X Ray Inspection Systems Technology Market Size 2024-2028

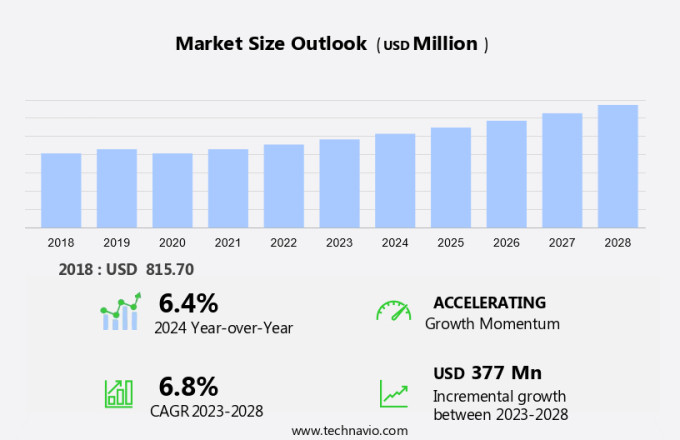

The X Ray inspection systems technology market size is forecast to increase by USD 377 million at a CAGR of 6.8% between 2023 and 2028.

- ?X-ray inspection systems technology is a critical component in various industries, including food and pharmaceuticals, for ensuring product quality and safety. The market for this technology is driven by stringent regulations, aimed at ensuring food safety and security. Automation in digital X-ray inspection systems is another significant trend, enabling faster and more accurate inspections. However, the use of high-frequency electromagnetic radiation in these systems poses a risk of radiation exposure, which is a challenge that manufacturers must address. Energy consumption is also a concern, as the machinery used in X-ray inspection systems can be power-intensive. The target market includes manufacturers of food products, as well as those producing medical devices and machinery components, where the need for non-destructive testing is paramount. The technology is essential for inspecting the density and integrity of skin, muscles, tissues, and other materials, making it an indispensable tool for quality control and assurance.

What will be the Size of the Market During the Forecast Period?

- X-ray inspection systems utilize high-frequency electromagnetic radiation to produce images of the internal structure of objects and are essential in various industries, including food and beverage, pharmaceuticals, and laboratory settings, for ensuring product quality and safety. X-ray systems generate beams through a target wall, which are then directed toward the object under inspection. As the X-rays pass through the object, they are absorbed differently based on the density and composition of the materials, and the resulting image provides valuable insights into the internal structure of the object. In food product inspection, x-ray systems are used to detect physical contaminants, such as metal, glass, or stones, that may be present in food products, and the technology can also ensure that products are complete and undamaged.

- For instance, in the pharmaceutical industry, x-ray systems are used to inspect tablets, capsules, and other products for their shape, size, and composition. In laboratory settings, x-ray systems are used for non-destructive testing of materials such as metals, alloys, and ceramics. The x-ray inspection technology market is driven by the increasing demand for non-destructive testing and quality control across various industries, and the technology's ability to provide critical information about the internal structure of objects without causing damage makes it an indispensable tool for ensuring product quality and safety. X-ray systems play a crucial role in providing valuable information about the internal structure of objects, and their ability to detect contaminants, ensure product completeness, and offer diagnostic images makes them essential for maintaining product quality and safety.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Flim based technology

- Digital imaging technology

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

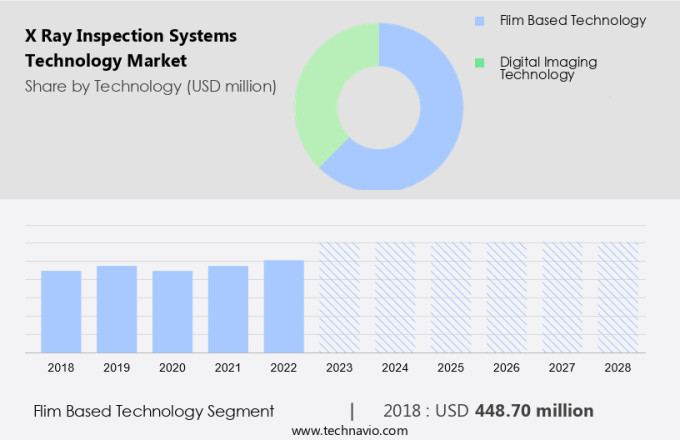

By Technology Insights

- The flim based technology segment is estimated to witness significant growth during the forecast period.

X-ray inspection systems utilizing film-based technology have long been a staple in industries for detecting defects in various products, including food and medical applications. The affordability of this technology compared to advanced alternatives is a significant factor fueling its market expansion. Small and medium-sized businesses, as well as organizations with limited budgets for X-ray inspection systems and maintenance, often prefer the cost-effective film-based solution. However, the increasing adoption of digitally advanced X-ray inspection systems may pose a challenge to the growth of the film-based segment in the coming years. This technology employs high-frequency electromagnetic radiation to produce images of the inner structures of objects, such as muscles, tissues, and bones, or the density of food products.

Furthermore, machinery using X-ray inspection technology is essential in various industries, including pharmaceuticals, food processing, and automotive, to ensure product quality and safety. The market is expected to witness steady growth due to the technology's ability to provide precise and accurate results, making it an indispensable tool for businesses.

Get a glance at the market report of share of various segments Request Free Sample

The flim based technology segment was valued at USD 448.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the United States, the X-ray inspection systems technology market is experiencing significant growth due to several factors. The increasing prevalence of chronic diseases, such as cancer and diabetes, necessitates increased healthcare expenditures. According to the Centers for Disease Control and Prevention (CDC), approximately 60% of American adults have been diagnosed with chronic diseases, leading to an annual healthcare expenditure of USD 3.8 trillion.

Furthermore, Medicare reimbursements for analog X-ray equipment and related products have been reduced by 20%, driving the adoption of advanced X-ray systems. Additionally, the presence of radiology associations is expected to bolster market growth. Metal detectors, a crucial component of X-ray inspection technology, play a vital role in ensuring safe and reliable food production. X-ray systems are used to detect product defects and ensure fill levels, maintaining the quality of food products with stainless steel packaging. The market is poised for continued expansion due to these factors.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of X Ray Inspection Systems Technology Market?

Stringent government regulations due to security concerns is the key driver of the market.

- X-ray inspection systems have become essential for industries to ensure product safety and quality, particularly in sectors such as food, healthcare, and automotive. Strict regulations governing exposure to ionizing radiation drive the market's growth. X-ray technology, including metal detectors, checkweighers, and X-ray inspection machines, generates images using ionizing radiation. Excessive exposure to these doses can lead to severe health complications, including DNA damage and cancer. Therefore, companies invest in X-ray inspection systems to comply with regulations and maintain consumer trust.

- The food safety systems market, for instance, relies heavily on X-ray technology to monitor fill levels in glass jars and detect metal contaminants in conveyor-transported food products. Conventional metal detectors, while effective for ferrous metals, cannot detect non-ferrous metals and other contaminants. X-ray inspection systems offer a more comprehensive solution, making them a preferred choice for industries seeking enhanced product safety and quality. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the X Ray Inspection Systems Technology Market?

Automation in digital X Ray inspection systems is the upcoming trend in the market.

- X-ray inspection systems have experienced technological advancements, transitioning from manual processes to automated solutions. This shift includes converting traditional X-ray equipment with analog detectors to digital ones, enhancing workflow and ensuring patient safety, cost-effectiveness, and swift disease diagnosis. X-rays, a form of electromagnetic radiation, are utilized extensively in diverse sectors, including food and manufacturing. The expanding application scope of automation in X-ray inspection systems is projected to foster growth.

- Automation reduces human error, thereby benefiting the market. With the increasing demand for efficient and accurate inspections, the X-ray system market is poised for significant progress. X-ray beams, which absorb differently based on wavelengths and materials, are integral to these systems. Human X-rays, for instance, provide valuable insights into bone structures. By leveraging the latest technology, X-ray inspection systems deliver precise and reliable results. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does X Ray Inspection Systems Technology Market face during the growth?

The risk of radiation exposure is a key challenge affecting the market growth.

- The risk of radiation exposure is the major challenge that affects the growth of the market. X-ray inspection systems are essential in various industries for detecting defects and ensuring product quality, particularly in the processing of non-ferrous metals, calcified bone, high-density plastic, and heterogeneous products. These industries rely on these systems to maintain line speeds and ensure the safety of packaging materials. However, the use of X-ray technology comes with potential health risks, as personnel may be exposed to low levels of radiation during operation.

- Although minimal exposure does not typically harm individuals, prolonged or high-dose radiation exposure can lead to severe health consequences, including cancer and acute radiation syndrome (ARS). Consequently, the potential health risks associated with X-ray inspection systems may hinder market growth, necessitating ongoing research and development to minimize radiation exposure and improve overall safety. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3DX-RAY Ltd

- Anritsu Corp.

- Carestream Health Inc.

- COMET Technologies Inc

- Creative Electron Inc.

- Dandong Aolong Radiative Instrument Group Co. Ltd.

- Eagle Product Inspection LLC

- General Electric Co.

- Glenbrook Technologies Inc.

- Illinois Tool Works Inc.

- Mettler Toledo International Inc.

- Nikon Corp.

- Nordson Corp.

- Scienscope International Inc

- Shenzhen Zhuomao Technology Co. Ltd

- Smiths Group Plc

- Thermo Fisher Scientific Inc.

- Viscom AG

- VisiConsult X-ray Systems and Solutions GmbH

- VJ Group Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

X-ray inspection systems technology utilizes high-frequency electromagnetic radiation, specifically X-rays, to provide critical information about the internal structure of various materials. In a lab setting, this technology is employed to examine human bones, using beams of X-rays that penetrate through the skin, muscles, and tissues to absorb energy differently based on the density of bones. Similarly, in the food industry, x-ray inspection technology is used to detect contaminants, such as metal fragments, in food products. X-ray systems analyze the wavelengths of electromagnetic radiation that are absorbed by different materials, allowing for the identification of physical contaminants, missing products, or broken products at critical control points.

Furthermore, X-ray inspection machines are essential for ensuring food safety requirements are met, as they can streamline the process by checking for contaminants at high line speeds. These systems are safe and reliable for both food and non-food applications, making them an essential component of quality control and food safety systems. X-ray technology can also be used to monitor fill levels in various containers, such as glass jars, and to detect product defects based on food product characteristics. The machinery used in X-ray inspection is designed to be effective for heterogeneous products and various packaging materials, making it a versatile solution for various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market Growth 2024-2028 |

USD 377 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.4 |

|

Key countries |

US, Canada, Germany, China, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch