US Used Car Market Size 2025-2029

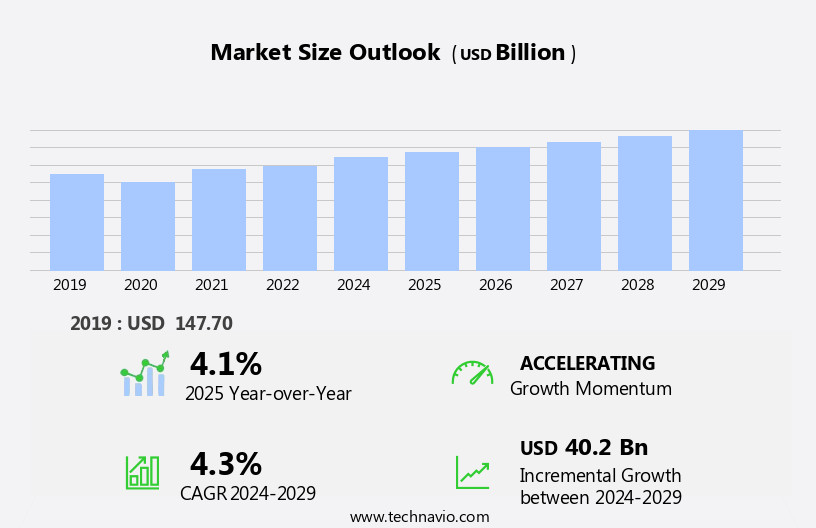

The US used car market size is forecast to increase by USD 40.2 billion, at a CAGR of 4.3% between 2024 and 2029.

- The used car market in the US is witnessing significant growth, driven by the excellent value proposition that used cars offer to consumers. The increasing popularity of websites dedicated to selling used cars has expanded market reach and convenience, allowing consumers to browse and purchase vehicles online. Stringent emission regulations are restricting the sales of non-compliant used cars, necessitating investments in upgrading and maintaining commercial vehicle fleets to meet regulatory requirements. These regulations necessitate investments in emission testing and certification processes, increasing operational costs for dealers. To capitalize on opportunities, dealers can focus on offering certified pre-owned vehicles and implementing robust emission testing procedures.

- Additionally, leveraging digital marketing strategies and offering flexible financing options can help attract and retain customers. Overall, the used car market presents both challenges and opportunities for players, requiring strategic planning and innovation to succeed.

What will be the size of the US Used Car Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The used car market in the US continues to evolve, with various sectors adapting to emerging trends and technologies. Vehicle data analysis plays a pivotal role in understanding vehicle depreciation curves and return on investment for dealers. Payment processing systems streamline sales transactions, while sales performance metrics and customer lifetime value inform strategic decision-making. Fraud detection systems ensure compliance with legal standards, and insurance cost factors influence acquisition channel efficiency. Inventory turnover rate, a key performance indicator, varies across dealerships. Compliance audits and dealer training programs maintain legal compliance and improve customer satisfaction. Market penetration rate and resale value prediction help dealers optimize pricing models.

- Consumer protection laws and financing product offerings shape customer trust and loyalty. Operating costs analysis, customer service feedback, and sales conversion rates contribute to profit margin calculation. Risk assessment models, employee performance metrics, marketing spend efficiency, and pricing model validation are essential for long-term success. A recent study reveals a 5% increase in sales for dealerships implementing advanced data analytics. Industry growth is expected to reach 3% annually, driven by these evolving market dynamics.

How is this market segmented?

The US used car market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- 3P channel sales

