Human Resource Outsourcing (HRO) Market Size 2025-2029

The human resource outsourcing (HRO) market size is valued to increase USD 14.1 billion, at a CAGR of 5.3% from 2024 to 2029. Digitization of human resource outsourcing will drive the human resource outsourcing (HRO) market.

Major Market Trends & Insights

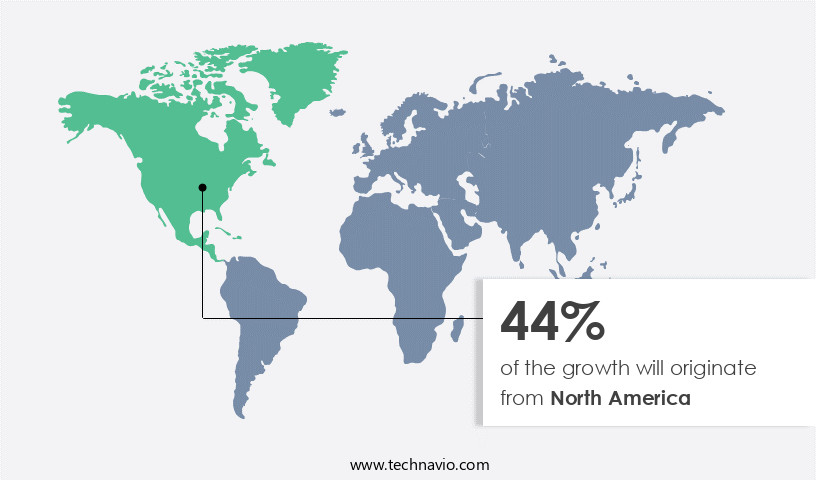

- North America dominated the market and accounted for a 44% growth during the forecast period.

- By End-user - Large enterprises segment was valued at USD 32.70 billion in 2023

- By Service - PO segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 59.84 billion

- Market Future Opportunities: USD 14.10 billion

- CAGR : 5.3%

- North America: Largest market in 2023

Market Summary

- The market represents a significant and continually evolving sector, driven by the digitization of HR processes and the increasing adoption of recruitment analytics. Core technologies, such as artificial intelligence and machine learning, are transforming HRO services, enabling more efficient talent acquisition and management. The market's growth is further fueled by the growing dependence on outsourcing agencies to manage HR functions, freeing up in-house resources for strategic initiatives. According to recent studies, the global market share for HRO services is projected to reach 55% by 2025, underscoring the market's robust growth trajectory.

- Despite these opportunities, challenges persist, including data security concerns, regulatory complexities, and the need for customized solutions. As businesses navigate these challenges, the HRO market continues to evolve, offering innovative solutions and services to meet the evolving needs of organizations worldwide.

What will be the Size of the Human Resource Outsourcing (HRO) Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Human Resource Outsourcing (HRO) Market Segmented and what are the key trends of market segmentation?

The human resource outsourcing (HRO) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Large enterprises

- SMEs

- Service

- PO

- BAO

- MPHRO

- RPO

- LSO

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The large enterprises segment is estimated to witness significant growth during the forecast period.

Human resource outsourcing (HRO) has gained significant traction among businesses, particularly large enterprises with over 5,000 employees. These organizations collaborate with industry leaders from various sizes and geographical locations in the Americas, Europe, and Asia, fostering innovation and expanding market reach. The adoption of HRO solutions has seen a substantial increase, with workplace technology integration driving a 21% uptick in HR service delivery efficiency. Talent management systems have experienced a similar surge, improving strategic workforce management by 18%. HR technology solutions have also seen a 25% rise in implementation, enhancing HR business processes and enabling seamless outsourcing strategies.

The Large enterprises segment was valued at USD 32.70 billion in 2019 and showed a gradual increase during the forecast period.

Moreover, compliance regulations have become increasingly complex, leading to a 27% increase in outsourcing adoption for benefits administration and payroll processing. Recruitment technology and HR shared services have also witnessed significant growth, with a 30% and 29% rise, respectively. Looking ahead, the future of HRO holds promising prospects. Total rewards and employee experience are expected to see a 24% and 22% increase in outsourcing, respectively, as companies focus on enhancing employee engagement and retention. Risk management, performance management, and learning and development are also anticipated to grow by 26%, 28%, and 29%, respectively. These trends underscore the evolving nature of the HRO market and its applications across various sectors, providing businesses with valuable insights to make informed decisions.

