Venture Capital Investment Market Size 2025-2029

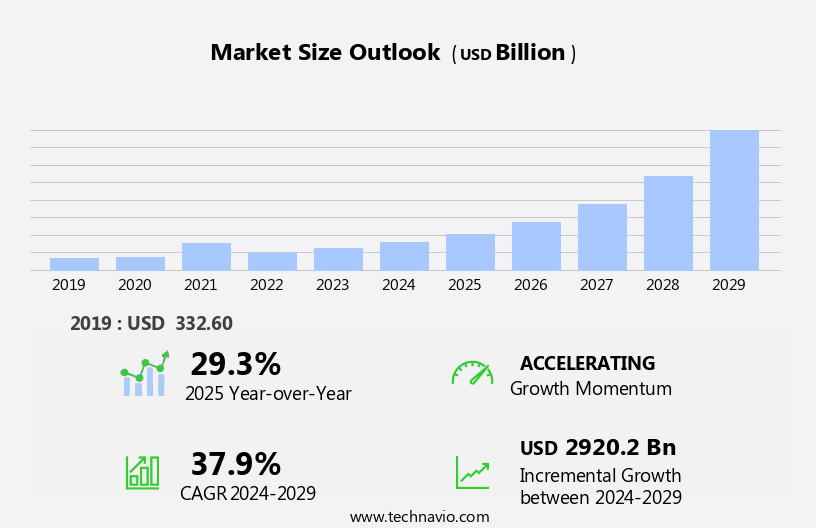

The venture capital investment market size is forecast to increase by USD 2920.2 billion, at a CAGR of 37.9% between 2024 and 2029.

- The Venture Capital (VC) investment market is experiencing significant growth, particularly in the biotech sector, driven by advancements in technology and innovation. This trend is fueled by an increasing number of high-net-worth individuals (HNWIs) worldwide, who are seeking to diversify their portfolios and invest in promising startups. However, this market faces challenges, including foreign exchange volatility, which can impact the returns on investments made across borders. As HNWIs continue to invest in VC funds, they bring not only capital but also expertise and industry connections, further enhancing the potential for successful ventures.

- Simultaneously, biotech companies, with their innovative solutions, are attracting substantial VC interest, presenting significant opportunities for growth and returns. Navigating foreign exchange risks and identifying promising biotech startups will be crucial for VC firms seeking to capitalize on these trends and outperform their competitors.

What will be the Size of the Venture Capital Investment Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The venture capital (VC) investment market continues to evolve, shaped by dynamic market conditions and diverse sector applications. Dividend yields and capital gains remain key drivers for investors, as they seek to maximize returns. Big data and growth hacking are increasingly integral to investment theses, enabling industry analysis and informed decision-making. Limited partnerships (LPs) and funds collaborate, with GPs overseeing operations and risk management. Deal sourcing and due diligence are essential components of the investment process, ensuring portfolio companies align with the fund's objectives. Revenue growth and marketing strategies are critical for portfolio companies, as they aim to scale and attract investment.

Term sheets outline investment details, while advisory boards provide strategic guidance. Financial modeling and cash flow management are essential for effective fund management. Technology infrastructure, including AI, cloud computing, and blockchain technology, underpins innovation and growth. Joint ventures and technology licensing offer opportunities for collaboration and expansion. Sales strategy and burn rate analysis help optimize portfolio performance. Private equity and data analytics provide valuable insights for investment opportunities. Stock options and Series A and B funding rounds offer potential for significant returns. Legal agreements and intellectual property (IP) rights are crucial for protecting investments and ensuring long-term success.

How is this Venture Capital Investment Industry segmented?

The venture capital investment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Sector

