Cyber Insurance Market Size 2025-2029

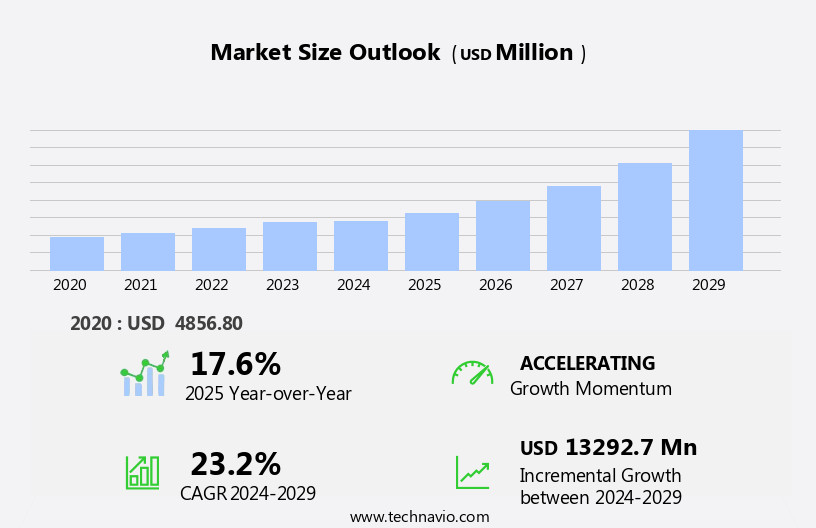

The cyber insurance market size is forecast to increase by USD 13.29 billion, at a CAGR of 23.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of technology and the subsequent heightened need for risk mitigation. Businesses are recognizing the importance of safeguarding their digital assets and are turning to cyber insurance to manage potential threats. However, this market faces challenges that hinder its growth and require careful navigation. One major obstacle is the lack of standardization in cyber insurance policies. This inconsistency makes it difficult for businesses to compare offerings and determine which policy best suits their specific needs.

- Additionally, the ever-evolving nature of cyber threats necessitates continuous updates and adaptations to insurance coverage, further complicating the process for both insurers and insured parties. Companies seeking to capitalize on market opportunities must stay informed of emerging trends and be prepared to offer customized solutions that address the unique challenges of the cyber insurance landscape.

What will be the Size of the Cyber Insurance Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Entities increasingly recognize the importance of securing their digital assets, leading to a growing demand for comprehensive cybersecurity solutions. Insurance providers respond by offering policies that integrate data encryption, phishing simulations, insurance coverage, threat intelligence, claims process, penetration testing, business continuity planning, vulnerability management, data governance, PCI DSS, disaster recovery, NIST cybersecurity framework, incident response, and cybersecurity consulting. Policy renewals reflect the continuous adaptation to emerging risks, with premium costs influenced by risk assessment, actuarial modeling, and fraud prevention. First-party coverage shields entities from financial losses due to cyber attacks, while third-party coverage protects against liabilities arising from data breaches.

Multi-factor authentication (MFA), single sign-on (SSO), password management, and network security are essential components of robust cybersecurity strategies. Risk profiling and claims adjustment ensure fair and accurate policy payouts, while cyber liability and loss mitigation help entities minimize damages. Regulatory compliance, risk management frameworks, application security, security awareness, and cybersecurity insurance brokers further bolster the market's resilience. The ongoing integration of these elements underscores the market's continuous dynamism, as entities and insurers collaborate to mitigate cyber risks.

How is this Cyber Insurance Industry segmented?

The cyber insurance industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Large enterprises