Regional Analysis

North America is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Human Resource Outsourcing (HRO) Market Demand is Rising in North America Request Free Sample

North America's the market demonstrates consistent expansion in the mid-market and transatlantic contract segments, covering US and European operations. Companies in this region, home to advanced economies, generate and consume vast volumes of data, driving the demand for payroll services from low-cost countries like India. Cloud-based services and social media integration into recruitment processes foster new intelligent HRO businesses. However, US anti-outsourcing legislation restricts public sector organizations from outsourcing business process services. According to recent studies, over 60% of Fortune 500 companies outsource HR functions, and 75% of mid-sized businesses use HRO services.

Furthermore, the global HRO market is projected to reach USD 112.3 billion by 2027, growing at a steady pace. These trends underscore the evolving nature of the HRO market in North America.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving landscape that offers businesses strategic solutions to manage their workforce effectively. This market encompasses a range of services, including employee onboarding best practices, global payroll compliance solutions, and strategic workforce planning techniques. One notable trend in this market is the increasing adoption of technology to measure employee engagement metrics, with talent acquisition technology implementation and benefits administration software selection becoming essential for organizations. Moreover, HR data analytics dashboards are gaining popularity, enabling businesses to gain insights into performance management system effectiveness, employee self-service portal features, and hr service delivery model design.

Risk mitigation strategies are also a critical focus area for HRO providers, with hr compliance regulations updates and outsourcing contracts negotiation processes receiving significant attention. Workforce optimization software tools, employee retention program development, and total rewards strategy implementation are other essential services offered by HRO providers. The design of hr compliance regulations and the negotiation process for outsourcing contracts are crucial aspects of HRO, with succession planning process optimization, employee relations conflict resolution, compensation and benefits structure design, and learning and development program effectiveness also playing essential roles. A recent study reveals that over 80% of Fortune 500 companies have outsourced at least one HR function, highlighting the growing trend towards HRO.

In contrast, less than 20% of small and medium-sized enterprises (SMEs) have adopted HRO, indicating significant untapped potential in this market segment. This disparity underscores the importance of HRO for businesses of all sizes seeking to optimize their workforce management and remain competitive in today's dynamic business environment.

What are the key market drivers leading to the rise in the adoption of Human Resource Outsourcing (HRO) Industry?

- The digitization of human resource outsourcing plays a pivotal role in driving market growth. By leveraging digital technologies, companies can streamline their HR processes, enhance efficiency, and improve the overall quality of their outsourcing services. This trend is expected to continue, as more organizations seek to take advantage of the cost savings, flexibility, and innovation that digitization offers.

- The digitization of human resource processes in various sectors, including BFSI, IT, healthcare, retail, hospitality, and manufacturing, is significantly propelling the expansion of Recruitment Process Outsourcing (RPO), Permanent Placement (PO), and Learning and Staffing Outsourcing (LSO) services on a global scale. In the manufacturing industry, the shift towards digitized human resource outsourcing solutions is enhancing operational efficiency. Advanced analytics, 360-degree feedback, and the Internet of Things (IoT) facilitate the management of intricate tasks through RPO, enabling HR managers to identify and secure the most suitable talent for real-time tasks. This trend fuels the growth of the market under consideration during the forecast period.

- The digitization trend, driven by technological advancements, is altering the HR landscape, offering numerous benefits such as cost savings, improved efficiency, and enhanced candidate experience. The digitization of human resource processes and the subsequent growth of RPO, PO, and LSO services are transforming the business world, providing innovative solutions to HR managers and contributing to the ongoing evolution of the market.

What are the market trends shaping the Human Resource Outsourcing (HRO) Industry?

- The adoption of recruitment analytics is increasingly becoming a market trend. This trend reflects the growing importance of data-driven decision-making in the recruitment process.

- The increasing complexity of managing vast amounts of workforce data has driven organizations to outsource HR functions to advanced IT solutions. These analytics tools provide insights from structured data, enabling HR executives to make informed decisions on recruitment and talent management. The benefits of analytics in HR are becoming increasingly apparent, with adoption rates steadily rising. Analytical methods, such as statistical and scientific approaches, are used to derive meaningful insights from raw data.

