Workover Rigs Market Size 2025-2029

The workover rigs market size is forecast to increase by USD 536.7 million, at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant advancements driven by technological innovations in drilling and workover technologies. The integration of laser technology in workover operations has revolutionized the industry, enabling more precise and efficient interventions. This technological shift is expected to continue, with rigless well intervention and abandonment technologies gaining traction. These advancements offer increased operational flexibility and cost savings, making them attractive to both operators and service providers.

- Companies seeking to capitalize on market opportunities must invest in research and development to stay competitive and navigate these challenges effectively. By focusing on technological innovation and addressing the skills gap, market participants can position themselves for long-term success in the evolving market. However, the market faces challenges, including the high initial investment costs for adopting new technologies and the need for skilled labor to operate and maintain them. Additionally, regulatory compliance and environmental concerns add complexity to workover rig operations. In addition, well stimulation techniques like jetting systems and coiled tubing are employed to enhance production.

What will be the Size of the Workover Rigs Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- In the dynamic oil and gas industry, workover rigs play a crucial role in maintaining and enhancing well performance. The market for workover rigs is driven by various factors, including the need for blowout prevention, well control, and well intervention in both onshore and offshore environments. Horizontal drilling and enhanced oil recovery from unconventional resources, such as shale gas and tight oil, have increased the demand for workover rigs. Well performance analysis and drilling optimization are key focus areas for operators seeking to reduce rig costs and improve rig efficiency. Workover cost analysis and wellbore modeling help identify opportunities for emissions reduction and reservoir stimulation.

- Drilling fluids and completion fluids are essential components of workover operations, requiring continuous innovation to ensure wellbore stability and minimize environmental impact. Carbon capture and field development are emerging trends in the industry, driving the need for advanced workover rig designs and technologies. Production monitoring and data acquisition are critical for well life cycle management and ensuring optimal well performance. Offshore workover operations present unique challenges, requiring specialized rigs and expertise. Overall, the market is characterized by ongoing innovation and a focus on improving operational efficiency and environmental sustainability.

How is this Workover Rigs Industry segmented?

The workover rigs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Onshore

- Offshore

- Type

- Single drum

- Double drum

- End-user

- Oil and gas

- Well service contractors

- National oil companies (NOCs)

- Independent operators

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Russia

- Middle East and Africa

- South Africa

- UAE

- APAC

- China

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

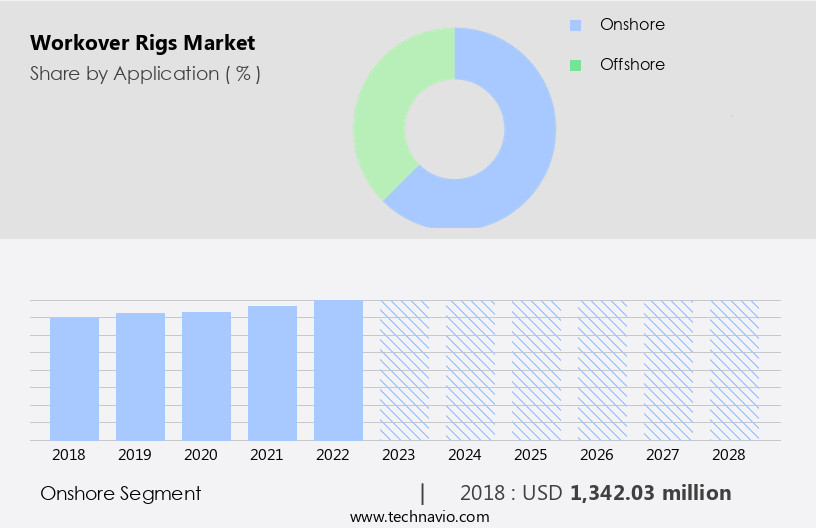

By Application Insights

The onshore segment is estimated to witness significant growth during the forecast period. Onshore workover rigs play a crucial role in the oil and gas industry, providing flexibility for various tasks such as wellbore cleanout, casing repairs, and artificial lift installations. These rigs are essential for optimizing production rates through the installation, repair, or maintenance of systems like electric submersible pumps (ESPs), rod pumps, and gas lift systems. Environmental concerns are increasingly shaping industry trends, and onshore workover rigs offer advantages in this regard due to their lower emissions and smaller infrastructure requirements compared to offshore rigs. Safety is a top priority in the industry, leading to the integration of safety equipment, fire suppression systems, and rig automation.

Pressure testing, flow control valves, and corrosion prevention are key components in ensuring well integrity. Telemetry systems, downhole motors, and well servicing rigs enable remote operation and maintenance, reducing the need for on-site personnel. Regulations governing environmental practices and well construction continue to evolve. Compliance with these regulations necessitates the use of sand control, tubing running tools, and wellhead equipment, including Christmas trees and choke manifolds. Well testing and reservoir management are critical for maximizing production, and flow rate measurement is essential for accurate assessment. Well plugging and abandonment, as well as production equipment maintenance and repair, are ongoing processes that require specialized tools and expertise.

The integration of hydraulic workover units, completion rigs, and pressure gauges facilitates these tasks. The oil and gas industry is constantly seeking ways to improve efficiency and productivity. Innovations in technology, such as downhole tools, flow assurance, and reservoir management systems, are driving advancements in well servicing and production optimization. Ultimately, the versatility and adaptability of onshore workover rigs make them an indispensable part of the industry's evolving landscape.

The Onshore segment was valued at USD 1.66 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is witnessing continuous expansion in 2024, fueled by the growth of unconventional oil and gas resources, particularly shale plays and tight reservoirs. Operators are increasingly relying on workover rigs to optimize production through techniques such as hydraulic fracturing and horizontal drilling. These rigs are essential for maintaining and enhancing well productivity, enabling efficient extraction from complex geological formations. Infrastructure development, including pipeline and processing facility expansions, is bolstering market growth. Seamless connectivity between new wells and existing production networks enhances operational efficiency and reduces downtime, making workover operations more cost-effective.

Downhole tools, safety equipment, fire suppression systems, pressure testing, flow control valves, and environmental regulations are integral components of workover rigs. They ensure well integrity, production optimization, and compliance with regulations. Advancements in technology, such as rig automation, telemetry systems, and remote operation, are further enhancing workover rig capabilities. Additionally, the integration of production equipment, including choke manifolds, electric submersible pumps, and rod pumps, supports efficient well intervention. Maintenance and repair, corrosion prevention, flow assurance, and well servicing rigs are other critical aspects of the market. They ensure the longevity and optimal performance of workover rigs, contributing to their overall value proposition.

Market trends include the increasing adoption of sand control, tubing running tools, and gas lift systems to improve well productivity and reduce operational costs. Well testing, wellhead equipment, and Christmas trees are also essential for ensuring well integrity and maximizing production. The North American market is experiencing steady growth, driven by the expansion of unconventional oil and gas resources and the need for efficient well intervention techniques. The integration of various components, including downhole tools, safety equipment, and advanced technologies, is enhancing operational efficiency and supporting market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Workover Rigs market drivers leading to the rise in the adoption of Industry?

- The market's growth is primarily attributed to technological advancements in drilling and workover technologies, which have significantly improved efficiency and productivity in the energy sector. Workover rigs are undergoing significant technological advancements to enhance operational efficiency and safety. Automation and robotics are integral to these developments, streamlining repetitive tasks and ensuring accuracy during interventions. Downhole tools, such as logging and measurement-while-drilling (LWD/MWD) tools, are being upgraded with advanced technology to provide real-time data on wellbore conditions. This information is crucial for assessing reservoir characteristics, identifying production issues, and planning effective workover strategies.

- Safety remains a top priority in the workover rig market. The use of safety equipment, including fire suppression systems and personal protective equipment, is essential to mitigate risks and ensure the wellbeing of personnel. Regulatory compliance with environmental regulations is also a critical factor, with companies investing in rig automation to minimize human intervention and reduce the environmental footprint. Flow control valves are essential components of workover rigs, managing fluid flow during drilling, production, and intervention activities. The market is witnessing significant innovation in this area, with the development of intelligent valves that offer improved accuracy, reliability, and efficiency.

What are the Workover Rigs market trends shaping the Industry?

- The endorsed use of laser technology in workover operations is currently gaining traction in the industry. This innovative approach is set to revolutionize the way well interventions are conducted, offering enhanced efficiency and precision. In the oil and gas industry, the drive for production optimization and well stimulation has led to significant advancements in workover technologies. Traditional completion and workover methods, which often rely on explosive charges, mechanical grinding, and harsh chemicals, have given way to more precise and efficient alternatives. One such technology is the use of high-power lasers for cutting, perforating, and milling operations. These laser workover systems enable the delivery of high-power laser energy down deep boreholes, providing the necessary power to perform laser workover and completion operations in challenging environments.

- The integration of these technologies enhances operational efficiency, reduces downtime, and minimizes costs. For instance, hydraulic workover units offer greater flexibility and mobility compared to traditional rigs, enabling them to be deployed in various locations and terrains. Moreover, the importance of safety and environmental considerations cannot be overstated. Corrosion prevention and flow assurance measures are essential to ensure the longevity and productivity of oil and gas assets. Pressure gauges and rig inspections are critical in monitoring and maintaining the integrity of the equipment and the wellbore. By focusing on these aspects, workover rig operators can ensure the safe and efficient production of oil and gas resources. Jetting systems, coiled tubing, rig inspection, artificial lift, hydraulic workover units, pressure gauges, corrosion prevention, and flow assurance are all crucial components of modern workover rigs.

How does Workover Rigs market face challenges during its growth?

- The emergence of rigless well intervention and abandonment technologies poses a significant challenge to the growth of the industry, requiring professionals to adapt and innovate in order to effectively implement these advancements. The oil and gas industry is experiencing a transition towards rigless intervention and abandonment technologies, which offer enhanced safety, efficiency, and cost savings compared to traditional workover rigs. This shift is driven by the increasing global oil and gas exploration and production (E&P) activities. Rigless intervention techniques, including wireline, hydraulic workovers, and coiled tubing, eliminate the need for conventional workover rigs, thereby reducing associated costs.

