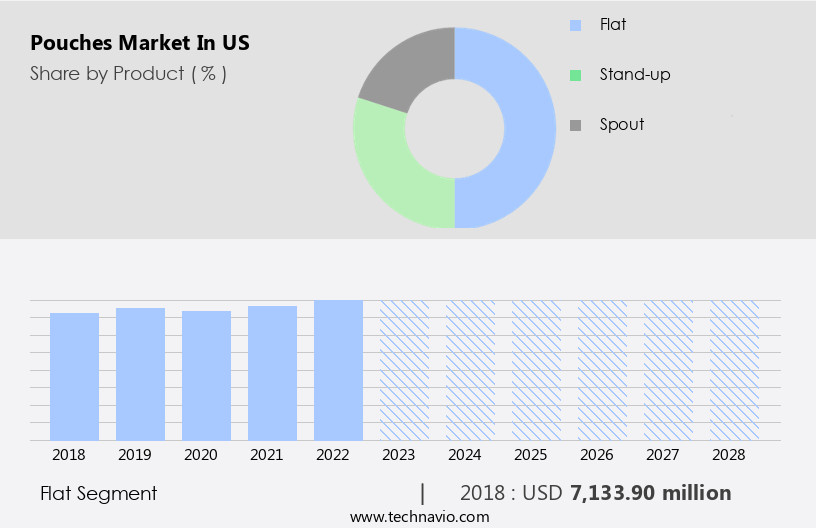

- The flat segment is estimated to witness significant growth during the forecast period.

The flat pouch segment In the US packaged food market is witnessing notable growth. This packaging format's popularity stems from its benefits, including portability and ease of consumption. Flat pouches cater to various industries, including snacks, pet food, baby food, and non-food items like detergents and cosmetics. The trend toward on-the-go consumption is driving demand for flat pouches due to their compact size and convenience. Space efficiency is another significant advantage, making them an attractive choice for manufacturers and consumers alike. Flat pouches are versatile, accommodating ready-to-eat meals, beverages, and various food products. Manufacturers employ packaging machinery to produce these pouches using plastic-based materials such as polyethylene, polypropylene, and polyethylene terephthalate.

Sustainable packaging options, including bioplastic materials like polyhydroxyalkanoates and polylactic acid, are gaining traction due to regulatory pressure and customer awareness. The end-use industries, including the food processing industry and organized retail, are also embracing flat pouches with closure options such as zipper and spout closures.

Get a glance at the market share of various segments Request Free Sample

The Flat segment was valued at USD 7133.90 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of US Pouches Market?

Rising focus on improving shelf life of products is the key driver of the market.

What are the market trends shaping the US Pouches Market?

Increasing vendor initiatives to promote sustainable packaging is the upcoming trend In the market.

What challenges does US Pouches Market face during the growth?

Increasing focus on reducing use of plastic packaging is a key challenge affecting the market growth.

Exclusive US Pouches Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Amcor Plc

- American Packaging Corp.

- Berry Global Inc.

- CarePac

- CCL Industries Inc.

- Constantia Flexibles Group GmbH

- FlexiPack

- Glenroy Inc.

- Huhtamaki Oyj

- LPS Industries

- Mondi Plc

- New York Packaging and RediBagUSA

- Polymer Packaging Inc.

- ProAmpac Holdings Inc.

- Sealed Air Corp.

- Smurfit Kappa Group

- Sonoco Products Co.

- UFlex Ltd.

- Wihuri International Oy

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The packaged food market In the US is witnessing significant growth, driven by the increasing preference for convenient and portable food solutions. One of the most popular packaging formats gaining traction in this space is stand-up pouches. These flexible packaging solutions offer numerous advantages, such as lightweight design, extended shelf life, and ease of use. Stand-up pouches are available in various sizes and shapes, catering to diverse end-use industries. The ready-to-eat (RTE) food segment, in particular, has seen substantial growth due to the rising demand for on-the-go meals. The beverage industry is another major consumer of stand-up pouches, with alcoholic and non-alcoholic beverages being popular applications.

The material segment for stand-up pouches includes plastic-based packaging products, such as polyethylene, polypropylene, and polyethylene terephthalate (PET). Plastic resins are widely used due to their cost-effectiveness, durability, and versatility. However, there is a growing trend towards sustainable packaging options, with bioplastic materials, such as polyhydroxyalkanoates (PHA) and polylactic acid (PLA), gaining popularity. Manufacturers are constantly innovating to meet the evolving demands of consumers and regulatory bodies. For instance, there is a focus on aseptic treatment types for stand-up pouches, which eliminate the need for refrigeration and extend the shelf life of the products. Closure options, such as zipper and spout closures, are also being developed to enhance the user experience.

The food processing processes used In the production of packaged food also influence the choice of packaging materials and designs. For example, certain food products require specific treatment types to maintaIn their quality and freshness. The flat product segment of stand-up pouches is gaining traction due to its ability to accommodate various food shapes and sizes. The US packaged food market is subject to regulatory pressure, with a focus on reducing food waste and promoting sustainable packaging options. Consumer awareness and ecological rating are key factors influencing the market dynamics. As a result, there is a growing demand for recyclable pouches made from bioplastic materials.

Marketing tactics, such as printed images and branding, play a crucial role In the success of stand-up pouches. The use of sustainable and eco-friendly materials is becoming a significant selling point for many brands. Additionally, the portability of stand-up pouches makes them an attractive option for various industries, including the pet food industry, medical supplies, fabric care, detergents, dried fruits, confectionery, baby food, yogurt, soup, dressing, salad items, and more. Packaging machinery and recycling facilities are essential components of the stand-up pouch value chain. Companies such as Omniplast, ProAmpac, and PHAS are key players In the market, offering innovative solutions to meet the evolving needs of various industries.

The use of lightweight materials and sustainable packaging options is expected to continue driving growth In the US stand-up pouch market. In conclusion, the US packaged food market is witnessing significant growth, with stand-up pouches emerging as a popular packaging format. The material segment includes plastic-based and bioplastic materials, with plastic resins being widely used due to their cost-effectiveness and durability. However, there is a growing trend towards sustainable packaging options, with a focus on recyclable pouches made from bioplastic materials. Regulatory pressure and consumer awareness are key factors influencing the market dynamics, with marketing tactics and portability being significant selling points.

Companies offering innovative solutions in this space are expected to thrive In the US market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

133 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.97% |

|

Market growth 2024-2028 |

USD 3989.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.28 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch