DNA Sequencing Market Size 2024-2028

The DNA sequencing market size is forecast to increase by USD 17.34 billion, at a CAGR of 20.01% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing adoption of Next-Generation Sequencing (NGS) technologies. NGS offers several advantages over traditional Sanger sequencing, including faster turnaround time, lower costs, and the ability to sequence entire genomes. This technological advancement has led to a surge in demand for DNA sequencing in various applications, including diagnostics, research, and forensics technologies. However, the market faces challenges, most notably the emergence of third-generation sequencing methods. These new technologies, such as PacBio and Oxford Nanopore, offer even faster sequencing speeds and longer read lengths than NGS. As these methods continue to advance, they may disrupt the market dynamics and force companies to innovate or risk becoming obsolete.

- Additionally, inadequate resources for DNA sequencing in developing countries pose a significant challenge. Despite the potential benefits of DNA sequencing, many countries lack the necessary infrastructure and financial resources to implement these technologies. Companies that can address these challenges and provide affordable and accessible solutions will be well-positioned to capitalize on the growing demand for DNA sequencing.

What will be the Size of the DNA Sequencing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technologies and applications across various sectors. Base calling, a fundamental process in sequencing, is being refined through the use of artificial intelligence and machine learning algorithms. Microbial sequencing, a key application, is revolutionizing fields such as metagenomics and environmental science. Precision medicine, another significant area, is benefiting from the integration of genomic data into clinical workflows, enabling personalized treatment plans. Nanopore sequencing, known for its long read length, is gaining traction in genome assembly and gene expression analysis. Variant calling, a crucial step in identifying genetic mutations, is being enhanced by the integration of multiple data sources and advanced algorithms.

Sample preparation, a critical step in the sequencing process, is being optimized for improved efficiency and cost reduction. Sequencing depth, read length, and sequencing coverage are key performance indicators that continue to evolve, enabling the detection of rare variants and complex genomic structures. Rare disease research is a growing application area, with high-throughput sequencing and exome sequencing playing a pivotal role in identifying disease-causing mutations. Regulatory compliance, data security, and data storage are becoming increasingly important considerations in the market. Cost reduction and workflow optimization are ongoing priorities for sequencing platform providers, with next-generation sequencing (NGS) and Sanger sequencing continuing to coexist in the market.

The ongoing advancements in DNA sequencing technologies and applications are shaping the market dynamics, with genome editing, clinical diagnostics, and forensic science being some of the emerging areas of focus. The integration of cloud computing and library preparation into the sequencing workflow is also transforming the market landscape. In the realm of research, applications such as phylogenetic analysis, methylation analysis, SNP analysis, and quality control are driving the adoption of sequencing technologies. The sequencing error rate, a critical performance metric, is being addressed through the development of advanced algorithms and sequencing reagents. Infectious disease research is another area of significant growth, with NGS playing a crucial role in identifying disease-causing pathogens and understanding their genetic makeup.

Targeted sequencing and CNV analysis are also gaining popularity in this field, enabling the detection of specific genetic variants and chromosomal aberrations. The market is a dynamic and evolving landscape, with ongoing advancements in technologies and applications shaping its future direction. The integration of various components, including base calling, microbial sequencing, precision medicine, variant calling, nanopore sequencing, sample preparation, sequencing depth, read length, rare disease research, sequencing coverage, sequencing reagents, high-throughput sequencing, exome sequencing, regulatory compliance, mutation detection, illumina sequencing, CNV analysis, data storage, library preparation, cost reduction, sequencing platforms, genome editing, clinical diagnostics, next-generation sequencing, Sanger sequencing, workflow optimization, sequencing error rate, phylogenetic analysis, methylation analysis, SNP analysis, quality control, data security, sequencing accuracy, and infectious disease research, is transforming the way we understand and address genetic information.

How is this DNA Sequencing Industry segmented?