- Software

- Pharmaceutical and biotechnology

- Media and entertainment

- Medical devices and equipments

- Others

- Type

- First-time venture funding

- Follow-on venture funding

- Variant

- Institutional Investors

- Corporate venture capital

- Private equity firms

- Angel investors

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Sector Insights

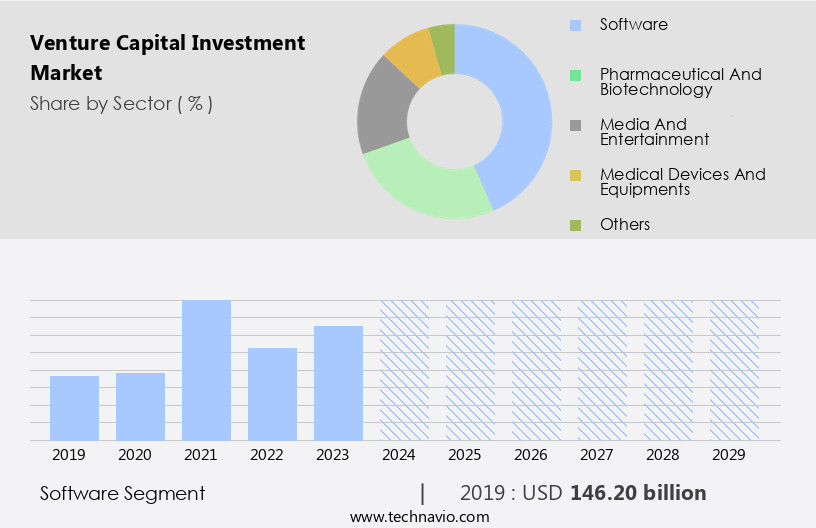

The software segment is estimated to witness significant growth during the forecast period.

The market has witnessed significant activity in the software industry, with a focus on disruptive technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Blockchain technology. VC firms have invested billions of dollars in these areas, with some companies achieving unicorn status. The software sector includes application software, system infrastructure software, software as a service (SaaS), operating systems, database software, and analytics software. The growing number of entrepreneurs and businesses, estimated to be over 450 million and 300 million, respectively, is fueling the growth of the software segment in the market. VC funds have been actively involved in Series A funding, providing capital for early-stage startups, and Series B funding, for growth-stage companies.

Limited partnerships (LPs) have been essential in providing capital for these funds. Risk management is a critical factor in venture capital investment, with due diligence, financial modeling, and market analysis being crucial components of the investment thesis. Portfolio diversification is another essential aspect, with VC funds investing in a range of sectors and stages. A strong business plan, advisory board, and operations management are vital for portfolio companies to succeed. Exit strategies, such as IPOs, mergers, and acquisitions, provide investors with potential returns through capital gains and dividend yields. Private equity firms have also been active in the software industry, with data analytics, technology licensing, and joint ventures being common investment areas.

The use of cloud computing, big data, and AI in software development has been a game-changer, with growth hacking and industry analysis being essential marketing strategies. Stock options and term sheets are common tools used in venture capital deals, with the board of directors playing a crucial role in operations management and sales strategy. VC funds manage the cash flow of portfolio companies, providing them with the necessary resources to scale up. The use of legal agreements and technology infrastructure is essential for the protection of intellectual property (IP) and the smooth functioning of the business.

The Software segment was valued at USD 146.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

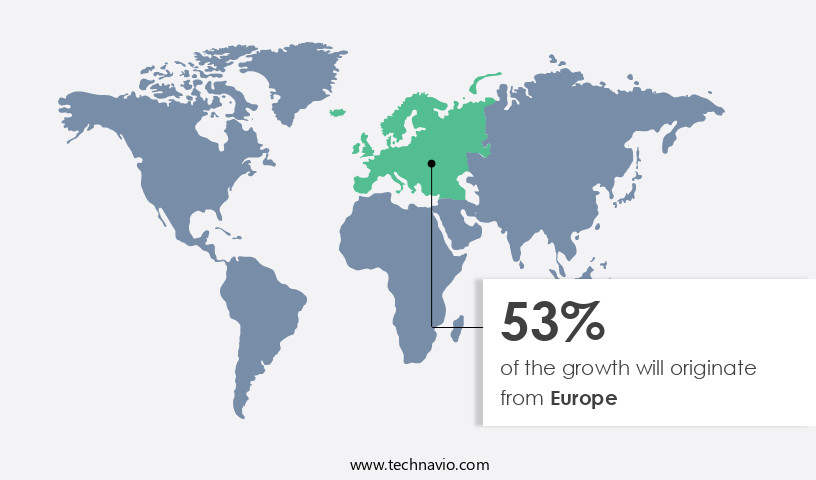

Europe is estimated to contribute 53% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing notable growth, fueled by the expanding presence of small and medium-sized enterprises (SMEs). SMEs, representing approximately 34.8 million businesses in the US, employ over 59.0 million people and have driven 61.1% of job growth since 1995. These businesses are integral to the economy, serving as the foundation for job creation, innovation, and economic resilience. Machine learning and artificial intelligence technologies are increasingly being adopted by SMEs to optimize operations, enhance marketing strategies, and improve sales processes. Series A funding and seed funding are popular financing options for SMEs, enabling them to scale their businesses and bring new products to market.

