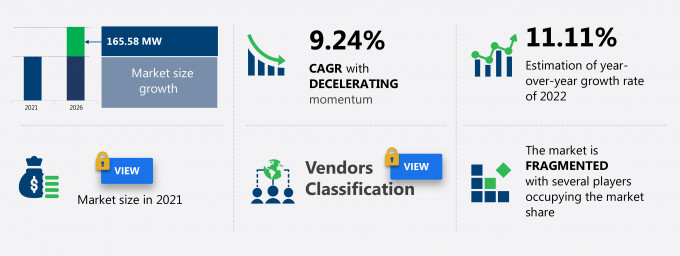

The wind energy market share in Austria is expected to increase by 165.58 megawatts from 2021 to 2026, at a CAGR of 9.24%.

This wind energy market in Austria research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers wind energy market segmentation in Austria by end-user (commercial and domestic) and installation sites (offshore and onshore). The wind energy market in Austria report also offers information on several market vendors, including ABB Ltd., American Superconductor Corp., ContourGlobal Plc, ENERCON GmbH, General Electric Co., Leitwind SPA, Siemens AG, Suzlon Energy Ltd., Vensys Energy AG, and Vestas Wind Systems AS among others.

What will the Wind Energy Market Size in Austria be During the Forecast Period?

Download the Free Report Sample to Unlock the Wind Energy Market Size in Austria for the Forecast Period and Other Important Statistics

Wind Energy Market in Austria: Key Drivers, Trends, and Challenges

The rising investments in wind energy projects is notably driving the wind energy market growth in Austria, although factors such as adoption of alternative renewable energy sources may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the wind energy market industry in Austria. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Wind Energy Market Driver in Austria

One of the key factors driving growth in the wind energy market in Austria is the rising investments in wind energy projects. Wind power installations in Austria significantly increased following the Green Electricity Act “Ökostromgesetz” (GEA). The GEA had established a long-term target of adding 2,000 MW of wind power capacity by 2020. Since then, several amendments have been made to the act, which focused on increasing the country’s wind power generation capacity. In July 2021, the Austrian Federal Parliament passed the Renewable Energy Expansion Act Package (REEAP), to promote renewable sources, including wind power, for the generation of electricity. Austria currently generates 75% of its electricity from renewable sources. To reach the target of 100% green electricity generation, the Government of Austria aims to increase the production of green electricity from the current level of 54 TWh to 81 TWh by 2030. The expansion includes the generation of an additional 10 TWh of wind power by 2030. In 2030, wind power is expected to supply 16.3% of electricity in Austria. Since the announcement of the national target of generating 10 TWh of wind power by 2030, there has been a growing focus on annual expansion plans to implement the targets. As per the Austrian Wind Energy Association, Austria is expected to accelerate the expansion of onshore wind capacity in 2022 and deploy the 427 MW of turbines across the country. These expansion plans will positively impact the wind energy market in Austria during the forecast period.

Key Wind Energy Market Trend in Austria

The growing concerns regarding decarbonization is a wind energy market trend in Austria that is expected to have a positive impact in the coming years. Decarbonizing heat and transport is a challenge that the government of Austria has been facing in recent years. Since 2014, Austria’s emission growth has been driven by the increase in final energy consumption in the buildings and transport sectors. In May 2018, the Austrian Federal Government adopted its Climate and Energy Strategy (Mission 2030) to reach the 2030 targets of decarbonization and meet the long-term goals of establishing a carbon-free energy sector in Austria by 2050. Among other measures, the government enacted a new climate protection law to reduce greenhouse gas emissions by 2040. The government also announced phasing out of oil and coal-fired heating systems in buildings in Austria by 2035 and restricted the use of natural gas for heating in new buildings from 2025. To reach the carbon neutrality targets by 2040, the role of electricity in the country’s energy mix is expected to increase significantly during the forecast period. The country had increasingly deployed wind energy to meet its goals of decarbonization. The share of coal, oil, and natural gas is being replaced by increased use of renewable energy sources, including wind. The growing concerns of the Austrian government regarding decarbonization will positively impact the growth of the wind energy market in Austria during the forecast period.

Key Wind Energy Market Challenge in Austria

The adoption of alternative renewable energy sources will be a major challenge for the wind energy market in Austria during the forecast period. Electricity production in Austria is dominated by renewable energy sources such as hydropower and bioenergy. The role of wind energy and solar power in electricity generation is still growing. The total supply of renewable energy sources in 2019 in Austria was dominated by hydropower and biomass, whereas wind and solar energy had much smaller shares. Hydropower accounts for approximately 60% of the total electricity generation in the country. The government of Austria plans to add 5 TWh from hydropower for achieving the overall target of 27 TWh of renewable power generation by 2030. Therefore, hydropower is expected to account for 85% of total electricity generation in Austria by 2030. Austria has proper waste management, and approximately 63% of the waste generated in the country is recycled. Bioenergy has a share of 59% of the total renewable energy production in Austria. Solar power has been growing rapidly in Austria in recent years. Solar power production has more than doubled from 0.6 TWh in 2013 to 1.4 TWh in 2018. Photovoltaic (PV) electricity generation has also significantly increased in the country, growing from 0.09 GW in 2010 to 1.4 GW in 2018. Thus, the increasing investments and favorable support for alternative renewable energy sources can pose a market challenge.

This wind energy market in Austria analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the wind energy market in Austria as a part of the global renewable electricity market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the wind energy market in Austria during the forecast period.

Who are the Major Wind Energy Market Vendors in Austria?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- ABB Ltd.

- American Superconductor Corp.

- ContourGlobal Plc

- ENERCON GmbH

- General Electric Co.

- Leitwind SPA

- Siemens AG

- Suzlon Energy Ltd.

- Vensys Energy AG

- Vestas Wind Systems AS

This statistical study of the wind energy market in Austria encompasses successful business strategies deployed by the key vendors. The wind energy market in Austria is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

-

ABB Ltd. - ABB Ltd. is a public company that is headquartered in Switzerland. It is a global company that generated a revenue of $28,945 million and had around 105,000 employees. Its revenue from the wind energy market in Austria contributes to its overall revenues, along with its other offerings, but is not a key revenue stream for the company.

-

ABB Ltd. - The company offers wind power generation turbines which are comprised of subsystems working in unison to efficiently and safely produce power.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The wind energy market in Austria forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Wind Energy Market in Austria Value Chain Analysis

Our report provides extensive information on the value chain analysis for the wind energy market in Austria, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the renewable electricity market includes the following core components:

- Inputs

- Electricity generation

- Electricity transmission

- Electricity distribution

- End-users

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

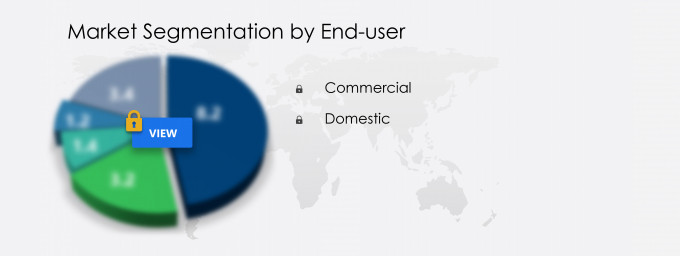

What are the Revenue-generating End-user Segments in the Wind Energy Market in Austria?

To gain further insights on the market contribution of various segments Request for a FREE sample

The wind energy market share growth in Austria by the commercial segment will be significant during the forecast period. The number of industrial applications of wind power has continued to grow. Small wind power systems are considered ideal for applications where storing and shipping fuel is uneconomical or impossible. Wind power systems are used for industrial applications such as telecommunications, radar, pipeline control, navigational aids, cathodic protection, weather stations/seismic monitoring, among others. Wind turbines used for industrial applications typically encounter extreme weather, which is not the case with home power systems. Thus, they must be designed to be robust and should require very minimal maintenance. The increasing requirements for wind power in the commercial sector will drive the growth of the market segment during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the wind energy market size in Austria and actionable market insights on post COVID-19 impact on each segment.

|

Wind Energy Market Scope in Austria |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 9.24% |

|

Market growth 2022-2026 |

165.58 MW |

|

Market structure |

Fragmented |

|

YoY growth (%) |

11.11 |

|

Regional analysis |

Austria |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

ABB Ltd., American Superconductor Corp., ContourGlobal Plc, ENERCON GmbH, General Electric Co., Leitwind SPA, Siemens AG, Suzlon Energy Ltd., Vensys Energy AG, and Vestas Wind Systems AS |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Wind Energy Market in Austria Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive wind energy market growth in Austria during the next five years

- Precise estimation of the wind energy market size in Austria and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the wind energy market industry in Austria

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of wind energy market vendors in Austria

We can help! Our analysts can customize this report to meet your requirements. Get in touch