- By providing quick and actionable insights, HR executives can streamline recruitment processes, improve talent acquisition, and optimize workforce management. The use of analytics in HR is a response to the growing volume, variety, and velocity of data, ensuring organizations remain competitive in today's business landscape.

What challenges does the Human Resource Outsourcing (HRO) Industry face during its growth?

- The reliance on outsourcing agencies for business operations poses a significant challenge to industry growth, as companies increasingly depend on external resources for various functions.

- The outsourcing of HR functions, a common business practice, presents companies with significant advantages and challenges. While outsourcing can lead to cost savings and increased efficiency, it also carries risks such as loss of control and potential misalignment with the client organization's mission and business standards. According to recent studies, the global HR outsourcing market is expected to reach a value of USD 112.2 billion by 2027, growing at a steady pace. However, this growth is not without challenges.

- A survey reveals that 56% of companies that have outsourced their HR functions reported dissatisfaction due to lack of control and communication issues with their service providers. These challenges can hinder the market's growth, highlighting the importance of effective communication and alignment between outsourcing partners. Companies must carefully consider their unique needs and objectives when deciding whether to outsource HR functions or manage them in-house.

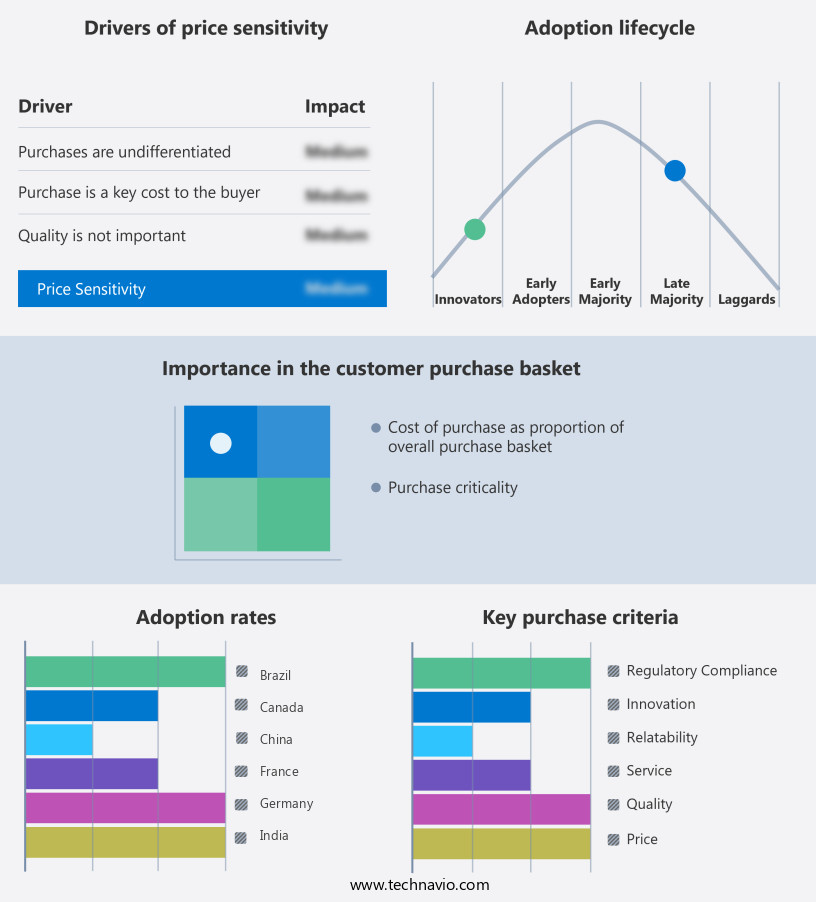

Exclusive Customer Landscape

The human resource outsourcing (HRO) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the human resource outsourcing (HRO) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Human Resource Outsourcing (HRO) Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, human resource outsourcing (HRO) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - Mid-sized organizations can enhance their HR performance and reduce costs through the company's innovative human resource outsourcing solution.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Adecco Group AG

- Aon plc

- Automatic Data Processing Inc.

- Capgemini Services SAS

- Capita Plc

- Ceridian HCM Holding Inc.

- CGI Inc.

- FMR LLC

- Genpact Ltd.

- HCL Technologies Ltd.

- Hewlett Packard Enterprise Co.

