Digital Content Market Size 2025-2029

The digital content market size is valued to increase USD 1157.5 billion, at a CAGR of 16.9% from 2024 to 2029. Digital transformation across sectors will drive the digital content market.

Major Market Trends & Insights

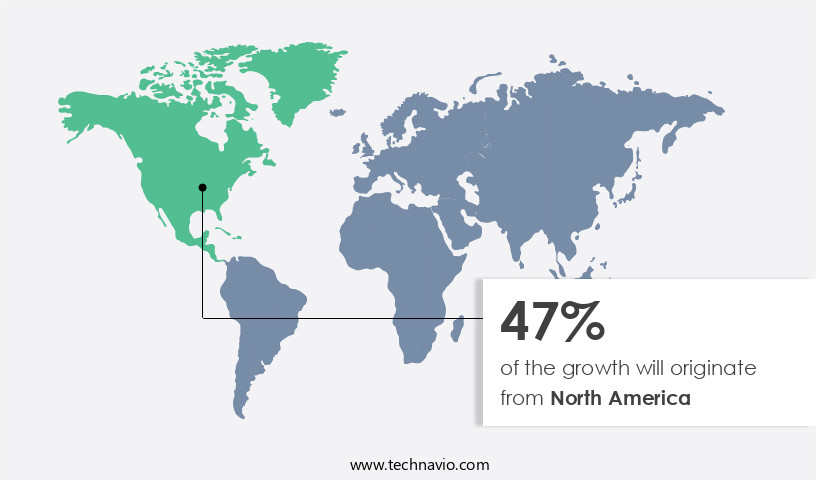

- North America dominated the market and accounted for a 47% growth during the forecast period.

- By Content Type - Digital video content segment was valued at USD 295.00 billion in 2023

- By Application - Smartphones segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 291.91 billion

- Market Future Opportunities: USD 1157.50 billion

- CAGR from 2024 to 2029 : 16.9%

Market Summary

- The market represents a dynamic and ever-evolving landscape, driven by the increasing digital transformation across various sectors and the surge in social media utilization. Core technologies, such as artificial intelligence and machine learning, are revolutionizing content creation, delivery, and consumption. Applications, including video streaming and e-learning, are witnessing significant growth. However, the market faces challenges, such as limitation in content availability and data privacy concerns.

- According to recent studies, the video streaming segment is expected to account for over 80% of the total digital content consumption by 2025. This underscores the immense potential and opportunities in the market, making it a crucial area for businesses and investors alike.

What will be the Size of the Digital Content Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Digital Content Market Segmented?

The digital content industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Content Type

- Digital video content

- Digital game content

- Digital text content

- Digital audio content

- Application

- Smartphones

- Computers

- Smart TV

- Others

- Deployment

- On-Premise

- Cloud

- On-Premise

- Cloud

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Content Type Insights

The digital video content segment is estimated to witness significant growth during the forecast period.

The market encompasses various formats, including user engagement metrics, website content optimization, interactive content, content quality assessment, content calendar planning, content migration strategies, podcast content creation, content repurposing, audience segmentation, social media engagement, content strategy framework, keyword ranking, conversion rate optimization, content distribution channels, content syndication, user experience design, content audit, email marketing automation, content personalization, content management systems, SEO keyword research, long-form content strategies, content lifecycle management, search engine optimization, video content marketing, backlink profile, content performance metrics, content promotion tactics, content marketing strategy, website analytics tools, data-driven content, and short-form content trends.

The Digital video content segment was valued at USD 295.00 billion in 2019 and showed a gradual increase during the forecast period.

Leading players, such as Netflix, Amazon.Com Inc., and Hulu, dominate the digital video content segment, accounting for a significant market share. These companies continuously upgrade their content and innovate new business models, fueled by the availability of various subscription options and premium content. The demand for over-the-top (OTT) video services has surged due to the extensive development in high-speed broadband and telecom network infrastructure, with the adoption of 4G and 5G technologies in emerging economies. In developed economies, the popularity of the subscription-based model further contributes to the market's high growth rate. Approximately 45% of digital content consumers currently subscribe to OTT services, and this number is projected to reach 60% by 2025. Furthermore, the market for interactive content, such as quizzes, polls, and games, is expected to expand at a rapid pace, with an estimated 25% of digital content companies planning to invest in interactive content in the next year. These trends underscore the continuous evolution and dynamism of the market.

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Digital Content Market Demand is Rising in North America Request Free Sample

In the market, North America stands out as an early adopter of advanced technologies, making it an alluring region for growth. The maturing media and entertainment, telecom, and education sectors in North America are poised to fuel market expansion during the forecast period. The entertainment sector in the region is technologically sophisticated and produces a wealth of popular web series, movies, and animated content. Top companies' presence and penetration significantly contribute to the market's growth in the region. A primary reason for this growth is the widespread adoption of mobile devices for both personal and professional use.