- Small and medium-sized enterprises

- Solution

- Standalone

- Packaged

- Coverage Type

- Data Breach

- Cyber Extortion

- Business Interruption

- Third-Party Liability

- Industry Vertical

- BFSI

- Healthcare

- Retail

- IT and Telecom

- Manufacturing

- Distribution Channel

- Direct Sales

- Brokers

- Online Platforms

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

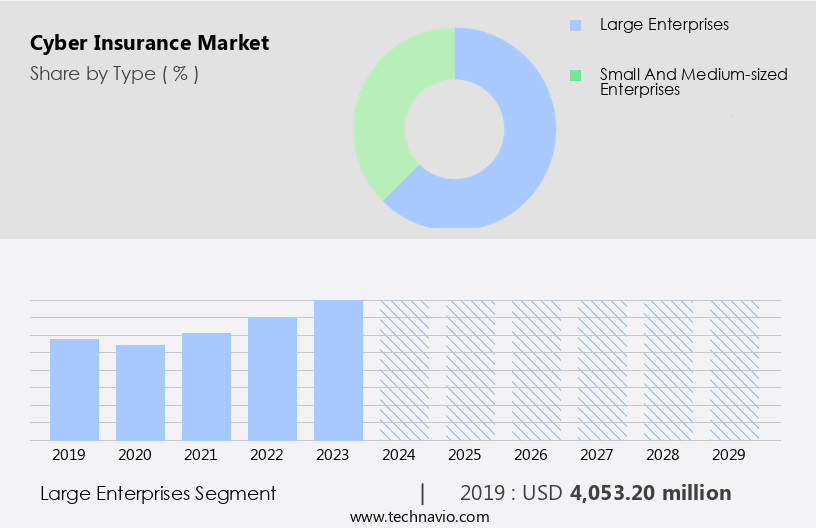

The large enterprises segment is estimated to witness significant growth during the forecast period.

In today's digital landscape, large enterprises face an increased risk of cyber-attacks due to their size, complexity, and valuable data. To mitigate the financial consequences of a breach, many enterprises opt for cyber insurance. For instance, Change Healthcare, a HIPAA-regulated entity, experienced a ransomware attack in February 2024, affecting over 100 million individuals, resulting in a financial impact of USD2.4 billion. This underscores the importance of robust cybersecurity measures. Enterprises invest heavily in advanced threat detection, incident response, and data protection solutions, including multi-factor authentication, data encryption, and penetration testing. They also prioritize regulatory compliance, such as PCI DSS and NIST cybersecurity frameworks, and implement cybersecurity awareness training.

Cybersecurity consulting firms assist in risk assessment, vulnerability management, and business continuity planning. Cyber insurance brokers help enterprises navigate policy renewals, claims process, and policy limits. Actuarial modeling and risk profiling aid insurers in assessing risk and pricing premiums. Threat intelligence and fraud prevention tools help mitigate risks, while claims adjustment and loss mitigation strategies minimize financial losses. Application security, network security, and password management are crucial components of a comprehensive cybersecurity strategy. Regulatory compliance, risk management frameworks, and data governance ensure adherence to industry standards and best practices. In conclusion, cyber insurance plays a vital role in protecting large enterprises from the financial repercussions of cyber-attacks.

The market continues to evolve, with insurers offering more extensive coverage, such as first-party coverage and third-party liability, to meet the growing demands of enterprises.

The Large enterprises segment was valued at USD 4.05 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

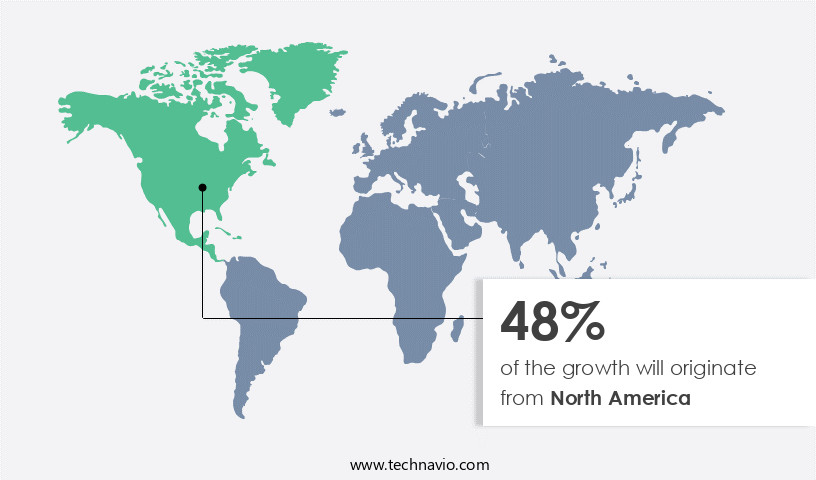

North America is estimated to contribute 48% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Cyber insurance is a burgeoning market in North America, with businesses and individuals seeking protection against the financial consequences of cyber-attacks. Insurers in the region offer a range of policies, each with varying levels of coverage. The global technology outage in July 2024, caused by a mishandled software update at CrowdStrike, served as a stark reminder of the potential vulnerabilities and repercussions in the industry. This incident, deemed the largest IT outage in history, has led to increased scrutiny and demand for robust cybersecurity measures. Insurance companies are responding to this need by integrating multi-factor authentication, data encryption, threat intelligence, and incident response into their offerings.

Premium costs for cyber insurance policies have risen as a result, with policy renewals requiring comprehensive risk assessments and regular security audits. Actuarial modeling and risk profiling help insurers determine policy limits and cyber liability, while incident management systems and business continuity planning ensure that claims are processed efficiently. Fraud prevention and claims adjustment are critical components of cyber insurance, with insurers employing advanced techniques such as phishing simulations and password management to mitigate losses. Regulatory compliance, such as PCI DSS and NIST cybersecurity frameworks, is also a focus for insurers, as they work to provide comprehensive coverage for their clients.

Cybersecurity consulting and vulnerability management are increasingly important services offered by insurers, helping businesses implement best practices and address potential weaknesses. Network security, application security, and single sign-on are essential components of a strong cybersecurity posture, and insurers are working to ensure that their clients have the necessary tools and resources to protect themselves. Insurers are also expanding their offerings to include third-party coverage, providing protection against risks arising from companies and contractors. Loss mitigation and data governance are key considerations, with insurers working to minimize the impact of cyber-attacks and help businesses recover quickly. As the market continues to evolve, insurers are focusing on providing comprehensive coverage and value-added services to their clients.

This includes offering cybersecurity awareness training, security audits, and antivirus software, as well as incident response and claims process support. By working closely with their clients and leveraging the latest cybersecurity technologies and frameworks, insurers are helping businesses navigate the complex and ever-evolving cyber threat landscape.

Market Dynamics

The Cyber Insurance Market is rapidly expanding, with cyber insurance policies and data breach insurance addressing critical needs in cyber risk management. Ransomware coverage and cyber liability insurance protect businesses from escalating threats, while business interruption insurance for retailers ensures continuity. The SME cyber insurance market and healthcare cyber insurance drive growth, supported by AI-driven cyber risk assessment for precise underwriting. Affordable cyber insurance and comprehensive cyber coverage for enterprises meet diverse demands. Cyber insurance policies for small businesses, data breach insurance for healthcare providers, ransomware coverage for manufacturing 2025, GDPR compliance insurance for European businesses, cyber liability insurance for tech startups, affordable cyber insurance for SMEs 2025, tailored cyber insurance for SMEs in technology, and fast claims processing for cyber insurance shape the industry's future.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Cyber Insurance Industry?

- The integration of technology is the primary catalyst fueling market growth. (Adoption and integration are interchangeable terms used to describe the process of implementing new technology in a business or industry. The market refers to a specific industry or sector, and growth indicates an increase in size or revenue. The use of professional and formal language ensures a polished and sophisticated response.)

- The market has experienced significant growth due to the increasing use of digital services and the Internet, which has created new opportunities for cybercriminals. The number of cyber-attacks has risen, leading to increased demand for insurance coverage to mitigate potential financial losses. With the proliferation of cloud-based services, multi-factor authentication, and mobile applications, the exposure to cyber risks continues to expand. First-party coverage, risk assessment, fraud prevention, claims adjustment, risk profiling, and actuarial modeling are essential components of cyber insurance policies.

- These features help businesses and individuals manage their risks and respond effectively to cyber threats. As technology advances, it is crucial for organizations to prioritize cloud security, implement robust multi-factor authentication, and invest in fraud prevention measures to reduce their risk profile and minimize potential losses.

What are the market trends shaping the Cyber Insurance Industry?

- The professional trend in the market is marked by a rising demand for cyber insurance. This increasing need for cyber insurance coverage reflects growing concerns over data security and potential cyber threats.

- The market is experiencing significant growth due to the increasing frequency and severity of cyber-attacks. With the rising dependence on digital services and the Internet, businesses and individuals are recognizing the importance of protecting against the financial consequences of cybercrime. According to recent research, organizations face over 2000 cyberattacks daily, resulting in substantial costs for those affected. By 2024, the cost of cybercrime is projected to surpass USD9 trillion, a number that is expected to continue rising. Cyber insurance plays a crucial role in mitigating these risks by providing coverage for data breaches, cyber-attacks, and other cyber threats. Key elements of cyber insurance policies include data encryption, phishing simulations, threat intelligence, claims process, penetration testing, business continuity planning, vulnerability management, data governance, and PCI DSS compliance.

- These measures help protect against various cyber threats and minimize the impact of successful attacks. In summary, the market is essential for businesses and individuals seeking to safeguard against the financial repercussions of cybercrime.

What challenges does the Cyber Insurance Industry face during its growth?

- The absence of standardization poses a significant challenge to the industry's growth trajectory.

