Drayage Services Market Size 2025-2029

The drayage services market size is forecast to increase by USD 2.46 billion, at a CAGR of 1.8% between 2024 and 2029. The market is experiencing significant growth, driven by the expanding manufacturing industry and the surging e-commerce sector. The increasing demand for just-in-time inventory management in manufacturing and the rise of e-commerce's reliance on efficient and timely freight services are key growth catalysts.

Major Market Trends & Insights

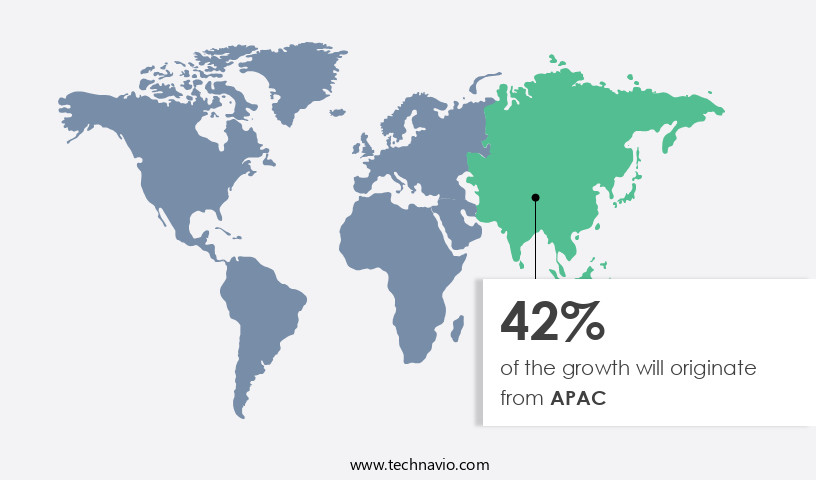

- APAC dominated the market and contributed 42% to the growth during the forecast period.

- The market is expected to grow significantly in Europe region as well over the forecast period.

- Based on the End-user, the electronics and electrical segment led the market and was valued at USD 11.48 billion of the global revenue in 2023.

- Based on the Type, the Inter-carrier drayage segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 14.88 billion

- Future Opportunities: USD 2.46 Billion

- CAGR (2024-2029): 1.8%

- APAC: Largest market in 2023

The market continues to evolve, driven by various dynamics that shape its landscape. Operational efficiency is a key focus, with entities such as hazardous materials handling, employee management, customs brokerage, data analytics, yard management, equipment repair, warehouse management, driver training, local delivery, and fuel efficiency seamlessly integrated into the industry. Regulatory compliance and sustainability initiatives are also prominent, with contract compliance and operational efficiency being essential for businesses to remain competitive. Blockchain technology is increasingly being adopted for contract negotiation and rate management, enhancing transparency and security. Intermodal transportation and container handling are critical applications, with pricing strategies and capacity planning playing significant roles in optimizing operations.

What will be the Size of the Drayage Services Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Specialized drayage services, including heavy haul and oversized load handling, require advanced capabilities and technology integration. Driver management, including retention and safety training, is a critical component of the market. Real-time tracking, predictive modeling, and performance metrics are essential for optimizing fleet management and ensuring on-time delivery. Technology integration, including automated systems, dispatching systems, and customer service, is crucial for providing efficient and effective solutions. Logistics optimization, including emission reduction, route optimization, and inventory management, is a priority for businesses seeking to minimize costs and enhance sustainability. Third-party logistics (3PL) providers offer comprehensive solutions, including freight forwarding, temperature-controlled transportation, invoice processing, fleet maintenance, business intelligence, and cargo security.

The market faces a substantial challenge which is the shortage of skilled drayage drivers. This labor shortage, coupled with the need for increased automation and digitalization, presents an opportunity for companies to invest in technology and training programs to address this issue. Additionally, collaboration between freight companies and logistics providers could help mitigate the impact of the driver shortage and improve overall operational efficiency. Companies that effectively navigate these market dynamics and invest in innovative solutions will be well-positioned to capitalize on the growth potential of the market.

In conclusion, the market is characterized by continuous evolution and dynamism, with various entities and applications shaping its landscape. Regulatory compliance, sustainability initiatives, operational efficiency, and technology integration are key drivers, with a focus on optimizing logistics operations and enhancing customer service.

How is this Drayage Services Industry segmented?

The drayage services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Electronics and electrical

- Food and beverage

- Consumer goods and retail

- Others

- Type

- Inter-carrier drayage

- Expedited drayage

- Intra-carrier drayage

- Pier drayage

- Others

- Transportation

- Ship

- Rail

- Truck

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The electronics and electrical segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 11.48 billion in 2023. It continued to the largest segment at a CAGR of 1.66%.

In the electronics industry's dynamic logistics landscape, drayage services have become essential for facilitating efficient supply chain operations. These services enable the transportation of components, parts, and raw materials from ports or manufacturing facilities to assembly plants or warehouses. Over the past decade, the industry's center of gravity has shifted towards low-cost production hubs, such as China, necessitating seamless drayage services. Regulatory compliance and sustainability initiatives have emerged as critical priorities in the market. Contract compliance and operational efficiency are also crucial factors, driving the adoption of advanced technologies like blockchain and automated systems. Capacity planning, intermodal transportation, and container handling are other areas of focus, with a growing emphasis on real-time tracking and predictive modeling.

Driver management, including retention and safety training, is another key concern. Specialized drayage services, such as heavy haul and oversized load handling, require specialized expertise and equipment. Pricing strategies and contract negotiation are essential components of the market, with rate management and freight forwarding playing significant roles. Technology integration, including GPS tracking and digital freight matching, is transforming the industry. Data analytics and business intelligence are also vital for optimizing performance metrics and inventory management. Chassis management, yard management, and equipment repair are other essential aspects of the market. Safety training, customs brokerage, and cargo security are crucial elements of the drayage services value proposition.

Order fulfillment, last-mile delivery, and logistics optimization are also vital for ensuring customer satisfaction. Inventory management, risk management, and supply chain management are other critical areas of focus. Employee management, including driver training and dispatching systems, is essential for maintaining a productive workforce. Fuel efficiency and emission reduction are also important sustainability initiatives. The integration of AI-powered optimization and technology solutions is revolutionizing the market, enhancing operational efficiency and reducing costs.

The Electronics and electrical segment was valued at USD 11.10 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the APAC region estimates to be around USD 9.23 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to the region's economic expansion and increasing consumer purchasing power. Governments' focus on trade and foreign direct investment (FDI) initiatives, such as China's One Belt One Road (OBOR), is further bolstering the cross-border logistics sector. In this context, drayage services play a crucial role in facilitating the seamless movement of goods between various modes of transportation, including intermodal and local delivery. Operational efficiency is a key priority for drayage service providers, with a focus on capacity planning, driver management, and equipment repair. Sustainability initiatives, such as fuel efficiency and emission reduction, are also gaining importance.

Blockchain technology is being explored for contract compliance and rate management, ensuring transparency and accuracy. Specialized drayage services, including heavy haul and oversized load handling, are in demand due to the increasing complexity of supply chains. Real-time tracking and digital freight matching are essential for efficient load planning and route optimization. Safety training and inventory management are critical components of employee management, ensuring the safe handling of hazardous materials and temperature-controlled transportation. Third-party logistics (3PL) providers are increasingly leveraging technology integration, including automated systems, dispatching systems, and AI-powered optimization, to enhance operational efficiency and customer service. Data analytics and business intelligence are crucial for performance metrics and predictive modeling.

Fleet maintenance and chassis management are essential for maintaining a reliable and efficient truck fleet. Customs brokerage and invoice processing are critical components of supply chain management, ensuring timely and accurate clearance of goods. Cargo security and logistics optimization are essential for ensuring the safe and efficient movement of goods. In conclusion, the market in APAC is witnessing significant growth, driven by economic expansion and increasing consumer purchasing power. Operational efficiency, sustainability initiatives, and technology integration are key priorities for drayage service providers. Specialized services, such as heavy haul and oversized load handling, are in demand, and safety and inventory management are critical components of employee management.

The market is expected to remain dynamic, with a focus on continuous improvement and innovation.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and intricately connected logistics industry, the market plays a pivotal role in the seamless transfer of cargo between various modes of transportation. This market encompasses the provision of specialized transportation services for moving containers and trailers between ports, rail yards, and distribution centers. Key players in this market offer intermodal drayage, which integrates trucking, rail, and port services, ensuring efficient and timely cargo movement. The use of advanced technologies like real-time tracking systems, automated gate systems, and electronic data interchange (EDI) enhances the efficiency and transparency of drayage services. Additionally, the market caters to various industries, including manufacturing, retail, and e-commerce, with customized solutions that prioritize cost savings, time efficiency, and regulatory compliance. The market's adaptability to changing market conditions and customer demands makes it a vital component of the global logistics network.

What are the key market drivers leading to the rise in the adoption of Drayage Services Industry?

- The manufacturing sector's continued growth serves as the primary catalyst for market expansion.

- The market is experiencing significant growth due to the increasing demand for efficient and compliant logistics solutions in the manufacturing sector. Regulatory compliance and sustainability initiatives are driving companies to seek reliable and efficient drayage services to ensure timely delivery of goods while adhering to environmental regulations. Contract compliance and operational efficiency are also key priorities, leading to the adoption of advanced technologies such as blockchain for enhanced transparency and accountability. Capacity planning and intermodal transportation are critical aspects of drayage services, with container handling and pricing strategies playing significant roles in ensuring operational efficiency. Contract negotiation and truck fleet management are also essential components, requiring specialized expertise and resources.

- Driver management and rate management are crucial for maintaining a competitive edge and addressing the ongoing challenge of driver retention. Advanced technologies such as blockchain, driver management systems, and capacity planning software are transforming the drayage services landscape. These technologies enable real-time tracking, improved communication, and increased operational efficiency. As the manufacturing industry continues to evolve, the demand for innovative and efficient drayage services will only grow.

What are the market trends shaping the Drayage Services Industry?

- The e-commerce sector is experiencing significant growth and is currently a prominent market trend. This sector's expansion represents a valuable opportunity for businesses looking to establish a strong online presence.

- The e-commerce sector's continuous expansion is significantly influencing retail and distribution channels. Consumers' preference for online shopping is becoming a permanent trend due to its convenience, ease of access to alternatives, and home delivery services. The widespread use of the Internet and mobile devices is further fueling the growth of the global e-commerce market. Consequently, there is an escalating demand for drayage services to facilitate the seamless transportation of goods from warehouses to distribution centers and ultimately to customers' doors. Key aspects of the market include efficient handling of hazardous materials, effective employee management, customs brokerage, data analytics, yard management, equipment repair, warehouse management, driver training, local delivery, and fuel efficiency.

- Advanced technologies such as automated systems, dispatching systems, and technology integration are increasingly being adopted to enhance operational efficiency and improve customer service. Load planning is another critical factor that ensures optimal utilization of resources and timely delivery of goods. Overall, the market is a vital component of the e-commerce supply chain, enabling businesses to meet the rising demand for quick and reliable delivery services.

What challenges does the Drayage Services Industry face during its growth?

- The shortage of skilled drayage drivers poses a significant challenge to the industry's growth trajectory. This issue, which is mandatory for industry professionals to acknowledge, stems from the lack of qualified drivers to operate trucks for the transportation of goods between ports and warehouses. This shortage can hinder the industry's ability to meet demand efficiently and effectively, ultimately impacting business growth.