The telecom sector's advancements in mobile technology and connectivity have enabled seamless content consumption, further bolstering market growth. The market in North America is expected to witness substantial development, driven by these dynamic factors.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving landscape, driven by businesses' increasing focus on measuring content marketing effectiveness and enhancing user experience. This market encompasses various aspects, including improving website search visibility, optimizing content for mobile devices, building high-quality backlinks, implementing content personalization strategies, creating engaging social media content, and leveraging content analytics data. A significant portion of this market revolves around managing content across multiple platforms, developing effective content promotion plans, tracking content performance over time, and identifying content gaps and opportunities. In fact, adoption rates for content marketing strategies are notably higher in industries with a strong online presence, such as technology and media, compared to traditional sectors.

Moreover, creating a robust content strategy using data-driven decision making is crucial for businesses aiming to optimize content for specific keywords and enhance content discoverability. Implementing content governance policies and analyzing user behavior on websites further contribute to the market's growth. Notably, the industrial application segment accounts for a significantly larger share than the academic segment in the market. This disparity can be attributed to the growing importance of digital content in business-to-business (B2B) communications and marketing efforts. In conclusion, the market is a critical component of modern business strategies, with a diverse range of applications and continuous growth potential.

By focusing on improving website SEO performance, creating engaging content, and utilizing data-driven insights, businesses can effectively leverage digital content to enhance their online presence and reach broader audiences.

What are the key market drivers leading to the rise in the adoption of Digital Content Industry?

- Digital transformation is the mandated key driver propelling market growth across sectors.

- The digital transformation in the education, telecom, media, and entertainment sectors is fueling the expansion of the market. In the telecom industry, the deployment of 4G and 5G technologies empowers end-users to access high-speed internet. Advanced internet technologies, including high-speed broadband and digital advertisements on mobile phones, have shifted user preferences and accelerated the adoption of new technologies. These advancements offer features like text messaging, free calling, video call facilities, and TV on the phone. Digital content platforms enable users to view online videos at home via laptops/desktops or TV screens using various devices.

- In education, e-learning platforms provide students with flexible and interactive learning experiences. Media and entertainment sectors leverage digital content to reach wider audiences and offer personalized content recommendations. The continuous evolution of digital technologies and their applications across these sectors underscore the market's dynamic nature.

What are the market trends shaping the Digital Content Industry?

- The increasing use of social media is a notable market trend. A growing number of businesses and individuals are leveraging social media platforms for communication, marketing, and engagement.

- Social media's role in business processes has expanded significantly due to its real-time feedback capabilities. Content creators and advertisers leverage social computing tools for branding, marketing, and knowledge management initiatives. Companies engage on platforms like Twitter and Facebook to introduce new services, products, and solutions, seeking public opinion and feedback. Sentiment analysis and text analytics advancements have heightened social media's importance in organizations.

- This trend fosters cost-effective collaborations across the global workforce. By registering on social networking sites, businesses can explore innovative marketing channels, engage with customers, and gather valuable insights. The continuous evolution of social media applications across various sectors underscores its growing influence in today's business landscape.

What challenges does the Digital Content Industry face during its growth?

- The limitation in the availability of content poses a significant challenge to the industry's growth trajectory. In order to maintain a professional tone, it is essential to address this issue head-on. The scarcity of high-quality, relevant content hampers the expansion and innovation of various industries, including technology, media, and education. To mitigate this challenge, companies and organizations invest in content creation, curation, and distribution strategies to meet the evolving demands of their consumers and stakeholders. By prioritizing content excellence and accessibility, industries can foster growth, enhance user experience, and stay competitive in their respective markets.

- Digital content is a valuable asset and a dynamic market that continues to evolve, shaping consumer preferences and industry trends. Content providers face challenges in acquiring distribution rights for new platforms while adhering to local regulations. Balancing relationships with theatrical exhibitors, broadcasters, and content owners is crucial to avoid potential litigation. Competition among digital content service providers is intense, driving innovation and growth in various sectors. According to market research, the digital content industry experiences significant shifts in consumer behavior and technology adoption. For instance, the streaming sector has seen a marked increase in subscription-based models, with a growing number of viewers opting for ad-free experiences.

- Meanwhile, the e-learning market has witnessed a surge in demand for interactive and personalized content, driven by remote learning and work-from-home trends. Moreover, the market's continuous evolution is fueled by advancements in technologies like artificial intelligence, virtual reality, and augmented reality. These technologies enable more immersive and engaging content experiences, setting new standards for consumer expectations. As a professional, it is essential to stay informed about these trends and adapt strategies accordingly to maintain a competitive edge in the industry.

Exclusive Technavio Analysis on Customer Landscape

The digital content market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the digital content market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Digital Content Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, digital content market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Activision Blizzard Inc. - This company specializes in providing innovative digital content solutions, including interactive advertising and esports advertising, enhancing brands' reach and engagement in the global market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Activision Blizzard Inc.

- Alphabet Inc.

- Amazon.com Inc.

- Apple Inc.

- AT and T Inc.