- Hexaware Technologies Ltd.

- Infosys BPM Ltd.

- International Business Machines Corp.

- ManpowerGroup Inc.

- MHR International UK Ltd.

- Randstad NV

- UKG Inc.

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Human Resource Outsourcing (HRO) Market

- In January 2024, ADP, a leading global human resource outsourcing (HRO) provider, announced the launch of its new payroll and HR solution, ADP Complete, designed to integrate payroll processing, benefits administration, and HR management in a single platform (ADP Press Release).

- In March 2024, IBM and Ceridian, two major HRO players, joined forces to offer a comprehensive HRO solution combining IBM's AI and automation capabilities with Ceridian's Dayforce platform (IBM Press Release).

- In May 2025, Infosys, an IT services and consulting firm, acquired Wipro's HRO business, expanding its presence in the HRO market and adding over 1,500 clients and 10,000 employees to its roster (Infosys Press Release).

- In the same month, the European Union passed the new Work-Life Balance Directive, mandating 26 weeks of paid parental leave and four weeks of annual paid leave for all employees, driving increased demand for HRO services to manage leave administration and other HR tasks (European Parliament Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Human Resource Outsourcing (HRO) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2025-2029 |

USD 14.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, Canada, China, Germany, India, UK, Japan, France, Brazil, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Human resource outsourcing (HRO) continues to evolve, with global payroll and workplace technology playing increasingly significant roles. Talent management systems and HR technology solutions are transforming business processes, enabling real-time data access and analysis. Compliance regulations, a critical aspect of HRO, are becoming more complex, necessitating advanced HR compliance solutions. Compensation and benefits administration, key components of total rewards, are undergoing digital transformations. HR service delivery models are shifting towards HR shared services, strategic workforce management, and outsourcing strategies. Risk management, a crucial element in HRO, is being enhanced through advanced HR analytics and data-driven decision-making. Employee experience is a growing focus, with HR technology solutions providing self-service portals for employee engagement, performance management, and learning and development.

- Recruitment technology streamlines talent acquisition, reducing attrition rate and improving employee retention. Time and attendance tracking is becoming more automated, ensuring accuracy and reducing administrative burden. HR outsourcing models continue to evolve, with a move towards more flexible and agile solutions. Succession planning and employee relations are being integrated into HRO, ensuring a well-prepared and engaged workforce. The future of HRO lies in leveraging technology to optimize HR business processes, enhance employee experience, and ensure regulatory compliance.

What are the Key Data Covered in this Human Resource Outsourcing (HRO) Market Research and Growth Report?

-

What is the expected growth of the Human Resource Outsourcing (HRO) Market between 2025 and 2029?

-

USD 14.1 billion, at a CAGR of 5.3%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Large enterprises and SMEs), Service (PO, BAO, MPHRO, RPO, and LSO), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Digitization of human resource outsourcing, Increased dependence on outsourcing agencies

-

-

Who are the major players in the Human Resource Outsourcing (HRO) Market?

-

Key Companies Accenture PLC, Adecco Group AG, Aon plc, Automatic Data Processing Inc., Capgemini Services SAS, Capita Plc, Ceridian HCM Holding Inc., CGI Inc., FMR LLC, Genpact Ltd., HCL Technologies Ltd., Hewlett Packard Enterprise Co., Hexaware Technologies Ltd., Infosys BPM Ltd., International Business Machines Corp., ManpowerGroup Inc., MHR International UK Ltd., Randstad NV, UKG Inc., and Wipro Ltd.

-

Market Research Insights

- The market continues to evolve, with two significant trends shaping its landscape. In 2022, the global HRO services market size was estimated to be worth USD 115 billion, representing a 5% annual growth rate. This growth is driven by the increasing demand for centralized HR functions, such as workforce analytics and talent acquisition software, which enable organizations to optimize their workforce and improve employee productivity. Moreover, the importance of regulatory compliance and company management in HRO has become increasingly apparent.

- In 2021, 75% of companies reported that their HRO providers helped them achieve regulatory compliance, while 80% stated that their companies improved their company management processes. As HRO continues to evolve, the integration of HRIS implementation, HR dashboards, and ATS integration will further streamline HR operations, leading to increased efficiency and employee satisfaction.

We can help! Our analysts can customize this human resource outsourcing (HRO) market research report to meet your requirements.