- The market faces a significant challenge due to the lack of standardization in policy coverage. This issue makes it challenging for businesses and individuals to compare and select the most suitable policy. Coverage offered by cyber insurance policies can vary significantly, and many include exclusions and limitations that may not be clearly communicated. This can result in gaps in coverage, leaving businesses and organizations vulnerable to financial losses in the event of a cyber-attack. To mitigate these risks, it's essential to work with cybersecurity consulting firms and insurance brokers who have a deep understanding of the cybersecurity landscape. They can help businesses and individuals navigate the complexities of cyber insurance policies and ensure that the coverage aligns with their specific needs.

- The NIST Cybersecurity Framework and incident response plans are crucial components of a comprehensive cybersecurity strategy. Application security, security awareness training, and loss mitigation are also essential elements that should be considered when evaluating cyber insurance policies. By partnering with experts in cybersecurity consulting and insurance, businesses and individuals can make informed decisions about their coverage and protect themselves from potential financial losses due to cyber-attacks.

Exclusive Customer Landscape

The cyber insurance market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cyber insurance market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cyber insurance market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AIG - This company specializes in cyber insurance solutions, mitigating risk accumulation through systematic determination and reduction of silent cyber exposure. Their offerings enable effective risk management and minimization in the complex cyber insurance landscape.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AIG

- Allianz Global Corporate & Specialty

- Arch Insurance

- AXA XL

- Beazley Plc

- Berkshire Hathaway Specialty Insurance

- Chubb Limited

- CNA Financial Corporation

- Coalition Inc.

- Cowbell Cyber

- Hiscox Ltd.

- Liberty Mutual Insurance

- Markel Corporation

- Munich Re

- Nationwide Mutual Insurance Company

- Sompo International

- The Hartford

- Travelers Companies Inc.

- Willis Towers Watson

- Zurich Insurance Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cyber Insurance Market

- In January 2024, Chubb Limited, a leading insurance provider, announced the launch of its new advanced cyber underwriting platform, CyberEdge, designed to offer customized cyber insurance solutions based on clients' unique risk profiles (Chubb Press Release, 2024). This innovation aimed to provide more accurate risk assessments and tailored coverage.

- In March 2024, Aon plc, the global professional services firm, and CyberCube, a cyber risk analytics company, entered into a strategic partnership to integrate CyberCube's advanced analytics capabilities into Aon's cyber risk solutions (Aon Press Release, 2024). This collaboration aimed to enhance Aon's cyber risk offerings and improve clients' risk management capabilities.

- In May 2024, Cisco Systems, Inc. Completed the acquisition of SentryCOP, a leading provider of advanced threat detection and response solutions, for approximately USD320 million (Cisco Press Release, 2024). This acquisition was intended to strengthen Cisco's cybersecurity portfolio and offer more comprehensive cyber insurance solutions to its clients.

- In January 2025, the European Union's General Data Protection Regulation (GDPR) was updated to include mandatory cybersecurity insurance for certain organizations (European Commission Press Release, 2025). This policy change aimed to increase data security and privacy, as well as reduce the financial impact of potential data breaches.

Research Analyst Overview

- The market is witnessing significant advancements in various areas of information security. One such trend is the integration of blockchain security solutions to enhance data immutability and transparency. Malware analysis and security orchestration are also crucial components, enabling swift response to emerging threats. Information security policies are increasingly adopting privacy by design principles and implementing purple teaming for effective security testing. Container security and data anonymization are essential for securing cloud environments and protecting sensitive data. Phishing detection and blue teaming are vital in mitigating social engineering attacks and strengthening overall security posture. Zero trust architecture, threat modeling, and encryption key management are key strategies for implementing robust security controls.

- Devops security, ethical hacking, and behavioral analytics are critical for securing agile development processes and proactively identifying potential threats. Regulatory compliance management, security analytics, and vulnerability scanning are essential for maintaining regulatory adherence and ensuring continuous security monitoring. Serverless security, data governance frameworks, ransomware protection, network segmentation, and red teaming are emerging priorities as businesses increasingly rely on digital infrastructure. These trends reflect the evolving cybersecurity landscape and the need for comprehensive, multi-layered security strategies.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cyber Insurance Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

191 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23.2% |

|

Market growth 2025-2029 |

USD 13292.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

17.6 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cyber Insurance Market Research and Growth Report?

- CAGR of the Cyber Insurance industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cyber insurance market growth of industry companies

We can help! Our analysts can customize this cyber insurance market research report to meet your requirements.