USB Devices Market Size 2024-2028

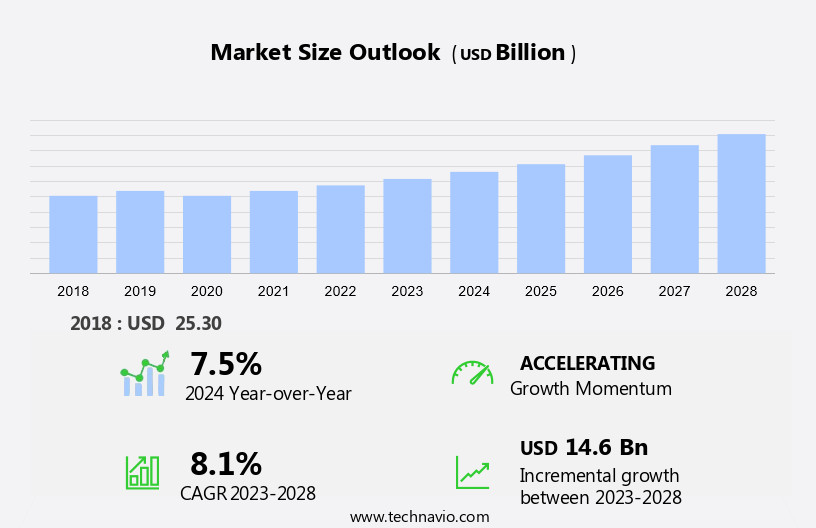

The usb devices market size is forecast to increase by USD 14.6 billion at a CAGR of 8.1% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for computer peripherals and the need for high-capacity solutions. The emergence of cloud storage services is also driving market expansion. In terms of connector types, USB Type-C is gaining popularity due to its fast data transfer rates and compatibility with various devices. The IT and telecommunication industries, as well as healthcare, are major contributors to the market's growth. In healthcare, USB devices are used in medical imaging equipment and other medical applications. The trend towards remote working and remote learning has also increased the demand for USB devices, particularly for connecting medical devices and other peripherals to computers. Additionally, the adoption of DDR5 DRAM is expected to further boost the market's growth. Overall, the market is poised for continued expansion, particularly in industries with high data transfer requirements and the need for compact, high-capacity solutions.

What will be the Size of the USB Devices Market During the Forecast Period?

- The market represents a significant segment of the consumer electronics industry, encompassing a range of peripheral devices that facilitate data transfer and connectivity between digital devices and computers. These devices include USB flash drives, memory card readers, digital audio players, USB hubs, docking stations, webcams, and more. USB technology has become a standard for computer hardware, enabling seamless data transmission rates and interoperability between various digital devices. The market has witnessed steady growth due to the increasing demand for small storage devices and the integration of USB technology in various applications, such as automotive entertainment and infotainment systems.

- The market for USB devices caters to diverse industries, including computer peripherals, consumer electronics, and security. USB Type-C, the latest USB standard, has gained popularity due to its faster data transfer rates and reversible design. This has led to an increase in demand for USB Type-C compatible devices, including external hard drives and laptops. The market is also influenced by the growing Internet of Things (IoT) trend. USB devices play a crucial role in data transmission and storage in IoT applications, making them an essential component of the IoT ecosystem. The demand for USB devices with higher storage capacity continues to grow as more data is generated and needs to be stored and transferred.

- In summary, the market is an essential segment of the consumer electronics industry, driven by the increasing demand for small storage devices, faster data transfer rates, and the integration of USB technology in various applications. The market is expected to continue growing as USB technology evolves and new applications emerge.

How is this USB Devices Industry segmented and which is the largest segment?

The USB devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- USB 2.0

- USB 3.0

- USB 4.0

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- APAC

By Type Insights

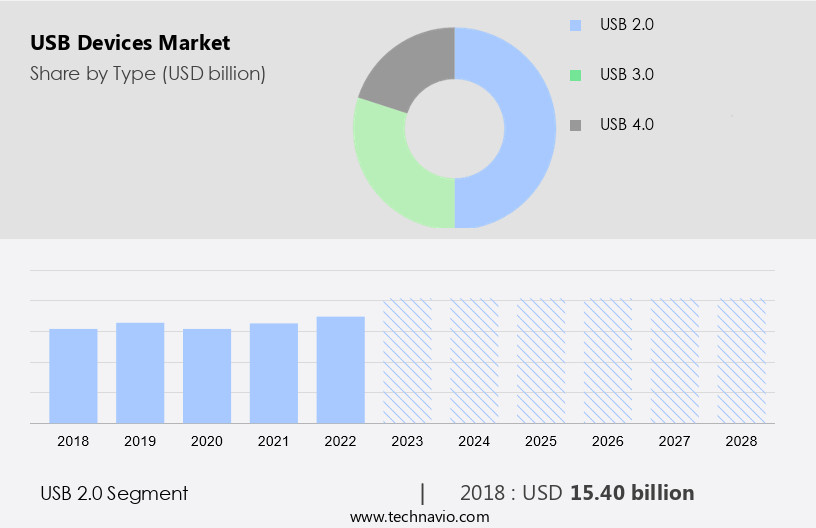

- The USB 2.0 segment is estimated to witness significant growth during the forecast period.

The USB 2.0 segment continues to hold a substantial market share In the USB devices industry. This is due to its dependable performance, extensive compatibility with various devices, and cost-effectiveness, making it an optimal solution for numerous applications, especially In the consumer electronics and peripherals sectors. USB 2.0 technology offers a data transfer rate of up to 480 Mbps, which caters to the requirements of most consumer applications without the intricacy and financial burden of newer protocols. Manufacturers are continually advancing within this segment, releasing enhanced USB 2.0 devices that cater to evolving market needs. Connector types, such as USB Type-C and Lightning Connector, have gained popularity in recent years.

These advanced connectors offer faster data transfer rates and versatile functionality. However, USB 2.0's widespread adoption and affordability make it a preferred choice for various industries, including IT and telecommunication, healthcare, remote working, and remote learning. In healthcare, USB devices are essential for medical imaging equipment, DDR5 DRAM, and other medical applications. USB devices play a crucial role In the seamless integration of technology In these industries. In summary, USB devices, particularly USB 2.0, continue to dominate the market due to their reliability, compatibility, and cost-effectiveness. As technology advances, newer connector types like USB Type-C and Lightning Connector provide enhanced functionality, but USB 2.0 remains a popular and versatile choice for various industries.

Get a glance at the USB Devices Industry report of share of various segments Request Free Sample

The USB 2.0 segment was valued at USD 15.40 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

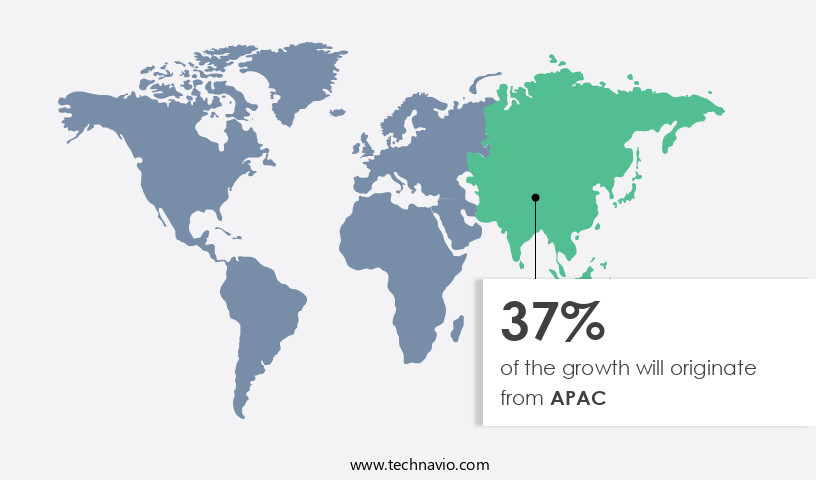

- APAC is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market In the APAC region is experiencing growth due to the increasing demand for data storage solutions. Major players In the market, including HP, Dell Technologies, and Corsair Gaming, are based In the region, providing a competitive advantage. Consumer electronics, particularly digital devices such as smartphones and digital platforms, are driving the need for USB devices. companies are responding to this demand by introducing high-capacity solutions, such as USB flash drives and memory card readers, with larger storage capacities. For instance, Toshiba's Canvio Flex portable storage, launched in September 2020, offers up to 4TB of storage and is compatible with both USB-C and USB-A cables, making it a versatile option for users of various digital devices. The market in APAC is expected to continue growing as the region remains the hub for consumer electronics and the demand for advanced technologies increases.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of USB Devices Industry?

High demand for compact storage devices is the key driver of the market.