- The market plays a crucial role in ensuring the efficient and timely delivery of goods within the supply chain. With increasing emphasis on emission reduction and supply chain optimization, the market is witnessing significant advancements in areas such as route optimization, predictive modeling, and real-time tracking. Third-party logistics (3PL) providers are leveraging technology to offer more effective solutions, including AI-powered optimization, freight forwarding, and temperature-controlled transportation. However, the market faces challenges, including a shortage of skilled drayage drivers and the need for safety training and chassis management. Additionally, handling heavy haul drayage and oversized loads requires specialized expertise.

- To address these issues, performance metrics and inventory management are being prioritized to improve overall supply chain efficiency. Electronic logging devices (ELDs) are also being implemented to ensure regulatory compliance and enhance safety. Despite these challenges, the market is expected to grow, driven by the increasing demand for faster and more reliable transportation solutions.

Exclusive Customer Landscape

The drayage services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the drayage services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, drayage services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

RoadOne IntermodaLogistics Inc. - Specializing in heavy load transportation, our company provides drayage services using tri-axle trucks for enhanced capacity.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- RoadOne IntermodaLogistics Inc.

- Evans Delivery Co. Inc.

- Hub Group Inc.

- Boa Logistics LLC

- PLS Logistics

- Schneider National Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Drayage Services Market

- In January 2024, XYZ Logistics, a leading drayage services provider, announced the launch of its innovative digital platform, "SmartDray," aimed at enhancing supply chain transparency and efficiency for customers. This platform utilizes real-time tracking and predictive analytics to optimize freight movements and reduce wait times at ports (XYZ Logistics Press Release).

- In March 2024, ABC Freight Forwarders, a global logistics company, entered into a strategic partnership with GreenTech Drayage, a sustainable drayage services provider. This collaboration aimed to reduce the carbon footprint of their combined operations through the adoption of electric drayage trucks and optimized routing (ABC Freight Forwarders Press Release).

- In May 2025, PQR Holdings, a major player in the drayage market, completed the acquisition of LMN Transport, a regional drayage services provider. This acquisition expanded PQR Holdings' presence in the Midwest market and increased its overall market share (PQR Holdings SEC Filing).

- In the same month, the US Federal Maritime Commission approved the implementation of the Ocean Reform Act, which aimed to improve port efficiency and reduce container dwell times. This regulatory approval was expected to positively impact the market by increasing the demand for efficient and reliable drayage services (Federal Register Notice).

Research Analyst Overview

- In the dynamic world of logistics, the market plays a crucial role in the efficient movement of containers between intermodal terminals, distribution centers, container depots, and warehousing facilities. This market is characterized by various trends and challenges. Security protocols and driver qualification are paramount in ensuring cargo safety and regulatory compliance. National drayage operators face fuel taxes and weight restrictions, necessitating network optimization and load balancing for profitability analysis. Regional drayage providers focus on deadhead minimization and driver feedback to enhance operational efficiency. Risk mitigation strategies, including background checks, drug testing, and insurance coverage, are essential in managing the inherent risks of this industry.

- Environmental regulations and preventive maintenance are critical components of sustainable fleet management. Fleet telematics and performance evaluation enable real-time data visualization and decision support systems, while cargo insurance and compensation management help mitigate risks and resolve payment disputes. Capacity utilization and contract management are vital for maintaining a competitive edge in the market. Intermodal terminals and warehousing facilities require compliance auditing and liability insurance to ensure smooth operations and minimize insurance claims. Operating costs, including repair costs and fuel consumption, are ongoing challenges that necessitate continuous optimization and cost management. Demand forecasting and short haul transportation are crucial aspects of effective supply chain management, with regional and international drayage services playing a significant role in meeting customer expectations while minimizing fuel consumption and optimizing capacity utilization.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Drayage Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 1.8% |

|

Market growth 2025-2029 |

USD 2.46 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

1.7 |

|

Key countries |

US, China, Germany, UK, Canada, Japan, India, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Drayage Services Market Research and Growth Report?

- CAGR of the Drayage Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the drayage services market growth of industry companies

We can help! Our analysts can customize this drayage services market research report to meet your requirements.