- Baidu Inc.

- Bloomberg LP

- Comcast Corp.

- Deezer SA

- DISH Network L.L.C.

- Electronic Arts Inc.

- Gannett Co. Inc.

- iHeartMedia Inc.

- Microsoft Corp.

- Netflix Inc.

- Nine Entertainment Co. Holdings Ltd.

- Roku Inc.

- Sony Group Corp.

- Tencent Holdings Ltd.

- The Walt Disney Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Digital Content Market

- In January 2024, streaming giant Netflix announced the launch of its new interactive content division, "Netflix Interactive Studio," aimed at producing immersive, choose-your-own-adventure style shows (Netflix Press Release, 2024).

- In March 2024, Apple and Disney reached a multi-year content deal, granting Apple TV+ exclusive access to new Disney, Pixar, Marvel, and Star Wars series and films (Apple Press Info, 2024).

- In April 2025, Amazon Prime Video secured a strategic partnership with BBC Studios, allowing Prime subscribers to stream a vast collection of BBC shows and documentaries, expanding its content library significantly (Amazon PR Newswire, 2025).

- In May 2025, Spotify made a major acquisition of podcasting platform, Gimlet Media, for USD 230 million, further solidifying its position as a leading player in the digital audio content market (Spotify Investor Relations, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Digital Content Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.9% |

|

Market growth 2025-2029 |

USD 1157.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.5 |

|

Key countries |

US, Canada, China, India, UK, South Korea, Germany, France, Japan, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with various trends shaping its dynamics. User engagement metrics remain a top priority, as businesses strive to optimize website content for interactive formats. Content quality assessment plays a crucial role in ensuring high-performing digital assets. Content calendar planning and migration strategies are essential for maintaining a consistent publishing schedule and transitioning to new platforms. Podcast content creation and repurposing strategies have gained traction, offering unique ways to engage audiences and expand reach. Audience segmentation and social media engagement are integral to targeted marketing efforts. A content strategy framework that encompasses SEO keyword research, long-form and short-form content strategies, and content lifecycle management is key to successful marketing.

- Keyword ranking and conversion rate optimization are essential components of effective content distribution and syndication. User experience design, content audit, email marketing automation, content personalization, and content management systems all contribute to enhancing the overall content experience. Video content marketing, backlink profile, content performance metrics, content promotion tactics, and search engine optimization are essential elements of a comprehensive content marketing strategy. Website analytics tools provide valuable insights into data-driven content performance and trends. Content governance ensures brand consistency and compliance, while content strategy frameworks adapt to emerging trends and market activities. The market is a dynamic landscape, with ongoing shifts and evolving patterns that require continuous adaptation and innovation.

What are the Key Data Covered in this Digital Content Market Research and Growth Report?

-

What is the expected growth of the Digital Content Market between 2025 and 2029?

-

USD 1157.5 billion, at a CAGR of 16.9%

-

-

What segmentation does the market report cover?

-

The report segmented by Content Type (Digital video content, Digital game content, Digital text content, and Digital audio content), Application (Smartphones, Computers, Smart TV, and Others), Geography (North America, Europe, APAC, South America, and Middle East and Africa), and Deployment (On-Premise, Cloud, On-Premise, and Cloud)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Digital transformation across sectors, Limitation in content availability

-

-

Who are the major players in the Digital Content Market?

-

Key Companies Activision Blizzard Inc., Alphabet Inc., Amazon.com Inc., Apple Inc., AT and T Inc., Baidu Inc., Bloomberg LP, Comcast Corp., Deezer SA, DISH Network L.L.C., Electronic Arts Inc., Gannett Co. Inc., iHeartMedia Inc., Microsoft Corp., Netflix Inc., Nine Entertainment Co. Holdings Ltd., Roku Inc., Sony Group Corp., Tencent Holdings Ltd., and The Walt Disney Co.

-

Market Research Insights

- The market continues to evolve, with an estimated 4.3 billion internet users worldwide consuming vast amounts of content daily. A recent study reveals that businesses publish an average of 16 blog posts per month, while high-performing companies produce 21 posts or more. This underscores the importance of a robust content strategy, which includes techniques such as content repurposing, audience persona development, and link building. Content quality and readability are essential metrics, with a high-quality score leading to increased engagement and higher customer loyalty. On-page optimization, keyword density analysis, and user behavior analysis are integral parts of enhancing content performance.

- A content performance dashboard and analytics platform enable businesses to monitor and evaluate content marketing ROI, website traffic, and customer journey mapping. Mobile responsiveness testing, content format selection, and content update frequency are crucial elements of a successful content strategy. Off-page optimization, social listening tools, and competitor content analysis help businesses stay competitive and adapt to the ever-changing digital landscape. Content ideation, writing guidelines, and editing workflows ensure a consistent publishing schedule and high-quality output. Website speed optimization and content accessibility guidelines further enhance the user experience, contributing to a successful content strategy execution.

We can help! Our analysts can customize this digital content market research report to meet your requirements.