- The integration of these advanced tools and techniques is crucial for maximizing revenues from existing oil and gas fields. The oil and gas sector's focus on innovation and operational excellence is leading to the development and adoption of new technologies. Rigless intervention services are gaining popularity due to their ability to minimize downtime, reduce costs, and enhance productivity. As the industry continues to evolve, the adoption of these technologies is expected to grow significantly. Telemetry systems, downhole motors, tubing running tools, gas lift, sand control, well servicing rigs, well testing, wellhead equipment, and Christmas trees are essential components of rigless intervention services. These technologies enable remote monitoring, efficient operations, and improved reservoir management.

Exclusive Customer Landscape

The workover rigs market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the workover rigs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, workover rigs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Baker Hughes Co. - The company specializes in Workover Rigs, a workover rig is a mobile drilling solution designed for performing remedial operations in the oil and gas industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Baker Hughes Co.

- Cactus Inc.

- Drillmec Spa

- Ensign Energy Services Inc.

- Halliburton Co.

- Independence Contract Drilling

- L and T Technology Services Ltd.

- MB LLC

- MFF Oilfield Group

- MND SAS

- Nabors Industries Ltd.

- National Energy Services Reunited Corp.

- Oil India Ltd.

- OiLSERV

- PR Marriott Drilling Ltd.

- Precision Drilling Corp.

- Schlumberger Ltd.

- Total Energy Services Inc.

- Transcontinental Energy Services LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Workover Rigs Market

- In February 2023, Baker Hughes, a GE company, announced the launch of its new PaceEdge workover rig, which incorporates advanced automation and digital technologies to enhance operational efficiency and safety. This innovation marks a significant technological advancement in the workover rig market (Baker Hughes, 2023).

- In July 2024, Halliburton and National Oilwell Varco joined forces to form a strategic alliance, combining their expertise in drilling and production services to offer integrated solutions for clients. This collaboration is expected to strengthen their market position and provide new opportunities for growth (Halliburton, 2024).

- In November 2024, the U.S. Bureau of Safety and Environmental Enforcement (BSEE) approved the use of a new workover rig design by Transocean, featuring a novel mud gas separation system. This approval signifies a key regulatory milestone and a step towards reducing greenhouse gas emissions in offshore drilling operations (Transocean, 2024).

- In March 2025, Saudi Aramco, the world's largest oil company, announced its entry into the workover rig market by investing in a new rig manufacturing facility in Saudi Arabia. This strategic move is expected to increase the company's control over its drilling operations and reduce reliance on external service providers (Saudi Aramco, 2025).

Research Analyst Overview

The market encompasses a diverse range of equipment and services essential for optimizing production and maintaining well integrity in the oil and gas industry. This dynamic market continues to evolve, with applications spanning from production optimization and well stimulation to jetting systems, coiled tubing, rig inspection, artificial lift, hydraulic workover units, completion rigs, and more. Downhole tools, safety equipment, and fire suppression systems are integral components, ensuring efficient and safe operations. Environmental regulations drive the demand for advanced environmental solutions, such as corrosion prevention and flow assurance systems. Telemetry systems and remote operation enable real-time monitoring and data analysis, enhancing operational efficiency.

Well servicing rigs, including sand control, tubing running tools, and gas lift systems, address specific challenges in various reservoirs. Drilling rigs and well testing are also critical aspects of the market, ensuring the successful execution of exploration and production projects. The ongoing integration of technologies like rig automation, pressure testing, flow control valves, and choke manifolds streamlines processes and improves overall performance. Maintenance and repair services ensure the longevity and optimal functioning of these rigs and associated equipment. Wellhead equipment, including Christmas trees and pressure gauges, play a crucial role in managing production and maintaining well integrity. Electric drives and power systems are increasingly being adopted in workover rigs, offering improved energy efficiency, reduced emissions, and enhanced control during drilling and intervention activities.

Well abandonment and plugging solutions are essential for decommissioning mature fields and ensuring environmental safety. The market remains a vibrant and ever-changing landscape, with ongoing innovation and adaptation to meet the evolving needs of the oil and gas industry. The workover rig market is experiencing a period of rapid technological advancement, driven by the integration of automation, robotics, and advanced downhole tools. These innovations are enhancing operational efficiency, improving safety, and ensuring regulatory compliance, making workover rigs a vital component of modern drilling and production operations. Fiber optic sensing technology is another innovation, providing real-time data on temperature, pressure, and strain for optimal well integrity management.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Workover Rigs Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 536.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, Canada, Saudi Arabia, China, Russia, Mexico, UAE, Brazil, South Africa, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Workover Rigs Market Research and Growth Report?

- CAGR of the Workover Rigs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Middle East and Africa, APAC, Europe, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the workover rigs market growth of industry companies

We can help! Our analysts can customize this workover rigs market research report to meet your requirements.