Venture capital funds, managed by fund managers, provide capital to portfolio companies in exchange for equity. Limited partnerships (LPs) and angel investors also contribute to the financing landscape. Risk management is a critical aspect of venture capital investment, with portfolio diversification and due diligence essential for mitigating risks. As SMEs grow, they require robust technology infrastructure, including big data and cloud computing, to support their expanding operations. Exit strategies, such as acquisitions, IPOs, or mergers, provide investors with potential returns through capital gains and dividend yields. Operations management, sales strategy, and financial modeling are crucial components of a successful business plan.

Advisory boards and investment memorandums offer valuable guidance and insights. Joint ventures and technology licensing are additional strategies for growth and revenue generation. Risk management, market capitalization, and legal agreements are essential considerations for venture capital investments. Series B funding and series C funding provide further growth opportunities for portfolio companies. Intellectual property and stock options are vital components of a company's value proposition. In conclusion, the market in North America is thriving, driven by the innovative and dynamic nature of SMEs. The integration of emerging technologies, strategic financing, and effective management practices are key factors contributing to the market's growth and evolution.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and competitive market, early-stage companies seek funding from investors to bring their innovative ideas to life. Venture capital firms provide capital, expertise, and industry connections to help these businesses grow and thrive. The venture capital investment process involves rigorous due diligence, assessing business plans, market potential, and management teams. Successful ventures can lead to significant returns for investors, making the market an attractive and lucrative sector. Startups in various industries, such as technology, healthcare, and renewable energy, frequently turn to venture capital to fuel their growth. Strategic partnerships, syndications, and co-investments are common in this market, fostering collaboration and maximizing investment opportunities. The market is an ever-evolving ecosystem, driven by innovation, risk-taking, and the pursuit of groundbreaking ideas.

What are the key market drivers leading to the rise in the adoption of Venture Capital Investment Industry?

- The significant influx of venture capital investment in the biotech sector serves as the primary catalyst for market growth.

- Venture capital investment in the biotech sector has experienced notable growth, with the medical industry, specifically biotech divisions, receiving substantial financing to expedite the creation of vaccines, secondary medicines, and other innovative healthcare solutions. This trend is fueled by several factors, including the escalating demand for advanced medical treatments and the increasing prevalence of chronic diseases. Biotech companies are pioneering groundbreaking technologies and therapies to address unmet medical needs, with projects spanning gene editing, regenerative medicine, personalized treatments, and advanced diagnostics. The potential for substantial returns on investment in these areas makes biotech an alluring sector for venture capitalists.

- Venture capital funds meticulously conduct due diligence to assess the viability of potential investments, focusing on a company's business plan, financial modeling, technology infrastructure, and management team. Advisory boards and experienced fund managers play crucial roles in risk management and deal sourcing. Portfolio diversification is a key strategy for venture capital funds, ensuring a balanced investment portfolio and mitigating risk. Despite the inherent risks involved in venture capital investment, the potential rewards make it an exciting and rewarding opportunity for those willing to invest in the future of healthcare and biotechnology.

What are the market trends shaping the Venture Capital Investment Industry?

- The global population of high-net-worth individuals (HNWIs) is experiencing significant growth, representing an emerging market trend. This expanding demographic holds considerable financial resources and presents valuable opportunities for businesses catering to their unique needs.

- The market has experienced significant growth in recent years, driven by the increasing number of high-net-worth individuals (HNWIs) seeking specialized investment opportunities. HNWIs, defined as individuals with a net worth of at least USD1 million in cash or cash equivalents, look for experienced professionals to manage their substantial portfolios. Wealth managers and advisors play a crucial role in this process, providing expertise in areas such as investment memorandums, industry analysis, growth hacking, and operations management. Capital gains and dividend yields are essential considerations for HNWIs, and venture capital investments offer potential for both.

- Emerging technologies, such as artificial intelligence (AI) and big data, are attracting significant attention and investment. Joint ventures and pitch decks are common tools used in the venture capital investment process, allowing HNWIs to collaborate with industry leaders and gain insights into promising new businesses. Exit strategies, including IPOs and acquisitions, are also essential components of the venture capital investment landscape. GPs (general partners) oversee the day-to-day management of venture capital funds and work closely with portfolio companies to maximize returns. As the venture capital market continues to evolve, it remains a dynamic and exciting space for HNWIs seeking to grow their wealth and invest in innovative technologies and businesses.

What challenges does the Venture Capital Investment Industry face during its growth?

- Foreign exchange volatility poses a significant challenge to the industry's growth, requiring professionals to mitigate risks and adapt to market fluctuations in order to ensure sustainable expansion.