- The market for USB devices, specifically external hard drives and other peripheral devices, is experiencing significant growth due to the increasing demand for compact storage solutions among Original Equipment Manufacturers (OEMs). As data storage needs continue to expand for both individual consumers and businesses, there is a rising preference for devices that offer high capacity within a small form factor. USB devices are particularly attractive due to their reliability, with shock absorb ratings of up to 200Gs ensuring data protection. Furthermore, USB devices can retain data for extended periods and can be reprogrammed multiple times. These features make USB devices an essential component in various consumer electronics, including feature phones, smartphones, tablets, cameras, and camcorders.

- USB devices also play a crucial role in automotive entertainment and infotainment systems, as well as in security applications that require data transfer with high bandwidth. In summary, the demand for USB devices is on the rise due to their compact size, reliability, and versatility in various applications.

What are the market trends shaping the USB Devices Industry?

The increasing need for high capacity solutions is the upcoming market trend.

- In today's digital age, the demand for consumer electronics such as smartphones and laptops continues to rise, leading to an increased need for USB devices for data transfer and storage. According to industry reports, the global data generated and replicated is projected to reach approximately 44 trillion GB by 2021. To cater to this growing data requirement, USB devices, including webcams, flash drives, memory card readers, digital audio players, USB hubs, and docking stations, are being developed with higher storage capacities and faster data transfer rates.

- USB devices have become essential tools for both personal and professional use, enabling seamless connectivity between various devices. As the number of connected devices continues to grow, the importance of USB devices in managing and transferring data efficiently will only increase.

What challenges does the USB device industry face during its growth?

The emergence of cloud storage services is a key challenge affecting the industry's growth.

- The market has faced challenges due to the rise of cloud storage services and advanced smartphone connectivity. As organizations and individuals increasingly turn to cloud platforms for data storage and management, the demand for physical USB devices, such as data storage solutions and computer peripherals, has decreased. Cloud storage offers several advantages, including scalability, cost-effectiveness, and easy access to data from any internet-enabled device. This trend is especially significant in today's remote work environment, where digital collaboration is increasingly common. Services like Dropbox, Google Drive, and Amazon Web Services have gained popularity, providing users with vast storage capacity without the limitations of physical hardware.

- However, this shift to cloud storage comes with potential risks, including the threat of malware and data loss. As such, it is crucial for users to prioritize data security and back up their data regularly. USB devices continue to play a role in specific use cases, such as memory card readers and mobile device charging, but their overall market share is expected to decline as cloud storage solutions become more prevalent.

Exclusive Customer Landscape

The USB devices market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the USB devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, USB devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADATA Technology Co. Ltd.

- Corsair Gaming Inc.

- Dell Technologies Inc.

- Harrys USB Manufacturing Co.

- HP Inc.

- Intel Corp.

- Kingston Technology Co. Inc.

- Koninklijke Philips N.V.

- Micron Technology Inc.

- Microsoft Corp.

- Netac Technology Co. Ltd

- Samsung Electronics Co. Ltd.

- Shenzhen Sino-Memory Electronics Co. Ltd.

- Strontium Technology Pte Ltd.

- Teclast Electronics Co., Ltd.

- Toshiba Corp.

- Transcend Information Inc.

- Uskymax International Ltd.

- Verbatim Australia Pty Ltd.

- Western Digital Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of consumer electronics that utilize the Universal Serial Bus (USB) technology for data transfer and power delivery. These devices include flash drives, memory card readers, digital audio players, USB hubs, docking stations, webcams, and various computer peripherals. The market caters to diverse industries such as IT and telecommunication, healthcare, remote working, and remote learning, among others. USB devices are integral to data storage and transfer, enabling seamless connectivity between digital devices and computers. With the advent of high-capacity solutions like USB Type-C and DDR5 DRAM, these devices offer increased storage capacity and faster data transmission rates.

The market is witnessing significant growth due to the increasing demand for small storage devices, wireless technology, and data storage solutions. The market is also driven by the integration of USB technology in medical imaging equipment, automotive entertainment systems, and security devices. Moreover, the integration of artificial intelligence (AI), machine learning (ML), and IoT in USB devices is expanding their applications in various industries. USB devices are now used for mobile device charging, malware protection, and data loss prevention, making them indispensable in today's digital world. The market offers numerous benefits, including high-speed data transfer, power delivery, smartphone connectivity, and data storage solutions. These devices cater to diverse industries and applications, making them an essential component of modern technology infrastructure.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.1% |

|

Market growth 2024-2028 |

USD 14.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.5 |

|

Key countries |

US, China, Japan, Germany, Canada, UK, India, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this USB Devices Market Research and Growth Report?

- CAGR of the USB Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the usb devices market growth of industry companies

We can help! Our analysts can customize this usb devices market research report to meet your requirements.