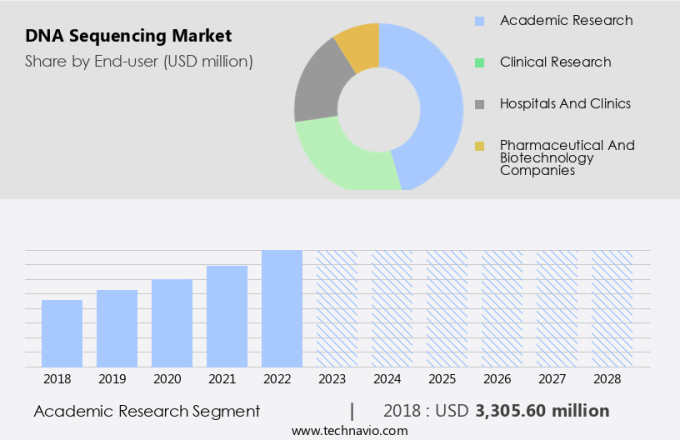

The DNA sequencing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Academic research

- Clinical research

- Hospitals and clinics

- Pharmaceutical and biotechnology companies

- Solution

- Products

- Services

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

The academic research segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, driven by the increasing demand for advanced genomic analysis in various sectors. Academic research holds a prominent position, with a large investment in genome sequencing projects to better understand human diseases and improve drug development. For instance, Global Gene Corp's investment in the Indian genome sequencing program showcases this trend. High-quality data generated from these projects enables researchers to discover novel drug targets and gain insights into disease pathogenesis. The demand for higher-resolution sequencing is expected to boost market growth, particularly in academic research. Cloud computing plays a crucial role in the market by providing scalable storage solutions for the massive amounts of data generated during sequencing processes.

PacBio sequencing, a long-read sequencing technology, and Nanopore sequencing, a real-time, portable technology, are gaining popularity due to their ability to generate longer reads, facilitating more comprehensive genome assembly and analysis. Forensic science, metagenomics sequencing, RNA sequencing (RNA-seq), single-cell sequencing, and gene expression analysis are other significant applications of DNA sequencing. Genome editing, such as CRISPR-Cas9, is revolutionizing the field by enabling precise modifications to DNA sequences. DNA extraction, sequence alignment, base calling, microbial sequencing, and library preparation are essential steps in the DNA sequencing workflow. Precision medicine, rare disease research, and infectious disease research are emerging areas where DNA sequencing plays a crucial role in diagnosis and treatment.

Regulatory compliance, mutation detection, and variant calling are essential aspects of clinical diagnostics, which is a growing segment in the market. High-throughput sequencing, exome sequencing, and targeted sequencing are advanced sequencing techniques that offer cost reduction and increased sequencing depth and coverage. Sequencing platforms, such as Illumina and Sanger sequencing, continue to dominate the market, while next-generation sequencing (NGS) is gaining popularity due to its ability to generate large amounts of data in a shorter time. Workflow optimization and cost reduction are key priorities in the market, with a focus on improving sequencing accuracy, data security, and turnaround time. Sequencing error rate, phylogenetic analysis, methylation analysis, and SNP analysis are essential quality control measures in DNA sequencing.

In summary, the market is witnessing significant growth due to the increasing demand for advanced genomic analysis in various sectors, including academic research, forensics, metagenomics, RNA sequencing, gene expression analysis, and clinical diagnostics. Cloud computing, long-read sequencing technologies, and regulatory compliance are key trends driving market growth.

The Academic research segment was valued at USD 3.31 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, driven by advancements in technology and increasing applications across various industries. In 2023, North America held the largest market share, with the region's dominant position expected to continue due to rising healthcare expenditures, a high prevalence of chronic diseases, and the presence of major biotechnology and life sciences companies. These companies, with headquarters in the US and Canada, export DNA sequencing instruments to other regions, enabling emerging companies to offer sequencing services locally. The high number of clinical trials in North America for drug development further fuels demand. Cloud computing is revolutionizing the DNA sequencing industry by enabling large-scale data analysis, storage, and sharing.

PacBio sequencing, nanopore sequencing, and Illumina sequencing are popular platforms used for DNA sequencing, each offering unique advantages such as long read length, high-throughput capabilities, and cost-effectiveness. RNA sequencing (RNA-seq), single-cell sequencing, and metagenomics sequencing are gaining popularity for gene expression analysis, genome assembly, and microbial identification. Genome editing, gene expression analysis, and variant calling are critical applications of DNA sequencing, with applications in precision medicine, rare disease research, and infectious disease research. Regulatory compliance, data security, and sequencing accuracy are essential considerations for the industry. Cost reduction, workflow optimization, and sample preparation are ongoing challenges addressed through advancements in sequencing reagents, library preparation, and sequencing depth.

Next-generation sequencing (NGS) is transforming clinical diagnostics, with applications in targeted sequencing, CNV analysis, and mutation detection. Sanger sequencing remains important for specific applications due to its high accuracy and low cost. Phylogenetic analysis, methylation analysis, SNP analysis, and quality control are essential for understanding genetic relationships and ensuring data integrity. In summary, the market is growing rapidly, driven by advancements in technology, increasing applications, and regional market dynamics. Cloud computing, various sequencing platforms, and applications such as genome editing, gene expression analysis, and clinical diagnostics are shaping the industry's future.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of DNA Sequencing Industry?

- The significant expansion of Next-Generation Sequencing (NGS) technology adoption is the primary market growth catalyst.

- Next-generation sequencing (NGS) technology, a game-changer in DNA sequencing, enables the analysis of an entire human genome in a day, significantly advancing genomic research. NGS is increasingly utilized in diagnosing and treating prevalent diseases, such as cancer and infectious diseases. According to the International Agency for Research on Cancer (IARC), the global cancer burden is projected to reach 27.5 million new cases and 16.3 million deaths by 2040. This increasing cancer prevalence necessitates advanced diagnostic tools, propelling the adoption of NGS. NGS technology is not only transforming disease diagnosis but also paving the way for personalized treatment plans.

- In addition, it plays a pivotal role in various research areas, including forensic science, metagenomics sequencing, RNA sequencing (RNA-seq), single-cell sequencing, genome assembly, gene expression analysis, genome editing, DNA extraction, and sequence alignment. Cloud computing, a crucial technology integration, facilitates the storage and processing of vast genomic data generated by NGS. This integration enhances data accessibility, enabling real-time analysis and collaboration among researchers. In summary, The market is driven by the increasing prevalence of diseases, the need for accurate diagnosis, and the advancements in NGS technology, leading to personalized treatment plans and breakthroughs in various research areas.

- Cloud computing integration further enhances the market's growth by providing a platform for data storage, processing, and real-time analysis.

What are the market trends shaping the DNA Sequencing Industry?

- The emergence of third-generation sequencing methods signifies a significant market trend in the field of genomic research. These advanced techniques offer increased speed, accuracy, and reduced costs compared to their predecessors.

- Third-generation DNA sequencing is an emerging class of technology in the genetic analysis market, offering significant advancements over first- and second-generation methods. Unlike traditional approaches that read nucleotide sequences in shorter fragments, third-generation sequencing reads DNA at the single-molecule level, preserving the integrity of long strands. This innovation addresses the limitations of previous methods, which require extensive sample preparation, clonal amplification, and shorter read lengths. Moreover, third-generation sequencing is revolutionizing the field of rare disease research and precision medicine by providing longer read lengths and sequencing depth, enabling the identification of complex variants and structural variations. Novel sequencing technologies, such as nanopore sequencing, are entering the market, offering unprecedented sequencing coverage and the ability to sequence RNA and epigenetic modifications in real-time.

- These advancements are expected to drive the growth of the market, as researchers and clinicians seek to unravel the complexities of the human genome and develop personalized treatment plans for various diseases. The focus on improving sequencing accuracy, reducing costs, and enhancing data analysis tools will further fuel the adoption of third-generation sequencing technologies.

What challenges does the DNA Sequencing Industry face during its growth?

- The lack of sufficient DNA sequencing resources in developing countries represents a significant challenge impeding the expansion and growth of the industry.

- The market has witnessed substantial advancements, leading to enhanced investigative accuracy and significant cost reduction. Next-generation sequencing (NGS) technologies, including exome sequencing and illumina sequencing, have revolutionized the field by providing faster and more cost-effective solutions for mutation detection and clinical diagnostics. However, regulatory compliance remains a challenge due to the complex nature of genomic data and the need for sophisticated data storage and analysis systems. CNV (Copy Number Variation) analysis and gene editing applications have further expanded the market's scope. Despite these advancements, the market remains underutilized in developing countries due to factors such as a lack of skilled personnel, high infrastructure costs, and limited access to advanced tools for genomic data analysis and manipulation.

- The cost of DNA sequencing has seen a significant decline in the last decade, but the prices of sequencing instruments and analysis remain high. The market dynamics are influenced by factors such as technological advancements, regulatory compliance, and cost reduction strategies. NGS sequencing platforms continue to dominate the market due to their high-throughput capabilities and cost-effectiveness. In summary, the market is poised for continued growth due to its expanding applications in clinical diagnostics, research, and gene editing. However, challenges such as regulatory compliance, data storage, and cost reduction remain key considerations for market participants.

Exclusive Customer Landscape

The DNA sequencing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the DNA sequencing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, DNA sequencing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

10X Genomics Inc. - This company specializes in the design and production of innovative sports equipment, leveraging advanced materials and technology to enhance athlete performance and safety.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 10X Genomics Inc.

- Abbott Laboratories

- Agilent Technologies Inc.

- Azenta Inc.

- Becton Dickinson and Co.

- BGI Genomics Co. Ltd.

- Bio Rad Laboratories Inc.

- Danaher Corp.

- Eurofins Scientific SE

- F. Hoffmann La Roche Ltd.

- Illumina Inc.

- Laboratory Corp. of America Holdings

- Macrogen Inc.

- Merck KGaA

- Pacific Biosciences of California Inc.

- PerkinElmer Inc.

- QIAGEN NV

- SeqLL Inc.

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in DNA Sequencing Market

- In January 2024, Illumina, a leading DNA sequencing company, announced the launch of its new NextSeq 2000 Series, offering increased sequencing capacity and faster turnaround times. This development aimed to cater to the growing demand for rapid and cost-effective DNA sequencing solutions (Illumina Press Release).

- In March 2024, Thermo Fisher Scientific and 23andMe, two major players in the market, entered into a strategic collaboration to expand 23andMe's genotyping capacity. This partnership enabled 23andMe to process a larger volume of customer samples, further solidifying its position in the consumer genomics market (Thermo Fisher Scientific Press Release).

- In May 2024, Qiagen, a German life sciences company, acquired BioGx, a Swiss molecular diagnostics firm, for â¬300 million. This acquisition strengthened Qiagen's position in the market by adding BioGx's advanced molecular diagnostic solutions and expanding its customer base (Qiagen Press Release).

- In April 2025, the US Food and Drug Administration (FDA) granted marketing authorization for Oxford Nanopore Technologies' MinION Mk1C handheld DNA sequencer. This approval marked a significant milestone in the market, as the portable device offers real-time sequencing capabilities and increased accessibility for researchers and clinicians (FDA Press Release).

Research Analyst Overview

- The market is characterized by rigorous quality control metrics and sample management to ensure accuracy and reliability in decoding the genetic code. Ethical considerations, including data privacy and informed consent, are increasingly shaping market penetration strategies. Machine learning applications, oligonucleotide synthesis, and capillary electrophoresis are driving innovation in industry standards. Biomarker discovery, research funding, and regulatory affairs are key factors propelling the integration of next-generation sequencing platforms and data visualization tools. Intellectual property, data interpretation, and sequencing workflow automation are essential components of the patent landscape. Drug discovery, gene expression profiling, and technology adoption are benefiting from artificial intelligence applications and bioinformatics tools.

- Data integrity and security breaches remain critical challenges, necessitating robust data management systems. The DNA synthesis sector is experiencing significant growth, fueled by advancements in data interpretation and regulatory compliance. Scientific publications continue to shape research and development in the field, while regulatory affairs and ethical considerations influence market dynamics.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled DNA Sequencing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.01% |

|

Market growth 2024-2028 |

USD 17344.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

16.42 |

|

Key countries |

US, UK, Germany, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this DNA Sequencing Market Research and Growth Report?

- CAGR of the DNA Sequencing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the DNA sequencing market growth of industry companies

We can help! Our analysts can customize this DNA sequencing market research report to meet your requirements.