- OEM channel sales

- Product

- Mid size

- Full size

- Compact size

- Vendor Type

- Organized

- Unorganized

- Fuel Type

- Diesel

- Petrol

- Geography

- North America

- US

- North America

By Distribution Channel Insights

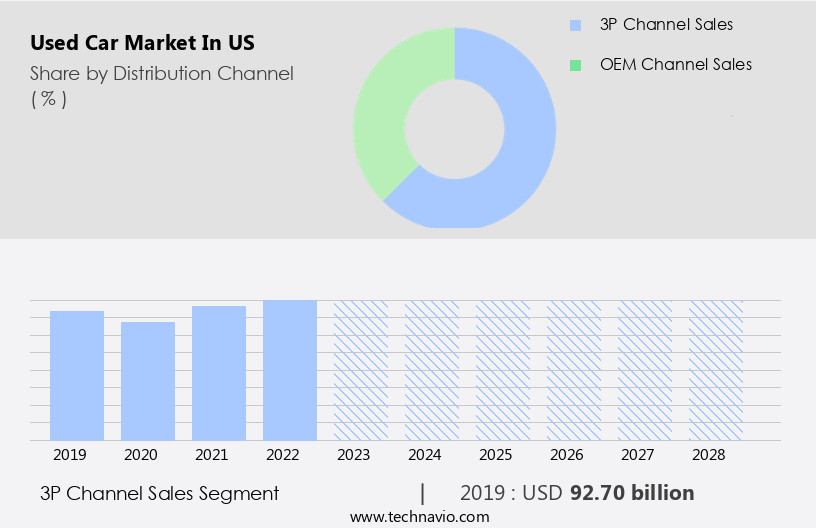

The 3P channel sales segment is estimated to witness significant growth during the forecast period.

The used car market in the US is an active and dynamic sector, driven by various factors. With the constant launch of new vehicle models, the supply of used cars increases, resulting in lower prices compared to new cars. This trend encourages car owners to sell their vehicles and upgrade to newer models, shortening the average ownership cycle. Online advertising platforms play a significant role in connecting buyers and sellers. Pre-purchase inspections and vehicle history reports ensure transparency and build trust. Repairs cost estimation and parts sourcing networks help in managing the expenses of used car ownership. Market segmentation strategies cater to different customer needs, while customer relationship management tools foster loyalty.

Emissions testing standards ensure the environmental sustainability of used vehicles. Auto appraisal value tools help in determining fair prices, and loan term comparison aids in financing decisions. Marketing campaign effectiveness is measured through customer acquisition cost and interest rate calculation. Mobile apps offer functionalities like mechanical inspection checklists, paint depth measurement, and damage assessment tools. Dealer inventory management, detailing services, and vehicle photography techniques enhance the sales process. Industry growth is expected to continue, with the used car market projected to expand by 3% annually. For instance, a dealership successfully increased its sales by 15% through effective search engine optimization and sales process optimization.

The 3P channel sales segment was valued at USD 92.70 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The used car market in the US is a dynamic and lucrative sector, with numerous opportunities for dealers and buyers alike. Understanding key factors influencing this market is essential for success. Bidding strategies at used car auctions can significantly impact final prices. Dealers employ various tactics, such as setting maximum bids and monitoring market trends, to secure desirable vehicles at competitive prices. Vehicle condition plays a pivotal role in determining value. Well-maintained cars with a clean history command higher prices, while those requiring extensive repairs or exhibiting significant damage fetch lower bids. Factors affecting used car value include make, model, mileage, and demand. Online purchasing experiences have transformed the industry, enabling buyers to access a vast inventory from anywhere. Effective used car advertising campaigns are crucial for attracting potential customers and generating leads. Accurate vehicle valuation is vital for both buyers and sellers. Utilizing methods like Kelley Blue Book or NADA guides can help establish fair market prices. Strategies to increase used car sales include offering financing options, extended warranties, and competitive pricing. Minimizing risk in used car purchases is essential. Vehicle history reports from services like Carfax or AutoCheck provide valuable information about a car's past, helping buyers make informed decisions. A good credit score is necessary for securing favorable financing terms. Optimizing used car inventory management is crucial for dealer profitability. Effective negotiation strategies, such as bundling services or offering financing incentives, can help close deals. Regular vehicle mechanical inspections ensure quality and trust with customers. Auto loan interest rate comparisons and average repair costs by vehicle type are essential considerations when buying or selling a used car. Developing a robust used car sales process, including pre-inspections, pricing strategies, and customer follow-up, can lead to increased customer retention. Best practices for used car reconditioning, such as thorough cleaning and repairs, can boost resale value. Dealer profitability analysis and effective online advertising are key components of a successful used car business.

What are the US Used Car Market drivers leading to the rise in adoption of the Industry?

- The significant value proposition of used cars, characterized by excellent return on investment, serves as the primary catalyst for the market's growth.

- The used car market in the US has experienced notable growth due to an influx of automakers entering the sector and the increasing popularity of online used car dealerships. This shift has significantly improved customer perception of used cars, as affordability continues to be a primary factor influencing purchasing decisions. However, concerns regarding the quality of used vehicles persist, given the lack of transparency regarding their previous ownership and potential damages post-sale. To build trust and alleviate these concerns, many used car dealers offer extended warranties.

- For example, a leading dealer provides free servicing at their dealership for a specified duration, commencing from the date of purchase. According to industry reports, the used car market is projected to expand by approximately 5% in the upcoming years, reflecting its growing significance in the automotive sector.

What are the US Used Car Market trends shaping the Industry?