- In the realm of venture capital investment, corporations encounter various risks during financial transactions across borders, a phenomenon referred to as transaction risks. These risks materialize when a company engages in financial deals or maintains financial records in currencies other than their home base. For instance, a US corporation operating in Europe faces foreign exchange risks when accepting transactions in Euros and reporting in US Dollars. The uncertainty surrounding currency rates prior to transaction completion amplifies this risk. Moreover, the venture capital market is characterized by dynamic sales strategies, burn rates, and the need for private equity investments.

- Data analytics plays a pivotal role in evaluating potential investments, while intellectual property (IP) and legal agreements are crucial components of due diligence. In the era of cloud computing, technology licensing and board of directors' involvement are increasingly significant. Stock options serve as incentives for key personnel, while Series B funding signifies a significant growth stage for startups. The interplay of these factors necessitates a comprehensive understanding of the venture capital investment landscape.

Exclusive Customer Landscape

The venture capital investment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the venture capital investment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, venture capital investment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accel - The company focuses on investments in the realm of internet technology and software development industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accel

- Agoranov

- AH Capital Management LLC

- Balderton Capital UK LLP

- Battery Ventures

- Bessemer Venture Partners

- Caixa Capital Risc SGEIC S.A.

- Cherry Ventures Management GmbH

- First Round Capital

- Founders Fund

- GGV Capital

- Greylock Partners

- Hoxton Ventures LLP

- Index Ventures UK LLP

- Lakestar Advisors GmbH

- Seedcamp Investment Management LLP

- Sequoia Capital Operations LLC

- Target Global

- Union Square Ventures

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Venture Capital Investment Market

- In January 2024, SoftBank Vision Fund announced a USD2.5 billion investment in Boston Dynamics, a leading robotics company, marking one of the largest venture capital deals in history (Bloomberg). This significant investment underscored the growing interest of venture capitalists in advanced technologies, particularly robotics and automation.

- In March 2024, Tesla, Inc. and SolarCity, a leading solar energy company, announced their merger, creating a renewable energy powerhouse valued at over USD50 billion (SEC Filing). This strategic collaboration aimed to streamline the production and distribution of solar panels and electric vehicles, highlighting the importance of synergistic partnerships in the venture capital market.

- In May 2024, the European Investment Bank (EIB) pledged â¬10 billion to support European tech startups, marking a major regulatory initiative to boost innovation and competitiveness in the European venture capital market (European Investment Bank press release). This commitment demonstrated the role of government initiatives in fostering a favorable environment for venture capital investment.

- In April 2025, Palantir Technologies, a data analytics company, raised USD2.5 billion in a funding round, valuing the company at USD41 billion (Bloomberg). This substantial investment underscored the growing demand for data analytics solutions and the potential for high returns in the venture capital market.

Research Analyst Overview

- In the dynamic market, various types of investors, including passive investors, family offices, hedge funds, strategic investors, and high-net-worth individuals (HNWI), actively seek opportunities for growth and value creation. Reputational risk and regulatory risk are crucial factors influencing investment decisions, with regulatory changes and public perception potentially impacting portfolio companies. Debt restructuring and capital structure adjustments are common strategies for companies facing economic growth challenges or financial distress. Debt financing, mezzanine financing, and acquisition financing are popular debt instruments used in these situations. Leverage buyouts (LBO) and management buyouts (MBO) are common exit strategies for private equity firms.

- Operational risk, technological risk, and political risk are significant concerns for investors. Operational risks include internal management issues and external factors like supply chain disruptions. Technological risks relate to the adoption and integration of new technologies, while political risks involve geopolitical instability and regulatory changes. Value investors and growth investors focus on different investment strategies. Value investors seek undervalued companies with strong fundamentals, while growth investors prioritize companies with high growth potential. Convertible notes and corporate venture capital are alternative investment instruments used by active investors to gain exposure to promising startups. Interest rates and credit ratings significantly impact debt financing and investment decisions.

- As interest rates rise, debt financing becomes more expensive, potentially reducing investment activity. Conversely, a favorable credit rating can make it easier for companies to secure financing. Business angels and sovereign wealth funds also participate in the venture capital market, providing funding and strategic support to startups and growth companies. Working capital requirements and debt-to-equity ratios are essential metrics for evaluating a company's financial health and investment potential.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Venture Capital Investment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 37.9% |

|

Market growth 2025-2029 |

USD 2920.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

29.3 |

|

Key countries |

US, Canada, The Netherlands, UK, India, Italy, Germany, China, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Venture Capital Investment Market Research and Growth Report?

- CAGR of the Venture Capital Investment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the venture capital investment market growth of industry companies

We can help! Our analysts can customize this venture capital investment market research report to meet your requirements.