Water And Wastewater Management Market Size 2025-2029

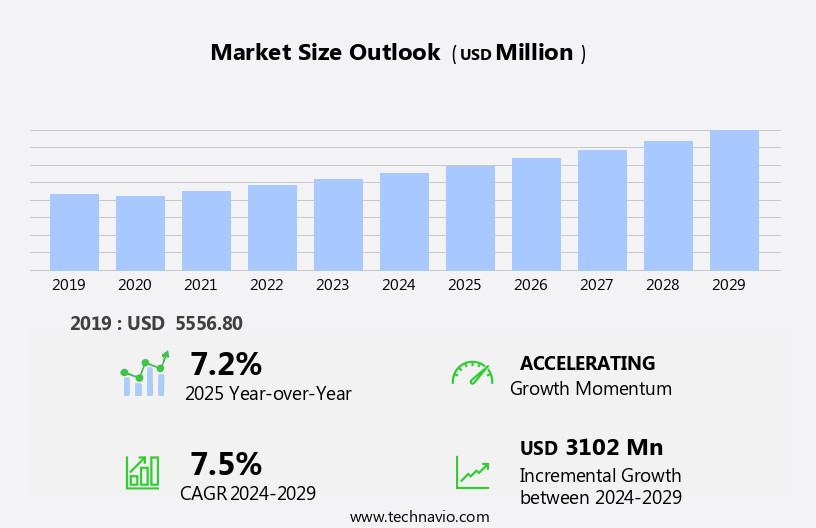

The water and wastewater management market size is forecast to increase by USD 3.1 billion, at a CAGR of 7.5% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. The adoption of sustainable practices in various industries, including mining, is driving the demand for advanced water and wastewater treatment solutions. Mining activities generate large volumes of wastewater containing coal particles and heavy metals like nickel, lithium, cobalt, and steel. To address this challenge, the market is witnessing the increasing use of machine learning and artificial intelligence in water treatment equipment for efficient mineral separation and wastewater management. Moreover, the construction industry's growing demand for detergents and surfactants is putting pressure on water resources, necessitating the need for effective water management.

- Ultrafiltration technology, a membrane filtration method, is gaining popularity due to its ability to remove impurities and contaminants from water and wastewater. The digital transformation in various sectors, including semiconductor manufacturing and renewable energy, is leading to an increased focus on data analytics and the Internet of Things (IoT) sensors for automating water treatment processes. These sensors enable real-time monitoring and analysis of water quality, ensuring optimal performance and reducing operational costs.

What will be the Size of the Water And Wastewater Management Market During the Forecast Period?

- The market encompasses the technologies and services employed to effectively manage the complex water cycles of various industries, with a significant focus on mining operations due to their substantial water usage and potential environmental impacts. This market is driven by the increasing awareness of water scarcity and security concerns, as well as stringent environmental regulations aimed at mitigating ecological impact from mining activities. Contaminants such as toxic heavy metals, ion exchange resins, membrane filtration, reverse osmosis, and other advanced treatment methods are utilized to address water quality issues. Mining processes generate wastewater laden with fine particles, surfactants, soaps and detergents, alkaline chemicals, high acidic chemicals, coal particles, and poisonous chemicals, necessitating strong water management systems.

- The global mining industry recognizes the importance of sustainable practices in water management, as mining companies face growing pressure to reduce their environmental footprint. Mining operations consume vast quantities of water, making it essential to optimize water usage and minimize the release of contaminants into water resources. The integration of advanced water treatment technologies and the adoption of circular water management systems are key trends shaping the market.

How is this Water And Wastewater Management Industry segmented and which is the largest segment?

The water and wastewater management industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Water treatment

- Wastewater treatment

- Type

- Primary treatment

- Secondary treatment

- Tertiary treatment

- Application

- Membrane separation

- Biological

- Disinfection

- Sludge treatment

- Others

- End-user

- Municipal

- Industrial

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- South America

- Brazil

- Middle East and Africa

- North America

By Product Insights

- The water treatment segment is estimated to witness significant growth during the forecast period.

The mining industry relies heavily on water for extraction processes, making water and wastewater management a critical aspect. Mining operations generate significant liquid and solid waste, which, if not treated, can pollute water resources. Mining companies are responsible for ensuring the availability of good-quality water for their operations. Extraction processes involve using large quantities of water and various chemicals, leading to contaminants such as toxic heavy metals, surfactants, fine particles, soaps and detergents, alkaline chemicals, high acidic chemicals, coal particles, and poisonous chemicals. Effective water treatment is essential to mitigate environmental impacts and comply with regulations. Water treatment technologies, including ion exchange, membrane filtration, and reverse osmosis, are employed to remove contaminants.

Digital technologies, such as sensors, machine learning, and artificial intelligence, are integrated for leak detection, treatment process optimization, and water usage monitoring, promoting sustainable water management. Water scarcity and security are significant concerns, particularly for freshwater resources. The global mining industry recognizes the need for sustainable practices and the integration of digital technologies to minimize environmental impacts. Mining chemicals and waste management techniques are also evolving to align with environmental awareness. Electric vehicles, metals and minerals, and wastewater treatment equipment are integral components of this evolution.

Get a glance at the market report of share of various segments Request Free Sample

The water treatment segment was valued at USD 2.88 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

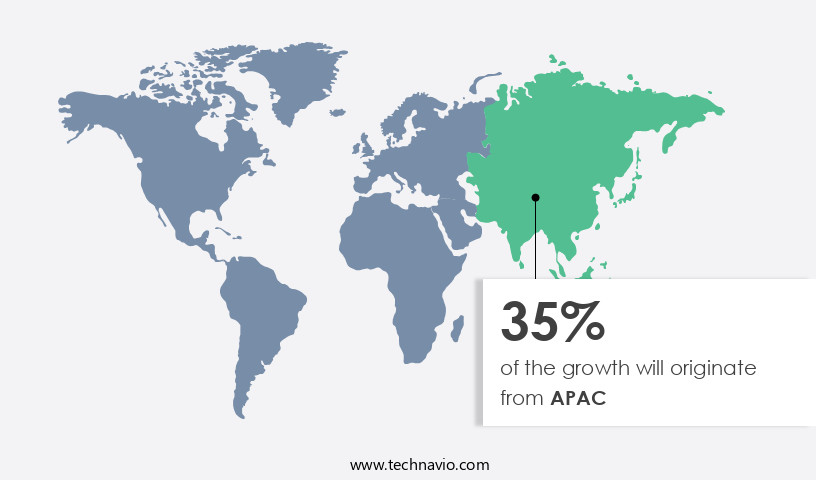

- APAC is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American region holds a substantial market share in water and wastewater management for the mining sector. The US and Canada are the primary contributors to this market due to stringent environmental regulations enforced on mining activities. These regulations necessitate the usage of advanced water and wastewater treatment technologies to mitigate environmental impacts. The production of metals and minerals, including cobalt, nickel, lithium, and others, in the US, Canada, and Mexico, necessitates the implementation of sustainable water management practices.

Digital technologies such as sensors, machine learning, and artificial intelligence are increasingly integrated into mining operations for leak detection, treatment process optimization, and water usage monitoring. Water scarcity and security concerns, driven by freshwater resource depletion, further accentuate the need for efficient water management. Key mining companies are adopting sustainable practices, integrating eco-friendly mining chemicals, and investing in waste management techniques to minimize the ecological impact of mining activities.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Water And Wastewater Management Industry?

The growing adoption of sustainable practices in mining industry is the key driver of the market.

- The mining industry relies heavily on water resources for various operations, including mineral extraction and transportation. However, the extensive use of water in mining activities can lead to ecological imbalance and water pollution. Surface and groundwater contamination are significant concerns due to the discharge of mining wastewater. This issue is particularly pressing in areas experiencing water scarcity, leading to community opposition to mining projects. In response, mining companies are adopting sustainable water management practices, such as capturing and reusing treated water, to minimize the ecological impact. Water treatment technologies, including ion exchange, membrane filtration, and reverse osmosis, play a crucial role in mitigating contaminants from mining wastewater.

- Mining operations generate various contaminants, such as toxic heavy metals, surfactants, fine particles, soaps and detergents, alkaline chemicals, and high acidic chemicals. Integrating digital technologies, such as sensors, machine learning, and artificial intelligence, into water usage monitoring and treatment process optimization, can enhance sustainable water management in the mining industry. The global mining industry's increasing environmental awareness and the growing demand for metals and minerals used in electric vehicles, such as cobalt, nickel, and lithium, necessitate the adoption of sustainable practices. Waste management techniques, including the use of eco-friendly mining chemicals, can further reduce the environmental impact of mining activities.

What are the market trends shaping the Water And Wastewater Management Industry?

Growing demand for mineral-based products is the upcoming market trend.

- The mining industry's expansion in developing countries is driving up the demand for water resources, posing a significant challenge for sustainable water management. With mining operations increasing and reserves dwindling, the need to manage water efficiently and minimize environmental impacts becomes crucial. Mining activities can introduce contaminants such as toxic heavy metals, surfactants, fine particles, soaps and detergents, alkaline chemicals, and high acidic chemicals into water resources. Environmental regulations and the growing awareness of ecological impact necessitate the implementation of advanced water treatment technologies, including ion exchange, membrane filtration, and reverse osmosis. Digital technologies, such as sensors, machine learning, and artificial intelligence, are also being integrated into water treatment processes for leak detection, treatment process optimization, and water usage monitoring.

- The global mining industry's shift towards sustainable practices, such as the use of electric vehicles and the production of metals and minerals like cobalt, nickel, and lithium, further focuses the importance of water and wastewater management. The integration of digital technology into mining operations is expected to play a vital role in addressing water scarcity and water security concerns in the mining sector. The market for water and wastewater treatment equipment, including ultrafiltration systems, is poised to grow as the mining industry continues to expand and prioritize sustainable practices.

What challenges does the Water And Wastewater Management Industry face during its growth?

The complexity of managing wastewater resources is a key challenge affecting the industry growth.

- In the mining industry, managing wastewater resources at mining sites is a significant challenge due to the complexities involved in administering water resources in effluent streams or tailings dams. Minimizing pollution of ground and surface water, efficiently collecting and treating polluted streams and leachates, and reducing the volume of water to be treated are key parameters for mining wastewater management. Common water management practices in mining include constructing upstream check dams to divert surface water, maximizing water recycling in ore processing, capturing runoff streams with liners and pipes, and facilitating water evaporation in ponds. Additionally, installing liners and covers on waste overburden and ore piles can help reduce groundwater contamination.

- Despite clear parameters, implementing these practices in actual mining projects faces various complications. Environmental impacts, operational needs, and ecological concerns necessitate the use of advanced water treatment technologies such as ion exchange, membrane filtration, and reverse osmosis. Compliance with environmental regulations also plays a crucial role in mining wastewater management. Water scarcity and water security are pressing issues, emphasizing the need for sustainable water management. Digital technologies, including sensors, machine learning, and artificial intelligence, can aid in leak detection, treatment process optimization, and water usage monitoring. Integrating digital technology into mining wastewater management can lead to more sustainable practices and improved efficiency.

Exclusive Customer Landscape

The water and wastewater management market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the water and wastewater management market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, water and wastewater management market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alfa Laval AB - The company offers water and wastewater management such as Mineral exploration drilling.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aquatech International LLC

- BQE Water Inc.

- Carmeuse Coordination Center SA

- Condorchem Envitech SL

- Fluence Corp. Ltd.

- General Electric Co.

- Genesis Water Technologies Inc.

- Gradiant Corp. Ltd.

- IDE Water Technologies

- John Wood Group PLC

- Lenntech BV

- Meridiam SAS

- MIWATEK

- Newterra Ltd.

- Saltworks Technologies Inc.

- Stantec Inc.

- The Dow Chemical Co.

- Veolia

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Water and wastewater management play a crucial role in various industries, including mining operations. Mining processes consume vast quantities of water for various purposes, such as dust suppression, ore processing, and cooling. However, the extraction and processing of minerals and metals can lead to significant environmental impacts on water resources. The ecological impact of mining on water resources is a growing concern for both mining companies and regulatory bodies. Mining operations can introduce contaminants into water sources, including toxic heavy metals, fine particles, surfactants, soaps and detergents, alkaline chemicals, high acidic chemicals, and coal particles. These contaminants can adversely affect aquatic life and human health.

Further, environmental regulations continue to evolve to mitigate the ecological impact of mining on water resources. Mining companies are increasingly adopting sustainable practices to minimize their water usage and reduce the amount of contaminants released into the environment. Water treatment technologies are a critical component of sustainable water management in the mining industry. Ion exchange, membrane filtration, reverse osmosis, ultrafiltration, and other water treatment techniques are used to remove contaminants from mining wastewater before it is discharged into the environment. Digital technologies, such as sensors, machine learning, and artificial intelligence, are transforming water and wastewater management in the mining industry.

Leak detection systems, treatment process optimization, and water usage monitoring are some of the applications of digital technologies in mining water management. The global mining industry is undergoing a digital transformation, with mining companies integrating digital technology into their operations to improve efficiency, reduce costs, and enhance sustainability. The integration of digital technologies in water and wastewater management is a key aspect of this transformation. Water scarcity and water security are becoming increasingly important issues in the mining industry, particularly in regions with limited water resources. Mining companies are exploring ways to minimize their water usage and recycle wastewater to reduce their reliance on freshwater resources.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

245 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.5% |

|

Market Growth 2025-2029 |

USD 3.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.2 |

|

Key countries |

US, China, Germany, Japan, France, India, Canada, South Korea, UK, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Water And Wastewater Management Market Research and Growth Report?

- CAGR of the Water And Wastewater Management industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the water and wastewater management market growth of industry companies

We can help! Our analysts can customize this water and wastewater management market research report to meet your requirements.