- The trend in the automotive market is shifting towards an increased penetration of websites specializing in used car sales. Used car sales websites are gaining significant traction in the market.

- The digital transformation of the used car market in the US has significantly expanded buying and selling opportunities. Online platforms have become a preferred choice for consumers, with an estimated 40% of used car buyers in the country opting for online purchases in 2021. These websites offer convenience, access to a vast buyer pool, and additional services, leading to a 15% increase in used car sales through such channels.

- The industry is projected to continue growing, with online sales expected to account for over 50% of the market by 2025. Manufacturers leverage these platforms to communicate vehicle updates, technology advancements, and new car launches, making online marketplaces an essential communication channel.

How does US Used Car Market faces challenges face during its growth?

- The used car industry faces significant growth constraints due to stringent emission regulations that prohibit the sale of non-compliant vehicles.

- The used car market in the US is facing significant changes due to stricter emission norms set by regulatory authorities, such as the Environmental Protection Agency (EPA). These new norms will render many used cars non-compliant, affecting their market value. In 2017, approximately 63% of the US population resided in areas with air quality levels surpassing federal standards, making the need for emission-compliant vehicles more pressing. Older cars, particularly pickup trucks, contribute significantly to vehicular emissions, which contain harmful gases detrimental to human health.

- For instance, the replacement of a single old pickup truck with a newer, emission-compliant model could potentially reduce annual nitrogen oxide emissions by up to 2.5 tons. According to industry reports, the used car market in the US is expected to grow at a robust rate of 3% annually over the next five years.

Exclusive US Used Car Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AutoNation Inc.

- CarMax Inc.

- Carvana Co.

- Cox Automotive Inc.

- Craigslist Inc.

- DriveTime Automotive Group Inc.

- eBay Motors

- Edmunds.com Inc.

- Hertz Car Sales

- Lithia Motors Inc.

- Penske Automotive Group Inc.

- Roomy Autos

- Shift Technologies Inc.

- Sonic Automotive Inc.

- Tesla Inc. (Pre-Owned)

- TrueCar Inc.

- Vroom Inc.

- WeBuyAnyCar USA

- CarGurus Inc.

- Kelley Blue Book (Cox Automotive)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Used Car Market In US

- In January 2024, Carvana, a leading e-commerce platform for buying and selling used cars, announced the acquisition of Hennessey Capital's Car360, a digital retailing platform for independent used car dealers (Carvana press release). This strategic move aimed to expand Carvana's reach and services to more dealers and consumers.

- In March 2024, General Motors and CarMax, two major players in the used car market, formed a partnership to create a new used vehicle certification program (General Motors press release). This collaboration aimed to provide consumers with more transparency and confidence in the used car buying process.

- In May 2024, CarGurus, a leading online automotive marketplace, raised USD 300 million in a funding round, led by BlackRock, to accelerate its growth and expand its services (CarGurus press release). This significant investment underscored the market's confidence in CarGurus' business model and growth potential.

- In February 2025, the National Automobile Dealers Association (NADA) and the Federal Trade Commission (FTC) reached an agreement on new guidelines for used car advertising (NADA press release). These guidelines aimed to provide consumers with clearer and more accurate information about the condition and history of used cars, enhancing transparency and trust in the market.

Research Analyst Overview

The used car market in the United States continues to evolve, driven by various factors and applications across diverse sectors. Vehicle Identification Numbers (VINs) play a crucial role in pre-purchase inspections, ensuring potential buyers make informed decisions. Online advertising platforms facilitate wider reach, while repairs cost estimation tools help in budgeting. Used car reconditioning and parts sourcing networks are essential for dealers, enabling them to offer competitive retail car pricing. Market segmentation strategies, customer relationship management, and emissions testing standards are key components of successful sales processes. Auto appraisal value tools help in loan term comparison and marketing campaign effectiveness evaluation.

Mileage verification systems and online vehicle auctions are transforming the wholesale car pricing landscape. Paint depth measurement, credit score impact, and automotive diagnostic tools are essential for dealers to optimize their sales processes. Mobile app functionality, damage assessment tools, and dealer inventory management systems streamline operations. Detailing services, vehicle photography techniques, and title verification services enhance the customer experience. Sales process optimization, search engine optimization, vehicle maintenance records, and warranty verification processes ensure transparency and trust. Industry growth is expected to reach 3% annually, reflecting the continuous dynamism of the used car market. For instance, a dealer successfully implemented a lead generation strategy, resulting in a 15% increase in sales.

This success story underscores the importance of effective marketing strategies and continuous market adaptation.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Used Car Market in US insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2025-2029 |

USD 40.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.1 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch